The Bitcoin price returned to its sideways price action following a powerful surge into new yearly highs. The cryptocurrency seems poised for further gains if bulls can hold a critical level.

As of this writing, BTC trades at $36,370, with a 2% loss in the last 24 hours. Over the previous week, the number one crypto by market capitalization recorded a 5% gain, while the sentiment in the sector looks mixed, with BTC recording losses as Ethereum and Solana stayed strong in the same period.

Bitcoin Likely To Bounce If This Scenario Plays Out

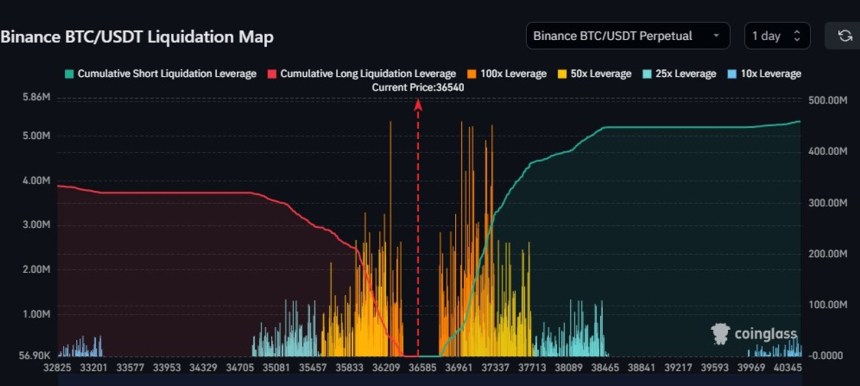

According to a pseudonym analyst, the liquidity in the Bitcoin spot market, measured by a “Liquidity Map,” has been allocated to the downside. This metric gauges the amount of leverage in the BTC/USDT trading pair.

The chart below shows that BTC is trading close to a huge liquidation cluster. Overleverage positions create these levels and are often tapped by big players to exploit the liquidity.

BTC whales chase liquidity, moving prices towards the biggest pools of overleveraged positions. If the $36,300 gets tapped, the next level of interest is located to the upside between $36,961 and $37,700. The analyst stated:

Big clusters at $36K and ~$37K. Would expect there to be quite some positions build up around that 37K region mainly as we chopped around it all day yesterday. Bears are back in control on the LTF (Low Timeframe) below $36.3K I’d say.

BTC Hits Local Top?

On the other hand, the Bitcoin price could trend sideways between $36,300 and the high of its current range. Additional data from crypto analytics firm Bitfinex Alpha indicates that historical data hints at bad news for optimistic traders.

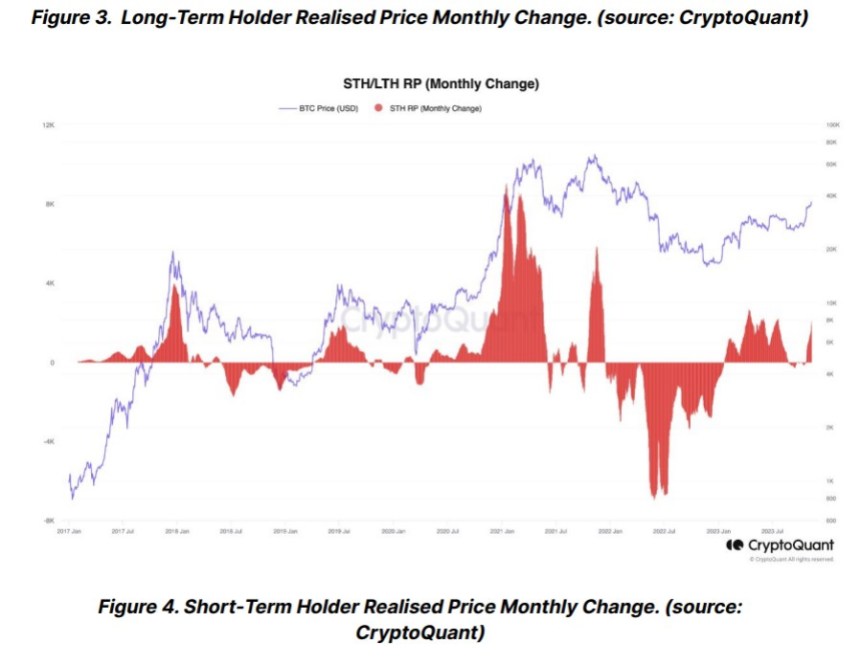

The firm advises caution for traders as the liquidity gap in the Bitcoin spot market increases. Per recent data, BTC Short-Term Holders Realized Price (STH RP) bought the cryptocurrency at an average price of $30,380, which could incentivize these investors to take profit at current levels.

This is the first time STH has had an opportunity to make a big profit on their BTC holdings since April 2022 and December 2022. Historically, a monthly change in STH RP exceeding $2,000 often signals local peaks, particularly post-recovery in bear markets, as seen in the chart below.

Concurrently, a negative monthly shift in LTH RP usually implies long-term holders are offloading their Bitcoin. The convergence of a $2,000 increase in monthly STH RP and a decline in LTH RP suggests a high likelihood of a local peak in Bitcoin’s price.

Cover image from Unsplash, chart from Tradingview

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC