Macro Overview

Recap of critical events, week commencing Oct. 10

As CryptSslate attended Bitcoin Amsterdam, there was no weekly MacroSlate report for the week commencing Oct. 10. Key macro topics that occurred were;

On Oct. 13, the U.S. CPI inflation report showed a worrying jump in prices excluding food and energy for September, pushing the ten-year treasury to a high of 4.08%.

While Oct. 14 saw the U.K experience U-turn after U-turn on fiscal policy. BOE jumbo-sized gilt purchases were finalized, which stabilized yields. This leaves Japan as the only G7 central bank still supporting its government debt, while the ten-year treasury was above 25 bps and the yen against the dollar kept making fresh highs.

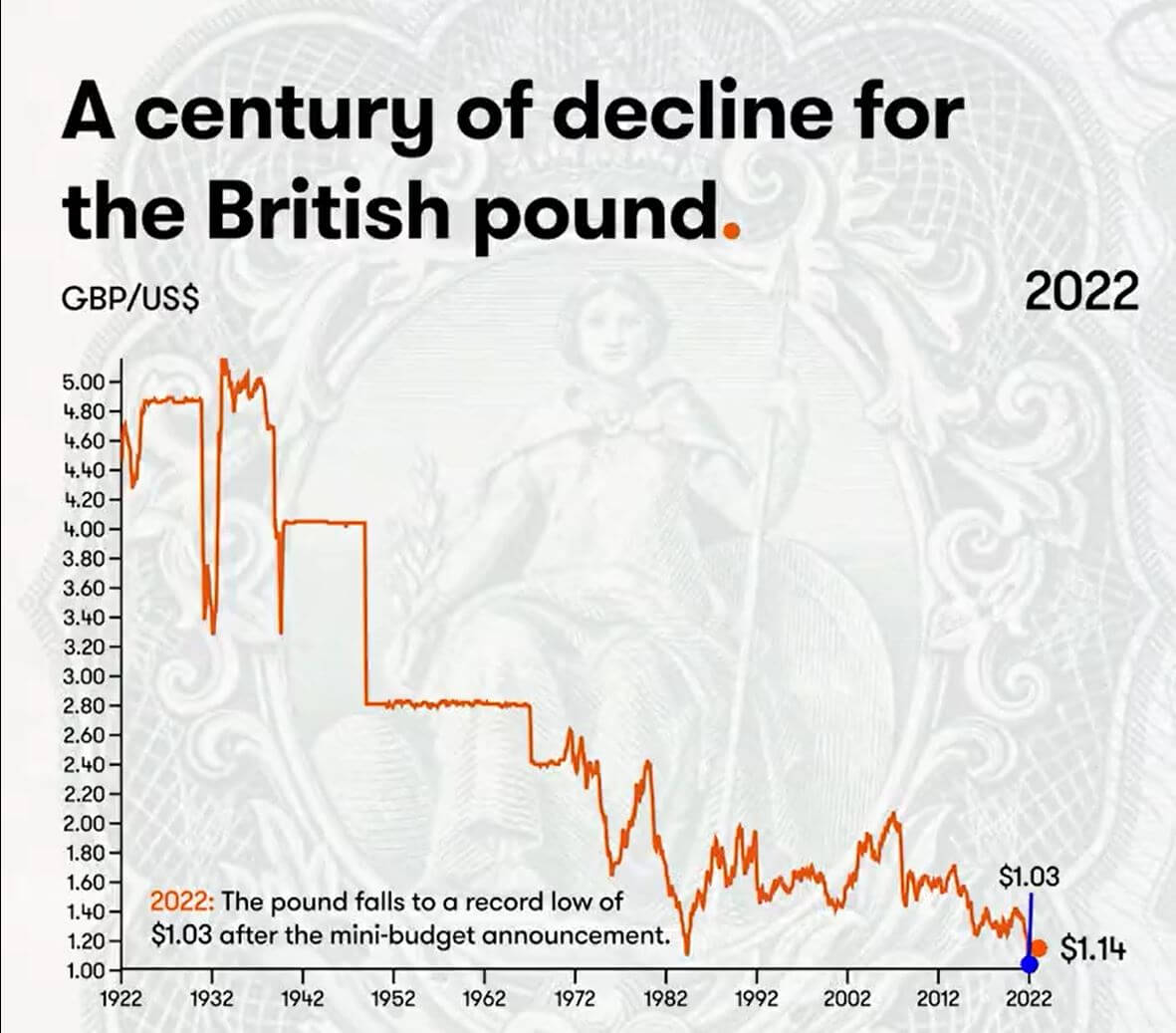

A century of decline for the British pound

The year 2022 has seen new lows for the British pound, with a government in disarray, the gilt market unstable, and the BOE acting as a backstop. The impact of poor monetary and fiscal policy decisions as its long-term bond yields convulsed and threatened the solvency of over-leveraged pension funds.

However, many investors believe this is a cycle, and the pound will return. If it’s cheap to buy, investors will buy it. However, this may not be the case; the U.K. is facing acute energy shortages and minimal fx reserves to defend the currency.

The last century has seen a massive decline in the British pound, and it doesn’t look like it will get better soon.

Since the U.S dollar came into existence in 1791, the free market rate was $4.55 to £1. Fast forward to 1925, and the pound has been sliding down against the dollar.

- 1925 – Winston Churchill returns sterling to the gold standard at the pre-war rate of $4.86.

- 1931 – The sterling comes off the gold standard, and the pound drops considerably. £1 is equivalent to $3.28.

- 1940 – Sterling drops with the outbreak of WWII. The British government pegs the value at £1 to $4.03.

- 1949 – The British government devalues the pound to $2.80 to support exports and rebalance the economy.

- 1967 – An economic crisis strikes. The British government devalues the pound to $2.40

- 1976 – High unemployment and inflation forced Britain to request an IMF loan. Sterling is allowed to float.

- 1985 – Ronald Regan’s tax cuts boosted the U.S economy and led to immense dollar strength.

- 1992 – the U.K exits the Exchange Rate Mechanism, and the pound drops to $1.48.

- 2001 – The pound falls to $1.40 after the dot-com bubble.

- 2008 – Global financial crash sees the dollar act as a haven currency.

- 2016 – Brexit referendum sees the pound fall to $1.23.

- 2022 – The pound falls to a record low of $1.03 after the mini-budget announcement.

(If you are curious, from 1861 – 1864, the £ surge to $~9 was US money fleeing the Civil War.)

Correlations

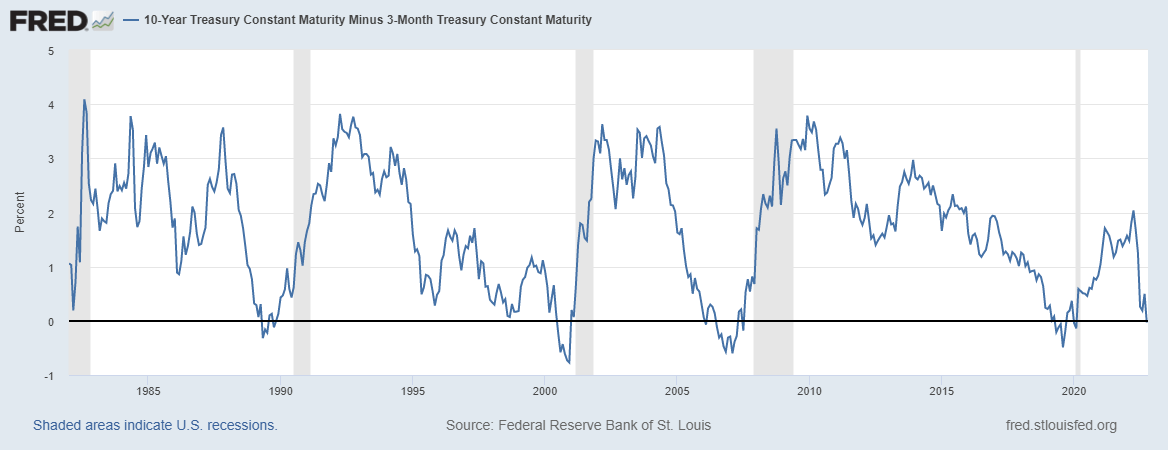

10 Year minus three-month treasury inverts has preceded every recession since WWII

When the 10-year and 2-year treasury note spread inverts, it is generally considered a warning of severe economic weakness; In contrast, when the credit spreads widen during times of financial stress, the flight to safe-haven assets such as the DXY, or the immediate need for dollar redemptions to meet payments.

The 10- year-three month spread inverted on Oct. 18, currently at -0.03bps, as many economists believe this is the accurate recession signal. The inversion of each yield curve has presaged every recession going back more than 40 years, and a recession usually occurs within the next six-twelve months.

Equities & Volatility Gauge

The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States. S&P 500 3,753 2.14% (5D)

The Nasdaq Stock Market is an American stock exchange based in New York City. It is ranked second on the list of stock exchanges by market capitalization of shares traded, behind the New York Stock Exchange. NASDAQ 11,310 2.48% (5D)

The Cboe Volatility Index, or VIX, is a real-time market index representing the market’s expectations for volatility over the coming 30 days. Investors use the VIX to measure the level of risk, fear, or stress in the market when making investment decisions. VIX 30 -8.33% (5D)

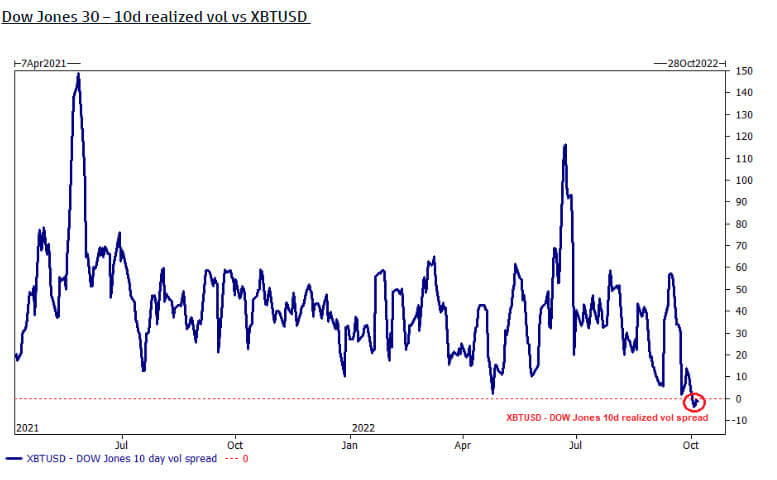

Bitcoin is less volatile than the Dow Jones

The Dow Jones (30 largest industrial stocks) is officially more volatile than Bitcoin, according to the ten-day realized vol spread. However, this is because Bitcoin over Q3 has stayed relatively flat in terms of USD price.

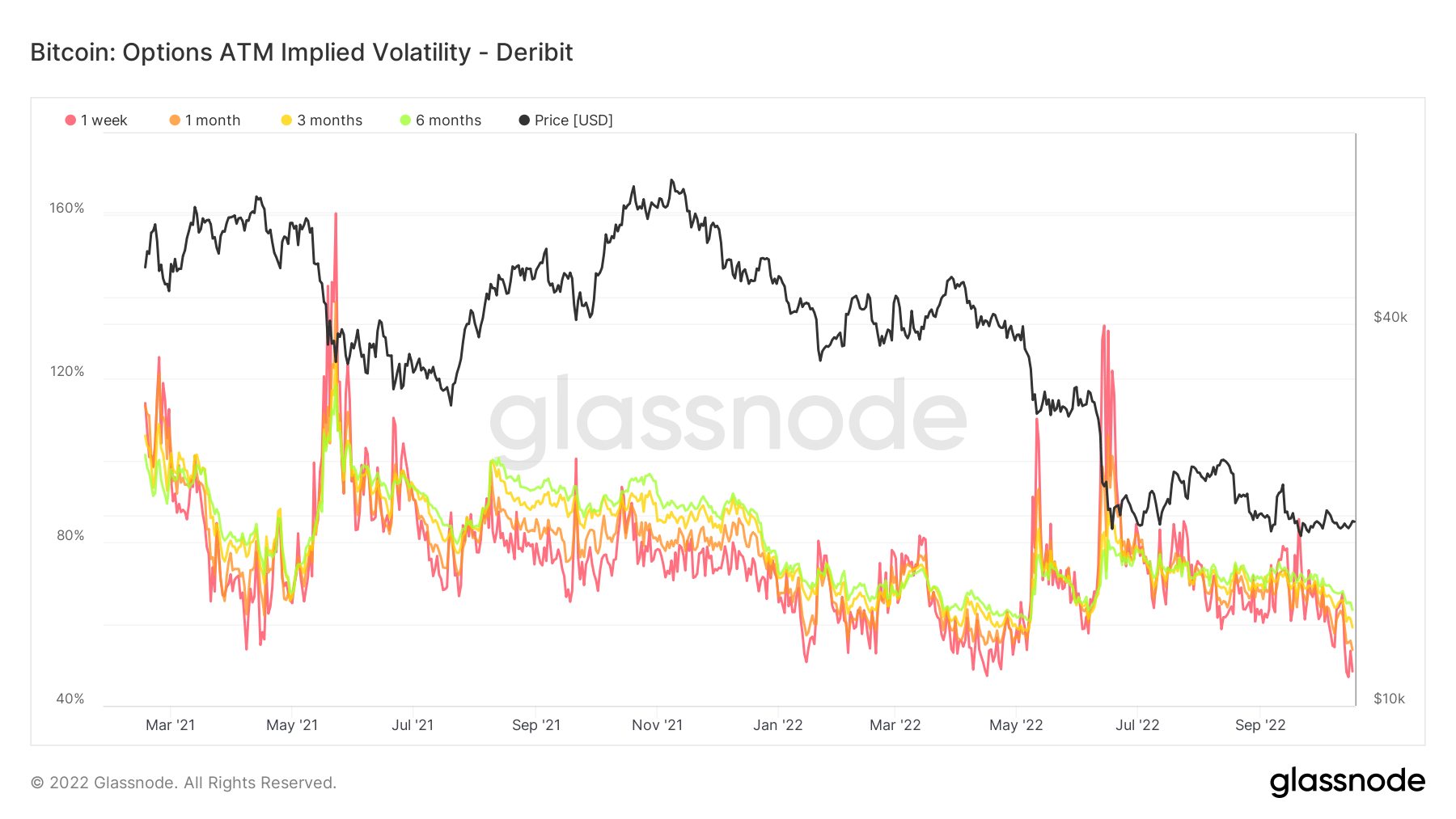

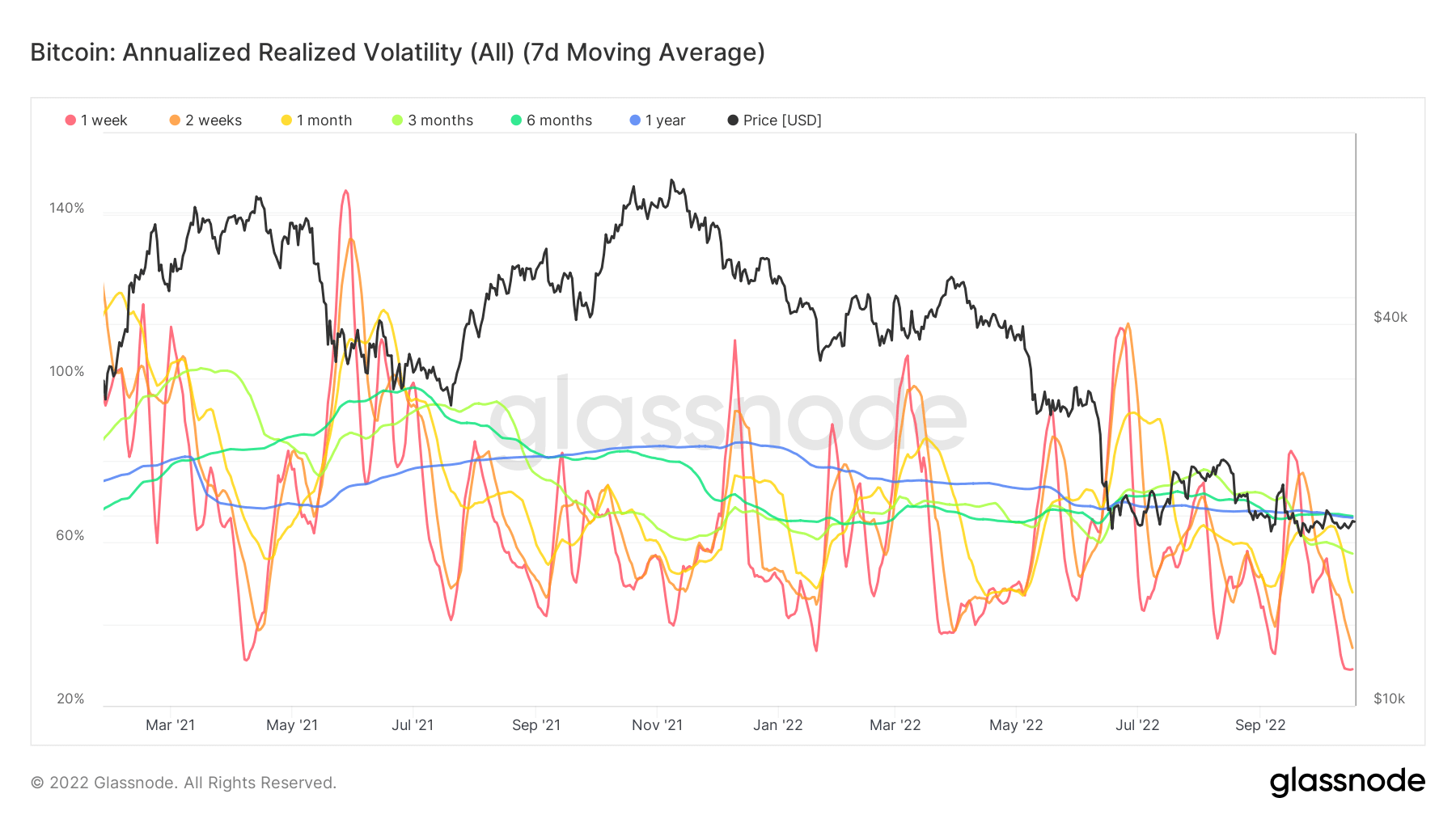

Bitcoin volatility at year-to-date lows

On-chain analytics shows the annualized realized volatility at an all-time low, just under 50% this week. Since March 2021, options implied volatility has been under 50% four times and has seen violent swings in price shortly after.

While implied volatility refers to the market’s assessment of future volatility, realized volatility measures what happened in the past. Insinuating that volatility has been at extremely low levels is encouraging, while traditional financial assets and currencies are as volatile as they come.

Commodities

The demand for gold is determined by the amount of gold in the central bank reserves, the value of the U.S. dollar, and the desire to hold gold as a hedge against inflation and currency devaluation, all help drive the price of the precious metal. Gold Price $1,658 0.61% (5D)

Similar to most commodities, the silver price is determined by speculation and supply and demand. It is also affected by market conditions (large traders or investors and short selling), industrial, commercial, and consumer demand, hedge against financial stress, and gold prices. Silver Price $19 5.52% (5D)

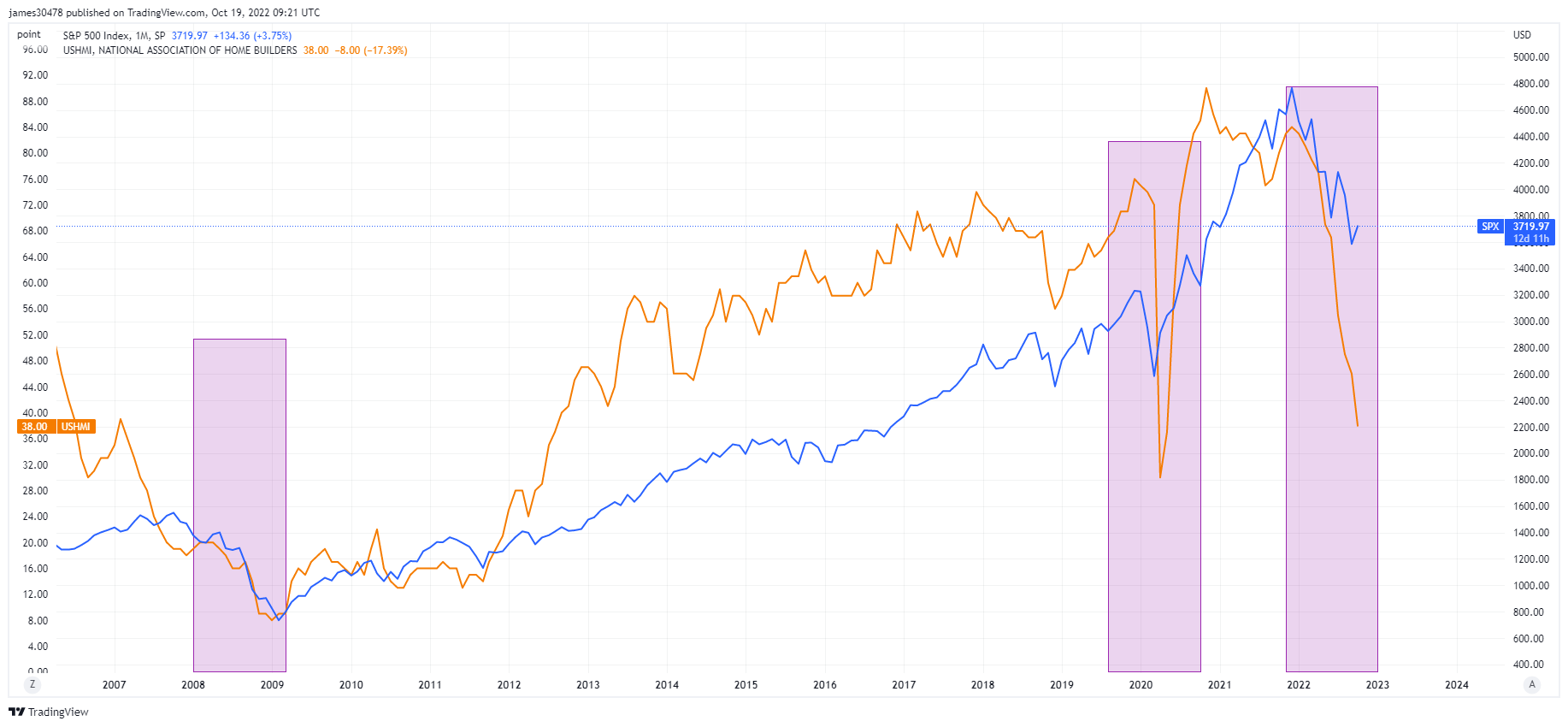

U.S. homebuilders’ sentiment hits a new low

The National Association of House Builders, housing market index sank another 8 points to 38 in October, going back to lows last seen in 2012, just after the GFC recovery. Mortgage rates approaching 7% have significantly weakened demand.

Overlaying the NAHB and S&P 500, with the past two recessions in 2008 and 2020, doesn’t bode well for what’s coming at the end of this year and into 2023; equities could continue to plunge further to the downside if the trend continues to be your friend.

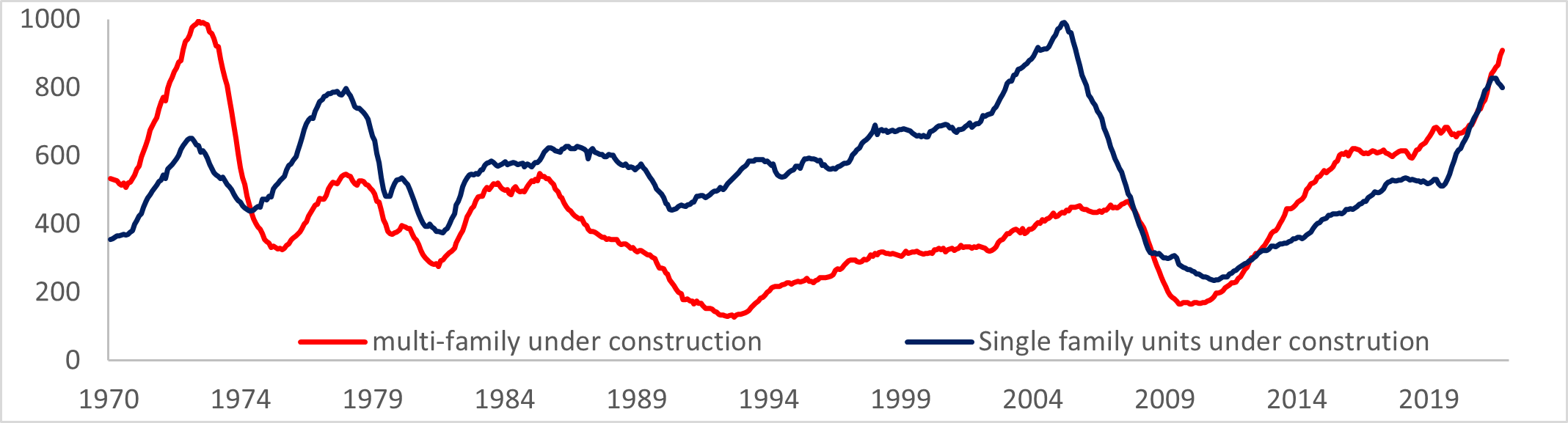

U.S. Construction building a bigger problem

According to MBA, the average 30- year mortgage rate rose 6.92%, and mortgage applications for home purchases fell considerably, almost 4%.

Increase in permits following continued strong demand for rental units, while single-home family permits declined to the lowest since the pandemic. More units are currently under construction than at any time since 1974; this does not seem to bode well for multifamily construction.

Rates & Currency

The 10-year Treasury note is a debt obligation issued by the United States government with a maturity of 10 years upon initial issuance. A 10-year Treasury note pays interest at a fixed rate once every six months and pays the face value to the holder at maturity. 10Y Treasury Yield 4.221% 4.95% (5D)

The U.S. dollar index is a measure of the value of the U.S. dollar relative to a basket of foreign currencies. DXY 111.875 -1.12% (5D)

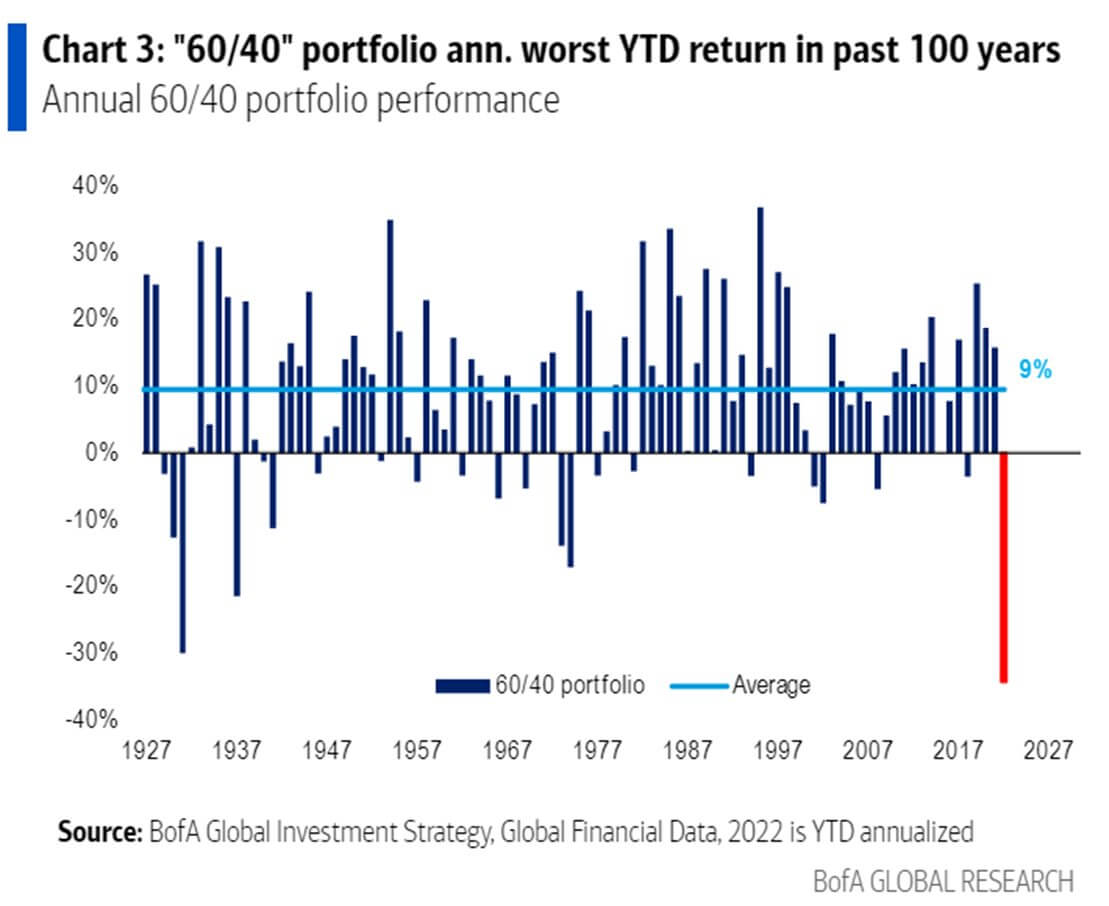

Unparalleled moves in the fixed-income market

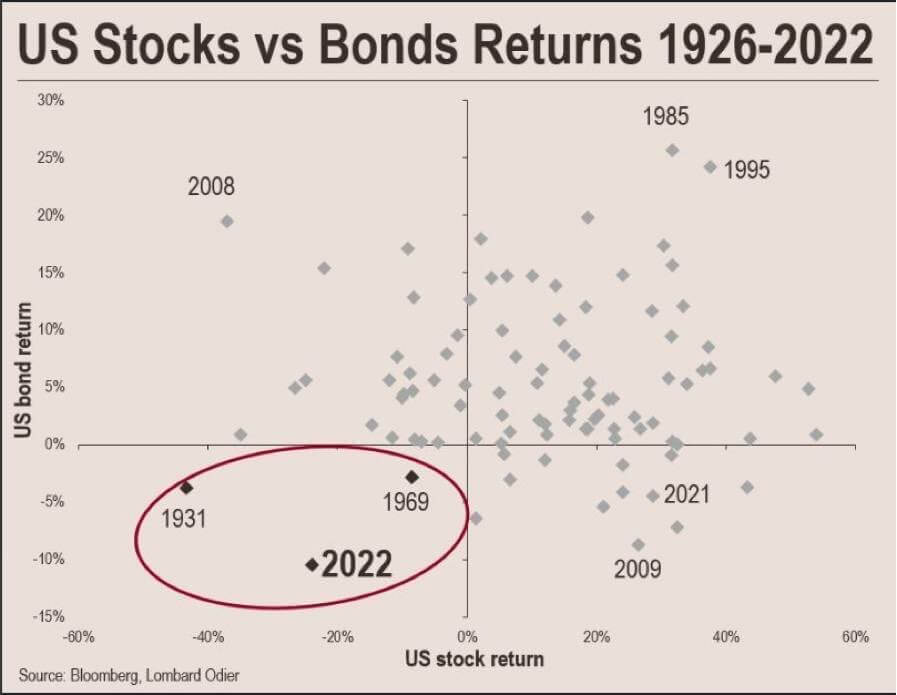

2022 has been an unprecedented year for asset performance; the 60/40 portfolio year to date is the worse performance in 100 years, according to BofA, even worse than the global depression of 1929.

So far, in 2022, the U.S stock and bond market has lost a combined value of nearly $60 trillion. The last time the U.S. markets faced a drawdown of this severity, the U.S. government defaulted its gold peg within the next two years.

In 1933, executive order 6102 required all persons to deliver gold bullion to the Federal Reserve for $20.67 per troy ounce. The U.S had been on a gold standard since 1879, but the Great Depression in the 1930s frightened the public into hoarding gold.

Second, in 1971, during the Nixon shock, President Nixon closed the gold window 1971, the convertibility of U.S dollars into gold, to address the country’s inflation problem and to discourage foreign governments from redeeming more dollars for gold.

Bitcoin Overview

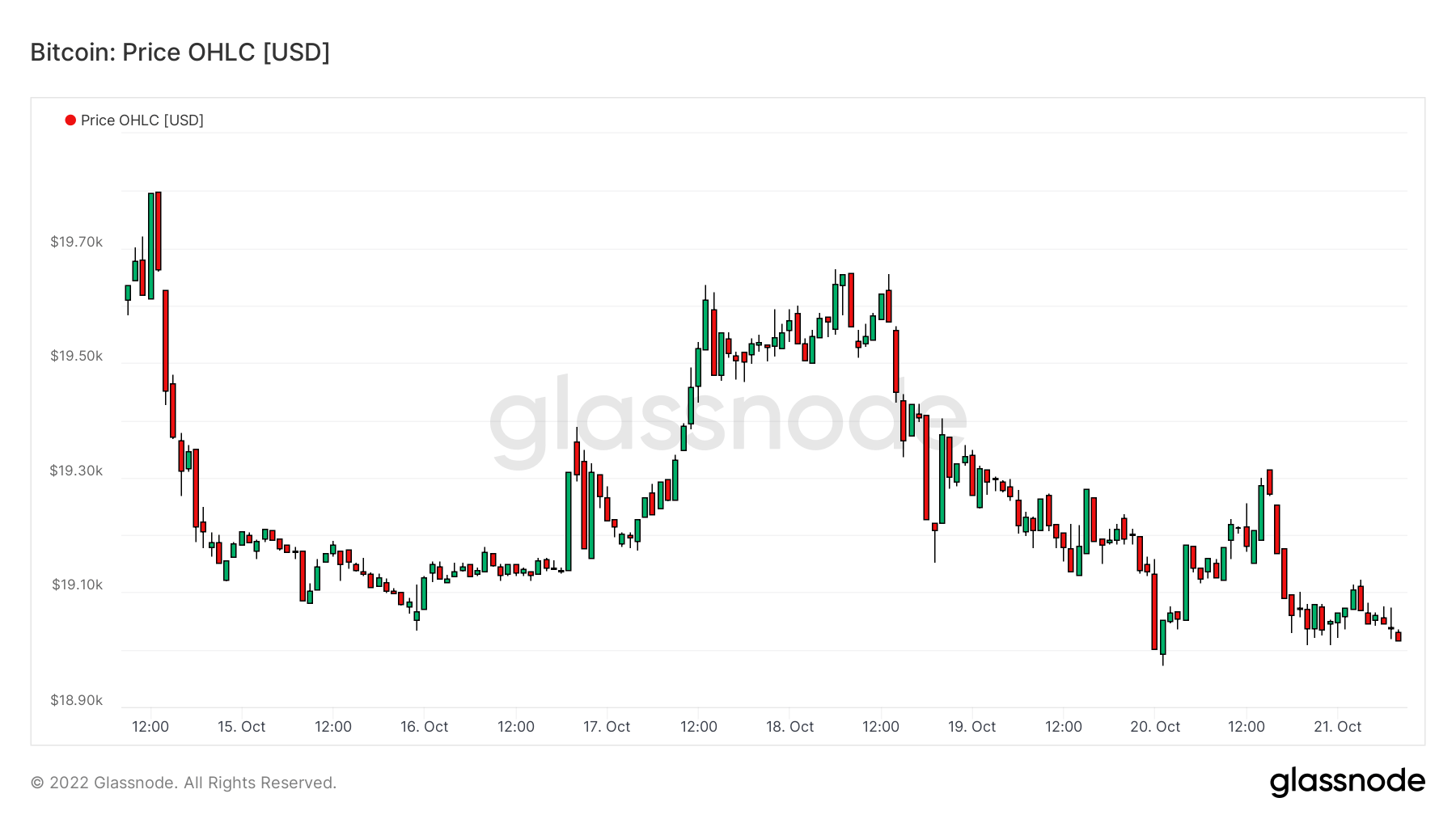

The price of Bitcoin (BTC) in USD. Bitcoin Price $19,160 -1.93% (5D)

The measure of Bitcoin’s total market cap against the larger cryptocurrency market cap. Bitcoin Dominance 41.93% 0.36% (5D)

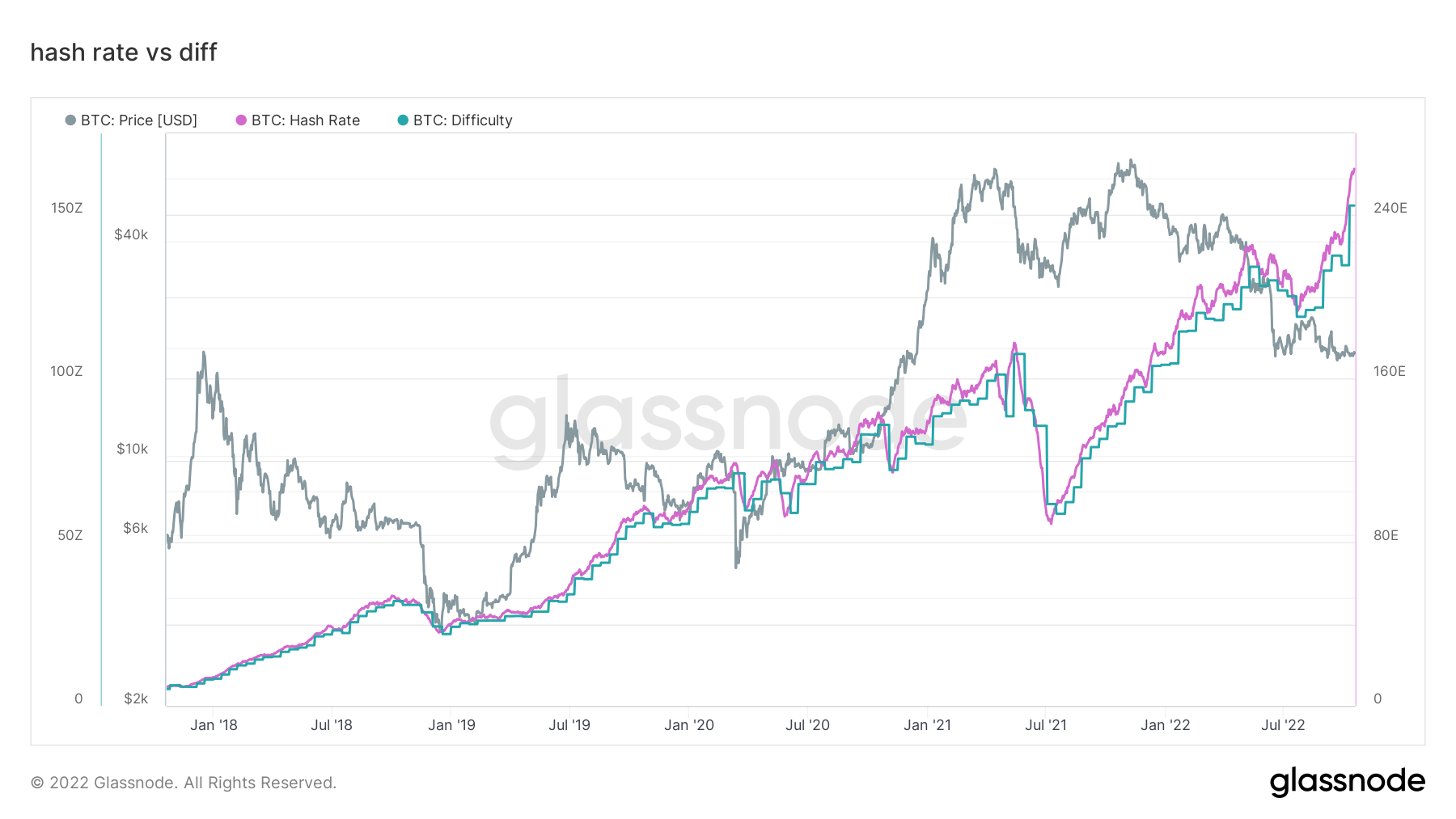

- Bitcoin hash rate continued to soar – 260 EH/S

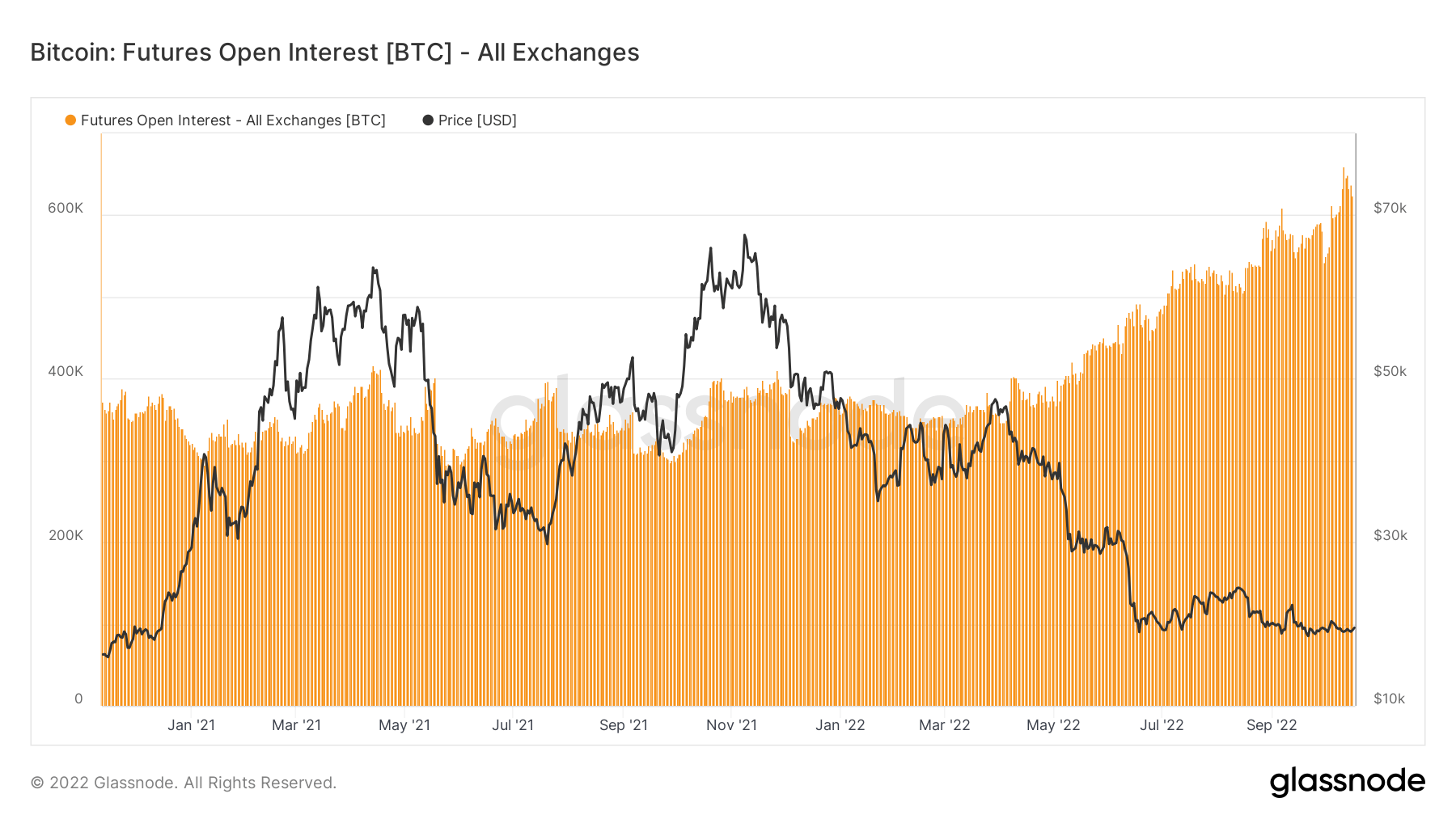

- Futures open interest denominated in BTC hits 650k

- Difficulty projected to increase by 3%

- Asia trade premium at its highest since the last bear market in 2019-2020

Addresses

Collection of core address metrics for the network.

The number of unique addresses that were active in the network either as a sender or receiver. Only addresses that were active in successful transactions are counted. Active Addresses 889,323 3.64% (5D)

The number of unique addresses that appeared for the first time in a transaction of the native coin in the network. New Addresses 406,205 1.97% (5D)

The number of unique addresses holding 1 BTC or less. Addresses with ≥ 1 BTC 908,988 0.40% (5D)

The number of unique addresses holding at least 1k BTC. Addresses with Balance ≤ 1k BTC 2,128 0.52% (5D)

Net accumulation for the first time since July

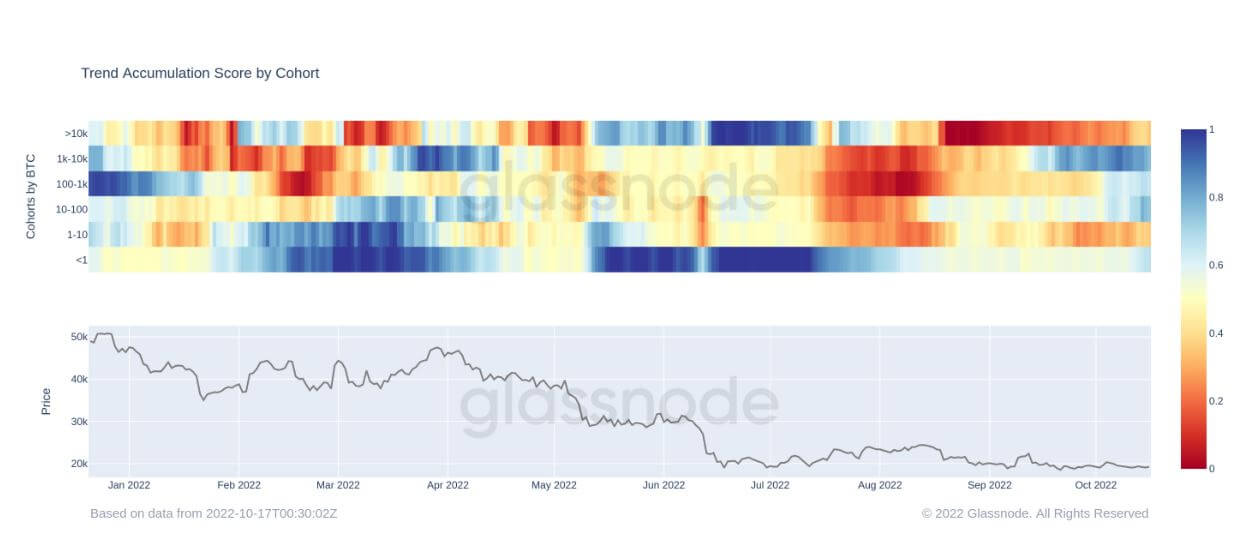

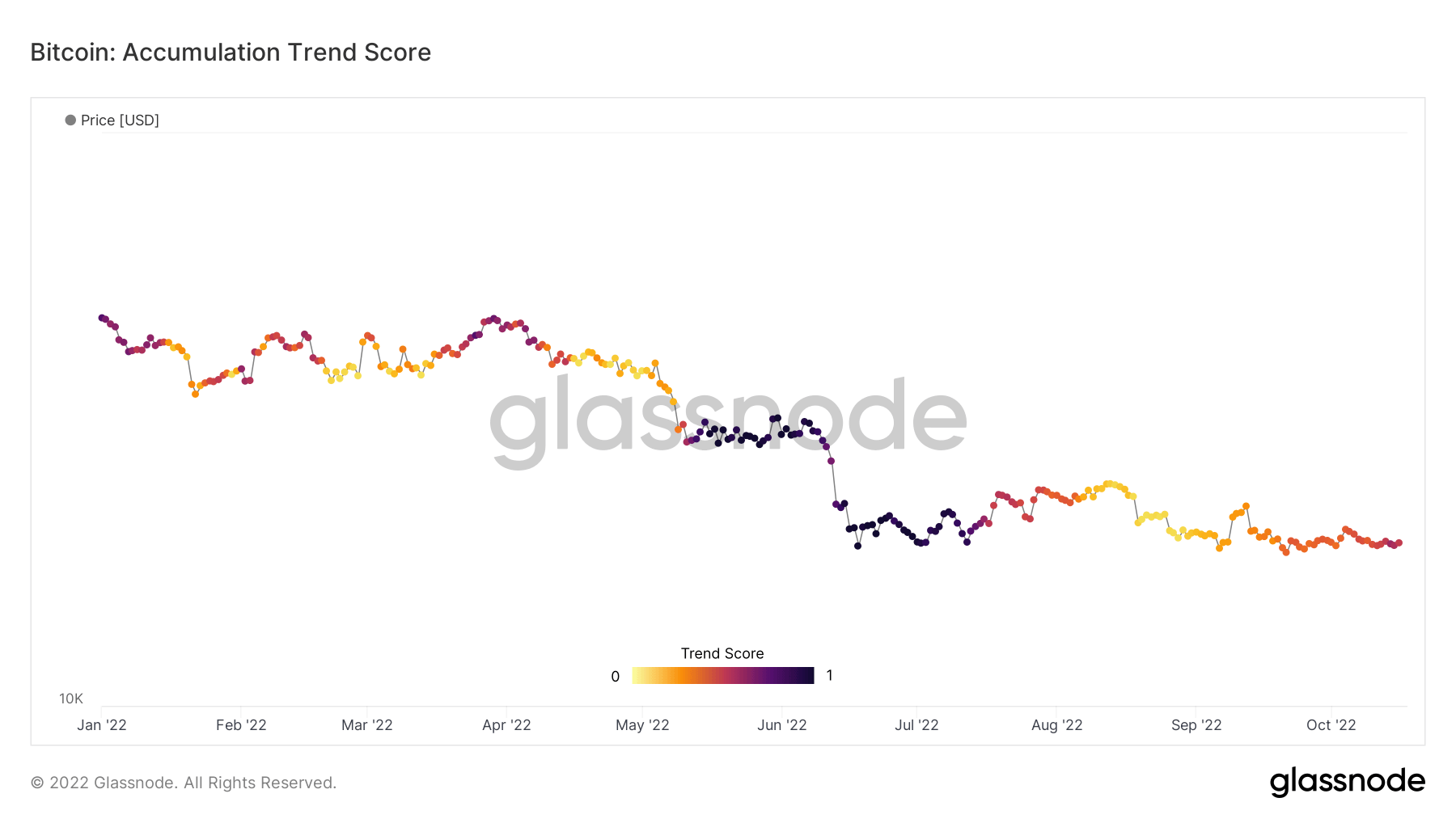

The Accumulation Trend Score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings. The scale of the Accumulation Trend Score represents both the size of the entities balance (their participation score) and the amount of new coins they have acquired/sold over the last month (their balance change score).

An Accumulation Trend Score of closer to 1 indicates that, on aggregate, larger entities (or a big part of the network) are accumulating, and a value more relative to 0 means they are distributing or not accumulating. This provides insight into the balance size of market participants and their accumulation behavior over the last month.

Since the beginning of August, the Bitcoin ecosystem has seen net distributors due to fear around the macro uncertainty with traditional finance assets getting hammered. However, since then, BTC has stayed relatively flat, hovering around the $20k mark, which has been encouraging to see and has most likely alerted wall street that this asset is here to stay.

By looking at the cohorts below, a number of them are accumulating again, such as whales between 1k-10k BTC and retail with less than 1 BTC. Whales that hold 10k BTC or more are still net sellers but have turned into more of an orange than a red, which shows their distribution is being reduced and less selling pressure has occurred.

Dervatives

A derivative is a contract between two parties which derives its value/price from an underlying asset. The most common types of derivatives are futures, options and swaps. It is a financial instrument which derives its value/price from the underlying assets.

The total amount of funds (USD Value) allocated in open futures contracts. Futures Open Interest $12.68B 5.20% (5D)

The total volume (USD Value) traded in futures contracts in the last 24 hours. Futures Volume $24.35B $153.29 (5D)

The sum liquidated volume (USD Value) from short positions in futures contracts. Total Long Liquidations $42.01M $0 (5D)

The sum liquidated volume (USD Value) from long positions in futures contracts. Total Short Liquidations $42.01M $3.25M (5D)

Futures open interest at all-time highs denominated in Bitcoin

Futures’ open interest, the total amount of (USD value) allocated in available futures contracts, has hit an all-time high. This tells us that levels of speculation within the market are increasing, despite Bitcoin falling over 70% from its all-time high.

Futures open interest has stayed relatively flat from January 2021 to May 2022, roughly 350k BTC but has soared to 640k denominated in Bitcoin futures open interest.

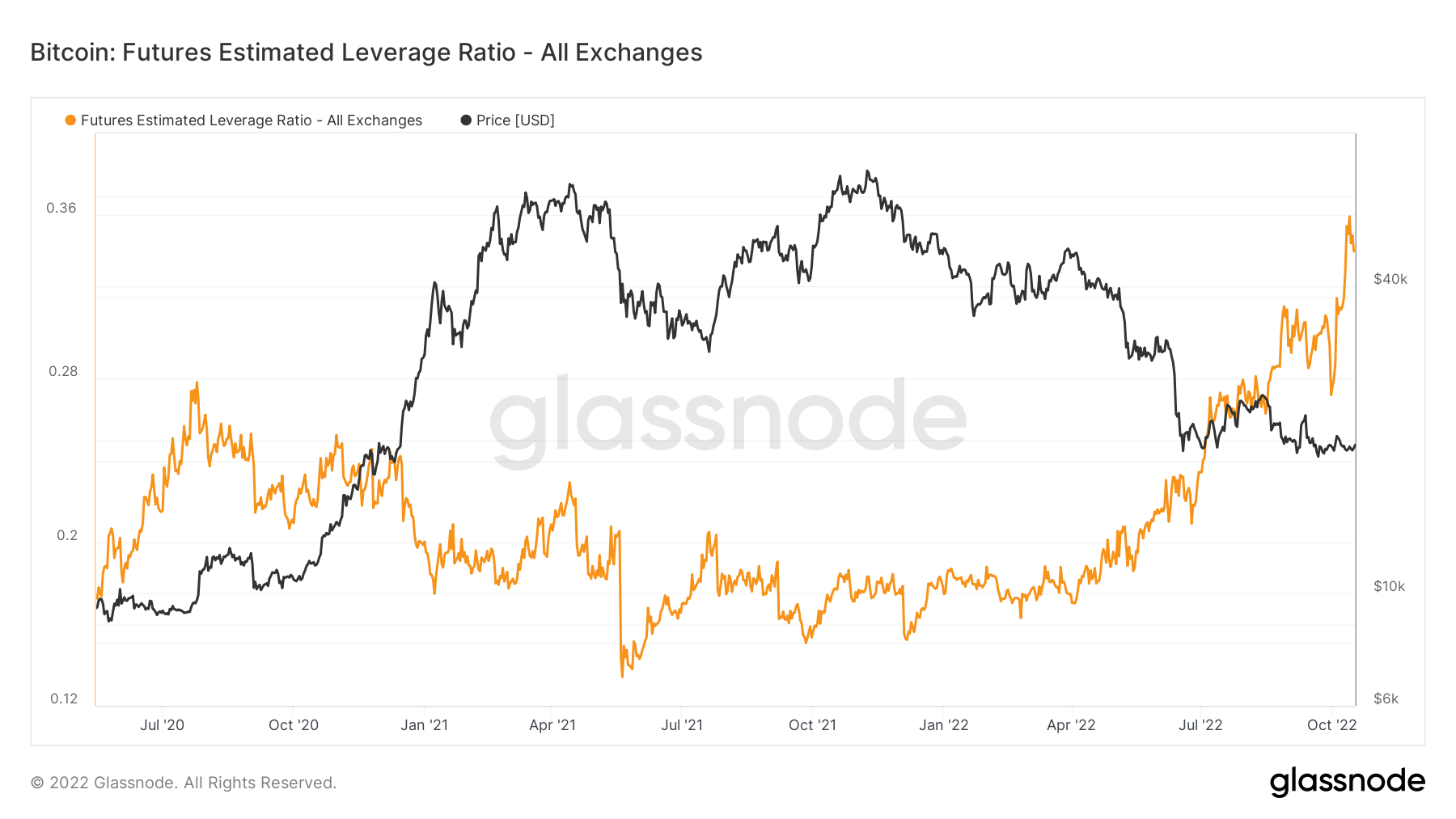

Leverage continues to increase

The Estimated Leverage Ratio is defined as the ratio of the open interest in futures contracts and the balance of the corresponding exchange.

From May 2020 to May 2022, the ELR has stayed in a constant range of around 0.17 to 0.25; however, since June 2022, the ELR has seen a remarkable climb. The ELR is at an all-time high, and a significant amount of leverage needs to be unwound. The BTC ecosystem has low liquidity right now due to being in a bear market while a substantial amount of cash remains on the sidelines; expect to see this leverage start to come down.

Miners

Overview of essential miner metrics related to hashing power, revenue, and block production.

The average estimated number of hashes per second produced by the miners in the network. Hash Rate 262 TH/s 2.34% (5D)

The current estimated number of hashes required to mine a block. Note: Bitcoin difficulty is often denoted as the relative difficulty with respect to the genesis block, which required approximately 2^32 hashes. For better comparison across blockchains, our values are denoted in raw hashes. Difficulty 152 T 13.43% (14D)

The total supply held in miner addresses. Miner Balance 1,830,490 BTC -0.20% (5D)

The total amount of coins transferred from miners to exchange wallets. Only direct transfers are counted. Miner Net Position Change -23,592 BTC -14,681 BTC (5D)

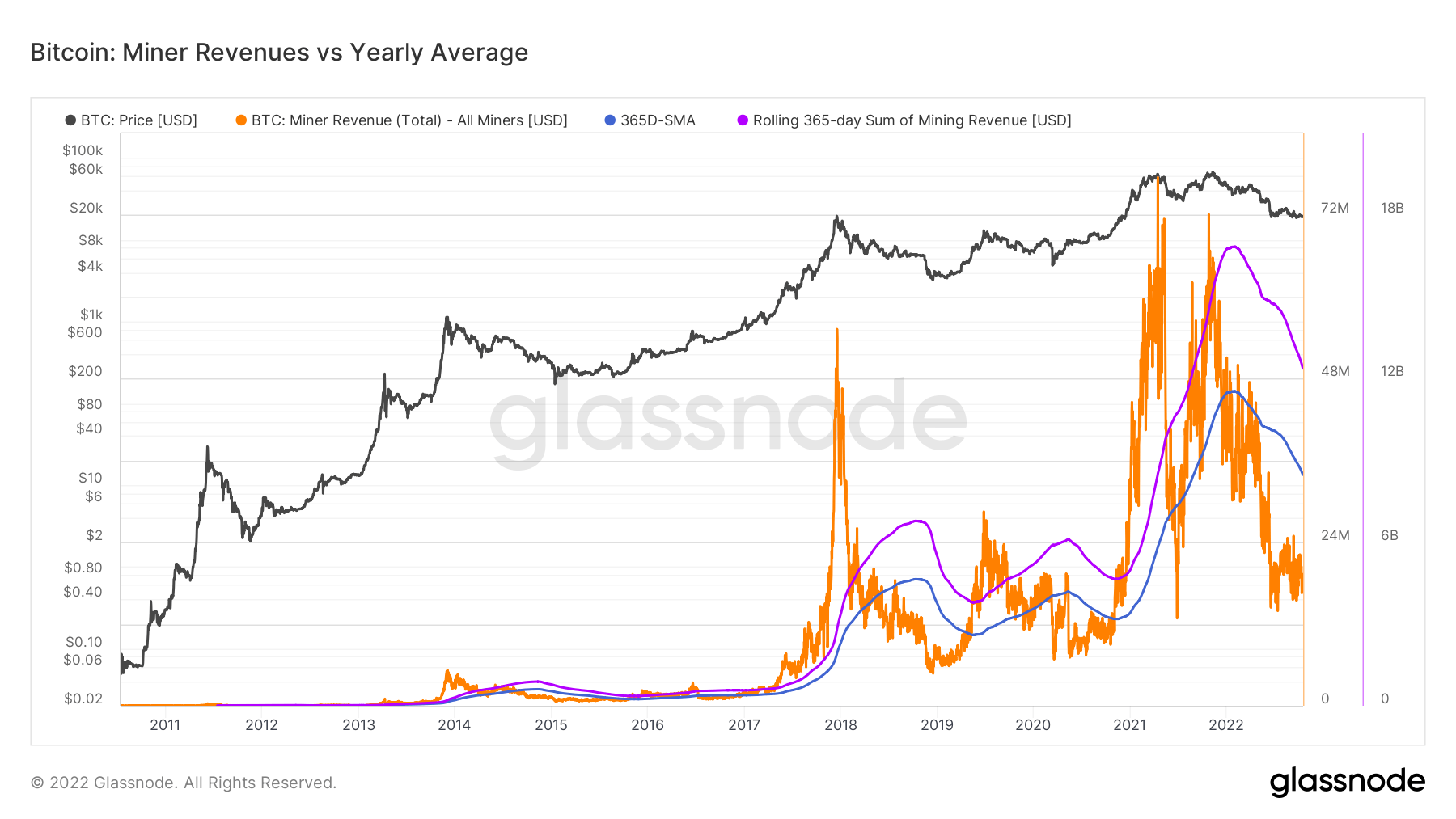

Miners continue to get squeezed

Throughout August to October, the hash rate has gone exponential, from 220 EH/S up to 260 EH/s, this is unheard of during a bear market, and difficulty is playing catch up, which is also at an all-time high, continuing to squeeze miner revenue. When the next difficulty epoch is completed, it is projected to adjust another 3% to the upside. A distant memory of May 2021, when China banned mining and saw the network drop to 84 EH/S.

To contextualize the stress miners are under and the lack of revenue they are incurring is the metric below miner revenue vs. the yearly average. Demonstrates the daily USD revenue paid to BTC miners in orange and compare it to the 365-day moving average. While also observing the aggregate industry income on a rolling 365-day sum of miner revenues.

On-Chain Activity

Collection of on–chain metrics related to centralized exchange activity.

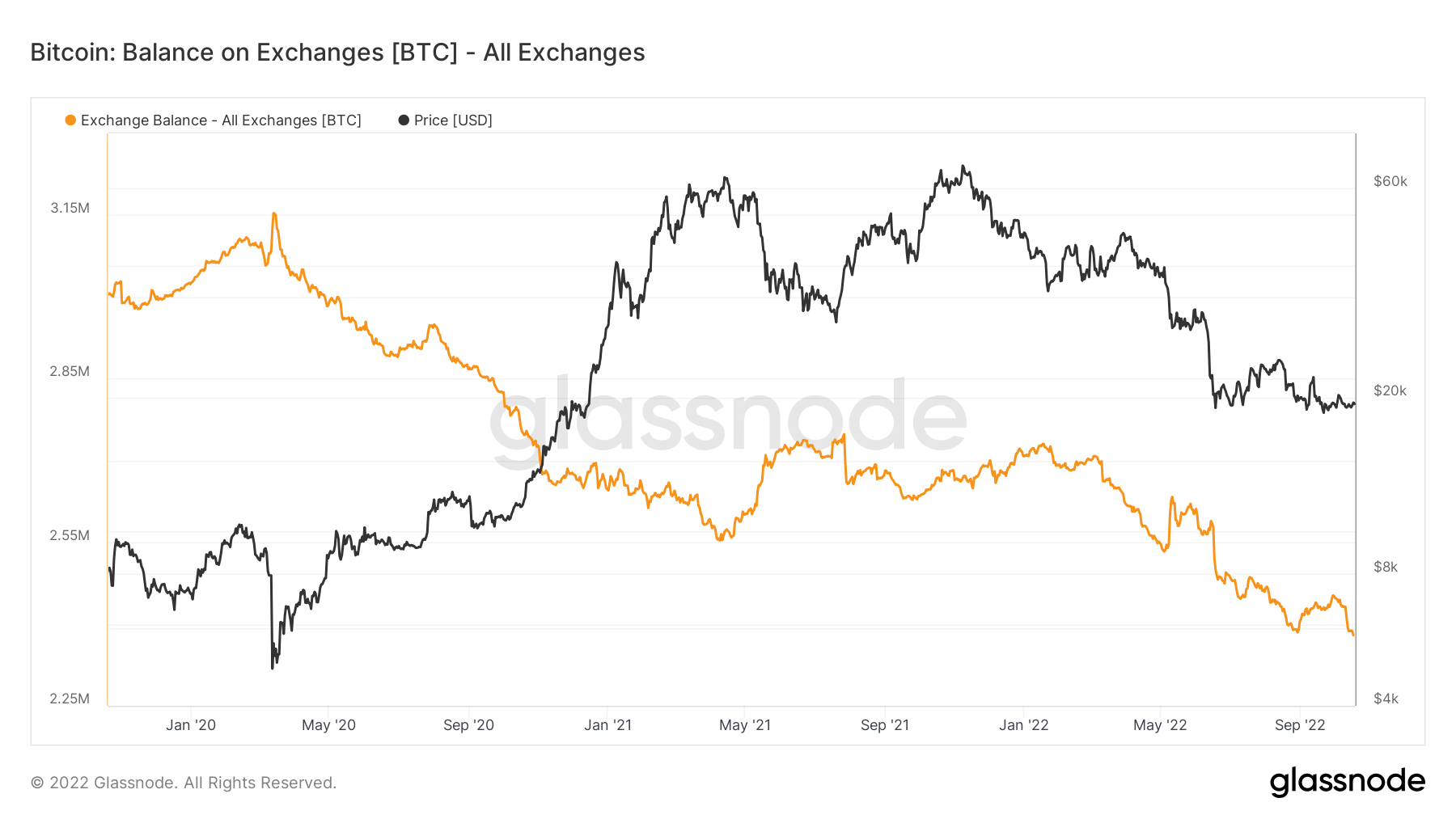

The total amount of coins held on exchange addresses. Exchange Balance 2,343,473 BTC -57,299 BTC (5D)

The 30 day change of the supply held in exchange wallets. Exchange Net Position Change 281,432 BTC -395,437 BTC (30D)

Bitcoin held on exchanges reached its lowest in 4 years

Bitcoin held by exchanges has reached its lowest in four years. Currently, the Bitcoin amount held by exchanges is just under $2,4 million, which is represented by the orange line in the chart below.

Over 300,000 Bitcoins have been removed from the exchanges during winter, indicating a bullish trend among investors. This lowered the supply held by exchanges to its 4-year lowest. The last time the Bitcoin balance on exchanges was around $2,4 million was in late 2018.

The current $2,4 million held within exchanges equate to roughly 12% of all Bitcoin supply in the market.

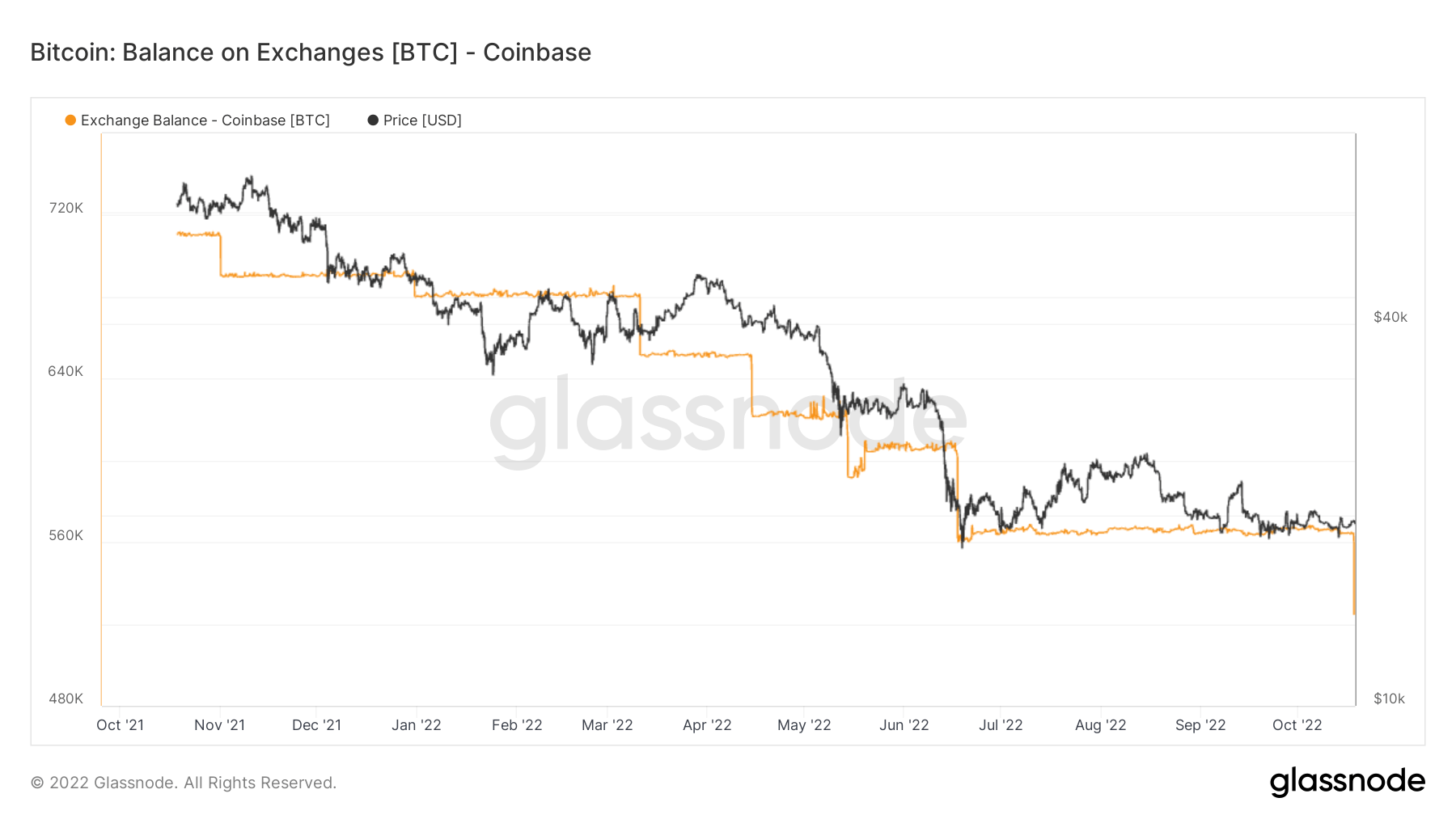

Since the November 2021 bull run, a minimal amount of Bitcoins were released back onto the exchange. At the time, Coinbase held almost 4% of the total Bitcoin supply. The exchange lost 1% of total Bitcoin in nearly a year and has just under 3% of it.

Coinbase is primarily used by large institutions in the U.S., which are known for their tendency to buy and hold. As is also demonstrated by the chart above, the exchange lost significant amounts of Bitcoin after the bear market hit.

Coinbase had nearly 680,000 Bitcoins at the beginning of the year, and that number had fallen to 560,000 in eight months in August. The exchange lost another 50,000 Bitcoins on Oct. 18, which dropped the total amount held by Coinbase to 525,000.

Geo Breakdown

Regional prices are constructed in a two-step process: First, price movements are assigned to regions based on working hours in the US, Europe, and Asia. Regional prices are then determined by calculating the cumulative sum of the price changes over time for each region.

This metric shows the 30-day change in the regional price set during Asia working hours, i.e. between 8am and 8pm China Standard Time (00:00-12:00 UTC). Asia 3,724 BTC -2,159 BTC (5D)

This metric shows the 30-day change in the regional price set during EU working hours, i.e. between 8am and 8pm Central European Time (07:00-19:00 UTC), respectively Central European Summer Time (06:00-18:00 UTC). Europe -3,464 BTC 4,093 BTC (5D)

This metric shows the 30-day change in the regional price set during US working hours, i.e. between 8am and 8pm Eastern Time (13:00-01:00 UTC), respectively Eastern Daylight Time (12:00-0:00 UTC). U.S. -3,445 BTC 5,721 BTC (5D)

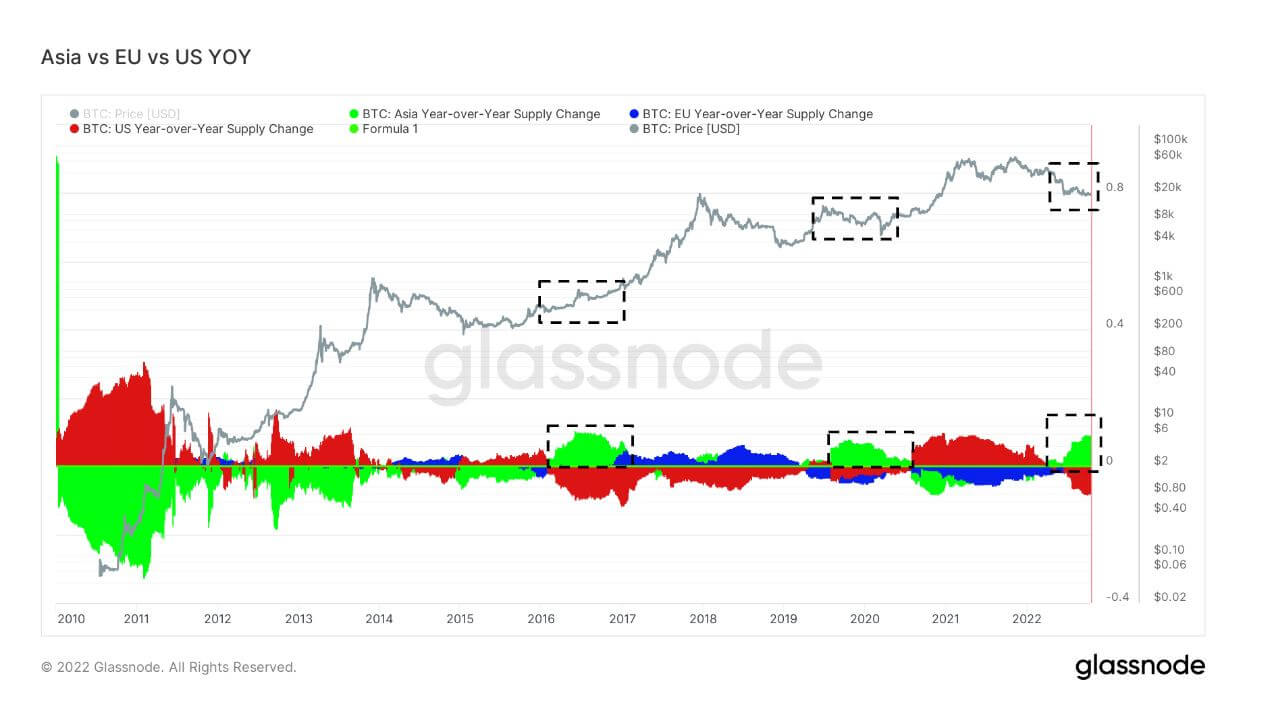

When Asia buys Bitcoin, it’s usually a good time to buy Bitcoin

The last three bear markets, 2016-2017, 2019-2020, and 2022, have seen Asia’s share of BTC ownership go up. This is currently the most significant Asia premium for several years. Cryptoslate has talked about Asia becoming the smart money in the ecosystem. Looking at previous bear markets, it is apparent that Asia scoops up cheap BTC.

Cohorts

Breaks down relative behavior by various entities’ wallet.

SOPR – The Spent Output Profit Ratio (SOPR) is computed by dividing the realized value (in USD) divided by the value at creation (USD) of a spent output. Or simply: price sold / price paid. Long-term Holder SOPR 0.50 -16.67% (5D)

Short Term Holder SOPR (STH-SOPR) is SOPR that takes into account only spent outputs younger than 155 days and serves as an indicator to assess the behaviour of short term investors. Short-term Holder SOPR 0.99 -1.00% (5D)

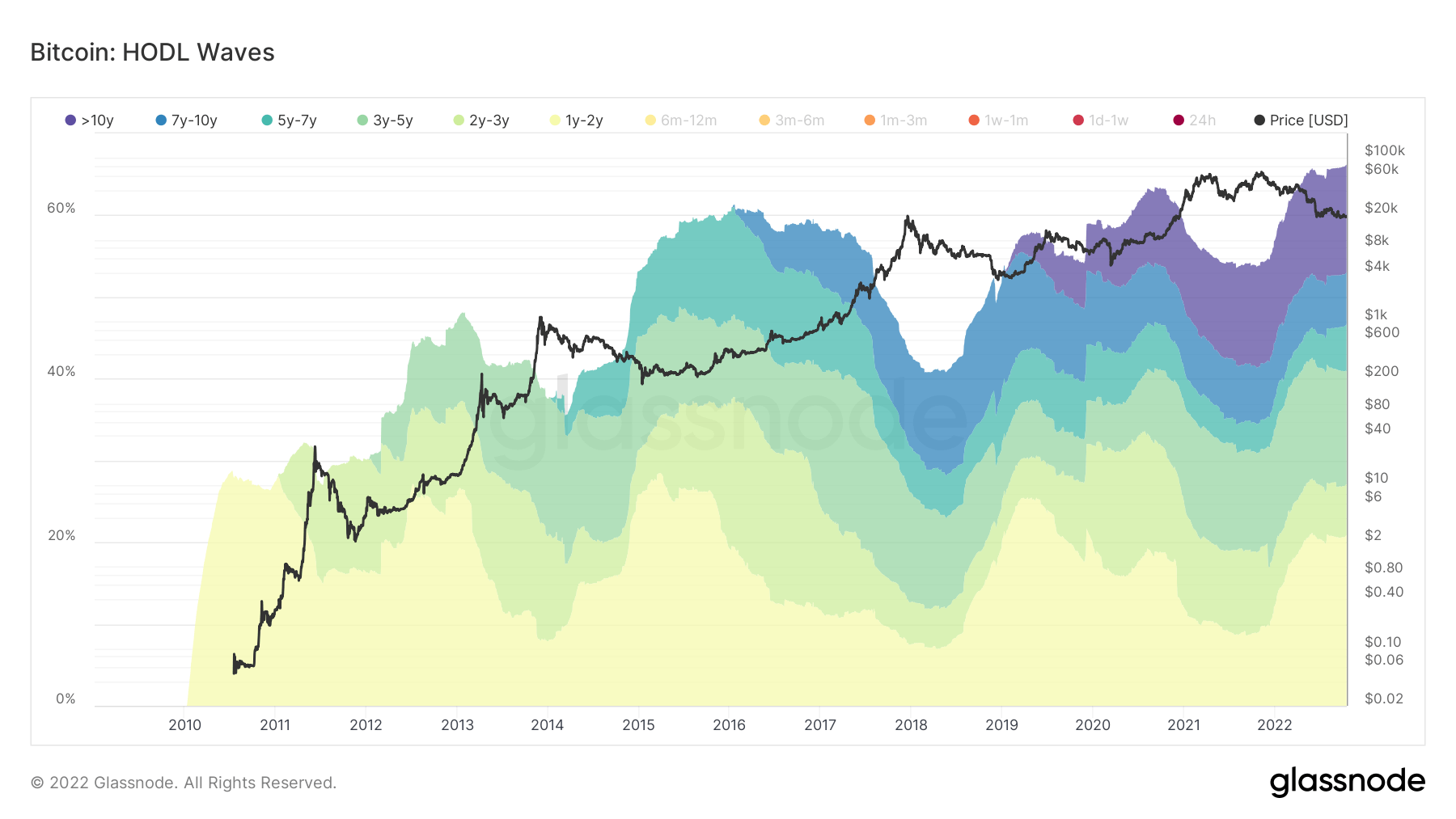

Long-term holders holding down the fort

Long-term holders are defined as a cohort that has held Bitcoin longer than 155 days and is considered to be the smart money of the ecosystem. As BTC’s all-time high came in November 2021, one-year cohorts were selected over six months to show this cohort has held from a 75% drawdown and is still hodling.

During bear market cycles, LTHs accumulate while the price is suppressed after STHs have left the ecosystem as they entered for price speculation. Currently, 66% of the supply is held by LTH, which is the most amount ever; during bear markets, LTH’s collection portion grows, forming the new base for each bear market cycle.

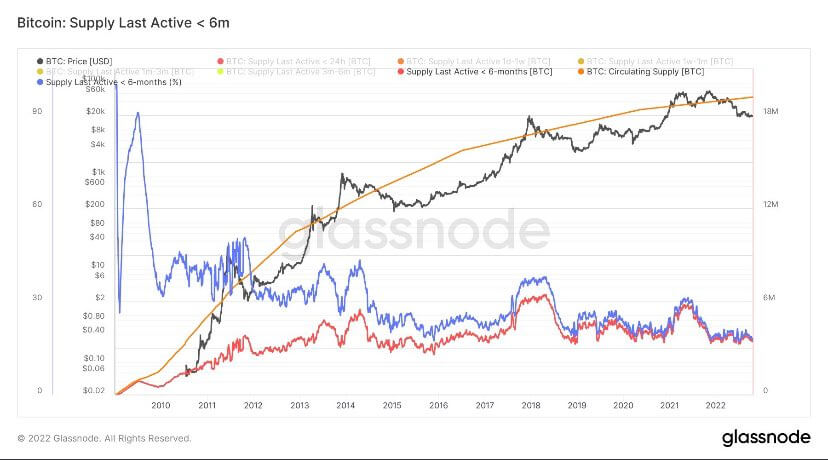

Short-term holders are at bear market lows

Short-term holders (6 months or less) are holding Bitcoin at extremely low levels, similar to previous bear market cycles. STH’s currently have around 3 million of the supply; during the 2021 bull run, this cohort got up to 6 million, and the same can be seen with the last bull run of 2017. Not all STH’s sold for fear of price; a migration occurred from STHs to LTH, which saw an increase of 10 million of the supply to 13 million across the back end of 2021.

Stablecoins

A type of cryptocurrency that is backed by reserve assets and therefore can offer price stability.

The total amount of coins held on exchange addresses. Stablecoin Exchange Balance $40.14B -0.05% (5D)

The total amount of USDC held on exchange addresses. USDC Exchange Balance $1.82B -23.87% (5D)

The total amount of USDT held on exchange addresses. USDT Exchange Balance $17.09B -0.05% (5D)

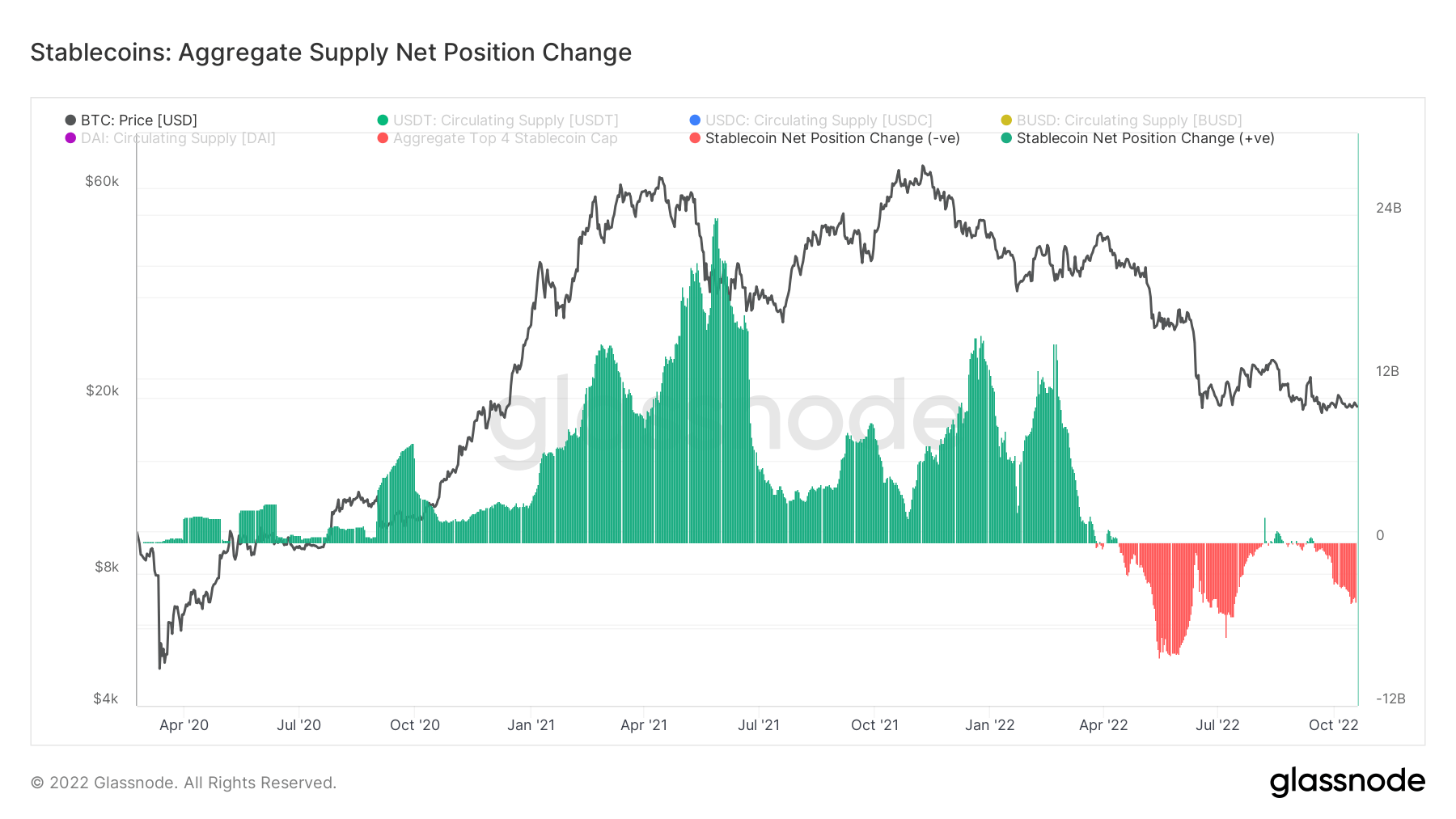

Change of regime for stablecoins

2021 was a monumental year for stablecoins, and going into 2022, the market cap of just the top 4 stablecoins alone was upwards of over $160 billion. Quite evidently, 2021 was a bubble propped up by futures and unsustainable yields. During the bull run of 2021, almost $24 billion of stablecoins were being put onto exchanges and most likely used in defi.

However, since the luna collapse, with Bitcoin dropping from $40k to $20k, distribution has been the central regime of stablecoins, at its peak of $12 billion of sell pressure. In a global deleveraging event in the macro world, selling occurs from stablecoins to fiat to make debt obligations; expect this regime to continue.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC