While Binance Coin had done well to record its mid-May gaining spree, the bullish bias swiftly faded away on Thursday after the price broke below a rising wedge. Investors need to be wary over the next 24-48 hours and hedge their risks by making short calls below $300.

A regular crypto investor would likely be familiar with Binance Coin’s recent progress. Its price has recovered steadily since 11-12 May, becoming the only altcoin to flash a positive weekly return on investment.

Now, at first glance, one would assume that BNB had started to look bullish on the daily chart. The price had formed higher highs and higher lows while the RSI was aboard a steady uptrend – a sign that bulls were commandeering the market.

However, Thursday’s retracement indicated that a bullish outlook was rather premature. The candles had breached below a rising wedge pattern and were dangerously close to closing below the daily 20-SMA (red). This breakdown coincided with an RSI rejection at 50. All in all, the developments indicated that bears were still very much in command of the BNB market.

So if BNB does manage to close below its 20-SMA (red), what’s going to happen next? Well, looking at recent exchange volumes, the sell-off could be devastating for BNB holders.

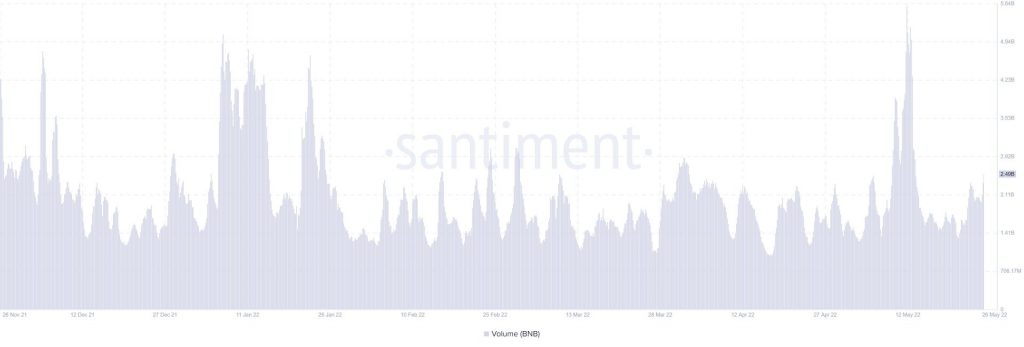

According to Santiment, exchange volumes have been on the higher end since 21 May. Unfortunately, trading volumes can turn out to be a double-edged sword – during a breakdown, high volumes can trigger an even sharper price decline and vice-versa during a breakout.

Furthermore, the breakdown could force holders who participated in BNB’s rally to cash out and avoid taking a loss on their investment.

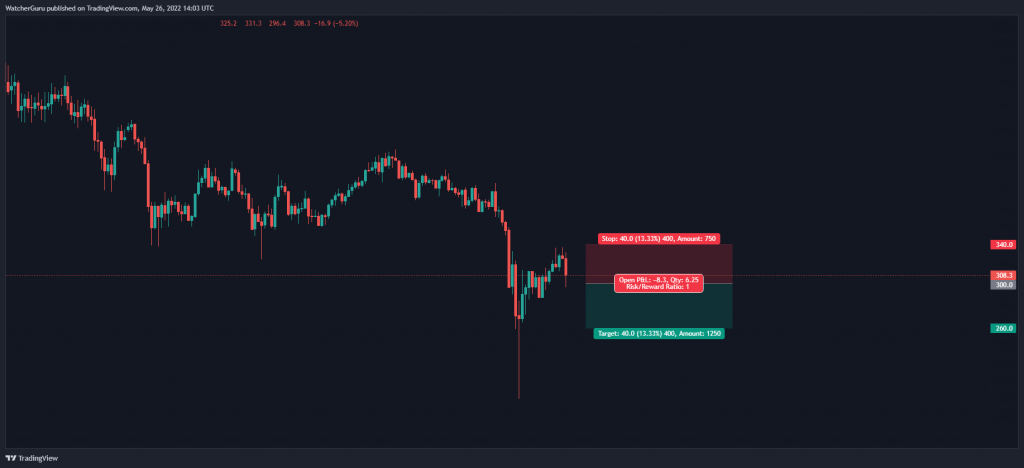

Binance Coin trade setup

Those who are actively trading BNB should be cautious of a further decline over the short term. A close below the 78.6% Fibonacci level (calculated through BNB’s drop from $333 to $207) could extend to a 32% decline, especially if BNB is unable to cut losses between the 61.8% and 50% Fibonacci levels.

To capitalize on this weakness, traders can set up short calls below $300 and cash out at $260. A stop-loss can be kept at $340, above the upper trendline. The trade setup carried a risk/reward ratio of 1.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB