The U.S. economy grew at an annualized pace of 1.1% in Q1 2023, which came in slower than expectations and was forecasted to come in at 1.9%. Stagflation is now a concern for the U.S.; this GDP print was significantly smaller than the previous two quarters, 2.6% and 3.2%, respectively.

Next week’s FOMC meeting, which takes place on May 3, is expected to raise rates by a further 25bps taking the federal funds rate to 5.00%.

The U.S.

Debt ceiling drama

What is the debt limit? According to the U.S. Department of Treasury, it is “The debt limit is the total amount of money that the United States government is authorized to borrow to meet its existing legal obligations, including Social Security and Medicare benefits, military salaries, interest on the national debt, tax refunds, and other payments”.

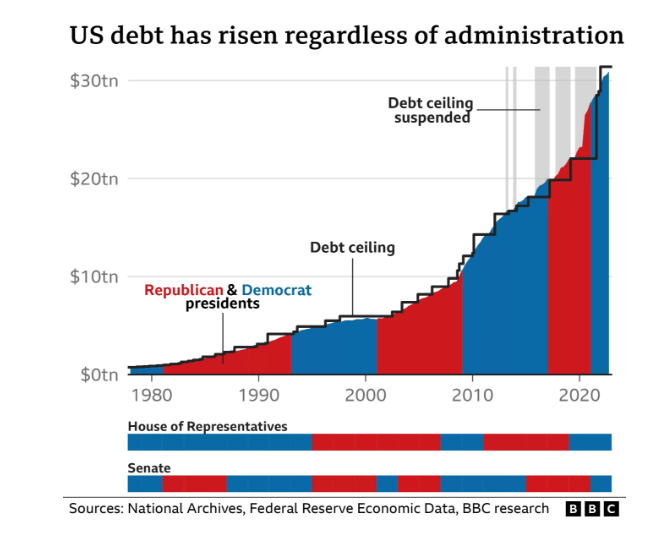

According to data from 1960 and corroborated by Lyn Alden, Congress has raised the debt ceiling 78 times, which has been raised by Democrats and Republicans 29 and 49 times, respectively.

You may have heard the news that the U.S. is approaching the debt ceiling, and this has caused uncertainty in the market. The base case and what we expect is for the U.S. debt ceiling to be raised and to kick the can down the road; this game of chicken will most likely go on into the eleventh hour. We have previously highlighted that the Treasury General account has been depleted, heading to 0, which has dislocated the market.

However, both Democrats and Republicans are miles apart from agreeing. Democrats insist on raising the debt ceiling without any conditions. Republicans are calling for spending cuts.

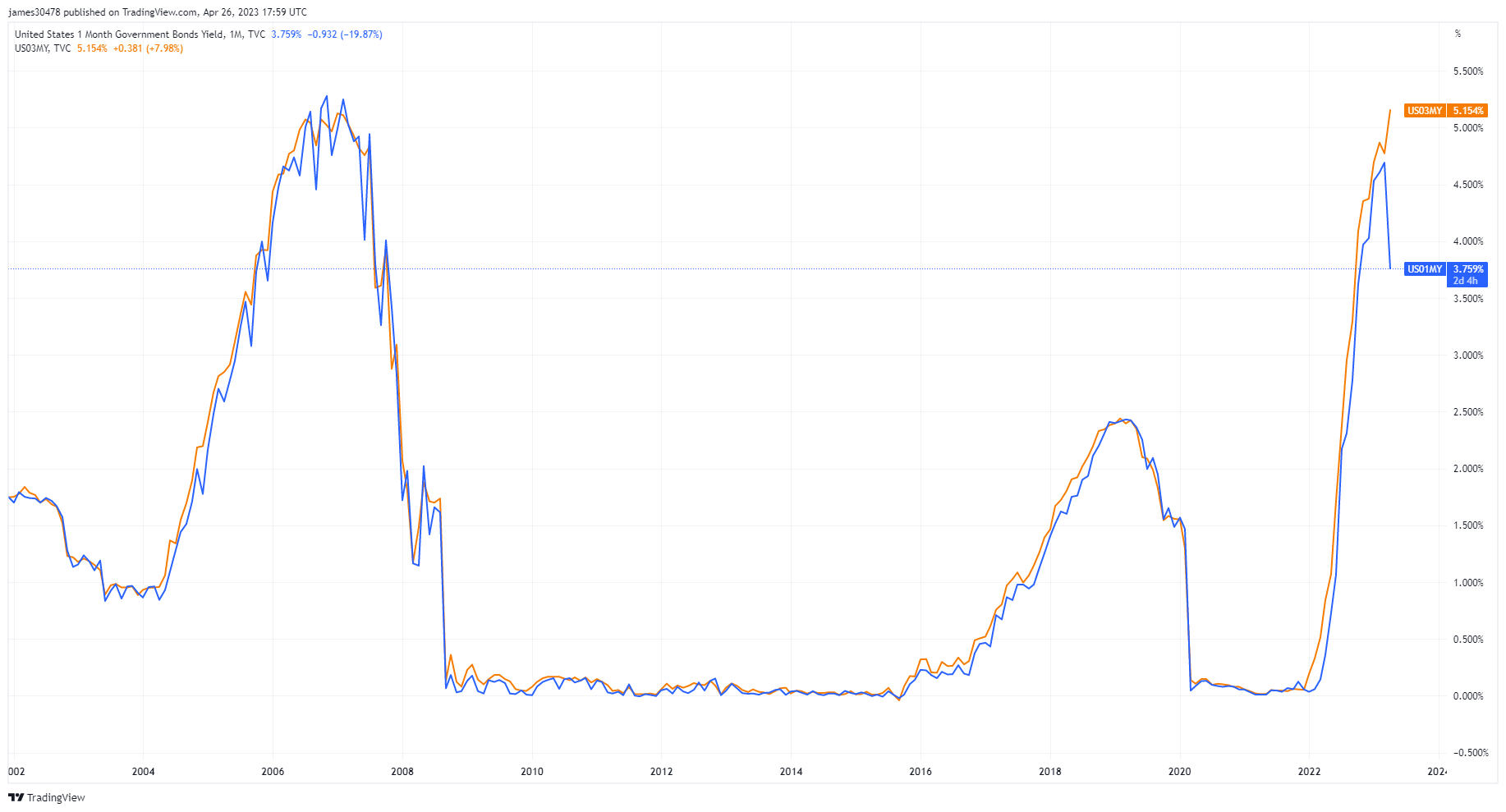

The longer this continues, puts further pressure on financial markets, which can be best viewed by the spread between the one and three-month U.S. treasury bills. The spread between the two yields should be zero. As you can see, the demand for the US 1-month T-bill, which matures before the U.S. treasury runs out of cash, is at 3.759%. At the same time, the 3-month T-bill faces the possibility of default unless Congress raises the debt ceiling, which is yielding 5.154%. Investors are concerned about the potential of a default, the earliest the Treasury would no longer be able to pay its bills would come as early as June, but we believe the ceiling will be extended.

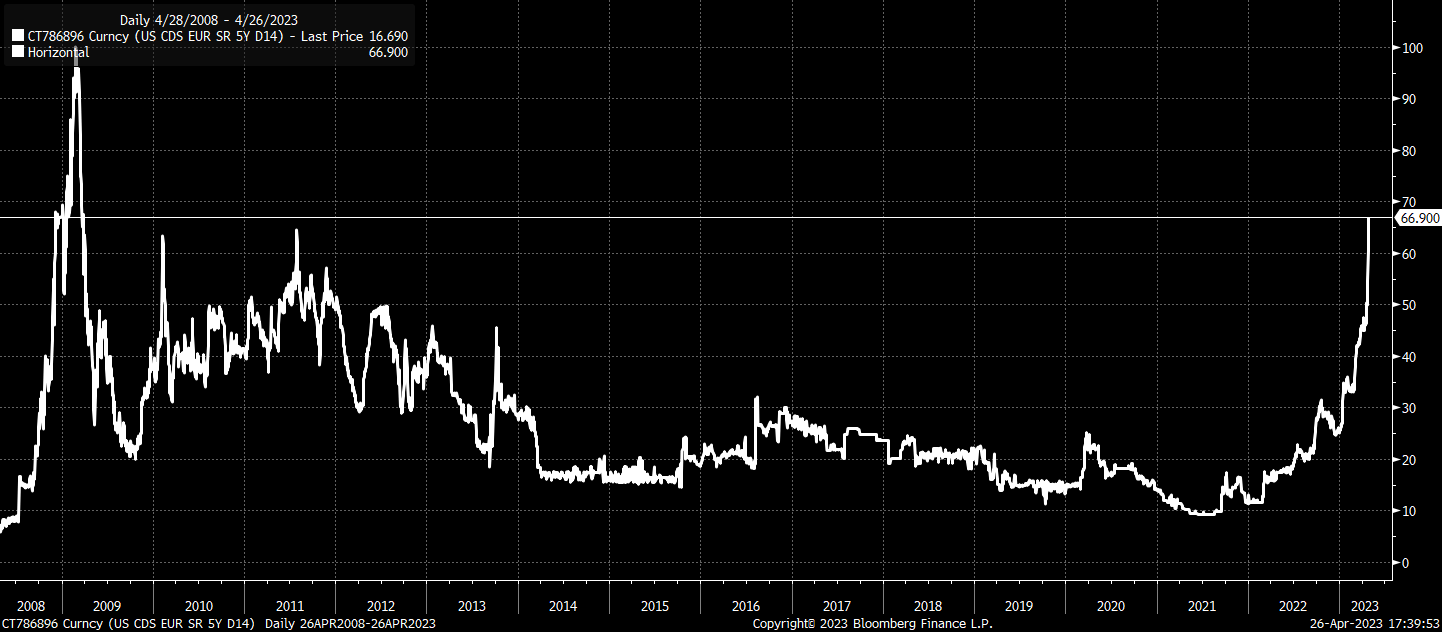

U.S. Treasuries are the foundation of the entire financial system, so a permanent default would disrupt the entire system. However, a small temporary default would affect U.S. credit, which can be seen with the 5 yr US CDS spread at its highest levels since 2009.

First Republic Bank

Why would the regional bank crisis be over when rates are still rising and elevated? Shares in First Republic Bank are almost down 95% in the past six months. As the federal funds rate is approaching 5%, deposit flights are a real issue for banks. First Republic Bank reported a huge deposit flight.

The crisis could deepen if the FDIC or a private organization finds no resolution. According to Macro Investment, if FRB held to maturity assets are sold, the realized losses on these assets would wipe out the value of its equity. It is more likely that the Fed and Treasury will need to organize a bailout similar to Credit Suisse.

The U.K.

BOE doesn’t take the blame for inflation

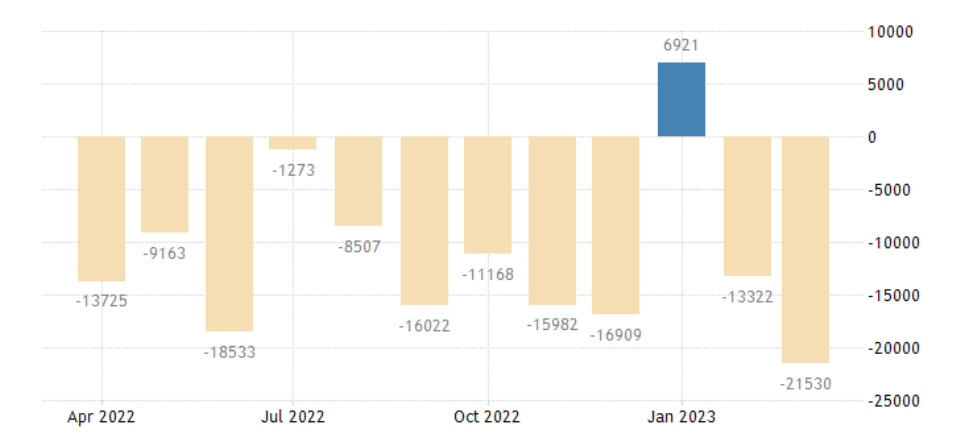

UK public sector borrowing increased yearly, totaling £21.5 billion, equivalent to 5.5% of the GDP, a deficit of £21.53 billion. In addition, interest costs soared over 47% higher than last year to over £106.6 billion.

It was a week to forget for the policymakers in charge, who need to, quite frankly need to go back to school and understand the fundamentals of economics. Deputy Governor Ben Broadbent outright refused that money printing during covid resulted from this out-of-control inflation. He blamed the cost of importing energy.

From one incompetent policymaker to the next, Chief Economist Huw Pill followed up this week by saying that people in the UK “need to accept that they’re worse off and stop trying to maintain their real spending power”. He blames people for pushing for higher wages contributing to higher inflation. He also expects inflation to come down to 2% in the next two years. He can now be added to the “inflation is transitory” team with Jerome Powell.

Japan

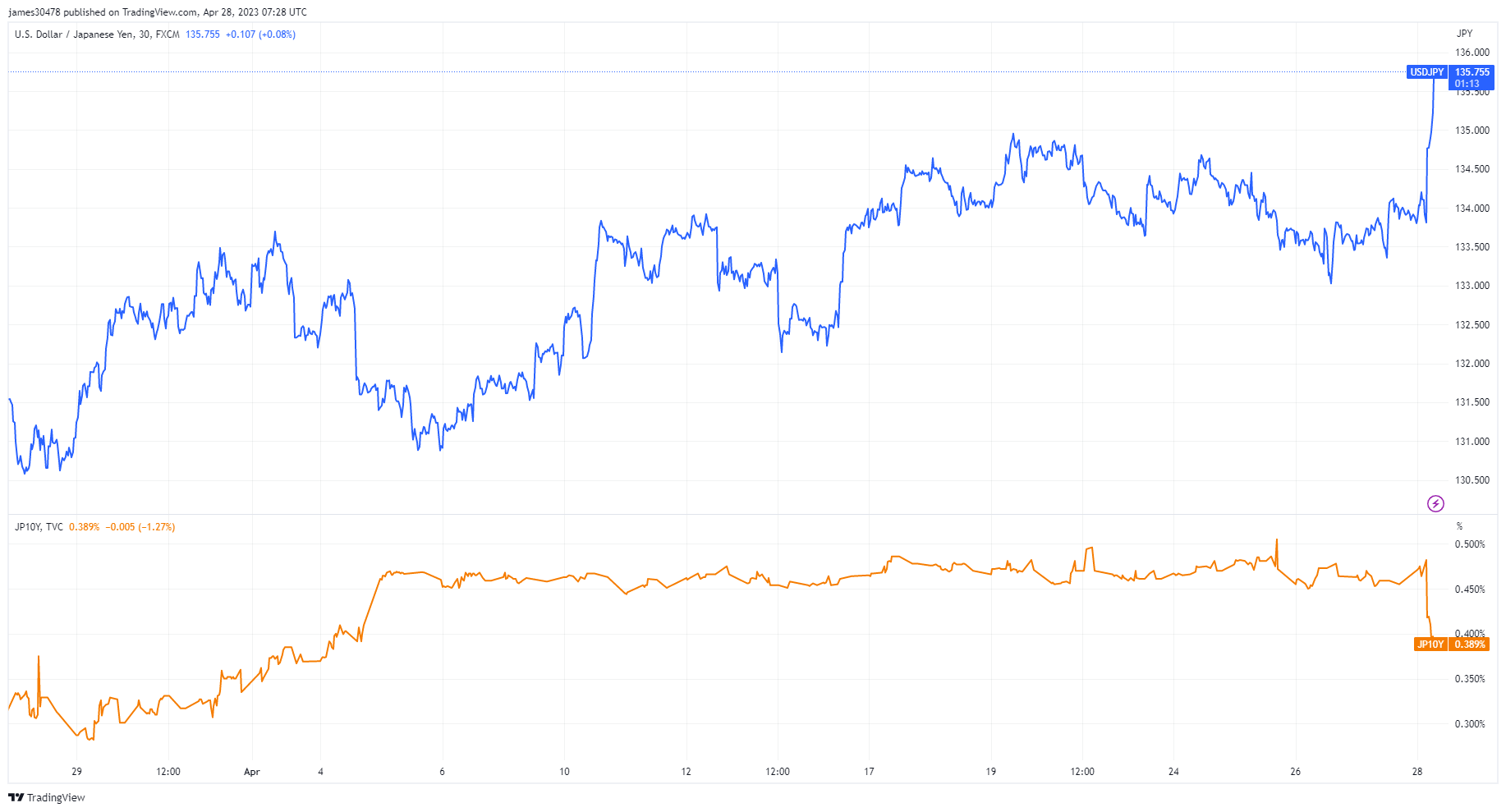

The Bank of Japan met again on Friday and unsurprisingly committed to a stimulus-first approach to maintain yield curve control on the 10-year bond. As a result, this sent the Yen and yields sharply lower.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  WETH

WETH  Polkadot

Polkadot  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC