This is an opinion editorial by Rune Østgård and Alexander Ellefsen, financial writers based in Norway.

Although we don’t have exact numbers on Bitcoin adoption globally, we do know that the global average cryptocurrency adoption rate was estimated to be at about 12% in 2022 and that bitcoin currently has about half of the total market cap of the global cryptocurrency market. Turkey (27.1%) and Argentina (23.5%) topped the 2022 adoption list, and the countries with the most inflation seem to have the highest adoption rates.

The oil-rich nation of Norway is at 8% cryptocurrency adoption, which is just two-thirds of the global average. Considering that it has a rather tech-savvy population, this is surprisingly low. The following factors might provide some explanation:

- The official consumer price index (CPI) numbers have been modest compared with most other countries.

- Norwegian politicians demonstrate a negative attitude toward cryptocurrencies, and as analyst Jaran Mellerud at Luxor reports, the government wants to “smoke” out miners.

- According to the Organisation For Economic Co-Operation And Development (OECD), six out of 10 Norwegians “trust” their government, which is 50% more than the average OECD country.

But a significant weakening of the Norwegian krone (NOK) may begin to incentivize more people and businesses to join the Bitcoin economy.

The NOK’s value has depreciated slowly but steadily since the financial crisis, and the “frog boiling” effect might be the reason why there has been so little focus on it. This has changed in the last few months, as the depreciation has gained momentum. At the time of writing, it takes 10.7 NOK to buy $1, up from 4.9 NOK in 2008. At its worst this year, the NOK had depreciated 10% against the USD, and even performed worse than the Turkish lira and one of the poorest European country’s currency, the Moldovan lei. It probably helped very little that Norway’s minister of finance, in the beginning of June, told the people that “the Norwegian krone is a good currency.”

Economists scratch their heads as they are at pains to explain why the NOK is so unpopular, but judging from media coverage, people and companies are becoming increasingly wary.

What Is Wrong In Norway?

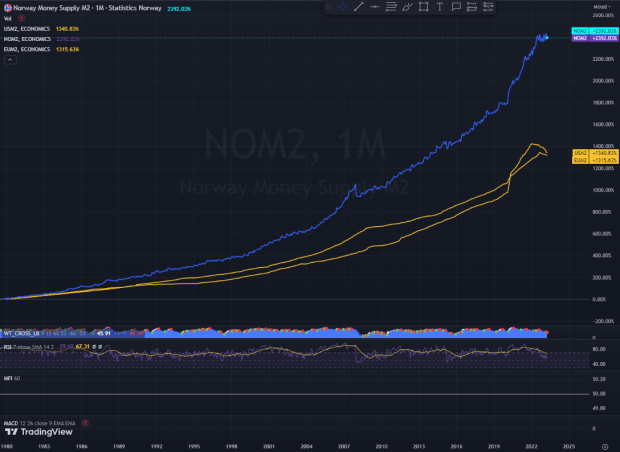

A loose monetary policy is probably one of the reasons why the NOK has performed so badly. The small country might be able to export large quantities of oil, but it’s in no position to export inflation. In the period of 2002 to 2022 the money supply (NOK M2) increased by an average per year at roughly 7%. This is on par with the USD, but it’s 16% faster than the euro, which had an average growth of 5.9% per year. While many factors affect the exchange rate, nothing good can come from letting the printing press run at high speed.

A lower exchange rate makes imports more costly, fuels CPI numbers and gives the central bank an excuse to continue to raise interest rates. Norwegian citizens therefore are now hit with a triple whammy: high interest rates, high domestic price inflation and sharply increased costs for the thousands of sun-deprived Norwegians who are used to traveling abroad for their vacations. When the mainstream media covers the weak NOK, the standard theme is that budgets dictate that people must stay within the borders when they go on summer holiday this year.

Corporations that have a relatively-high share of their costs in foreign currency while their income mainly is in NOK have a particularly tough time. Home builders, who find themselves in this category due to increased reliance on imported materials, are hit hard. The weak currency eats up their profits, while the steep interest rate hikes have caused the market for sales of new homes to plummet. Adjusted for population growth, sales are now at the same levels as when the market bottomed out during the great financial crisis.

If you also consider that:

- The government continues to raise taxes although Norway already has a high tax rate and a public sector that consumes about two-thirds of GDP (66% in the pandemic year of 2020 and 61% in 2022)

- A record number of super-rich people are abandoning Norway for low-tax countries

- Norwegians now top the OECD’s ranking of debt to disposable income per household (247%)

…then the picture looks increasingly grim.

It probably doesn’t help the NOK that most of the state’s income from taxes on oil and gas is being transferred to the government’s sovereign wealth fund, which only invests its capital outside of Norway. Today, the fund makes up more than two times the GDP. The consequence of swapping the value of the petroleum resources in Norway for capital that is invested abroad is that the country gets an increasingly smaller capital base that the NOK can be invested in.

No wonder that the players in the foreign-exchange market and the wealthiest Norwegians worry that the NOK in the future will be reduced to nothing but a token for tax payments.

Primed For Bitcoin

The violent depreciation of the NOK compared to the currencies of almost all other nations and the low adoption rate of cryptocurrencies make the Norwegian case special. If the NOK falls further and Norwegians invest more into bitcoin, this might indicate that the same will happen in other advanced economies with loose monetary policies.

It remains to be seen if Norwegian citizens and corporations begin to line up for a consultation with Dr. Bitcoin. Considering that there is no other remedy in sight, we believe that economic incentives will beat the citizens’ exaggerated trust in the government.

This is a guest post by Rune Østgård and Alexander Ellefsen. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC