Earlier this week, cryptocurrency bank Silvergate announced that its exposure to FTX was limited to its deposits. The U.S. bank, which services the majority of the crypto industry in the country, said that it had no loans or investments in FTX.

The bank’s statements managed to soothe the market, with its stock posting a slight recovery after losing almost 50% of its value in the past month.

However, Silvergate is not out of the woods yet. The bank acts as a foundation of the crypto market in the U.S. and is deeply intertwined with the global industry. While FTX’s bankruptcy proceedings might have an insignificant effect on its balance sheet now, the broader market downturn is causing its foundation to crack.

What is Silvergate, and why is it important to the crypto industry?

The bank began targeting crypto companies as clients as early as 2013 and has become one of a handful of tradFi institutions to offer services to the industry.

Being first to the market, Silvergate managed to position itself as the main pipeline facilitating the flow of fiat funds and the conversion of cryptocurrencies between exchanges. The company counts some of the largest crypto companies in the U.S. among its clients — Coinbase, Kraken, Gemini, Genesis, Circle, Bitstamp, Paxos, and FTX all use the bank’s services.

Its importance to the industry lies in the licenses it holds in the U.S. Silvergate is regulated by the Federal Deposit Insurance Corporation, the Federal Reserve, and the California Department of Financial Protection and Innovation.

This kind of regulation enabled the bank to develop a real-time payments system called the Silvergate Exchange Network (SEN), which allows crypto exchanges and institutions to exchange dollars and euros in real-time. The service was revolutionary at the time, as no other bank had real-time payment capabilities that would match the 24/7 payment needs of the crypto industry.

As of September 2022, Silvergate had 1,677 customers using SEN and held around $12 billion worth of customer deposits.

Because the bank charges no fees to use SEN and the customer deposits don’t bear any interest, it makes money by using the deposits to invest in bonds or issue loans to earn money on the spread. The bank also gives Bitcoin-collateralized loans through SEN Leverage, but deposits are its primary source of revenue.

According to Forbes, commitments to SEN Leverage reached $1.5 billion in mid-October, up from $1.4 billion recorded in June.

Silvergate and the FTX fallout

In a statement issued last week, Silvergate said that it had no lending relationship with FTX. However, even if it did, the outstanding balances on SEN Leverage represented less than 10% of Silvergate’s total assets last month.

Reports also showed that only around $300 million had been drawn on these credit lines at the end of September, with no reason to worry this number will significantly increase. Even if it did, all of Silvergate’s loans are overcollateralized, and it is yet to experience any loss or force liquidate the collateral, the company said in its mid-quarter update.

Other than the $1.2 billion of FTX deposits, Silvergate saw around $900 million of further deposit outflows in the past week.

While last week’s outflows alone weren’t enough to trigger market-wide panic, it left many worried that the contagion from FTX could spread to other creditors. Silvergate’s ten biggest depositors — which include Coinbase, Paxos, Crypto.com, Gemini, Kraken, Bitstamp, and Circle — accounted for around half of the bank’s deposits at the end of the third quarter.

Trouble has already begun brewing at Gemini, which halted withdrawals from its Gemini Earn program earlier this week. The New York-based exchange cited problems with crypto lender Genesis, which acted as the official lending partner of the program. Genesis halted its own customer withdrawals a few days earlier, saying exposure to Three Arrows Capital, the firm faced hundreds of millions in losses from the over-leveraged hedge fund.

Gemini noted that none of its exchange funds were affected by the trouble at Genesis. Other large exchanges tried to front-run any rumors about insolvency by posting their reserves and committing to better transparency efforts in the future.

However, many players in the industry believe that the worst is yet to come.

Multicoin Capital, a cryptocurrency venture fund with a hefty investment in FTX, said it didn’t expect the market to turn anytime soon. In a letter to investors, the company said that it expected the contagion fallout from FTX to continue over the next few weeks.

