Quick Take

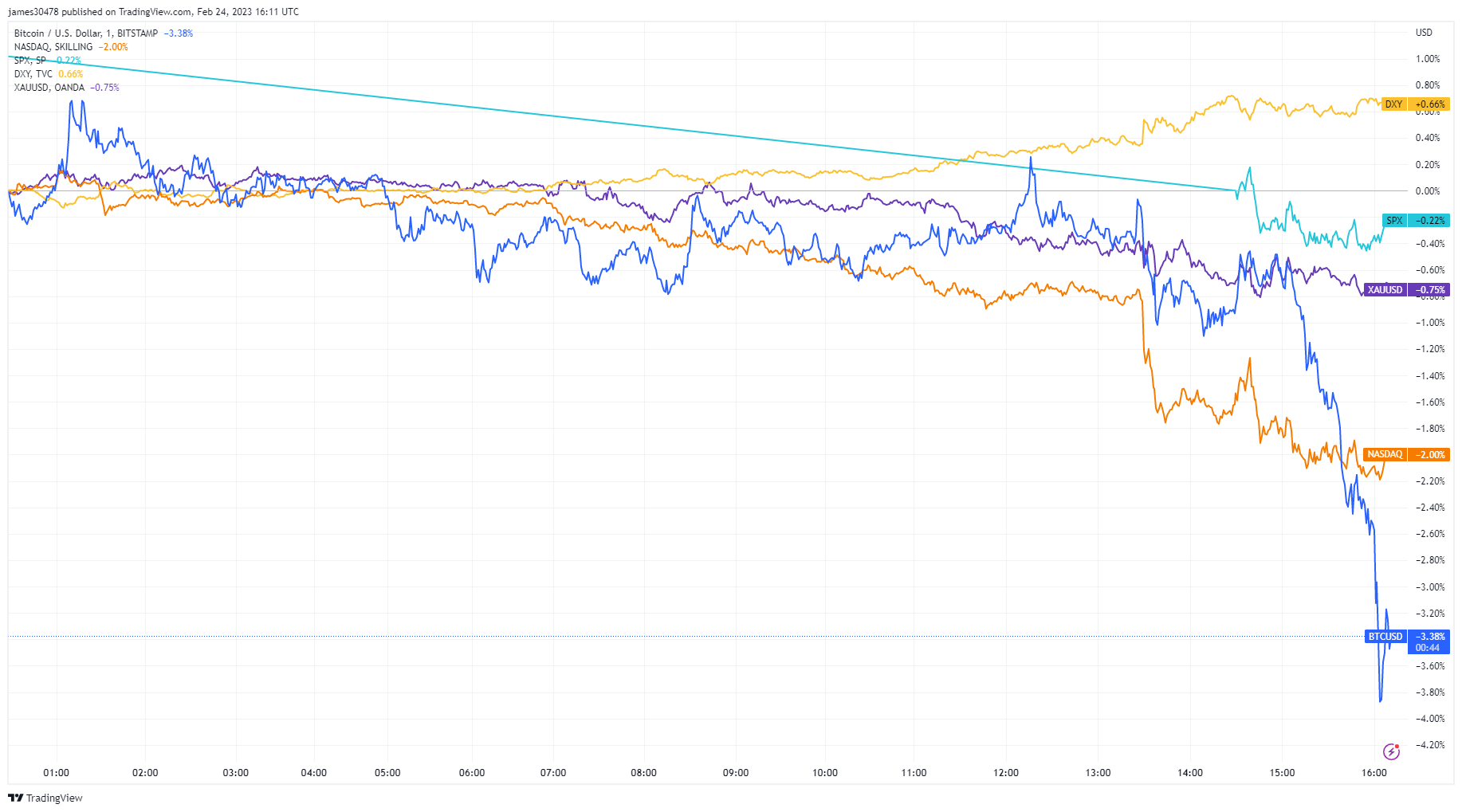

- Bitcoin is down -3.31% on Feb. 24 due to a hotter than expected PCE data.

- Traditional assets are also down on the day, which includes SPX (-0.22%), XAUUSD (-0.75%), and Nasdaq (-2.00%).

- Wall Street is now pricing another 25 bps hike, in addition to the 50 bps remaining, due to today’s PCE.

- This would take the federal funds rate to 5.25 – 5.50% for the end of 2023, a total of 75 bps remaining.

The post Wall Street is now pricing in a terminal rate of 5.25-5.50, after hot PCE data, BTC down over 3% appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Litecoin

Litecoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Hedera

Hedera  Stellar

Stellar  Sui

Sui  LEO Token

LEO Token  Toncoin

Toncoin  Shiba Inu

Shiba Inu  USDS

USDS  MANTRA

MANTRA  Polkadot

Polkadot  Hyperliquid

Hyperliquid  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  NEAR Protocol

NEAR Protocol  Pepe

Pepe  Dai

Dai  Internet Computer

Internet Computer  Ondo

Ondo  sUSDS

sUSDS  Ethereum Classic

Ethereum Classic  Aave

Aave  Bittensor

Bittensor  OKB

OKB  Gate

Gate  Official Trump

Official Trump  Mantle

Mantle  Coinbase Wrapped BTC

Coinbase Wrapped BTC  POL (ex-MATIC)

POL (ex-MATIC)