All new technology comes with significant potential for abuse. Non-fungible tokens (NFTs) are no different.

And while the new asset class is yet to suffer from major thefts, it lends itself to two pretty profitable illicit activities—wash trading and money laundering.

NFT wash trading is a game of luck

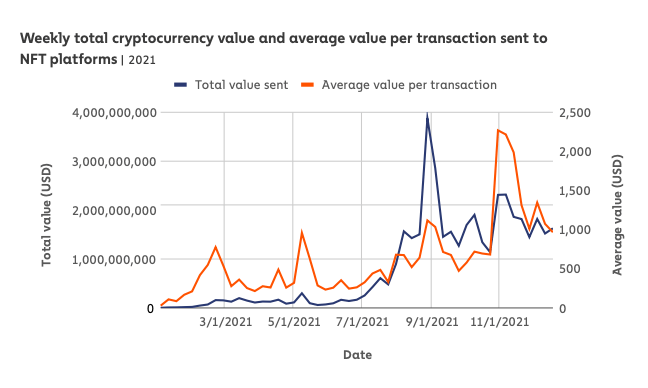

Few things in the crypto industry have experienced a popularity boom as huge as NFTs have. According to Chainalysis‘ NFT Market Report, a minimum of $44.2 billion worth of cryptocurrency has been sent to ERC-721 and ERC-1155 contracts in 2021. This represents a 41,598% increase from the $106 million that was recorded in 2020.

As was the case with the growth of DeFi we outlined in our last Crypto Crime Series report, the growth NFTs have seen last year was also followed by a significant increase in illicit activities. But, unlike DeFi, which was hit the hardest with scams, NFTs suffered the most from wash trading and money laundering.

Wash trading has always been present in the crypto industry but has grown to unprecedented highs with NFTs. Used to artificially inflate an asset’s value and liquidity, wash trading is a transaction in which the seller is on both sides of the trade—i.e. selling to yourself.

It has historically been associated with cryptocurrency exchanges, which often used wash trading to make their trading volumes appear larger than they actually were. Wash trading NFTs also makes them appear more valuable and, in turn, more sought-after on the secondary market.

And while centralized exchanges needed to employ quite a bit of technical know-how to perform wash trades, wash trading NFTs is significantly easier. Most NFT trading platforms don’t require their users to verify their identities as they aren’t subject to any KYC requirements. This means that the only thing required to trade NFTs is connecting a wallet to the platform.

With no identification required, users can connect as many wallets as they want to the platform and engage in an endless circle of selling themselves any amount of NFTs.

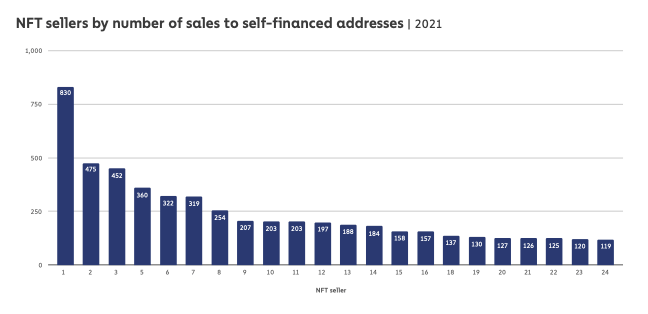

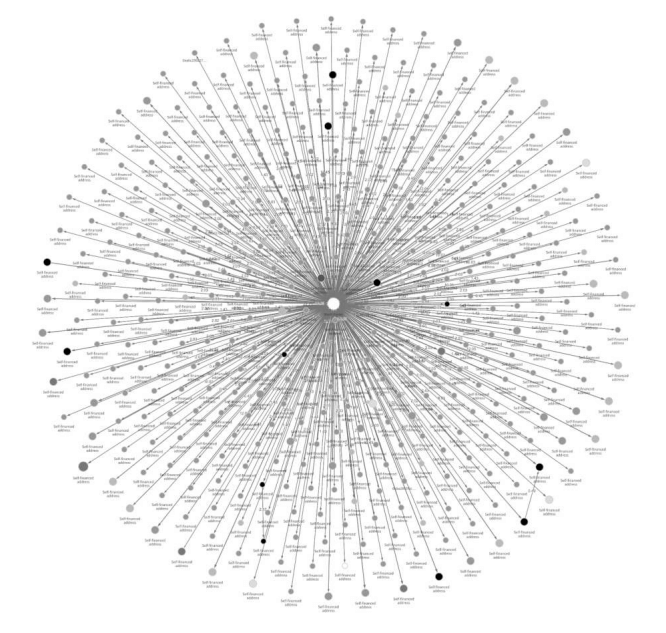

To get a better understanding of how big and how profitable wash trading really is, Chainalysis analyzed sales of NFTs to Ethereum addresses that were self-financed, meaning they were funded either by the selling address or the address that initially funded the selling address.

Analysis of these sales showed that some NFT sellers have conducted hundreds of wash trades. The most prolific NFT trader on the chart above made 830 sales to self-financed addresses last year but has so far failed to turn a profit.

In total, Chainalysis identified 262 users who have sold an NFT to a self-financed address more than 25 times. And while the company said that it couldn’t be completely sure that all instances of NFT sales to self-financed wallets were intended for wash trading, it was fairly confident that the 25-transaction threshold was enough to produce results.

And produce results it did, as further analysis showed that more than half of those wash traders failed to turn a profit.

The report calculated the overall profit of the 262 wash traders by subtracting the amount they’ve spent on gas fees from the amount they made selling NFTs to “real” buyers. Out of 262 wash traders, 152 have been unprofitable, losing just under $417,000 in aggregate.

However, the wash traders that have been profitable made so much money in their trades, that they caused the entire group of 262 to reap an immense profit overall. There have been 110 profitable wash trading addresses in 2021, reaping a profit of $8.9 million throughout the year.

“That $8.9 million is most likely derived from sales to unsuspecting buyers who believe the NFT they’re purchasing has been growing in value, sold from one distinct collector to another.”

Despite its growth, NFT wash trading still exists in legal limbo. Wash trading itself is prohibited in securities and futures markets but is yet to be subject to any kind of regulations when it comes to the NFT space.

However, it’s important to note that the wash trading Chainalysis identified on Ethereum still represents less than a fraction of the overall NFT trading volume we’ve seen last year. It’s also equally as important to note that turning a profit wash trading NFTs is extremely hard—those that do usually owe it to an unexpected stroke of luck.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)