GFC vs. 2023

It seems contraction in the U.S. economy is starting to appear. However, a recession is not scheduled for the time being. Comparing previous eras and recessions might fit human psychology, but it will undoubtedly be different. But most likely, the Federal Reserve will continue to hike rates until something materially breaks.

We have had a banking crisis, which is fundamentally different from 2008. In 2008, we had mortgage defaults and saw a knock-on effect with house prices falling drastically. At the same time, banks had deep losses on loans on their balance sheets. SVB was fundamentally different as depositors panicked about severe unrealized losses on their treasury portfolio.

OPEC +

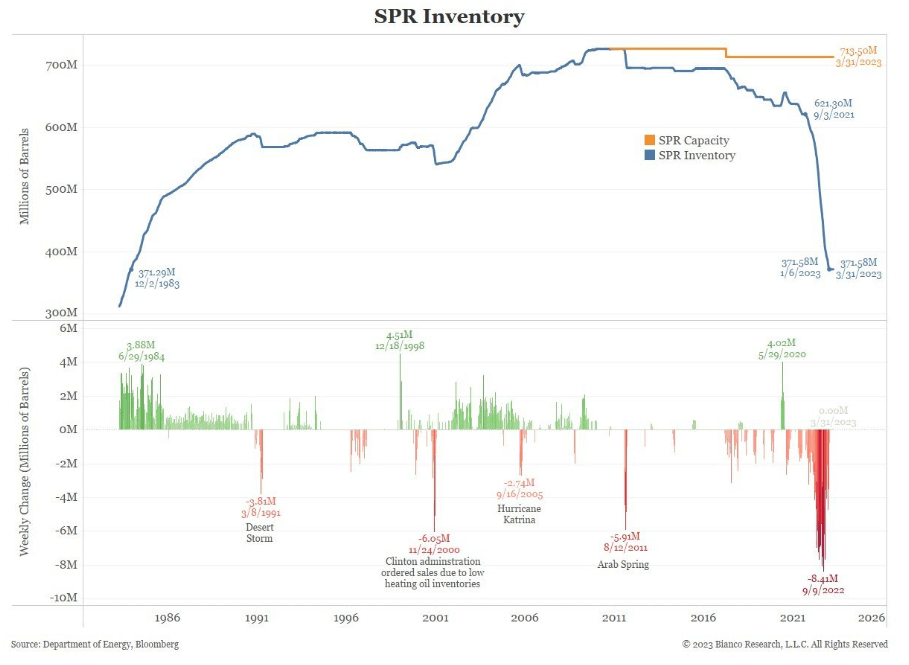

To start the week, we had OPEC + announcement of cutting over 1m barrels/day starting next month, while 2m barrels/day are being cut from October. CryptoSlate analyzed the repercussions of these cuts; not only is this pure signal of demand collapsing. It also left the Biden administration in trouble after drawing down on the Strategic Petroleum Reserve while failing to build on the reserves when prices were surpassed. Crude Oil WTI (NYM $/bbl) closed the week at $80/ barrel while it was as low as $67, with some analysts expecting triple digits.

U.S. manufacturing slumps

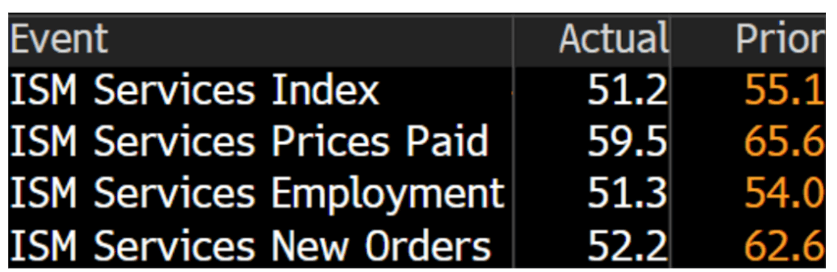

The March ISM manufacturing survey continued its decline, staying within the contraction zone of 46.3, undershooting expectations. In addition, JOLTS data printed 9.93 million vs. the 10.5 million expected. This was the smallest print since April 2021. While every part of ISM Services PMI also continued to drop. New orders are down to 52.2 from 62.6.

Unemployment at record lows

Staggeringly, unemployment dropped to 3.5% from 3.6%. At the same time, the U.S. Bureau of Labor Statistics employment report showed 236,000 nonfarm jobs added for March. Economists expected 239,000 jobs.

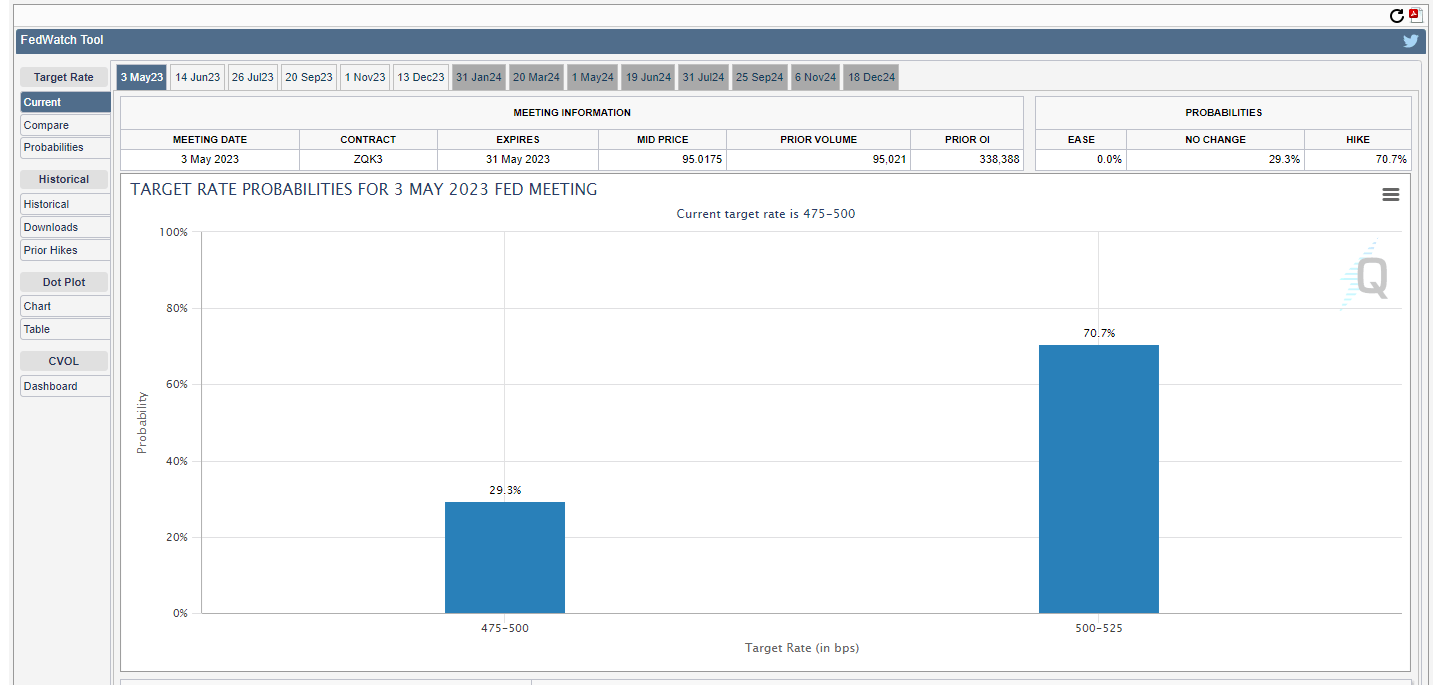

As a result, we now see a 69% chance of another .25 rate hike at the May FOMC. This would put the federal funds rate over 5%.

Fed balance sheet update

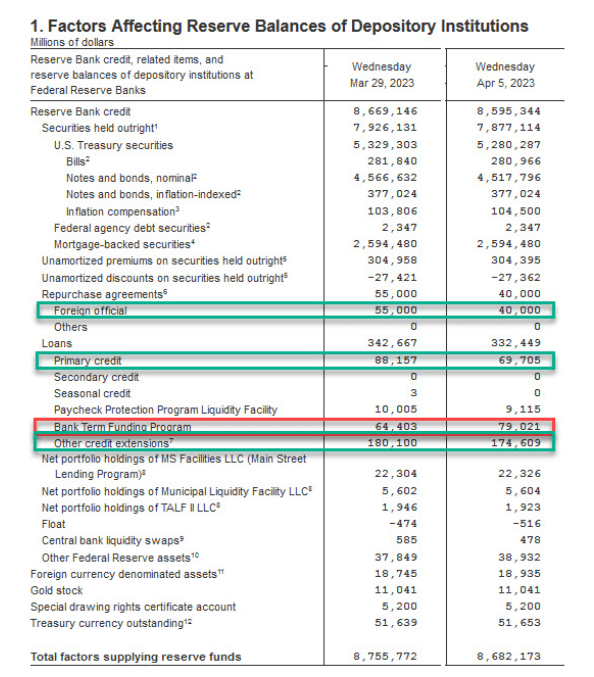

Thursday afternoon clock watch of the fed balance sheet is now becoming a main event. The fed balance sheet fell by $74 billion this week, roughly reduced by $100 billion in the past two weeks. The fed balance sheet is now shrinking faster than before the SVB collapse.

This shows fewer banks and less distressed assets are needed to be supported by the Fed. In addition, BTFP loans rose to $79 billion from $64.4 billion as the Fed discount window usage dropped to $69.7 billion from $88.2 billion.

It’s safe to say this was not a round of quantitative easing but short-term emergency loans that will be paid back.

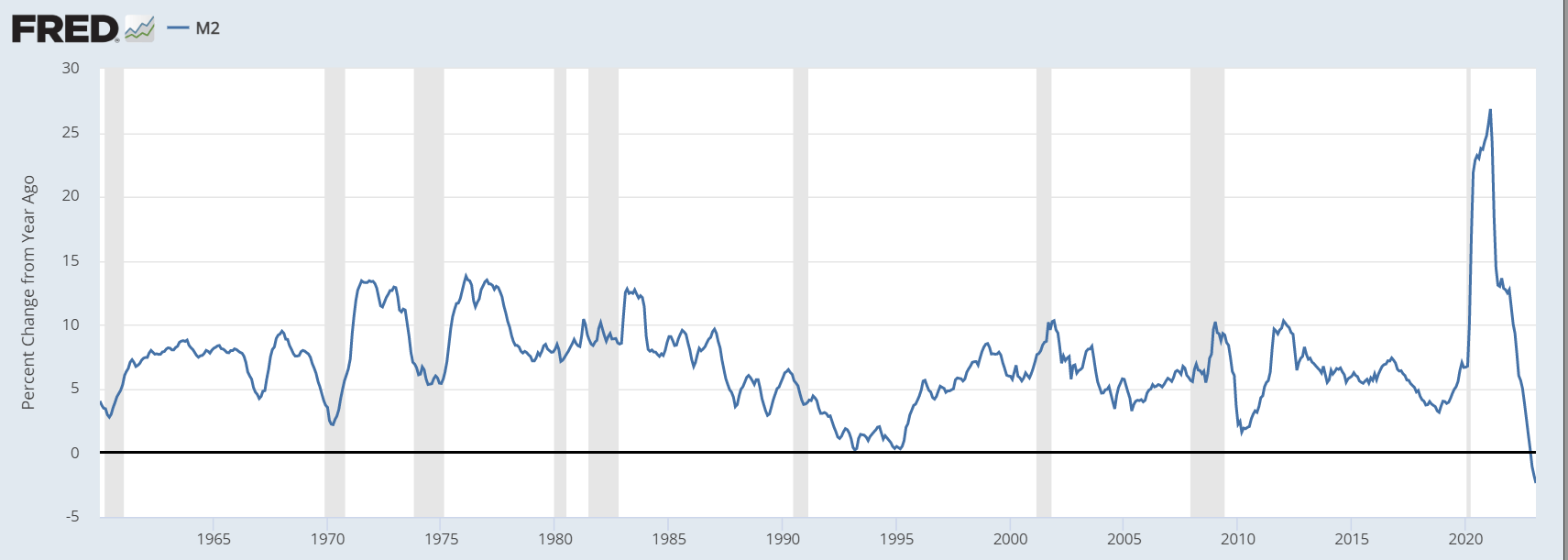

But the key issues here are quantitative tightening and liquidity being drained from the system. We have witnessed the fastest tightening cycle in history; the money supply measured by M2 has fallen 2.5% since last year, the sharpest deterioration since the great depression in 1929.

Even small contractions in the money supply can cause big economic problems and lead to bank runs. You would assume banks will start to cut back lending and hold more cash on hand, which will potentially cause a credit crunch. No doubt lending standards will tighten.

Bitcoin vs. M2

In the short term, it is very hard to give definitive answers about a credit crunch, a recession, and if Bitcoin will exceed a certain price target. But we champion Bitcoin because it’s an asset that allows you to ignore all the macro uncertainty and geo-political games and focus on the bigger task at hand. An asset with no counter-party risk doesn’t suffer from the contagion potential of TradFi assets.

The long game is money supply will continue to expand; the balance sheet will expand, inevitably inflating all our assets.

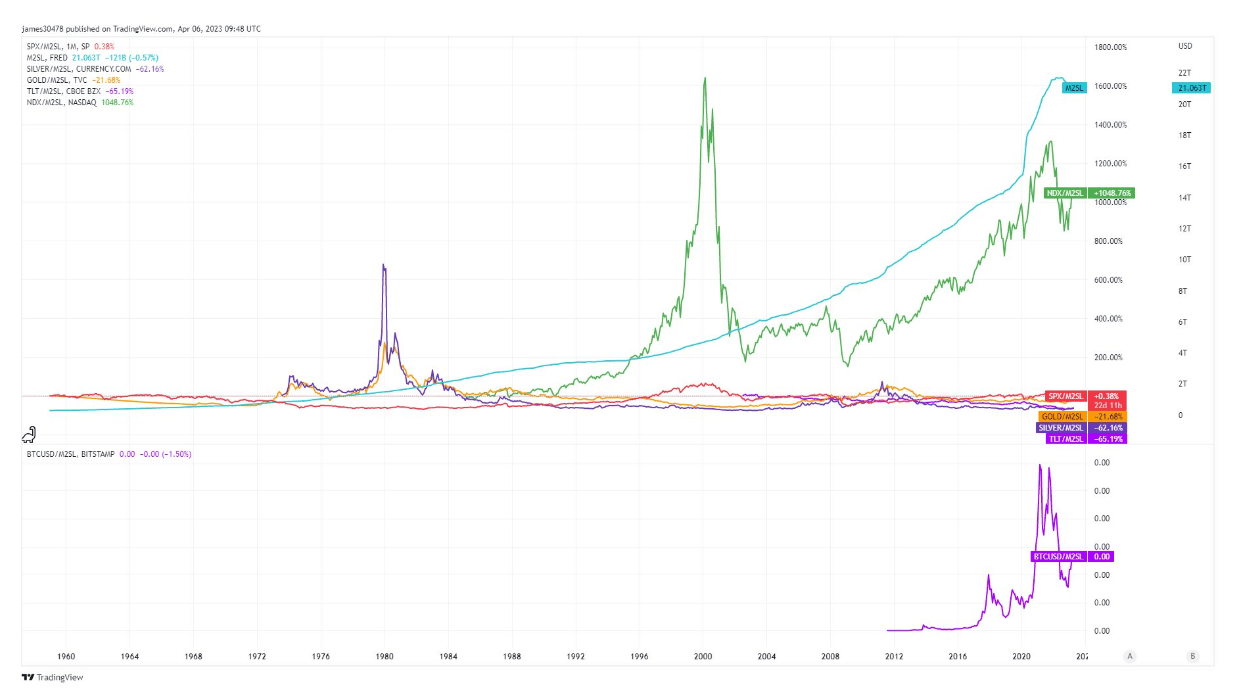

CryptoSlate analyzed major assets vs. M2 money supply, and it’s clear to see one winner in this game. The illusion of money printing makes you think you are getting wealthier; however, in real terms, you are not even staying afloat.

Bitcoin remains the number one asset to keep you ahead of the devaluation of the currency.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB