Right before the UST’s fiasco, the Luna Foundation Guard—the non-profit in charge of catering to the health of Terra’s ecosystem—kept buying Bitcoin to replenishing its reserves. At a point, it possessed over 70,736 BTC (worth over $2 billion).

Now that people from the space have accepted the fate of LUNA-UST, the eyes remain fixated towards the organization’s unaccounted Bitcoin reserve.

Over the weekend, Terra founder Do Kwon took Twitter to share that that the team was working on documenting the use Luna Foundation Guard’s reserves during the de-pegging event. He had simultaneously requested the community to remain patient.

Nonetheless, people have already lost their cool and have started asserting things like, “the lack of statement is the statement.”

Where did the Bitcoins actually go?

Well, the ultimate aim of LFG’s BTC purchase was to bolster UST’s reserves and aid it retain its $1 valuation. The purchases, however, proved to be futile as Terra’s stablecoin lost its stability. At press time UST was trading substantially below its $1 peg, at $0.1520.

Out of the total its reserves, LFG provided a “loan” of $750 million in Bitcoin to over-the-counter trading firms and market makers last week “to help protect the UST peg.”

Per basic Math, post providing the loan, the foundation should have been possessing Bitcoin worth at least $1.2 billion in its reserves. Per data, nonetheless, the balance was down to 0 last week itself.

Alongside, the Foundation’s publicly-known wallet address depicted a 0 Bitcoin balance at press time, confirming the same.

Even though it is still not clearly known where LFG has sent its Bitcoins, the most common speculative theory suggests that the Foundation has abandoned all its BTC.

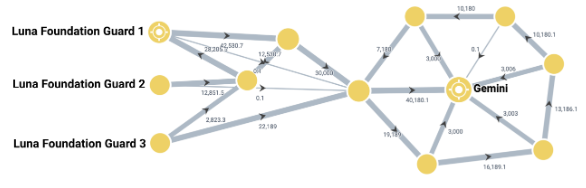

Blockchain analytics platform Elliptic used its software to follow the money trail and discover the fate of the LFG Bitcoins.

Exactly around the $750 million loan announcement time, 22,189 BTC (worth $750 million at that time) was sent from a Bitcoin address linked to LFG, to a new address. Post that, in the evening, an additional 30,000 BTC (worth $930 million at the time) was sent from other LFG wallets, to this same address.

Then, per Elliptic,

“Within hours the entirety of this 52,189 BTC was subsequently moved to a single account at Gemini, the US-based crypto currency exchange – across several Bitcoin transactions.”

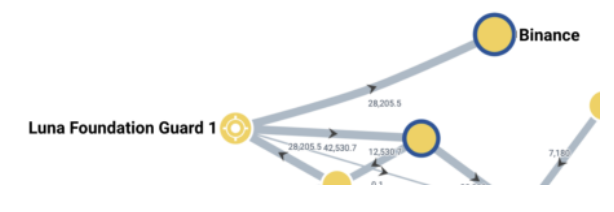

Post the Gemini transfer, LFG should have had left 28,205 BTC in its reserves. Coincidentally,

“At 1 AM UTC on May 10th, this was moved in its entirety, in a single transaction, to an account at the cryptocurrency exchange Binance.”

The analysis platform was, however, couldn’t track down if the said Bitcoins were sold or subsequently moved to other wallets post the transfer.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  Hyperliquid

Hyperliquid  USDS

USDS  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC