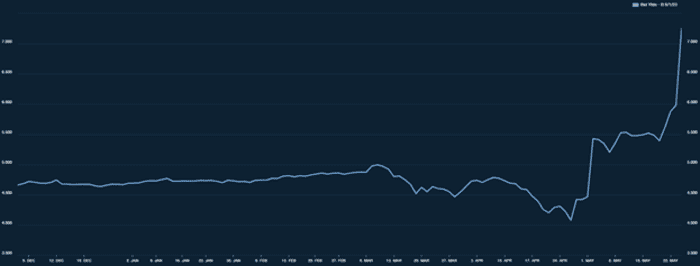

U.S. Treasury yields experienced a notable rise this week, causing increased apprehension in the market. Notable upswings occurred on Wednesday and Thursday when concerns over the debt ceiling and speculation over interest rate hikes pushed yields to record highs.

In the early hours of Thursday, May 25, the yield on the 12-month Treasury bill reached 5.18%, while the 6-month bill reached 5.41%. The yield on the 3-month bill reached 5.33%. The 10-year Treasury reached 3.76%, while the 2-year Treasury saw a seven basis point increase to 4.46%.

“Treasuries” refer to U.S. government securities that represent the debt obligations of the United States government as it borrows money to finance its operations. Treasury yields are the return on investment investors receive by holding these securities. They are a vital benchmark in the financial market, serving as a critical indicator of market sentiment, inflation expectations, and overall economic conditions in the country.

While several factors contribute to the rate of return on Treasury yields, demand is the most significant. When investors exhibit higher demand, prices increase, resulting in a decrease in yields. Conversely, when demand weakens, prices decline, leading to higher yields.

Additionally, market expectations regarding interest rates and inflation can significantly impact Treasury yields. If investors anticipate higher interest rates or inflation, yields tend to rise as a reflection of the increased risk associated with holding fixed-income securities.

The recent drop in demand for Treasuries can likely be attributed to two primary factors: concerns surrounding the debt ceiling and speculations about impending interest rate hikes.

As the U.S. nears its debt limit, there’s increasing uncertainty about the government’s ability to fulfill its financial obligations. This uncertainty prompts investors to demand higher yields to compensate for the perceived risk. Furthermore, the possibility of interest rate hikes introduced by the Federal Reserve adds to the market’s unease, as higher rates would impact the value of existing fixed-income investments.

The market’s concern regarding the debt ceiling becomes evident when analyzing the 1-month Treasury bill. On Wednesday, May 24, the 1-month bill maturing on June 1 reached multi-decade highs of 7.226%. This indicates that investors have been dumping their short-maturity bills, fearing the prospect of a technical default on June 1 if the debt ceiling negotiations fail.

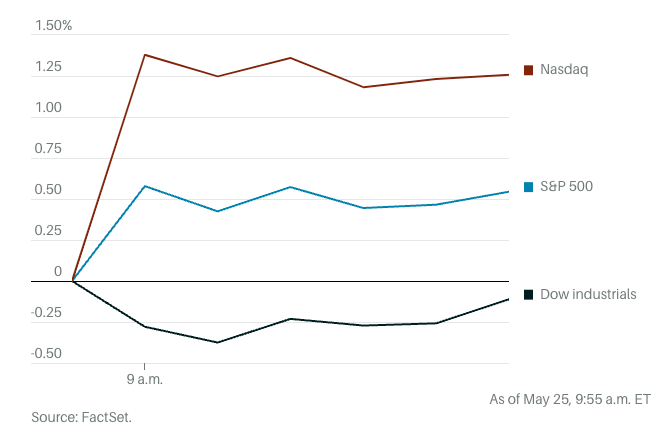

The surge in Treasury yields has significant implications for the broader financial market. It increases borrowing costs and causes higher interest rates for all types of borrowing, dampening consumer spending and business investments. Rising Treasury yields can also cause downward pressure on the stock market, as the high yields of fixed-income investments become comparatively more attractive than stocks.

The stock market is experiencing increased volatility, with investors weighing the economic health of the market amid the debt ceiling talks. All three major indices in the U.S. saw a slump late Wednesday after Fitch Ratings put the U.S.’ AAA long-term rating on a negative watch. Dow Jones Industrial Average futures were down by 86 points, or 0.3%, early on Thursday. S&P 500 futures were up 0.6%, and Nasdaq 100 futures were up 1.4%. However, the positive action seen in S&P 500 and Nasdaq 100 futures can be attributed to the exceptional performance from Nvidia (NVDA), which sent tech shares rallying.

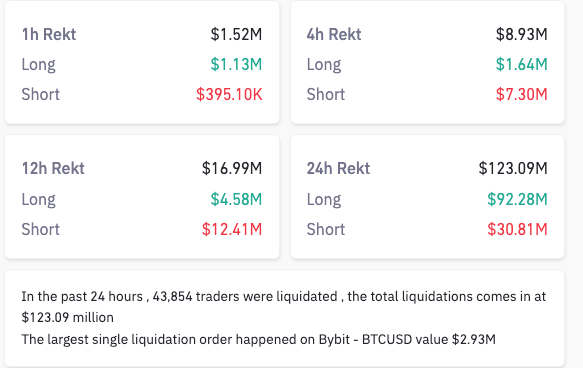

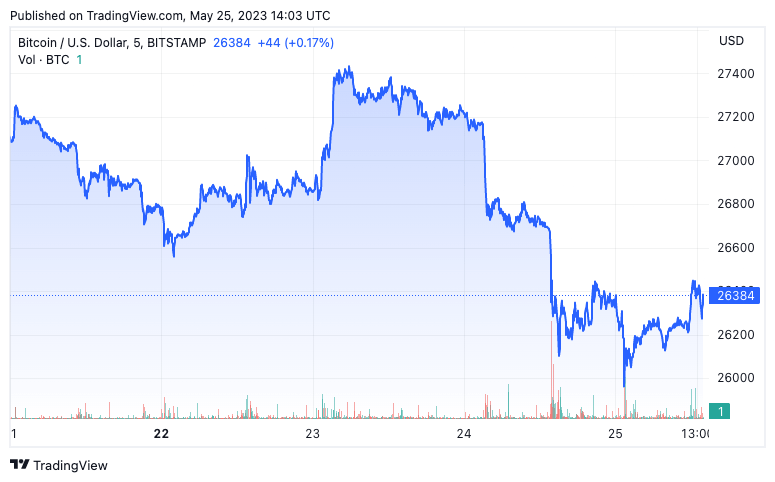

The cryptocurrency market is also affected by the rise in Treasury yields. Bitcoin tumbled below $26,000, triggering a $120 million liquidation storm mostly made out of long positions.

The spike in liquidations suggests an inverse relationship between treasury yields and BTC. As yields rise, investments typically divert from riskier assets such as Bitcoin. And while institutional investors might be shifting capital into fixed-income investments with growing returns, retail investors might be concerned about the price volatility that could arise from another interest rate hike.

The post U.S. Treasury yields soar and Bitcoin stumbles amid debt ceiling, rate hike concerns appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC