Blockchain project Terra and its native token LUNA have quickly moved from the sidelines to the forefront of DeFi. With over $11.9 billion in TVL, it’s the fifth largest blockchain project, trailing closely behind Avalanche.

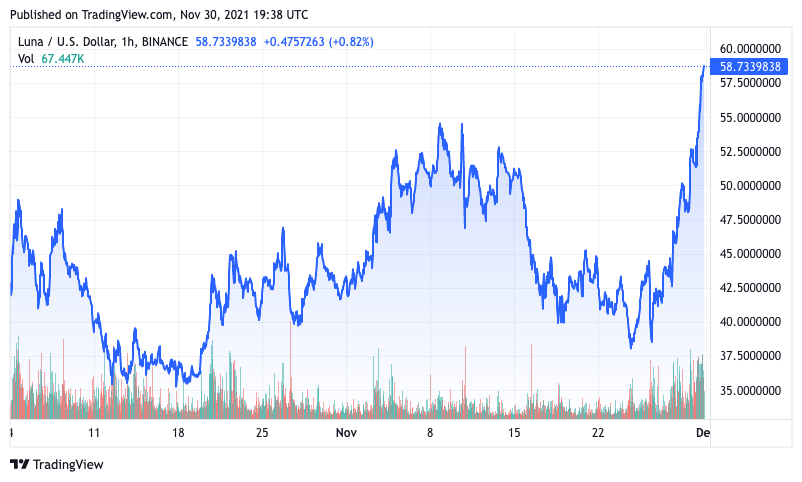

With several major fundamental developments underway, LUNA saw its price increase by over 50% in the past week, with industry insiders believing that this is just the start of a major bull run set to take place in the following weeks.

What’s behind LUNA’s major rally?

After Bitcoin took a massive hit last week, dropping dangerously close to its coveted $50,000 resistance levels, the rest of the market went into the red alongside it. However, the major drag downwards doesn’t seem to have affected LUNA, the native token of the Terra blockchain.

The Layer-1 blockchain platform has quickly risen from the sidelines to the forefront of DeFi, riding a wave of extreme interest in its innovative stablecoin products. Terra enables users to swap their LUNA tokens for a wide variety of stablecoins pegged to different fiat currencies. As minting $1 worth of UST requires burning $1 worth of LUNA, an increasing supply of stablecoins on Terra decreases the circulating supply of LUNA, thus raising its value.

This simple proposal has led to over 3.2 million registered accounts and 15.3 million UST in tax rewards distributed in the past year.

Earlier this month, the Terra community passed a proposal to burn 88.7 million LUNA tokens, worth roughly $4.5 billion at the time. The burn was initiated to mint between 4 and 5 million terraUSD (UST), a decision analysts believe would further boost interest in Terra.

And boost interest it did—the token saw its price increase by over 50% since last week, fueled mostly by a slew of new proposals set to be approved by the community.

The ultimate goal for all of the recently submitted proposals is to have UST become the go-to interchain stablecoin. This process is set to begin by increasing UST liquidity on Curve Finance, Ethereum’s premier AMM for stablecoin swaps, through a 6-month incentive plan through several Terra apps.

1/ A new proposal to significantly increase $UST liquidity on @CurveFinance pools via a 6-month incentive plan through @VotiumProtocol, @ConvexFinance, and @TokenReactor is now posted on Agora 👇https://t.co/PiUnSqWUCw

— Terra (UST) 🌍 Powered by LUNA 🌕 (@terra_money) November 30, 2021

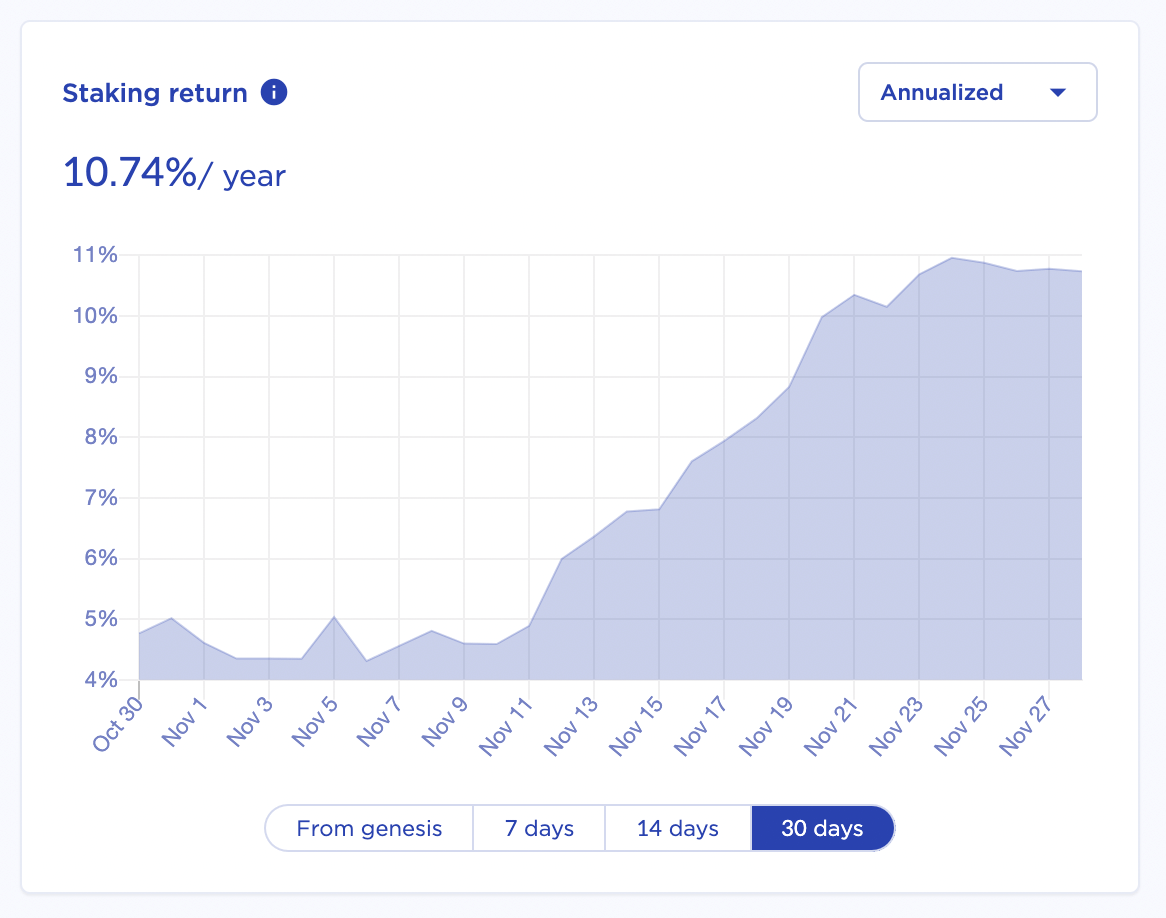

All of the previous LUNA burns have caused a huge increase in the annualized staking return for the token, which jumped from 4.61% at the beginning of November to 10.74% at the end of the month.

According to Nicholas Flamel, one of the more prominent Terra community members, we are about to see an even bigger increase in LUNA’s price in the coming weeks.

“The Terra economy is in full expansion,” he told CryptoSlate. “I’m fairly confident that we have seen nothing yet.”

Flamel said that both the Terra community and its development team anticipate that UST will reach $10 billion in market capitalization by the end of the year. And as minting 1 UST requires burning $1 worth of LUNA, the Terra ecosystem is about to go parabolic.

“This means we will have to buy/burn around $2.5 billion worth of LUNA in the next 4 weeks. This is big. I’m not sure we have ever seen such massive buying pressure incoming on a coin like this before.”

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Toncoin

Toncoin  Sui

Sui  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Hyperliquid

Hyperliquid  Stellar

Stellar  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  Aptos

Aptos  USDS

USDS  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  MANTRA

MANTRA  WhiteBIT Coin

WhiteBIT Coin  Monero

Monero  Bittensor

Bittensor  Dai

Dai  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum  Ethena

Ethena