Join Our Telegram channel to stay up to date on breaking news coverage

Cryptocurrencies are poised for a resurgence as central banks in Europe, Canada, Switzerland, and Sweden cut interest rates. This shift could inject fresh liquidity into the market, creating a favorable environment for risk-on assets like crypto. Historically, lower rates have boosted crypto, evident in 2020 when Bitcoin soared from $7,000 to $69,000. As the U.S. Federal Reserve might follow suit, this could trigger a significant crypto boom. Now, let’s dive into our top gainers in the market today and see who’s leading the charge.

Biggest Crypto Gainers Today – Top List

The global cryptocurrency market cap is $2.57 trillion today, showcasing a dynamic shift with a marginal -0.43% decline in the last 24 hours. This is juxtaposed against a significant 142.23% increase over the past year. Despite these statistics, the market sentiment remains cautiously Bearish, as indicated by a Crypto Fear & Greed Index reading of 74 (Greed). Furthermore, in the past 24 hours, 28% of cryptocurrencies have witnessed gains, setting the stage for a closer look at the top gainers driving this enthusiasm and market movement.

1. SSV Network (SSV)

SSV Network leverages a unique protocol called Secret Shared Validators (SSV) to enhance Ethereum staking. The protocol splits a validator key into four or more shares distributed among independent node operators. This design ensures no single node has control or can compromise the validator.

Nodes can operate simultaneously and perform validator duties without risking slashing. SSV improves security by keeping only encrypted shared keys online, significantly reducing exposure to attacks. Additionally, this infrastructure allows stakers to customize and optimize their validator setups, enhancing flexibility and fault tolerance.

The technology is an intermediary between the validator node and the beacon chain. The threshold signature scheme allows a validator to remain operational even if some nodes go offline. This setup ensures optimal fault tolerance and uptime. SSV Network is the first public implementation of this primitive, reshaping Ethereum staking.

Empowering builders & contributors is a key element of a thriving protocol and ecosystem.

Meet the new SSV Ecosystem Grants Program: now more aligned, strategic and streamlined to support the next innovative, dedicated builders and protocols.https://t.co/ToYtj0qG7J

— SSV Network (@ssv_network) June 10, 2024

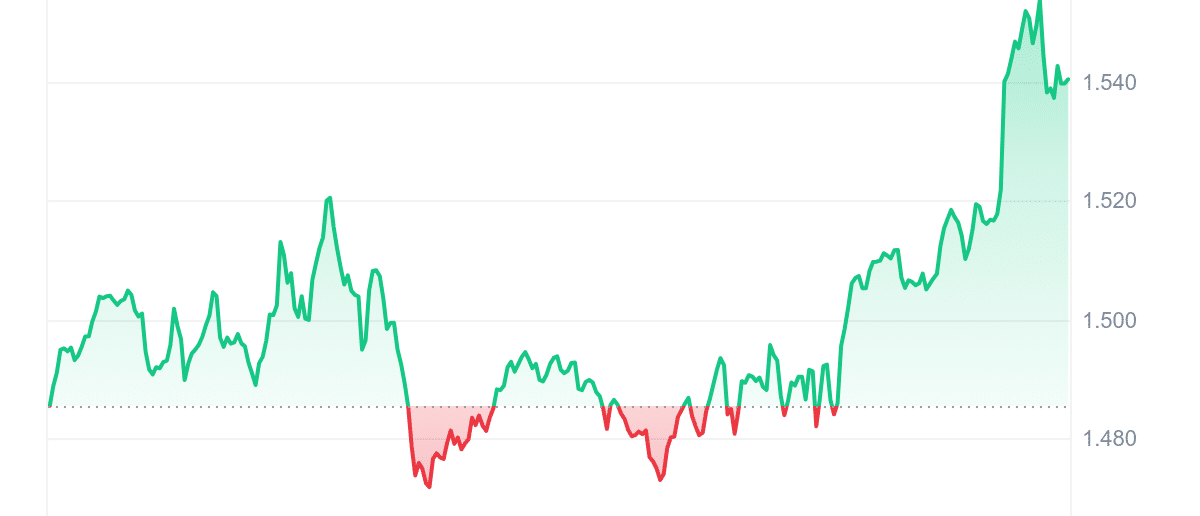

In the last 24 hours, SSV’s price surged by 6.08%, reaching $38.71. This bullish momentum isn’t just a short-term trend; over the past year, SSV’s price has increased by 144%, surpassing 57% of the top 100 crypto assets. Trading well above its 200-day Simple Moving Average (SMA) of $18.98, SSV is showing strong market confidence. Despite this growth, the 14-day Relative Strength Index (RSI) at 58.75 suggests the token is in a neutral zone. With 15 green days in the last 30 days and low volatility at 9%, SSV Network exhibits both stability and upward potential, making it an exciting asset to watch.

2. Raydium (RAY)

Raydium plays a crucial role in driving the dynamics of the Solana blockchain ecosystem. It specializes in automated market making (AMM) and liquidity provision for the Serum decentralized exchange (DEX). It is unique for integrating on-chain liquidity with Serum’s central limit order book. Here, funds deposited into Raydium are converted into limit orders directly on Serum’s order books.

This innovative approach enhances liquidity provision and grants liquidity providers (LPs) access to Serum’s extensive order flow and existing liquidity pools. Thus, amplifying their market participation and potential profitability within the DeFi space.

RAY, the platform’s native utility token, is used to stake and earn protocol fees and secure Initial DEX Offerings (IDOs) allocations. Additionally, RAY holders participate in governance decisions, ensuring a decentralized approach to protocol development and future enhancements.

This gainer has seen a 3.76% price increase in the last 24 hours, reflecting ongoing market interest and activity. Over the past year, RAY has surged 827%, besting 91% of the top 100 crypto assets by market cap. Trading 420.56% above the 200-day SMA, Raydium demonstrates robust performance amidst market fluctuations.

👀 https://t.co/Mu4mqdSoBO

— Raydium (@RaydiumProtocol) June 14, 2024

With a 14-day RSI indicating overbought conditions at 72.78, caution is advised as the token may face potential correction. Despite 37% green days in the last 30 days, indicating mixed trading sentiment, Raydium maintains medium liquidity. The volume-to-market cap ratio stands at 0.0232, reflecting ongoing market engagement.

3. Sealana (SEAL)

Sealana, a Solana-based meme coin, has made a strong debut by raising over $4 million in its presale, positioning itself as a notable newcomer in the cryptocurrency market. Sealana’s charm lies in its chubby seal mascot inspired by popular culture, which has resonated with a broad audience and boosted its popularity.

The presale, set to end on June 25, 2024, at 6 PM UTC, has generated significant interest. Once the presale concludes, SEAL tokens will be airdropped to investors in preparation for the token’s listing on decentralized exchanges (DEX). This DEX launch is highly anticipated, with crypto experts predicting a significant token value increase.

Sealana’s growing community is another positive indicator. The project has amassed over 10,000 followers on X (formerly Twitter) and over 9,000 members on its Telegram channel. This vibrant community highlights Sealana’s broad appeal and playful theme, attracting many investors. As the presale nears its end, investors are eager to secure SEAL tokens at discounted rates, anticipating significant gains at the market debut.

Investors can purchase SEAL tokens at $0.022 using various payment methods, including SOL, ETH, USDT, USDC, and fiat currency via bank cards. After the presale ends, SOL purchases will be airdropped on the Solana blockchain. In contrast, ETH purchases will be airdropped on the BNB Chain, minimizing gas fees and ensuring a seamless experience for investors.

Visit Sealana Presale

4. OriginTrail (TRAC)

OriginTrail stands out with its robust infrastructure dedicated to trustworthy AI knowledge. It actively combats misinformation while guaranteeing the authenticity and traceability of information. At its core lies the innovative Decentralized Knowledge Graph, a robust repository for AI-ready assets. This graph organizes data efficiently and enables enterprises to discover verified information seamlessly.

TRAC, the native token of OriginTrail, powers various operations within the network. It is used for publishing, updating, and maintaining Knowledge Assets on the Decentralized Knowledge Graph, ensuring secure and transparent data sharing. TRAC also serves as collateral on OriginTrail nodes, incentivizing honest and efficient performance from node operators. This maintains the network’s integrity and reliability.

The OriginTrail network’s security is robust, leveraging the Ethereum blockchain to safeguard TRAC. Since its launch on Ethereum, TRAC has benefited from Ethereum’s proven security mechanisms, which ensure the reliability and safety of transactions and data exchanges within the OriginTrail ecosystem.

📢[ANNOUNCEMENT]@origin_trail has been chosen for @EU_EBSI‘s @EuropeanSandbox 2nd cohort! This amazing opportunity allows us to collaborate closely with regulators & authorities, driving forward Verifiable Internet for #AI in the EU/EAA space.👇https://t.co/b0x3pjthPv https://t.co/AAs4cUu58B pic.twitter.com/x2n9mvdMzM

— OriginTrail (@origin_trail) June 13, 2024

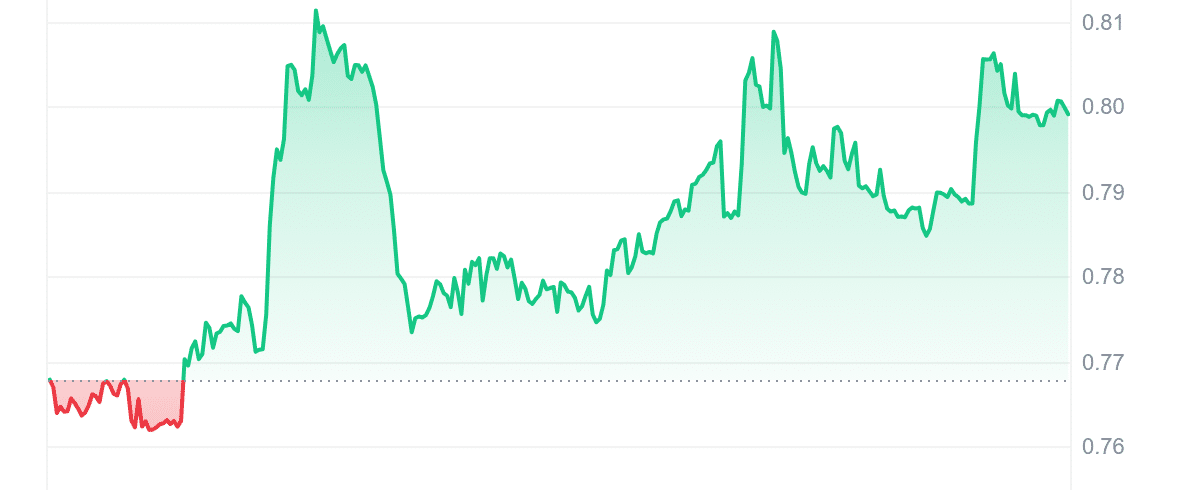

TRAC’s market performance has been impressive, with its price increasing by 275% over the past year. In the last 24 hours alone, OriginTrail saw a 4.21% increase, highlighting positive momentum in its trading activity. Currently trading at $0.80256, it stands 162.46% above its 200-day SMA. The 14-day RSI is neutral at 46.82, showing balanced market sentiment, while the 30-day volatility is low at 6%. Despite moderate liquidity with a volume-to-market-cap ratio of 0.0097, OriginTrail remains a stable investment.

5. Ultima (ULTIMA)

Ultima is a comprehensive cryptocurrency ecosystem centered on the ULTIMA token, offering various innovative products. These include advanced crypto wallets, a unique crypto debit card, a crowdfunding platform, and its marketplace. Ultima aims to redefine how people engage with cryptocurrencies globally, facilitating instant cross-border payments and enhancing user experience in digital finance.

Ultima’s security is multifaceted, leveraging blockchain technology for decentralized transaction security. Secure wallets with two-factor authentication (2FA) add an extra layer of protection, minimizing the risk of unauthorized access. Smart contracts further ensure secure and automated transaction execution, reducing fraud potential. A dedicated team of engineers fortifies Ultima’s global infrastructure through regular updates and security audits.

➡️Splitting — Ultima’s Flagship #Blockchain Technology of the Future

🔹 Splitting allows users to interact directly with the blockchain and get daily rewards in the $ULTIMA token for providing liquidity to pools.

🔹 The technology is successfully used by nearly three million…

— Ultima_Ecosystem (@UltimaEcosystem) June 5, 2024

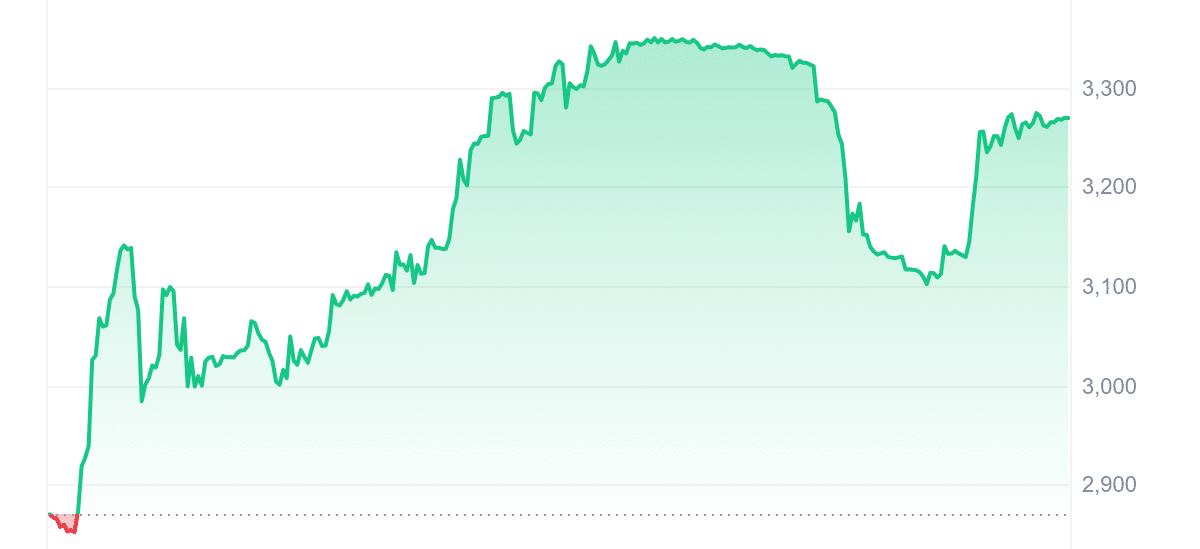

The ULTIMA token is the backbone of Ultima’s ecosystem, facilitating seamless financial transactions across its platforms. Recent price movement has shown resilience with a 14.13% increase in the last 24 hours, though a slight decline of -1.53% over the past seven days. In the previous 30 days, the token has seen a 6.1% increase, with a neutral 14-day RSI of 78.96, indicating current overbought conditions. Despite this, Ultima maintains a stable 30-day volatility of 13%, reflecting its position as a promising player in the cryptocurrency market.

Read More

PlayDoge (PLAY) – Newest ICO On BNB Chain

- 2D Virtual Doge Pet

- Play To Earn Meme Coin Fusion

- Staking & In-Game Token Rewards

- SolidProof Audited – playdoge.io

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)