“Many trading firms will be wiped out and shut down, which will put pressure on liquidity and volume throughout the crypto ecosystem. We have seen several announcements already on this front, but expect to see more.”

Marc Cohodes, the legendary short-seller from Alder Lane Farm, believes Silvergate won’t be immune to the contagion.

In an interview on Hedgeye, Cohodes said Silvergate was facing a much more significant danger than what they’re projecting to the public.

“If they lose all their depositors, there’s gonna be a run on the bank.”

If U.S. regulators begin digging deep into Silvergate and the $1 trillion worth of transactions it facilitated, Cohones believes the bank could be in trouble. He said that investigation into the bank could reveal little to no KYC and AML processes and question its involvement in what he calls “FTX’s criminal operation.”

Many have accused Cohones of manipulating facts to drag down Silvergate’s shares. Silvergate must provide quarterly financial statements to U.S. regulators as a regulated institution, outlining its assets and liabilities. The bank’s third-quarter statements show no risk of default thanks to its overcollateralized loans and a healthy asset balance.

@AlderLaneEggs is either dumb or deliberately trying to manipulate (for lack of a better word) $SI shares. Silvergate Capital is a bank holding company operating a federally regulated banking institution. As per Q3 Form 10-Q, their total assets amount to $15.5 billion, pic.twitter.com/62sjwVsmut

— Kashyap Sriram (@kashyap286) November 16, 2022

Trouble is brewing for Silvergate.

Nonetheless, the list of companies ceasing their use of the bank keeps increasing.

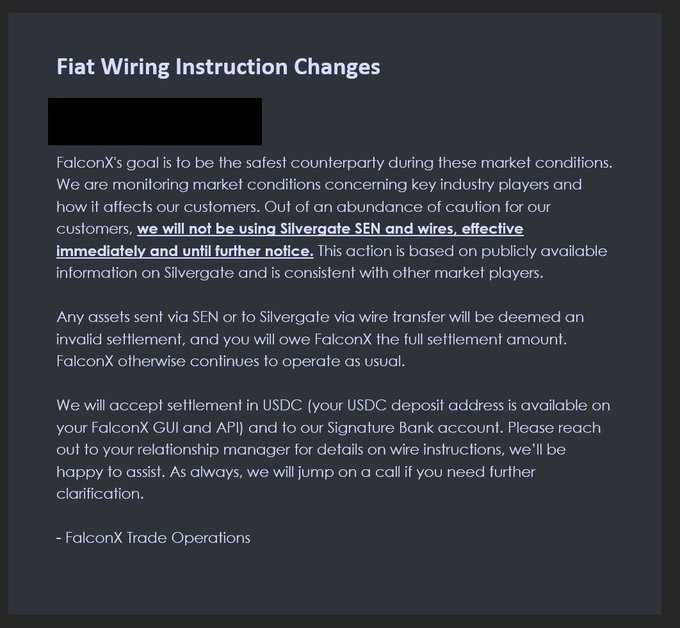

FalconX, one of the leading crypto prime brokerages in the U.S., announced that it will stop using Silvergate SEN and wire transfers “effective immediately and until further notice.”

“This action is based on publicly available information on Silvergate and is consistent with other market players,” the company said in an email to clients. “FalconX otherwise continues to operate as usual.”

The bank was also recently subpoenaed and found to have $425 million in transfers among its crypto bank accounts to South American money launderers. While Florida courts are yet to rule whether there is cause for a lawsuit and forfeiture, the affidavit raised concerns.

If further investigations into the bank are opened, its remaining depositors could begin withdrawing funds. However, financial records show the bank is entirely solvent, so depositors will likely not experience any difficulties withdrawing.

However, the contagion from FTX could affect other Silvergate borrowers. Liquidating their Bitcoin collateral would put additional selling pressure on the already struggling market and trigger more liquidations as the value of remaining collateral drops below the value of the loans.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Litecoin

Litecoin  WETH

WETH  Polkadot

Polkadot  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Official Trump

Official Trump  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB