Join Our Telegram channel to stay up to date on breaking news coverage

Yesterday, the crypto market lit up with excitement among investors as Bitcoin Cash (BCH), Mantle (MNT), and Bittensor (TAO) stole the spotlight. Fuelled by a cocktail of factors, including a pervading bullish sentiment and the weakening of the U.S. dollar, these altcoins took centre stage in the market.

BCH’s surge follows its successful completion of a reward halving, reducing its token supply and potentially driving prices upward. However, MNT’s momentum stems from the launch of its “Mantle Rewards Station,” enticing users with rewards for locking up tokens. Also, TAO’s rebound following scrutiny over its network’s value creation suggests a nuanced market sentiment toward these assets.

Biggest Crypto Gainers Today – Top List

The cryptocurrency market boasts a total trading volume of $325.63 billion within the last 24 hours, indicating significant activity. Presently, market sentiment is neutral, albeit with a touch of extreme greed, reflected in the crypto Fear & Greed Index scoring 79. Notably, 70% of cryptocurrencies have experienced gains, while the remaining 30% have suffered losses, showcasing the market’s volatility. This article digs into the top gainers in the crypto market, providing an insightful analysis of the strategies, innovations, and performance of four distinct coins.

1. Telcoin (TEL)

Telcoin serves as the native currency and protocol token of the Telcoin decentralized financial platform. It enables seamless access to user-owned financial products globally. Telcoin Remittances, the platform’s leading product, facilitates high-speed, low-cost digital money transfers to mobile platforms and e-wallets. Version 3 introduced two new user-owned financial products: the Send Money Smarter Network (SMS) and TELxchange, a decentralized digital asset exchange.

Telcoin stands out by leveraging telecom partnerships to provide decentralized financial services to over 5 billion mobile phone users worldwide. Telcoin aims to distribute decentralized financial products seamlessly through alignment with telecoms, minimizing traditional finance risks. Regulated in multiple global markets, it seeks to transform finance by offering automated, user-owned applications accessible to everyone.

Trade $LDO with the convenience of the Polygon Network and the security of assisted #SelfCustody on the #Telcoin App!

Android: https://t.co/Ti3maLD8FB

iOS: https://t.co/ktYXPcdNRL pic.twitter.com/5OQLHGg2MH— Telcoin (@telcoin) April 2, 2024

With its recent 5.33% surge in price, Telcoin continues to demonstrate its potential for growth and adoption in the decentralized finance space. Trading at $0.003768, Telcoin has seen a 55% increase in the last year. Additionally, it is currently trading 110.62% above the 200-day SMA. The 14-day RSI suggests a neutral stance, while the 30-day volatility is at a modest 12%. However, with low liquidity, as indicated by a 0.0024 volume-to-market cap ratio, investors should assess their risk tolerance carefully.

2. Ethereum Classic (ETC)

Ethereum Classic is the original Ethereum (ETH) blockchain, launched in July 2015. It functions primarily as a smart contract network supporting decentralized applications (DApps) and is powered by its native token, ETC. Since its inception, Ethereum Classic has aimed to distinguish itself from Ethereum, with its technical paths progressively diverging.

It boasts unique attributes such as remaining a proof-of-work blockchain, ensuring robust security, and its fixed monetary policy, positioning it as digital gold. Programmability through smart contracts renders ETC more versatile than simpler cryptocurrency chains. Moreover, the comprehensive replication across all network nodes is a robust shield, bolstering security measures. Furthermore, its composability feature facilitates seamless and secure interactions among myriad applications within the system.

List of Wallets that Support Ethereum Classichttps://t.co/dBsZdfgHsW$ETC #ETC 🍀 #EthereumClassic 🍀

— Ethereum Classic (@eth_classic) March 20, 2024

ETC is priced at $32.75, showcasing a 5.43% surge in the last 24 hours, reflecting investor interest. With a market dominance of 0.19%, ETC maintains a notable position within the cryptocurrency landscape. Trading comfortably at 37.17% above the 200-day Simple Moving Average (SMA) indicates sustained bullish sentiment over the long term.

While exhibiting a moderate level of volatility, with a 30-day volatility rate of 9%, ETC boasts high liquidity, as evidenced by a volume-to-market cap ratio of 0.1880. These metrics collectively offer investors a reassuring outlook on ETC’s market performance.

3. Slothana (SLOTH)

Slothana represents a shift from utility-focused predecessors to community-driven projects. Its approach is characterized by simplicity, eschewing intricate whitepapers or roadmaps in favour of a singular focus on the purchasing process. The simplicity of Slothana’s approach is a vital part of its allure, drawing in investors with its straightforward engagement promise.

The project’s minimalist website, providing scant details beyond token acquisition guidelines, aligns with a prevalent meme coin trend emphasizing community and hype. This approach seems effective as Slothana rapidly gains traction on social media, reminiscent of prior hits like Slerf. Adding to Slothana’s allure is speculation of ties to Smog’s creators, amplifying its mystique. Investors are lured by high returns in a speculative environment with limited project details, fostering rapid investments.

🚨 Attention Slothana community! Thread ahead 🌿 Due to expected upcoming volatility, we’ve moved funds into USDT on Polygon. SOL USDT withdrawals are suspended on major exchanges therefore we have had to use Polygon. Address in bio.

— Slothana (@SlothanaCoin) April 4, 2024

Anticipation surrounds Slothana’s exchange listing post-launch, which is expected to boost value, liquidity, and accessibility, mainly benefiting presale participants. Early investors who join the presale stand to gain the most, seizing the opportunity to invest at the project’s inception before its listing. With over $7 million raised in its ongoing presale, speculation mounts that SLOTH could emerge as the next viral sensation on the Solana blockchain.

Visit Slothana Presale

4. Stacks (STX)

Stacks operate as a crucial Bitcoin Layer for smart contracts. It enables decentralized applications to leverage Bitcoin as an asset while settling transactions on the blockchain. Its unique selling point lies in its comprehensive understanding of the complete Bitcoin state. Its innovative Proof of Transfer consensus mechanism and Clarity programming language facilitate this understanding. Through this, Stacks ensures seamless integration with Bitcoin, empowering users with the security and stability of the Bitcoin network.

The standout features of Stacks underscore its innovation within the crypto space. Notably, its impending transition to being secured by the entire hash power of Bitcoin ensures unparalleled security and finality. This transition sets it apart from other blockchain platforms. Using the Clarity language, Stacks prioritizes safety and transparency, offering users a reliable environment for executing contracts efficiently.

Most of the Bitcoin innovation is going to happen on the L2 🟧

Builders are getting excited by the idea of building on Bitcoin.

– Stacks creator @muneeb on Bitcoin innovation pic.twitter.com/79K1Qzhn7B

— stacks.btc (@Stacks) April 4, 2024

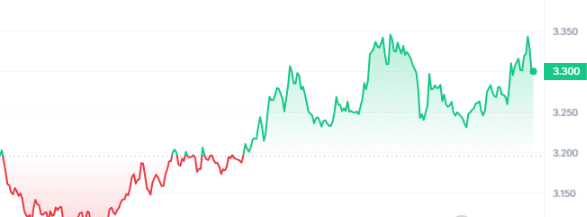

As evidenced by its current price of $3.29 and a 3.09% surge in the last 24 hours, STX demonstrates resilience and growth potential in the market. Its impressive performance metrics signify investor confidence and market strength. These metrics include a remarkable 283% increase in the last year and trading well above the 200-day SMA by 239.49%. Furthermore, its high liquidity positions it as a promising player in decentralized finance. This liquidity is reflected in a volume-to-market cap ratio of 0.0552, indicating substantial market activity and investor interest in the project.

5. Reserve Rights (RSR)

Reserve Rights functions as an ERC-20 token within the Reserve Protocol. It plays dual roles in overcollateralizing Reserve stablecoins (RTokens) through staking and governance. Additionally, it facilitates proposing and voting on configuration changes. Reserve stablecoins back themselves with diverse cryptocurrencies, unlike traditional stablecoins supported by fiat currencies in bank reserves. These include USD Coin (USDC) and DeFi-yield-bearing assets like Compound USD Coin (cUSDC) and Aave Dai (aDAI). The protocol, initially Ethereum-based, aims for interoperability across all blockchains to ensure accessibility.

The Reserve Protocol endeavours to address critical financial challenges. It provides a stable digital currency exchangeable from volatile currencies, facilitating inexpensive cross-border money transfers and offering a hedge against inflation. It aims to enhance financial accessibility by aiding businesses in international transactions and individuals in safeguarding funds. Such comprehensive goals align with its vision of fostering financial inclusivity and stability.

Ummm are you seeing these yields on @ExtraFi_io?! 🤯

Lend Based ETH (bsdETH) and earn boosted rewards paid in RSR and EXTRA — plus, liquidity in the lending pool would allow users to loop and leverage farm the bsdETH/ETH @aerodromefi pool… 👀

👉 https://t.co/ccDrk2nHr0 https://t.co/QOzXp4y3GN

— Reserve (@reserveprotocol) April 4, 2024

RSR displays promising price movement, with a current price of $0.009818 and a 7.63% spike in the last 24 hours. Over the past year, it has witnessed a 118% increase, trading above the 200-day SMA by 286.65%. With high liquidity, reflected in a volume-to-market cap ratio of 0.2955, it asserts its strength in the cryptocurrency market. Additionally, boasting relatively low volatility at 27%, RSR exhibits resilience and stability amidst market fluctuations.

Read More

Smog (SMOG) – Meme Coin With Rewards

- Airdrop Season One Live Now

- Earn XP To Qualify For A Share Of $1 Million

- Featured On Cointelegraph

- Staking Rewards – 42% APY

- 10% OTC Discount – smogtoken.com

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC