Tether’s USDT stablecoin value wobbled from its $1 peg amid the market carnage that wiped nearly $100 billion from the crypto market on Aug. 17.

Typically, cryptocurrency traders resort to stablecoins as a hedge against the inherent market volatility within the industry. These assets are designed to consistently maintain their pegged value, irrespective of prevailing market conditions.

USDT, however, failed at that during the last 24 hours as its value oscillated between $0.99847 during the thick of the carnage on Aug. 17 to as high as $1.0007 during the early hours of today, according to Tradingview data.

Data from CryptoSlate shows that USDT has recovered but has yet to fully regain its $1 peg as of press time. The stablecoin was trading for $0.99951 at the time of writing.

Tether’s USDT is the largest stablecoin by market cap, controlling more than 60% of the entire market, according to CryptoSlate’s data. Per its quarterly attestation, the stablecoin issuer has an excess reserve of up to $3.3 billion.

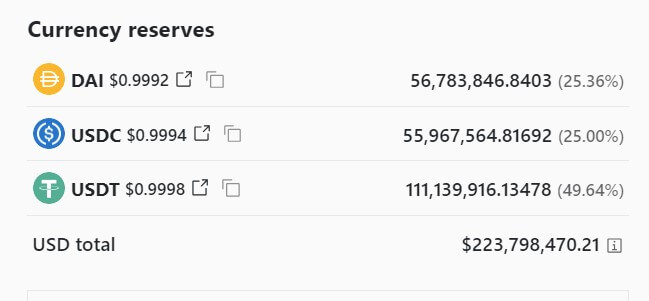

However, a look at 3Pool’s dashboard — the largest liquidity pool on Curve —shows that crypto investors favored rival stablecoins options over USDT during the market situation. According to the dashboard, USDT accounts for nearly 50% of the reserve, while USD Coin (USDC) and DAI make up the 50% balance.

This means traders have likely been selling USDT for DAI and USDC, as the pool is supposed to contain an equal amount of 33.33% of each of the three stablecoins.

Additionally, Tether’s market cap saw a slight decline from a peak of $83.08 billion to its current balance of $82.8 billion, according to CryptoSlate’s data. This further indicates how the market situation impacted USDT as traders sought refuge in other assets.

Notwithstanding these challenges, USDT emerged as the most traded stablecoin in the past 24 hours, boasting a trading volume exceeding $50 billion. This figure is six times higher than its rival, USDC, recorded during the same period.

The post Tether USDT stability tested amid crypto market shakeup appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Avalanche

Avalanche  Litecoin

Litecoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Toncoin

Toncoin  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Bitget Token

Bitget Token  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Dai

Dai  Mantle

Mantle  Internet Computer

Internet Computer  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  sUSDS

sUSDS  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  Sonic (prev. FTM)

Sonic (prev. FTM)