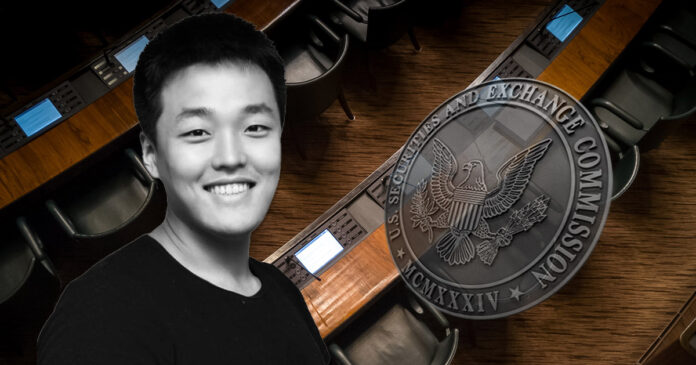

Do Kwon and Terraform Labs (TFL), the South Korean company behind the blockchain project Terra (LUNA), are suing the US Securities and Exchange Commission (SEC), last week’s filing shows.

The lawsuit comes in response to subpoenas served to the co-founder and CEO of Terraform Labs on September 20, 2021, while in New York City attending a cryptocurrency summit.

TFL and Do Kwon vs. SEC

According to the filing, TFL and Do Kwon’s lawsuit against the US regulator is “challenging two subpoenas improperly issued and served by the SEC and the SEC’s failure to keep confidential an investigation into the ‘Mirror Protocol,’ all in violation of the Due Process Clause, the SEC’s Rules and the APA.”

[8] The Law (cont.)

But by doing so, the SEC violated:

the 14th Amendment of the U.S. Constitution;

Section 555(c) of the Administrative Procedure Act;

Title 17 of the Code of Federal Regulations Section 203.8; and

SEC Rule of Practice 150(b)— 카이사르리처드 닉슨 Hiram (@caesar_milhous) October 25, 2021

TFL’s Mirror Protocol (MIR) allows users to mint “synthetics,” which track prices of real-world assets, such as stocks.

“The subpoenas were served on Mr. Kwon in public: Mr. Kwon was approached by the process server as he exited an escalator at the Mainnet summit while on his way to make a scheduled presentation that was not about the Mirror Protocol,” the suit read.

The filing argues that the US regulator acted “arbitrarily and capriciously,” since the service of the subpoenas “was intended to impermissibly secure personal jurisdiction over Mr. Kwon and TFL in a way that was not legally available to the SEC.”

Investigation into the Mirror Protocol

According to the filing, the issue arose back in May 2021, when two attorneys from the SEC’s Division of Enforcement contacted Kwon via email, requesting his voluntary cooperation in connection with a formal order of investigation styled “In the Matter of Mirror Protocol.”

TFL and Kwon retained Dentons US LLP to represent them in connection with the SEC’s request.

Dentons and the SEC attorneys eventually negotiated an agreement that Kwon would be interviewed by the SEC, whereby SEC agreed that his statements could not be directly used against him or TFL in a subsequent case.

Subsequent to the interview, which took place in July and lasted approximately five hours, the SEC requested that Kwon and TFL voluntarily produce documents.

“The request (1) in part sought records that were not available and (2) was otherwise so broad and/or defective that, to the extent responsive documents might exist, the requests had to be narrowed and clarified,” read the filing, adding that “communications between the SEC and Dentons lawyers ensued for the purpose of reaching common ground for the voluntary production of information responsive to the SEC’s request.

During these discussions, the Dentons lawyers requested feedback from the US regulator on how the SEC viewed TFL and Kwon in connection with its investigation.

As noted in the filing, “the SEC attorneys advised that they believed that some sort of enforcement action was warranted against TFL and that any cooperation, and implementation of remedial actions as to the Mirror Protocol, would result in a reduced financial sanction as part of any consent agreement.”

Instead of specifying anything in regard to the amount of potential financial sanction or any remedial actions or further cooperation, Kwon was personally served by an SEC-hired private process service company with subpoenas, seeking production of documents and Kwon’s in-person testimony in Washington, D.C.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Like what you see? Subscribe for updates.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC