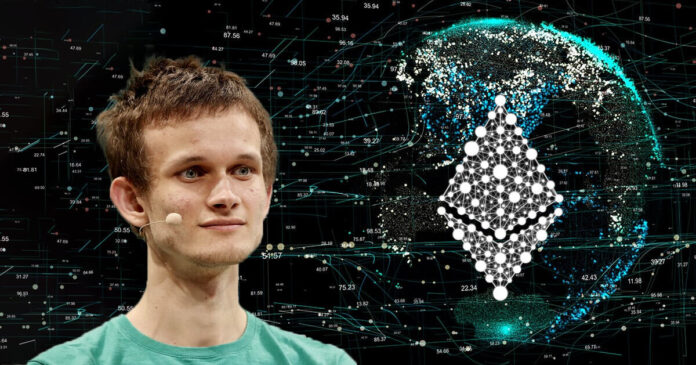

Vitalik Buterin, the co-founders of Ethereum, has lately voiced his discontent with the way that cryptocurrency legislation is currently being handled. He is of the opinion that the current regulatory framework has resulted in what he refers to as a “anarcho-tyranny” in the bitcoin field. Buterin contends that these laws have driven developers with good intentions into a corner, which has resulted in a scenario that is more precarious than both anarchy and tyranny.

However, in order to solve this problem, Buterin has made three ideas for the regulation of cryptocurrencies:

The use of leverage should be restricted: Buterin proposes the establishment of laws that would restrict the amount of leverage that may be used in bitcoin trading. The taking of unnecessary risks and the possibility of market manipulation would be reduced as a result of this.

Buterin places a strong emphasis on the significance of openness in the cryptocurrency business, and he calls for audits and transparency to be required. He suggests that rules should mandate that cryptocurrency projects be subjected to frequent audits in order to provide investors with protection and guarantee the projects’ validity.

The implementation of knowledge exams as a means of regulating usage: Buterin suggests putting in place knowledge assessments for persons who are interested in participating in certain bitcoin activities. For the purpose of ensuring that consumers have a fundamental comprehension of the dangers and difficulties associated with bitcoin transactions, these tests would be carried out.

It is important to note, however, that members of the cryptocurrency community hold a variety of perspectives regarding the manner in which laws should be enacted. An excessive amount of regulation, according to some people, stifles innovation and hinders the progress of the sector.

While some people feel that tougher restrictions are important to safeguard investors and prevent fraudulent activities, others claim that such laws are unnecessary.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC