On one hand, exceptional alts like Chiliz are rallying. On the other, top crypto assets like Cardano, Solana, and Ripple’s XRP have been stuck in their consolidation phase. As far as the latter token is concerned, it has neither been able to break above $0.4, nor has it dropped below $0.33 since the beginning of the month. Resultantly, its movements have mostly been horizontal of late.

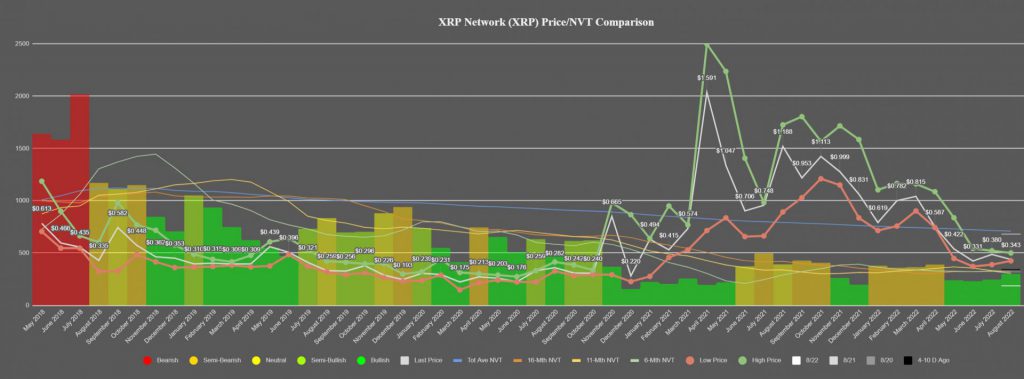

Will the tables turn going forward? Well, to answer that, let’s first look into Ripple’s NVT. This ratio, as such, gauges network value and compares it to the value being transferred to the network. XRP’s circulation had, notably, picked up a lot of steam on the network in May.

However, like most assets, it was pulled down in June. But this month, per Santiment, it appears as though XRP is on its way to revealing a “bullish or semi-bullish” NVT divergence. Elaborating on the same, the analysis platform’s recent report noted,

“XRP has actually looked to be one of the better NVT charts we see in crypto right now… with four straight months in the green, this could be promising.”

Will XRP’s price be impacted?

Well, the current state of the NVT is definitely an encouraging sign, but there are no other tangible signs that the same might rub off positively on the price. Consider this: The token has been seeing considerable interest from whales, and notably, large transactions inclined during the end of last week. Per Santiment’s data, the same was XRP’s largest spike since May.

Even though whales were active on Friday, the price of Ripple’s native asset did not show any significant sign of improvement, indicating that large participants’ action lacks the bullish thrust.

Alongside, it is worth noting that XRP’s active addresses created a handful of spikes over the past few weeks. An address, as such, is considered to be active when it becomes a direct participant in a successful transaction. Thus, the higher the number, the better because it points out that more participants are engaging in transactions.

However, the spikes created were quick to slash back. The active addresses were around their 11-month low of 34.23k at press time, indicating the deflated interest of market participants. As illustrated below, similar levels were last noted back in September 2021.

Furthermore, Ripple’s native token shares a correlation of 0.8 with Bitcoin, and with no signs of a sustainable uptrend on the macro front, it doesn’t look like XRP will rally straight off the bat.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Ondo

Ondo  Aave

Aave  Bittensor

Bittensor  Aptos

Aptos  Dai

Dai  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC