The biggest news in the cryptoverse for Sept 20 includes Wintermute losing $160 million to DeFi operation hack, Ethereum developer confirming that Shanghai upgrade will not unlock staked ETH, Experts arguing that SEC cannot claim jurisdiction over Ethereum transactions, MicroStrategy buys an additional 301 Bitcoin for $6 million.

CryptoSlate Top Stories

Wintermute reveals $160M hack in DeFi operations

A hacker attacked about 90 crypto assets belonging to leading market maker Wintermute. The firm’s DeFi operation lost over $160 million to the incident.

Wintermute’s CEO Evgeny Gaevoy said that market-making funds are safe, as the CeFi and OTC operations were not affected by the hack.

Ethereum vanity address exploit may be cause of Wintermute hack

Blockchain security firm Certik confirmed claims by the Ethereum community that a vanity address exploit could be the root cause of the Wintermute attack.

Here is what we know so far from the @wintermute_t exploit 👇

We have recorded that $162,509,665 have been stolen.

The exploit is likely due to a brute force attack on Profanity wallet compromising a private key.

Stay vigilant! pic.twitter.com/zVRd3e5TbS

— CertiK Alert (@CertiKAlert) September 20, 2022

1nch contributor k06a noted that since Wintermute’s address had 7 leading 0’s, it may have taken only 50 days to brute force hack the address using a 1,000 GPU mining rig.

Ethereum developer confirms Shanghai upgrade will not unlock staked tokens

In a chat with CryptoSlate, Ethereum developer Micah Zoltu affirmed that the Shanghai upgrade will not enable the withdrawal of staked ETH tokens, but will focus on reducing gas fee.

Zoltu added that there is no specified timeline for enabling withdrawal, as Ethereum core devs are yet to discuss the modalities to unlock staked ETH.

Experts argue SEC cannot claim jurisdiction over Ethereum transactions

Etherenodes data shows that approximately 43% of Ethereum validator nodes operate from the U.S. As a result, the SEC is laying claims that Ethereum transactions happened in its jurisdiction.

Crypto experts have differed with the SEC on the issue stating that it is an unacceptable precedent that the crypto community has to fight against.

Voyager urges Alameda Research to repay $200M loan

Back in July, Alameda Research said it was happy to return its loan and retrieve its collateral “whenever works for Voyager.”

The appointed time is here, as Voyager has filed a motion requesting Alameda to repay its $200 million loan. Voyager also agreed to release Alameda’s $160 million collateral.

Vitalik Buterin argues that highly decentralized DAOs will be more efficient than corporations

Vitalik has argued that decentralized autonomous organizations (DAOs) will be more efficient than traditional corporations if they maintain the ethos of decentralization while incorporating elements from corporations.

To design an effective DAO, Vitalik proposed that protocols should learn how to make decisions in a timely manner from corporations and look up to political sovereigns when designing their succession system.

MicroStrategy buys additional 301 Bitcoin for $6M

Michael Saylor-led MicroStrategy has topped its asset holding by purchasing 301 Bitcoin, at the cost of $6 million.

So far, MicroStrategy has amassed a total of 130,000 BTC and plans to inject up to $500 million to buy more.

U.S. Treasury requests public comment on curbing crypto-related crimes

The Treasury has called on the public to provide feedback that will guide its approach in drafting a regulatory bill aimed at curbing illicit financing perpetrated using cryptocurrencies.

The Treasury is also open to learning how it can apply blockchain analytics tools to improve its AML/CFT compliance process.

Crypto promoter Ian Balina labels SEC charge ‘frivolous,’ turns down settlement

The SEC filed a case against Ian Balian for promoting the SPRK token in 2018. The commission classified the tokens as an unregistered security, stating that Balina unduly formed an investment pool to resale the token.

Balina said that he declined to settle with the SEC for what he considers a “frivolous’ charge.

Research Highlight

State of Ethereum derivatives market post-Merge

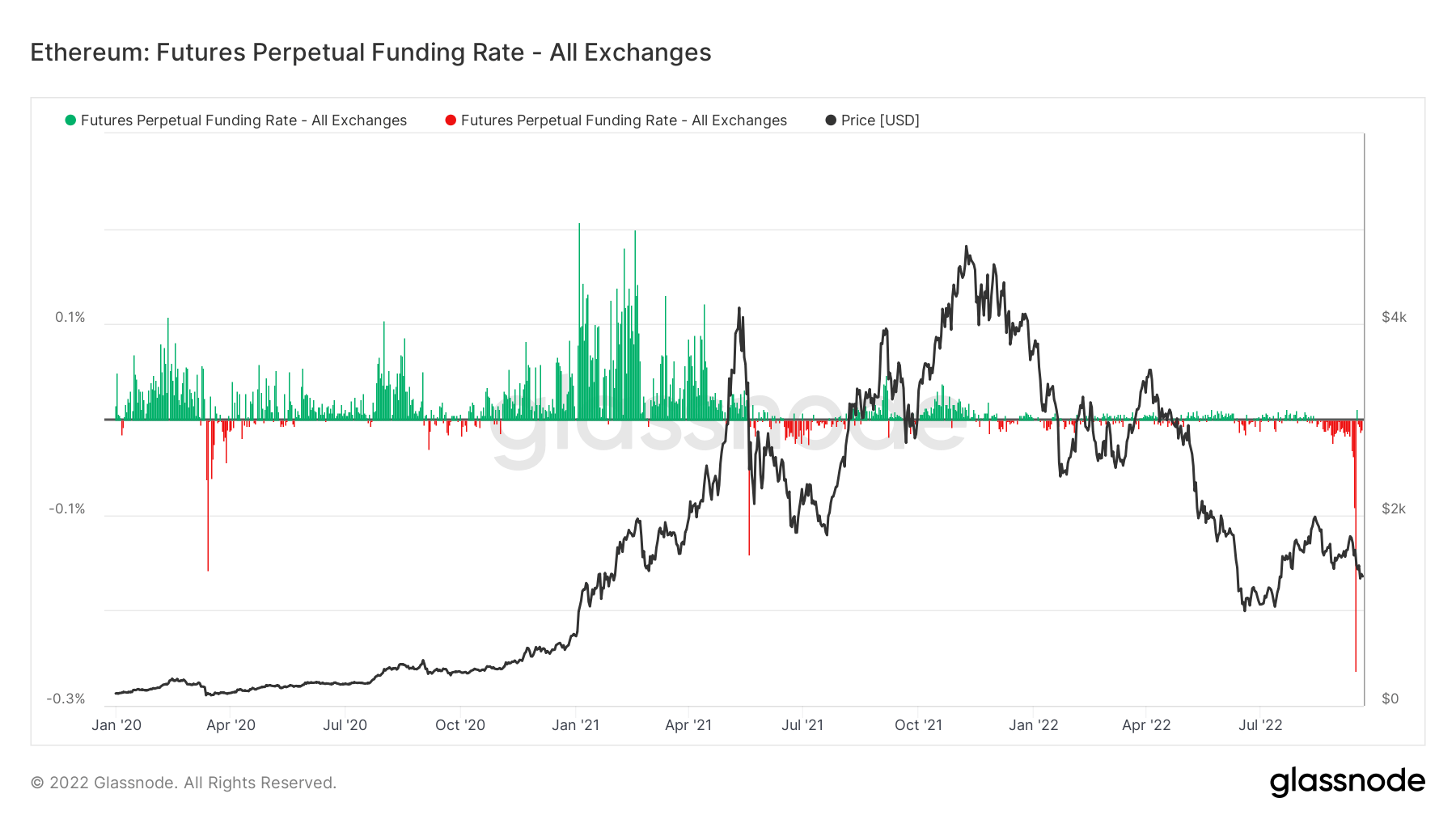

CryptoSlate analyzed Ethereum’s futures perpetual funding rate and open interest to reveal that although speculations around the Merge are over, investors are willing to go long.

According to the funding rate data, ETH traders were paying up about 1,200% to short Ethereum, which saw ETH decline over 20% over the last seven days.

As of press time, the trend is reversing, suggesting that short-term speculation is over, and traders are looking to reinvest.

News from around the Cryptoverse

Robinhood brings USDC to its users

USDC was listed today as the first stablecoin on Robinhood’s stock trading platform. The move indicates the company’s commitment to expanding its crypto trading business model.

Crypto Market

In the last 24 hours, Bitcoin declined below the $19k support level to sit at $18,913, recording a decrease of -3.19%. Over the same period, Ethereum declined by -3.95%, to trade at $1,324.

Biggest Gainers (24h)

Biggest Losers (24h)

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  Shiba Inu

Shiba Inu  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  WhiteBIT Coin

WhiteBIT Coin  Pepe

Pepe  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Dai

Dai  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)