Bitcoin and cryptocurrencies kicked off a new era with the inauguration of the first-ever pro-crypto president. The key question is whether the shift towards crypto-positive regulation and rising market activity is a sustainable one or a temporary reaction to changing political tides.

Made in USA crypto tokens have performed well this week, emerging as the most relevant narrative in the sector.

Bitcoin and crypto markets break record in market activity

Donald Trump’s election as U.S. President fueled hopes of crypto traders and firms. A pro-crypto administration supported the narrative of a new age for cryptocurrencies paved with greater certainty and higher market activity.

According to CCData’s latest exchange review report, one of the key measures of market participation hit a milestone in 2024. Aggregated spot and derivatives trade volume climbed to $75 trillion against the 2021 record of $64 trillion.

The two key catalysts were the speculation surrounding the November 2024 election and the Bitcoin bull run, at the end of 2024. Both November and December were record breaking months for crypto with $10.51 trillion and $11.31 trillion in monthly volumes.

Stablecoin market capitalization helps identify market activity, participation and onboarding of new users within the ecosystem. Stablecoins act as fiat on and off ramp for new traders and beginners in crypto, therefore representing market participation and adoption. Data from DeFi tracker DeFiLlama shows a large spike in stablecoin market capitalization on President Trump’s inauguration day.

Market cap crossed $210 billion and observed a year-to-date increase of 3.3% as liquidity and trade volume across centralized and decentralized exchanges spiked. A massive influx of capital from traders supported the spike.

As of Thursday, January 23, stablecoin market capitalization is $214.407 billion, as seen in the DeFiLlama chart below.

Crypto traders are optimistic on made in USA tokens

President Donald Trump’s statement that he wanted all remaining Bitcoin to be “made in the USA” led to the rise of a new crypto narrative, the made-in-USA tokens. CoinMarketCap and CoinGecko have launched a category of tokens under “made in USA.”

XRP (XRP), Solana (SOL), Cardano (ADA), Chainlink (LINK) and Avalanche (AVAX) are the top five altcoins in the list, and the category’s market capitalization exceeds $541 billion.

CCData report states that the basket of crypto tokens in this category has outperformed the remainder of the market. The coins are up 360% since the election, as traders anticipate a positive regulatory environment and more favorable conditions for the tokens made in the states.

The narrative depends on policy and actions of the CFTC and the SEC, and whether President Trump delivers a strategic Bitcoin reserve during his time in office. Four-year crypto market cycle could see a shift and stray from historical trends.

Made in USA vs. China coins narrative

In 2024, the China coins narrative trended on X and other social media platforms as traders flocked to buy cryptocurrencies made in China, like Neo (NEO), VeChain (VET), Huobi (HTX), Filecoin (FIL), Qtum (QTUM), and Ontology (ONT), among others.

With the shifting tides in politics and regulation, the made-in-USA narrative has the potential to compete with Chinese coins. President Trump appointed SEC Commissioner Hester Peirce as head of a new “crypto task force” to provide clarity and support to the industry. There is an expectation that the new task force will support gains for made-in-USA tokens.

Bitcoin traders could gain from these 5 tokens

Solana, XRP, Sui (SUI), Aptos (APT) and Injective (INJ) could rally in the coming weeks, building on the made in USA narrative. Solana was conceptualized in California and is popular for its fast transactions and scalability.

The issuance of President Trump and First Lady Melania’s meme coins on the Solana blockchain has contributed to the rising activity on the chain.

Crypto firm Ripple was fined $125 million for violation of securities laws in its institutional sales of XRP, both sides (SEC and Ripple) appealed the ruling and the SEC has argued that XRP’s institutional and secondary market sales should be treated in a similar manner.

While XRP traders await an outcome in the appeals process, XRP holds steady above $3, after hitting a new all-time high in January 2025.

SUI and APT are US-backed Layer 1 tokens that enable higher scalability and faster transactions for traders while deriving security from the Ethereum base chain.

INJ is a DeFi token with a focus on innovation and AI, the project is made in the USA and could benefit from the DeFAI narrative.

On-chain analysis of top 5 made-in-USA tokens

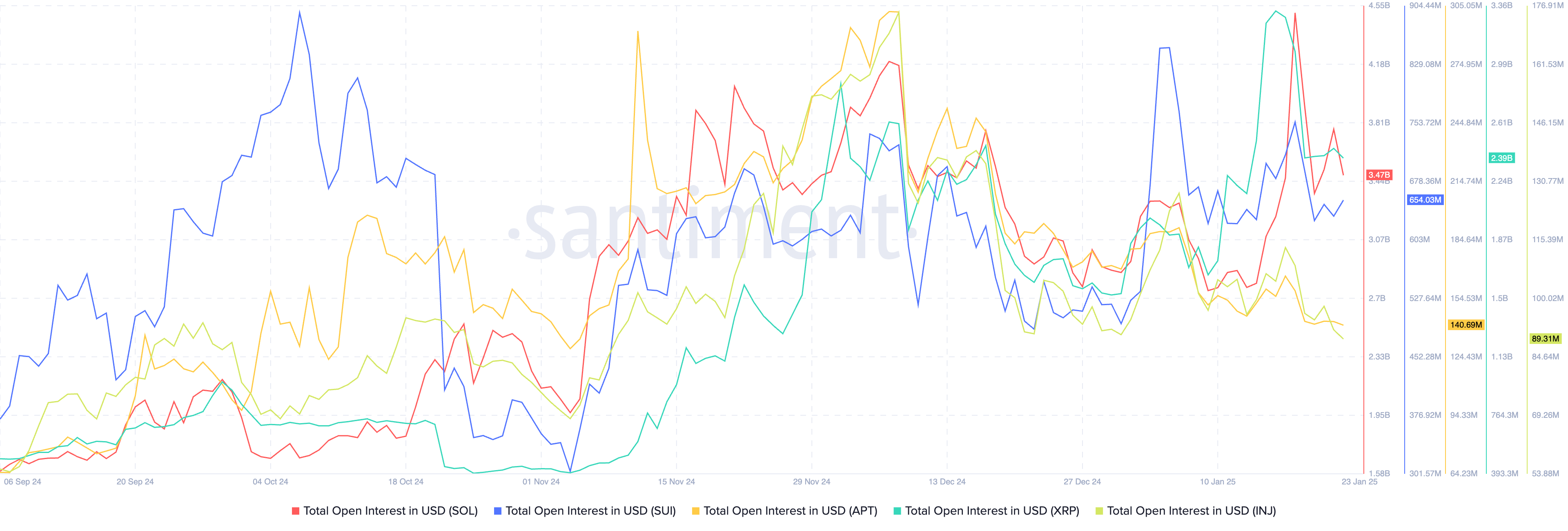

Santiment data shows that the total open interest in USD in the top 5 made in USA tokens noted considerable spikes in January, closer to the inauguration. Even as OI drops from its highest level in assets, it is above the 2024 average, supporting a bullish thesis for the tokens.

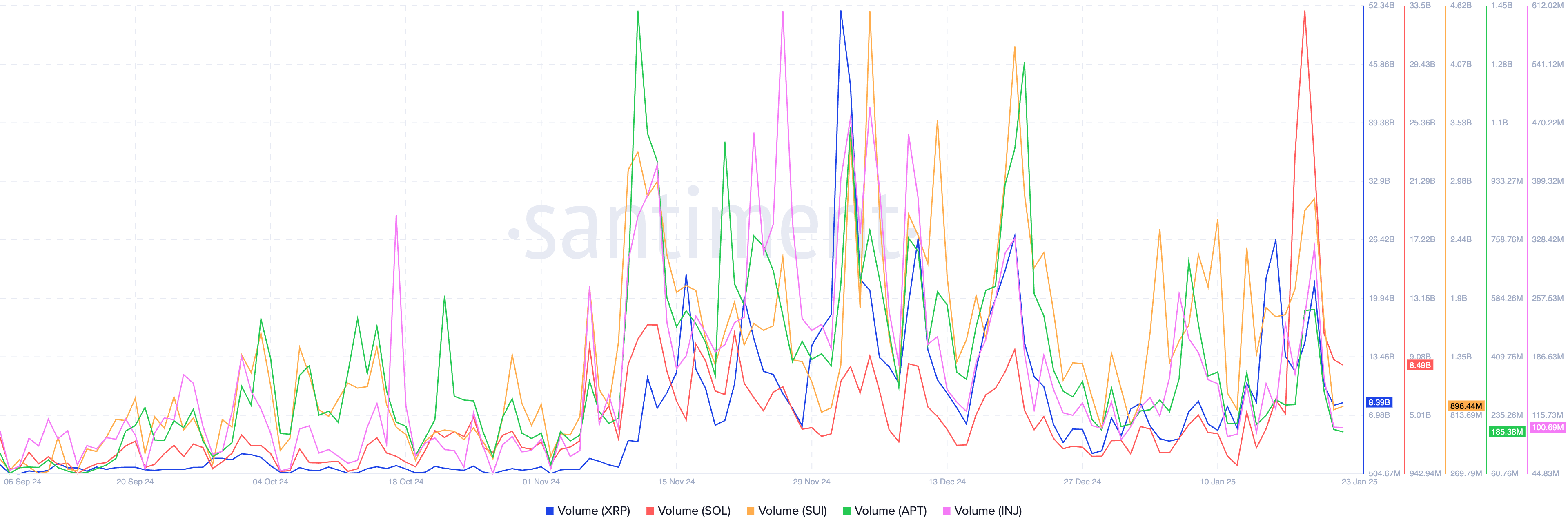

Similarly, volume in the top 5 made in USA tokens recorded a spike earlier in January, since then volume remains above the average levels.

Solana is holding on to double-digit gains for the last seven days while other cryptocurrencies in the top 5 struggle, alongside Bitcoin, on Thursday.

Ruslan Lienkha, chief of markets at YouHodler told Crypto.news:

“We may see an accelerated pace of cryptocurrency ETF approvals. However, the more significant development lies in the potential establishment of a comprehensive legal framework for the cryptocurrency industry in the U.S. This could lead to the full recognition of cryptocurrencies as a distinct asset class. Previously, attempts were made to classify cryptocurrencies under existing asset categories, such as securities or commodities, which did not fully capture their unique characteristics.”

Tim Ogilvie, Global head of institutional at Kraken, said that:

“Bitcoin’s bullish momentum still has room to grow, as indicated by the relative strength index (RSI), which currently sits at 65. Generally, an RSI above 70 is considered overbought.

Solana (SOL) hit an all-time high of $260 this week. However, technical analysis suggests that it is now in overbought territory, with an RSI around 75. While there may still be bullish momentum, this could also signal caution for short-term traders. They will be watching to see if SOL can close above $260 to confirm renewed bullish momentum.”

In the Crypto Regulatory Affairs newsletter, experts at Elliptic said:

“On January 20, US President Donald Trump was sworn into office for his second term in office, a moment the cryptoasset industry has been awaiting with high expectations. Prior to his inauguration, recent news reports had indicated that President Trump – who campaigned on a promise to make the US a leader in cryptoasset innovation – planned to issue executive orders upon taking office that would declare crypto to be a national strategic priority, appoint a crypto czar and establish a crypto council to effect policy changes, and repeal a controversial accounting rule on crypto established by the Securities and Exchange Commission (SEC), known as Staff Accounting Bulletin (SAB) 121.

However, in his first twenty four hours in office, President Trump did not sign any executive order pertaining to crypto.”

Crypto traders and experts maintain optimism of positive action within the first 100 days of Trump’s return to office.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Sui

Sui  Stellar

Stellar  Avalanche

Avalanche  Hedera

Hedera  Litecoin

Litecoin  Toncoin

Toncoin  LEO Token

LEO Token  Shiba Inu

Shiba Inu  USDS

USDS  MANTRA

MANTRA  WETH

WETH  Hyperliquid

Hyperliquid  Polkadot

Polkadot  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Bittensor

Bittensor  Aave

Aave  Dai

Dai  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)