Research firm TokenInsight released its Q1 Crypto Exchange Report — showing centralized platforms had a buoyant start to 2023.

The report stated that, during the quarter, the total crypto market cap had grown from $831.8 billion to $1.24 trillion — a nearly 50% increase. Bitcoin (BTC) jumped almost 100% from $16,000 to a $30,000 high during the period.

With that, TokenInsight suggested that crypto winter may be thawing — recommending readers use exchange metrics to help make up their minds.

“With the price of Bitcoin rising from $16,000 at the beginning of the year to a high of $30,000, it looks like winter is over for the Crypto industry. But when will the bull market actually arrive? Perhaps the most intuitive answer comes from the data on the exchanges.”

Crypto Trading Volume

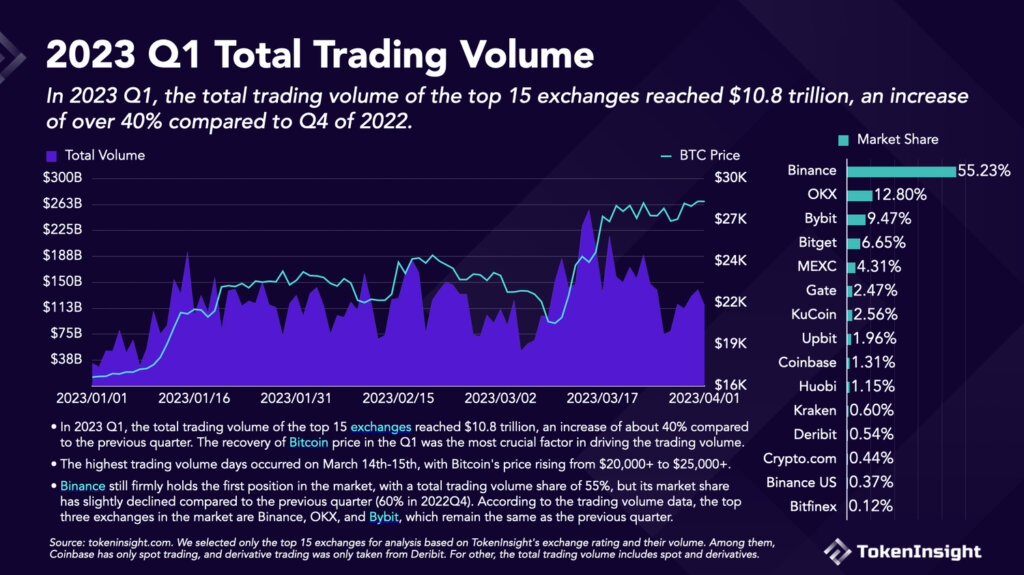

Q1 2023 total trading volume for the top 15 crypto exchanges showed a 40% increase to $10.8 billion versus the prior quarter.

The period around March 14-15 saw the most significant increases in daily volume — as the price of Bitcoin recovered from the banking crisis fallout — likely driven by realizations of fiat fragility and the demand for harder assets.

Binance maintained its dominance throughout the quarter, taking more than half the market share at 55%. However, TokenInsight pointed out that in Q4 2022, Binance held a 60% market share — suggesting recent regulatory enforcement actions and rumors of insolvency have had an impact.

Other exchange metrics

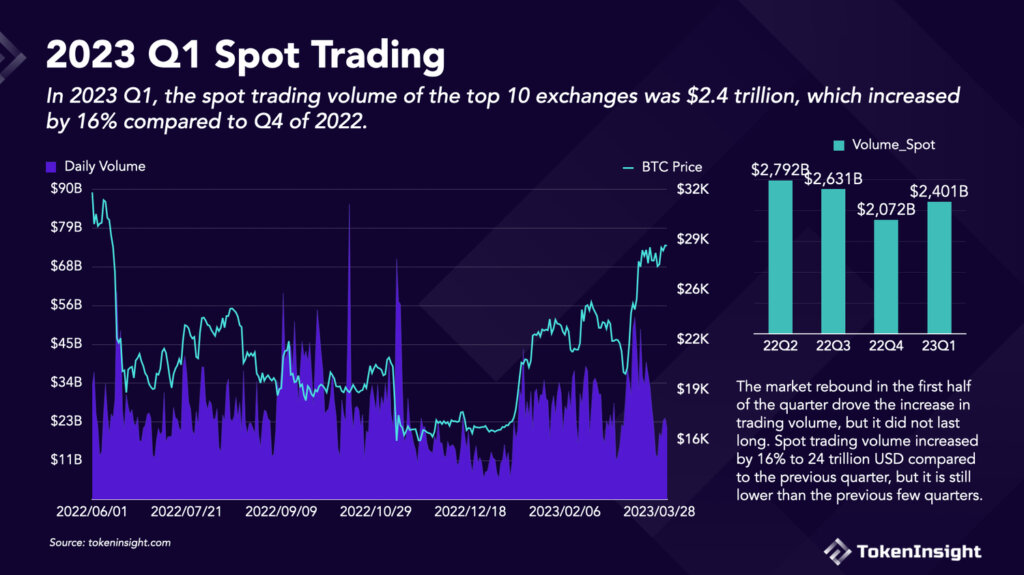

Spot volume for the top 10 crypto exchanges increased by 16% over the prior quarter to $2.4 trillion. However, this is still down versus Q3 and Q2 2022 — which were $2.6 trillion and $2.8 trillion, respectively.

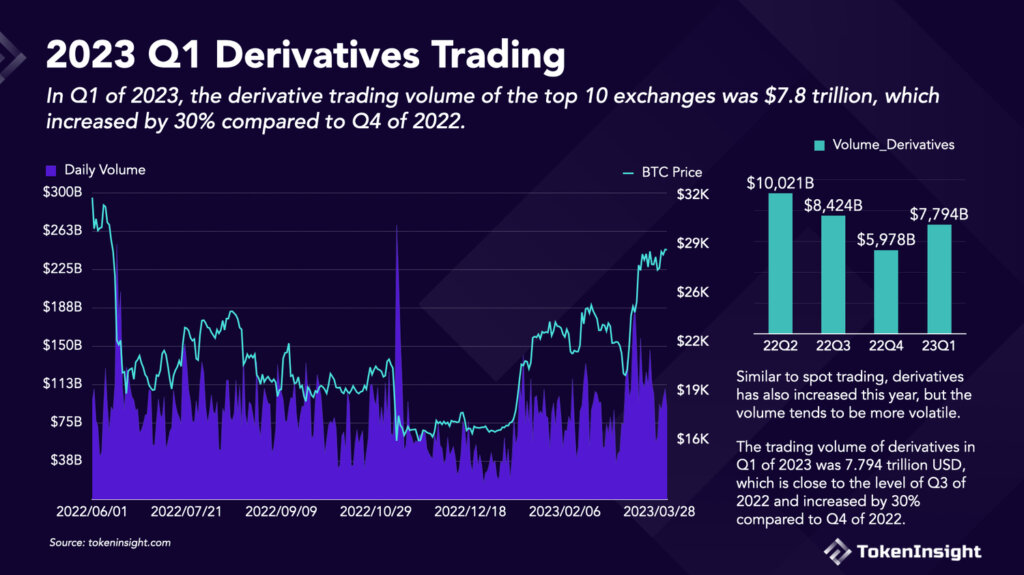

The same pattern is repeated with derivatives volume, with Q1 2023 showing a 30% increase on the prior quarter to $7.8 trillion. But still down compared to Q3 2022 at $8.4 trillion and Q2 2022 at $10 trillion.

Exchange tokens

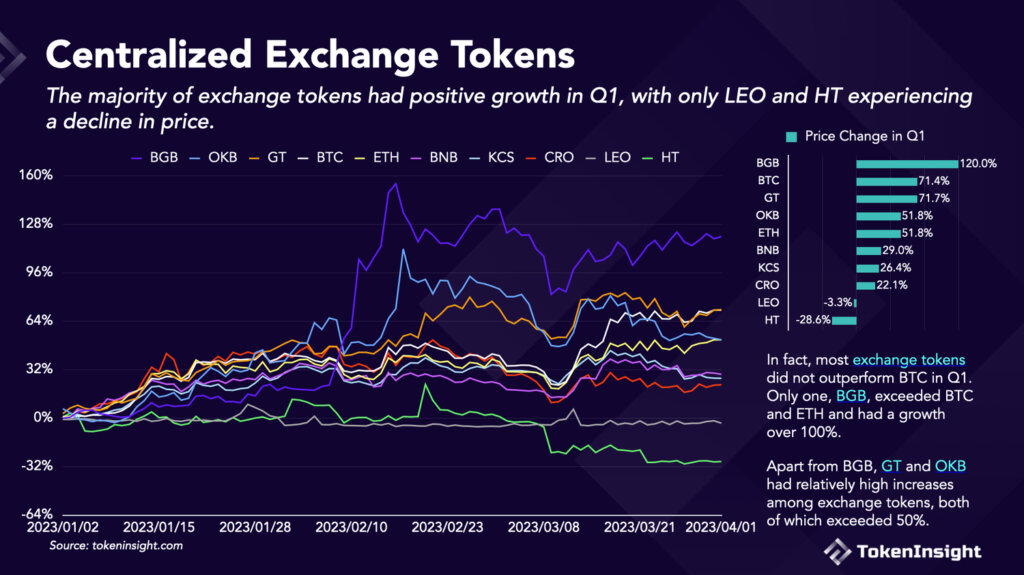

Given the spate of centralized finance (CeFi) bankruptcies in 2022, exchange tokens had garnered a bad reputation.

Case in point, FTX’s FTT token was used to prop up the exchange’s balance sheet — enabling the firm to borrow against the token. This worked well until panic selling tanked the value of FTT, meaning FTT collateralized loans lost their backing and became worthless.

Nonetheless, the chart below shows a return in confidence in exchange tokens. TokenInsight found all but UNUS SED LEO, and Huobi Token saw price appreciation — with the Bitget Token experiencing 120% growth during the period to outperform Bitcoin.

GateToken placed second, approximately matching Bitcoin’s growth, at a 72% increase in value during the quarter — the other exchange tokens underperformed versus the market leader.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  Polkadot

Polkadot  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Litecoin

Litecoin  Bitget Token

Bitget Token  Official Trump

Official Trump  Hyperliquid

Hyperliquid  Uniswap

Uniswap  Pepe

Pepe  Wrapped eETH

Wrapped eETH  USDS

USDS  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Ethereum Classic

Ethereum Classic  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Render

Render  Dai

Dai  OKB

OKB  Algorand

Algorand  Bittensor

Bittensor