Four days after the Ethereum (ETH) Shapella upgrade, more than 1 million ETH has been withdrawn, according to beaconcha.in data.

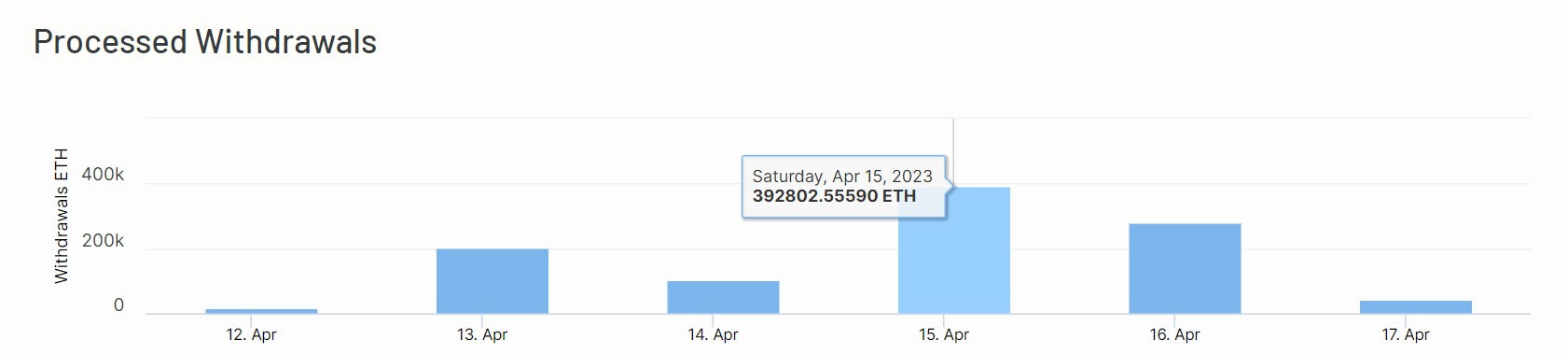

According to the data, 1.04 million ETH has been withdrawn from the 491,037 processed withdrawals. The highest withdrawal was processed on April 15 when validators removed 392,8012 ETH from the Beacon Chain.

On other days, over 150,000 ETH were withdrawn, respectively.

Meanwhile, more ETH will be withdrawn over the coming days. According to Token Unlocks, 866,850 ETH valued at $1.81 billion are awaiting withdrawal from 471,370 validators.

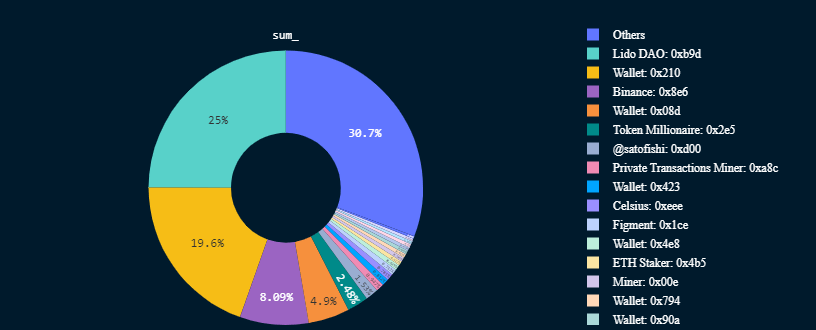

Lido tops withdrawals

According to Nansen’s dashboard, Lido DAO is responsible for most withdrawals. The liquid staking platform accounts for 25% of all withdrawals processed.

It is followed by Binance — which has withdrawn 84,145 staked ETH, equating to 8.11% of withdrawn ETH. Other centralized entities like bankrupt lender Celsius, Figment, and Satofishi are also among the top addresses that have withdrawn their staked tokens.

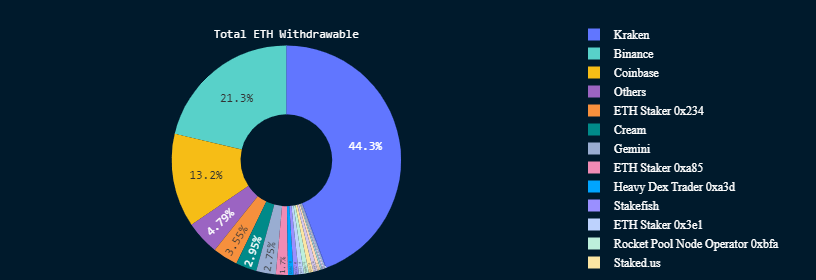

Centralized exchanges dominate pending withdrawals

Meanwhile, centralized exchanges — Kraken, Coinbase, Binance, and Gemini — dominate the platforms awaiting withdrawals of their staked ETH.

CryptoSlate previously reported that these platforms account for 78% of the entities waiting to withdraw their staked Ethereum. As of press time, these platforms want to withdraw 736,500 ETH.

Recent regulatory troubles in the United States are forcing these platforms to withdraw their assets to remain in compliance with the Securities and Exchange Commission (SEC).

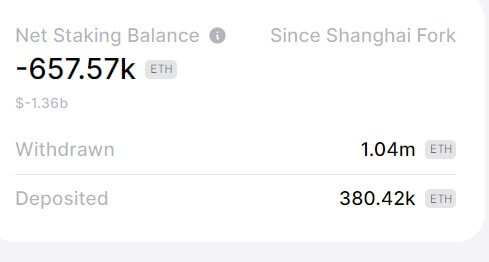

Over 380,000 ETH have been deposited since Shapella upgrade

Since the Shanghai hard fork, staked ETH balance has declined by 3.8% to 17.3 million ETH despite investors depositing 380,420 ETH, according to Token Unlocks.

This means there has been a net decline of 657,570 ETH ($1.36 billion) in staked ETH as of press time.

Meanwhile, Lookonchain reported that some addresses withdrawing their staked ETH immediately re-staked them. According to the on-chain sleuth, three wallets out of the top 15 withdrawal addresses re-staked 19,844 ETH.

Lookonchain further pointed out that some addresses withdrawing their assets were also selling them. The investigator highlighted three wallets that sent 71,444 ETH to unnamed centralized exchanges.

ETH has been one of the best-performing digital assets since the Shapella upgrade. The cryptocurrency increased by more than 12% over the past week and pulled the broader market into a green run.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  USDC

USDC  Lido Staked Ether

Lido Staked Ether  Cardano

Cardano  TRON

TRON  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Toncoin

Toncoin  Wrapped Bitcoin

Wrapped Bitcoin  Shiba Inu

Shiba Inu  Sui

Sui  Hyperliquid

Hyperliquid  Stellar

Stellar  Polkadot

Polkadot  Hedera

Hedera  WETH

WETH  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Uniswap

Uniswap  Litecoin

Litecoin  Pepe

Pepe  Wrapped eETH

Wrapped eETH  NEAR Protocol

NEAR Protocol  Ethena USDe

Ethena USDe  USDS

USDS  Aptos

Aptos  Internet Computer

Internet Computer  Aave

Aave  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Render

Render  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  MANTRA

MANTRA  Dai

Dai  Bittensor

Bittensor  Artificial Superintelligence Alliance

Artificial Superintelligence Alliance  Arbitrum

Arbitrum