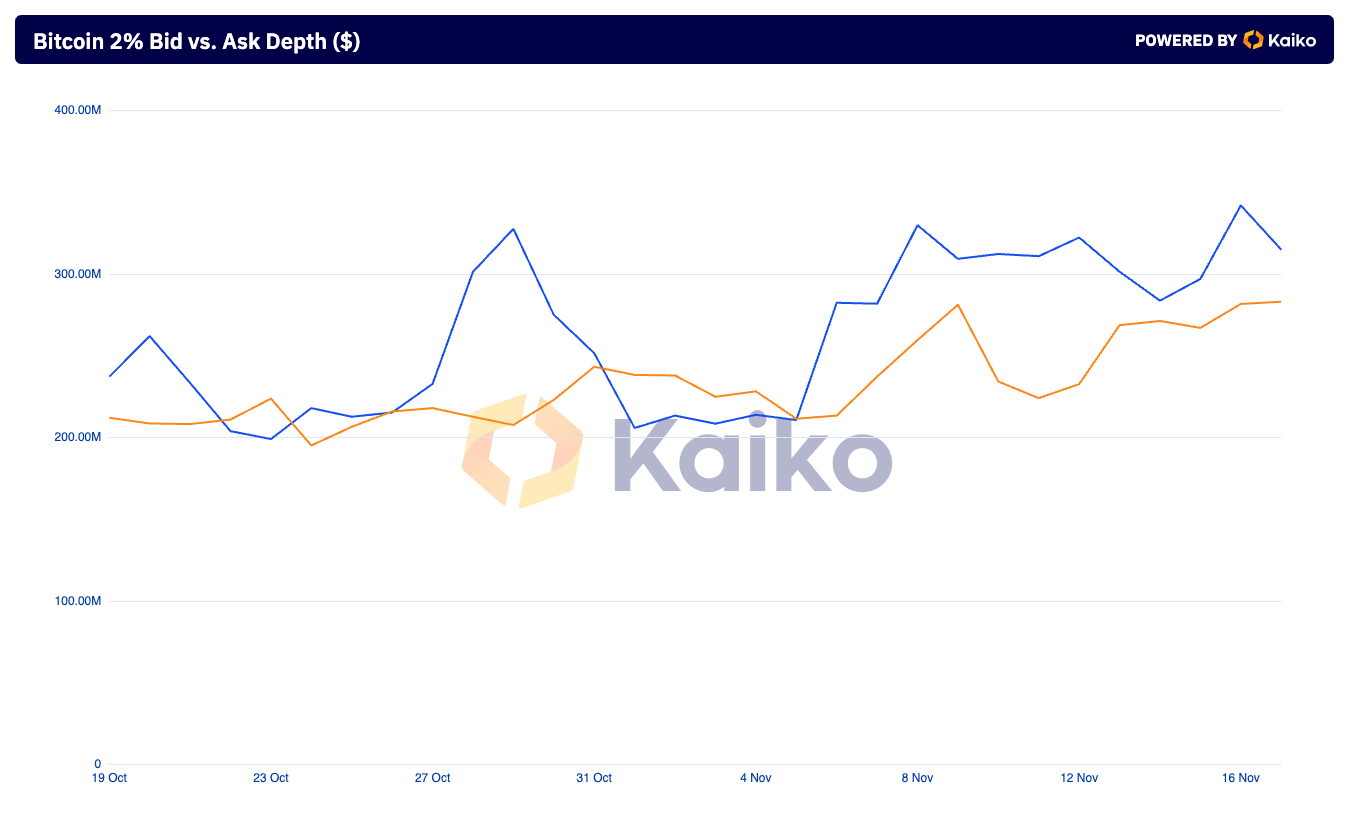

Bitcoin’s aggregated 2% market depth, a measure of liquidity that combines buy and sell orders within a narrow 2% price range around the market price, has surged to a one-year high of $623.40 million as of Nov. 16. This represents a significant increase from $422 million on Nov.5 — a significant increase in liquidity over a short period.

It suggests growing market confidence, as deeper liquidity typically indicates that traders and institutions are more willing to participate in the market, providing a buffer against price volatility.

This increase in market depth leading up to and following the US presidential election is not an isolated event but part of a broader shift in macroeconomic and political conditions. Donald Trump’s election and his administration’s announced intention to support Bitcoin and the crypto industry through concrete policies have catalyzed increased market activity.

This newfound political alignment with the crypto space likely signaled to institutional and retail investors that the regulatory environment could become significantly more favorable, reducing perceived risks and encouraging greater participation.

The market responded enthusiastically to the prospect of a pro-crypto administration, with traders likely interpreting the news as a green light for broader adoption and institutional inflows. This price surge, combined with the increase in aggregated market depth, suggests that market participants were trading in response to the election results and positioning for a sustained bullish trend. The expanded market depth reflects this increased engagement, as deeper liquidity allows larger orders to be executed with minimal slippage—critical in a market experiencing rapid upward price movements.

The election’s impact can also be observed in the bid versus ask depth. While the imbalance favoring sell orders at $341.81 million over $281.59 million in buy orders suggests some profit-taking, it is important to note that this activity did not trigger a significant price correction. Instead, the market absorbed sell-side pressure efficiently, indicating robust buyer demand even as Bitcoin crossed $93,000.

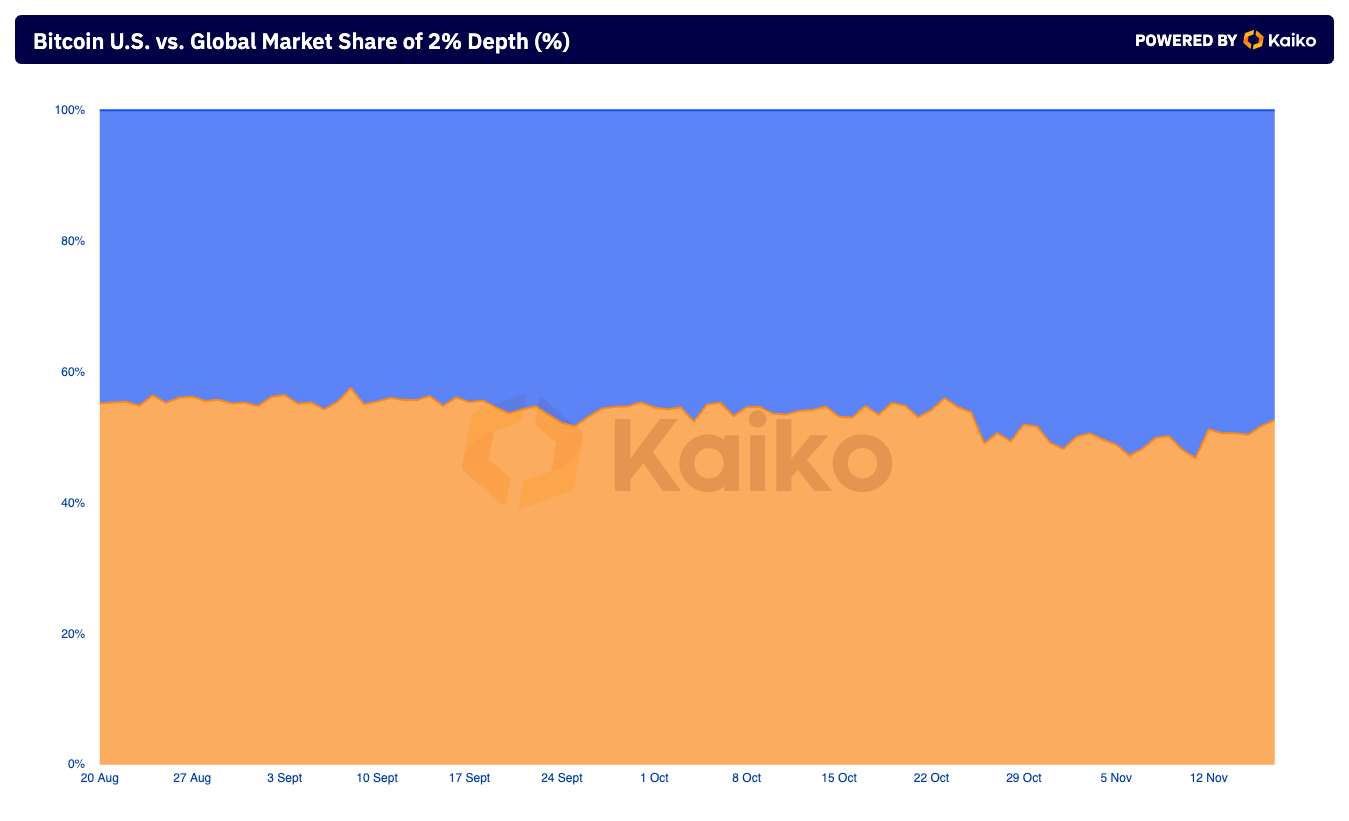

The US market’s historically dominant share of global market depth appears to have played a significant role in driving this liquidity surge. Although US market share dipped slightly post-election, the broader trend throughout 2024—where the US accounted for over 50% of global depth—suggests that American institutions and traders have been pivotal in shaping market activity.

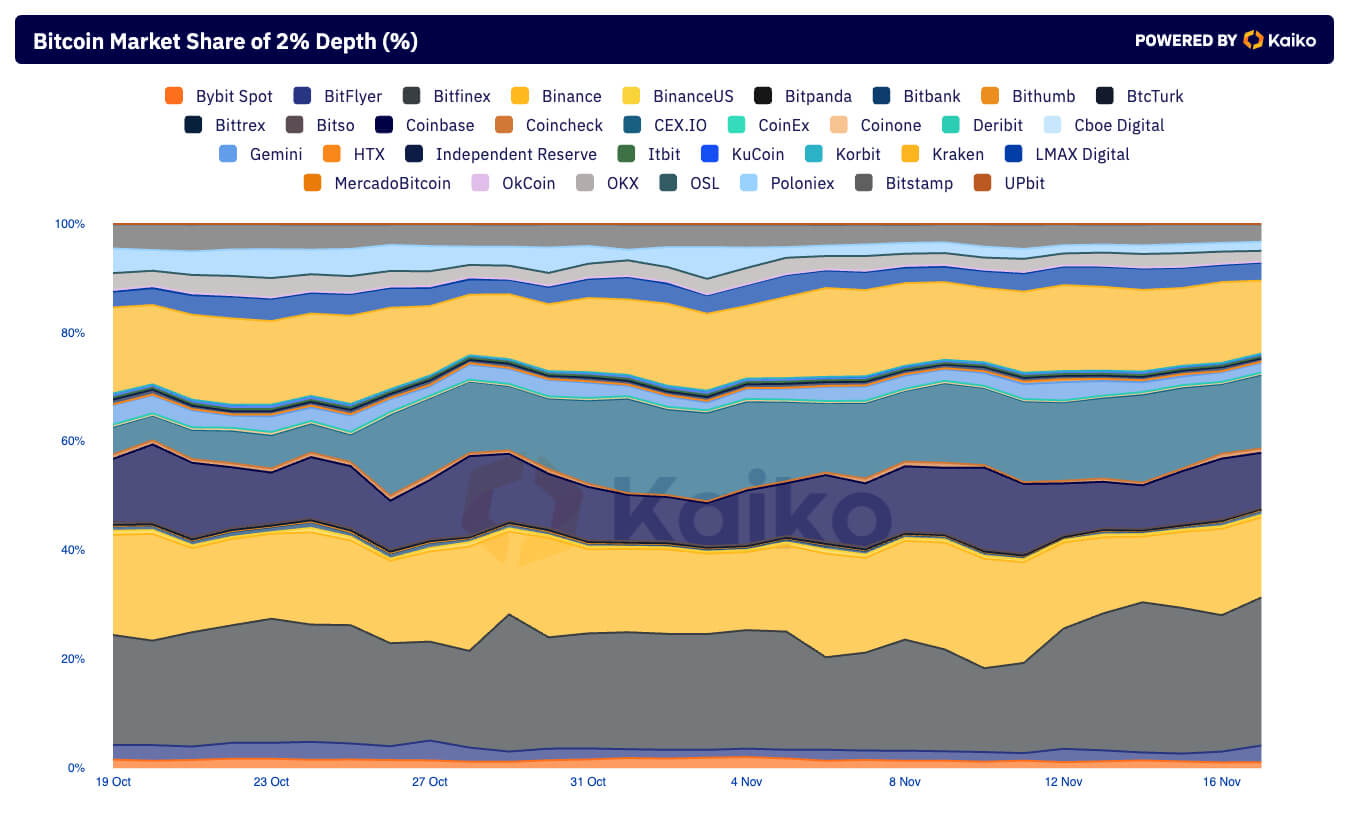

On an exchange-specific level, the rise of Bitfinex as the leader in global market depth may reflect its ability to attract liquidity amid these political and market shifts. The exchange’s 27% share on Nov. 16 coincides with Bitcoin’s post-election rally, suggesting that Bitfinex successfully captured a significant portion of the increased trading activity.

In contrast, Binance’s declining share, hovering between 10% and 15% in November, could be attributed to ongoing regulatory scrutiny, which may have deterred institutional players from utilizing its platform despite the broader market optimism.

The post US elections boosted Bitcoin’s liquidity to new highs appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  Hyperliquid

Hyperliquid  USDS

USDS  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC