Trading possibilities have been expanded by the XRP derivatives listing on Crypto.com. This is marking a major advancement in cryptocurrency exchange offerings. North America’s largest platform’s futures contract introduction is a sight to behold! Likewise, multiple trading metrics indicate surging market interest across different sectors. Some strategic positions have been taken by various market makers, and they have their reasons. Additionally, unprecedented preparation levels have been noted by several key players. Through an official CFTC submission, the exchange’s plans were confirmed. The new product is being launched on February 14, 2025, as crypto market volatility and trading demand intensify.

🚨BREAKING: The largest North American exchange will list #XRP on February 14th, driving billions in daily trading volume! pic.twitter.com/fPD6tmV935

— Levi | Crypto Crusaders (@LeviRietveld) February 13, 2025

Also Read: AI Predicts Shiba Inu (SHIB) Price For February 20, 2025

How Crypto Exchanges Impact XRP Price and What Investors Need to Know

New Derivatives Product Launch

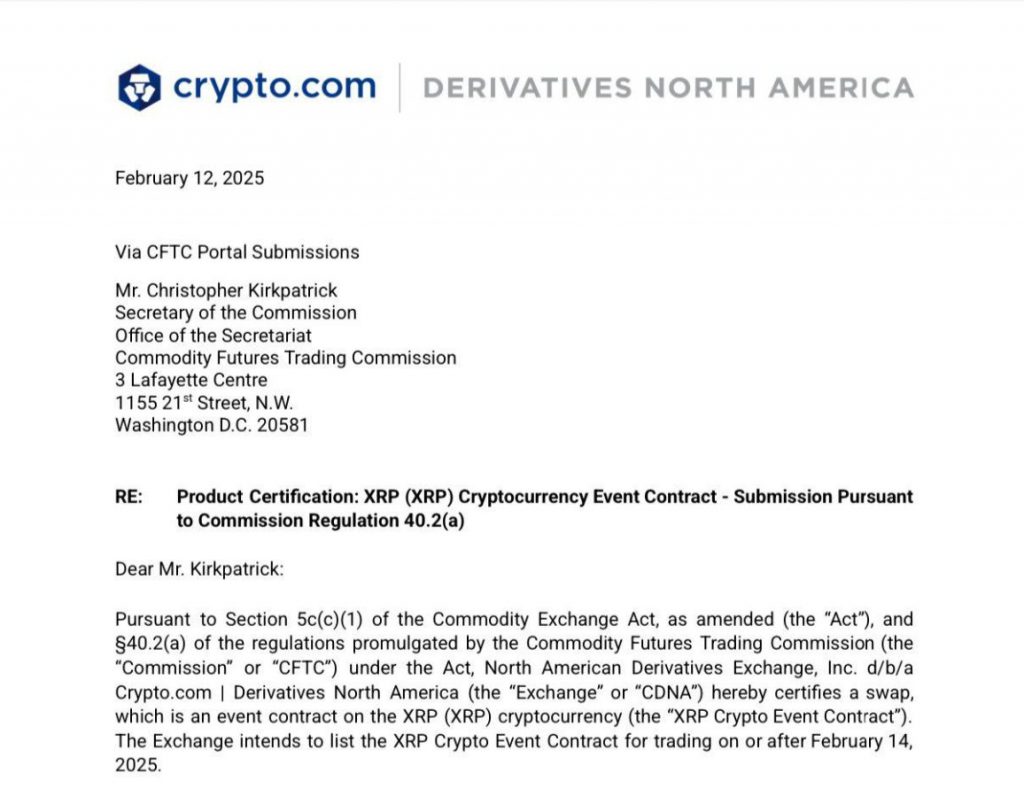

Crypto.com Derivatives North America (CDNA) submitted its XRP derivatives listing certification to the CFTC on February 12. This new instrument complements the platform’s existing spot trading offerings, and also expands cryptocurrency exchange options for North American traders.

Levi Rietveld, a prominent crypto figure, stated:

“The listing could drive billions in daily trading volume.”

Trading Volume and Market Impact

A pivotal moment has been indicated by multiple market signals. The XRP derivatives listing is being launched during substantial growth waves experienced by Crypto.com. Record-breaking milestones in crypto market volatility tracking were revealed by a recent Coindesk report. Various trading metrics have achieved new highs. The most striking performance was demonstrated by their monthly spot trading volume. There was also a dramatic surge from $34 billion to $134 billion recorded between July and September 2024. Several consecutive months of exceptional performance were marked.

Strategic Market Position

Crypto.com has been seriously crushing it in North American trading. Now several market watchers see the XRP derivatives listing pushing their dominance even further. The exchange has left multiple competitors like Coinbase and Kraken playing catch-up. Various regulated channels show impressive crypto adoption numbers. With numerous institutional players knocking at the door, the platform’s expansion in derivatives offerings hits different market sweet spots. Also, several analysts are watching this space heat up.

Also Read: 3 Oil Stocks That Can Surge If Trump’s ‘Drill Baby Drill’ Policy Goes Live

Price Dynamics and Trading Analysis

The XRP price prediction landscape transforms with derivatives trading introduction. Historical data from cryptocurrency exchange listings shows that new derivative products often generate distinct trading patterns and price movements, especially on major platforms. The XRP listing enhances market depth through sophisticated trading instruments.

Contract Specifications and Trading Structure

The XRP Crypto Event Contract brings several innovative trading mechanisms to the table starting February 14. Seriously, this launch also has multiple market-makers buzzing. Various traders can now take strategic positions across numerous market conditions. Groundbreaking trading configurations also open up different market plays. CDNA has everything locked down with Regulation 40.2(a) of the Commodity Exchange Act. This ensures that several institutional players can dive into these new trading options while keeping things properly regulated across multiple market segments.

Future Market Implications

Several major developments position the XRP derivatives listing at the forefront of regulated crypto trading. Crypto.com is leading numerous exchanges and multiple institutional players have also sparked the exchange’s rapid growth across North American markets. Various cryptocurrency exchange activities show increasing professional trader participation. Some analysts suggest this significant expansion in trading options will transform numerous XRP price prediction models. Several market dynamics are adapting to accommodate the sophisticated derivatives trading landscape.

Also Read: XRP ETF Filing Accepted by SEC —Is Crypto’s Next Big ETF Wave Coming?

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Litecoin

Litecoin  Stellar

Stellar  Avalanche

Avalanche  Sui

Sui  UGOLD Inc.

UGOLD Inc.  Toncoin

Toncoin  Shiba Inu

Shiba Inu  LEO Token

LEO Token  USDS

USDS  Hedera

Hedera  WETH

WETH  Hyperliquid

Hyperliquid  MANTRA

MANTRA  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Monero

Monero  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  NEAR Protocol

NEAR Protocol  Aptos

Aptos  sUSDS

sUSDS  Mantle

Mantle  Dai

Dai  Official Trump

Official Trump  Internet Computer

Internet Computer  Bittensor

Bittensor  Ethereum Classic

Ethereum Classic  OKB

OKB  Gate

Gate  Tokenize Xchange

Tokenize Xchange