Asset prices in the crypto market have been wildly fluctuating over the past week. Monday started off as quite a humdrum day. Tuesday and Thursday saw prices across the board plummet, while Wednesday and Friday noted sharp bounce-backs. To say the least, the market has not been following any short-term decisive trend.

Amidst the price see-sawing, LUNA—the market’s ninth-largest crypto—steered away from the large-cap pack and registered five back-to-back green candles over the course of Monday to Friday. In effect, its valuation inflated by close to 40% from $48.9 to $68.5.

Terra’s fundamentals in play?

Luna’s network Terra, underwent its Columbus-5 upgrade last fall. As such, the upgrade is gradually set to simplify the economic design of Terra and upscale the value capture of LUNA HODLers based on UST’s growth. UST, on its part, is a stablecoin built on the Terra blockchain.

So basically, Terra doesn’t use merely one asset, it uses two. And what’s good for UST is obliquely good for LUNA. Being an algorithmic stablecoin, UST leverages LUNA to maintain nearly equal value to the U.S. dollar. LUNA, as Terra’s utility token, is minted when demand for UST is low and burned when demand for UST rises.

Prior to the upgrade, whenever UST was minted, the Terra Protocol would burn only a portion of earned LUNA, and the rest would be diverted to fund various community projects. Due to the rapid pace of seignorage generation, Terra’s community pool and oracle reward pool became overfunded. So, to fix this flaw and make the LUNA HODLers benefit from the same, Columbus-5 implemented the burning of all community pool funds.

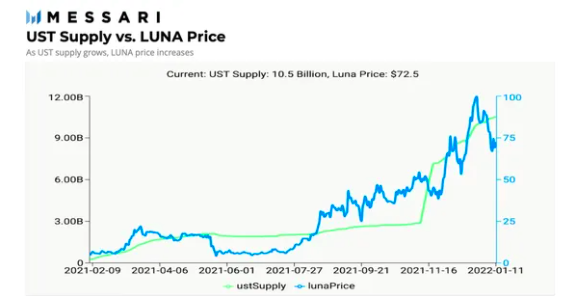

So now, post the upgrade, the liquid supply of LUNA has been decreasing via increased burning and staking. In effect, the asset has gradually started becoming deflationary. Alongside, UST’s adoption has also been rapidly growing of late, making it a win-win for the Terra ecosystem.

Highlighting the same in of their research reports, market data providing platform Messari noted,

“Increased burning has led LUNA to become a radically deflationary asset and has improved its value capture based on UST’s growth.”

Also, quite recently, Terra and the Luna Foundation Guard (LFG), a nonprofit organization designed to support the Terra network, announced a $1 billion token sale of LUNA led by Three Arrows Capital and Jump Crypto. LFG will be using the funds to create a ‘UST Forex Reserve.’

Per Jump Crypto, Three Arrows, and other buyers in the $1 billion sales would be subjected to a four-year vesting period for the LUNA tokens. This means they can’t be dumped in the open market right away. To a fair extent, even this dev is expected to aid in creating a supply crunch going forward.

LUNA experiencing a 1023.78% appreciation in valuation over the past year, and UST’s supply surpassing the $10 billion mark speak volumes about how Terra’s ecosystem has been thriving. In fact, LUNA also deserves credit for being able to sail through the current rough patch alone.

So now, if things continue going as planned, then LUNA’s value would only further boost over the long-term.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Litecoin

Litecoin  WETH

WETH  Polkadot

Polkadot  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Official Trump

Official Trump  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB