Following the disastrous sell-off in the crypto market last week, a few alts were reclaiming their values on the chart. DeFi lending platform AAVE was on a similar growth trajectory. However, external factors suggested that the recovery could be short-lived, with sellers gearing to force the next correctional round.

Since hitting its lowest point in nearly two years on 12 May, AAVE’s price moved upwards as bulls initiated a recovery from $64-support. The price made a chain of higher lows and sat within an ascending triangle on the hourly chart – a technical pattern that often triggers breakouts leading to more price growth.

However, the technical position on the chart is only half the narrative. On the flip side, the most popular indicators – the Relative Strength Index and the MACD, showed that the buying pressure gradually easing. At press time, the RSI held around 50 after slipping lower on Wednesday morning. Meanwhile, the MACD used to gauge market trends, also held flat around its mid-point – These signs were not ideal for an AAVE breakout.

Looking at exchange data, the bias was already shifting gear. Several sell trades were placed on exchanges in the past 12 hours, with a minimal counter-response from buyers.

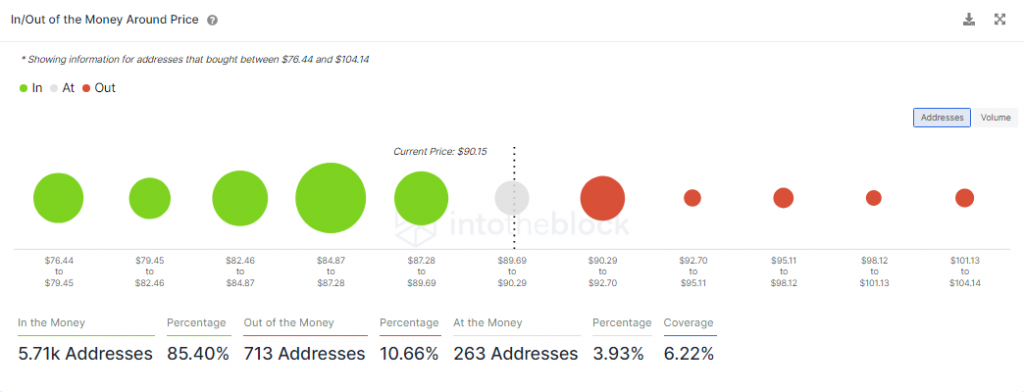

If the current trend continues over the next 24-48 hours, the sell-off could be severe. Data from IntoTheBlock showed that 85% of the addresses that bought AAVE after last week’s decline were currently in profit. These addresses might be tempted to cash out and avoid taking more hits on their investment as the broader crypto remains sketchy.

AAVE Hourly Chart

Judging by the height of the triangle, AAVE projected a 34% upswing back to the $128-mark. However, after looking at exchange data, AAVE seemed to lack the momentum required to meet its breakout target.

On the other hand, a downside move could follow if sellers continue to apply more pressure. Hence, investors are cautious of a daily close below $85. The same could drag AAVE back to 12 May’s swing low of $62, marking a 26% decline.

However, there is light at the end of the tunnel. The altcoin market is currently heavily reliant on Bitcoins’ cues and a BTC rally could end up saving AAVE from the forecasted decline.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)