Quick Take

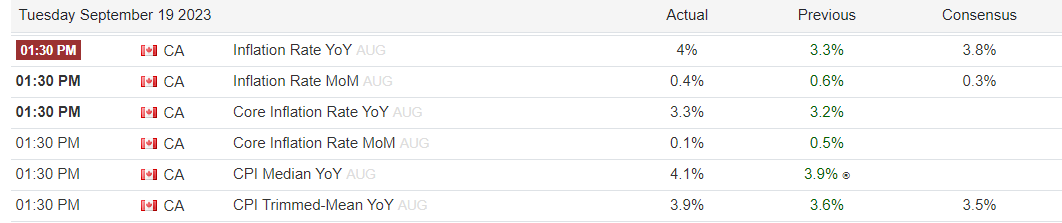

The trajectory of the 10-year treasury yield took a surprising turn as it charted a new cycle high at 4.3%. This was propelled by an unexpectedly high Consumer Price Index (CPI) print for Canada, which emerged as a significant variable in the financial landscape.

Bucking predictions, inflation rose beyond the anticipated 3.8% to reach 4%. This deviation from projected figures signifies a robust inflationary environment, underpinning the upward trend in treasury yields.

Meanwhile, the financial sphere anticipates the forthcoming U.S. Federal Open Market Committee (FOMC) decision. The prevalent conjecture is that the committee will opt for a rate pause, maintaining the fed funds rate between 5.25% and 5.50%.

This decision could potentially provide some stability amidst the inflation-induced volatility and might be a key factor influencing the future direction of treasury yields.

The post Unexpected inflation surge in Canada propels 10-year treasury yield to new highs appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Hedera

Hedera  Toncoin

Toncoin  Sui

Sui  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Polkadot

Polkadot  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Official Trump

Official Trump  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Ondo

Ondo  MANTRA

MANTRA  Aave

Aave  Monero

Monero  Aptos

Aptos  Internet Computer

Internet Computer  WhiteBIT Coin

WhiteBIT Coin  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  Mantle

Mantle  Cronos

Cronos  Dai

Dai  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB