Join Our Telegram channel to stay up to date on breaking news coverage

The Stacks price prediction shows that STX is showing signs of consolidation and potential bullish momentum, if the price successfully breaks to the upside, it could trigger a strong bullish rally.

Stacks Prediction Data:

- Stacks price now – $1.33

- Stacks market cap – $2.05 billion

- Stacks circulating supply – 1.51 billion

- Stacks total supply – 1.51 billion

- Stacks CoinMarketCap ranking – #55

Getting in early on crypto projects can be a game-changer, as history has shown with numerous tokens surging in value over time. Take Stacks (STX) as an example—since hitting its all-time low of $0.04501 on March 13, 2020, it has skyrocketed by a staggering +2929.4%, proving the power of long-term holding in the right projects. While its all-time high of $3.84 in April 2024 is a distant memory, STX remains a strong performer in the crypto space. Keeping an eye on such tokens and their historical growth can help you identify promising opportunities early.

STX/USD Market

Key Levels:

Resistance levels: $2.10, $2.20, $2.40

Support levels: $0.60, $0.40, $0.20

STX/USD is currently showing a continuation of its downward trend within a descending channel. The price is trading at $1.33, slightly above the lower boundary of the channel, indicating that the market is testing a crucial support level. However, the 9-day MA (red line) remains below the 21-day MA (green line), confirming ongoing bearish momentum. Therefore, if the price fails to break above the 9-day MA, sellers may push the price lower toward the key support at $1.00, which aligns with the lower trendline of the channel. A strong bearish close below this level could trigger further downside movement, extending losses into deeper price zones.

Stacks Price Prediction: STX/USD May Consolidate Below the Moving Average

Stacks (STX) price is on its way toward the 9-day and 21-day moving averages at $1.33. On the bullish side, there is a chance for a short-term rebound as the price is near a historical support zone. If buyers gain momentum and the price closes above the 9-day MA, the next target would be the 21-day MA, currently around $1.43. A successful breakout beyond this moving average would signal a potential trend shift, leading to a retest of the major resistance level at $2.0. However, any further bullish movement could hit the resistance levels of $2.10, $2.20, and $2.40.

Nevertheless, the market outlook for STX/USD remains bearish unless a breakout above the 21-day MA and the descending trendline occurs. If the price stays below these resistance levels, the probability of testing the supports at $0.60, $0.40, and $0.20 increases. Meanwhile, traders should watch for price action near the current support zone and monitor whether the 9-day MA acts as resistance or is breached to the upside. A decisive move in either direction will determine whether STX continues its downtrend or starts forming a bullish recovery pattern.

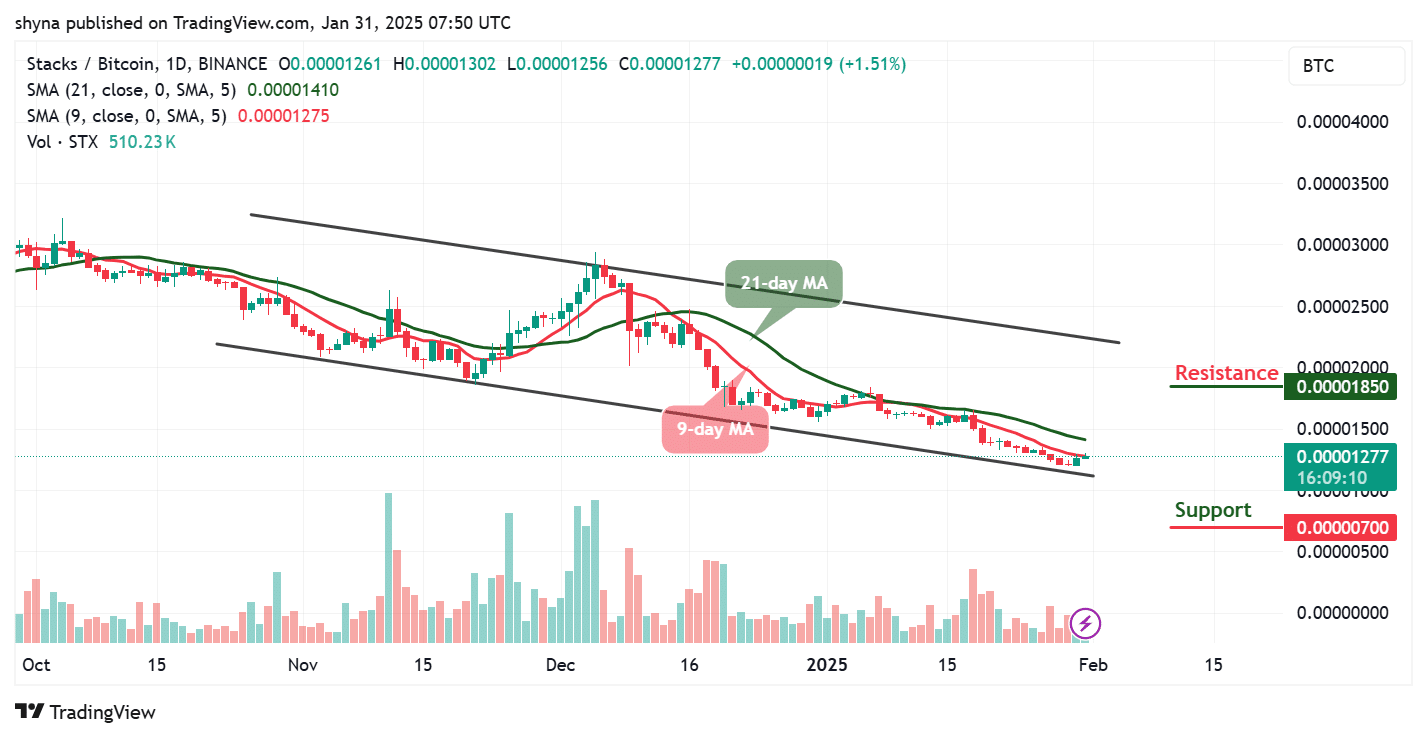

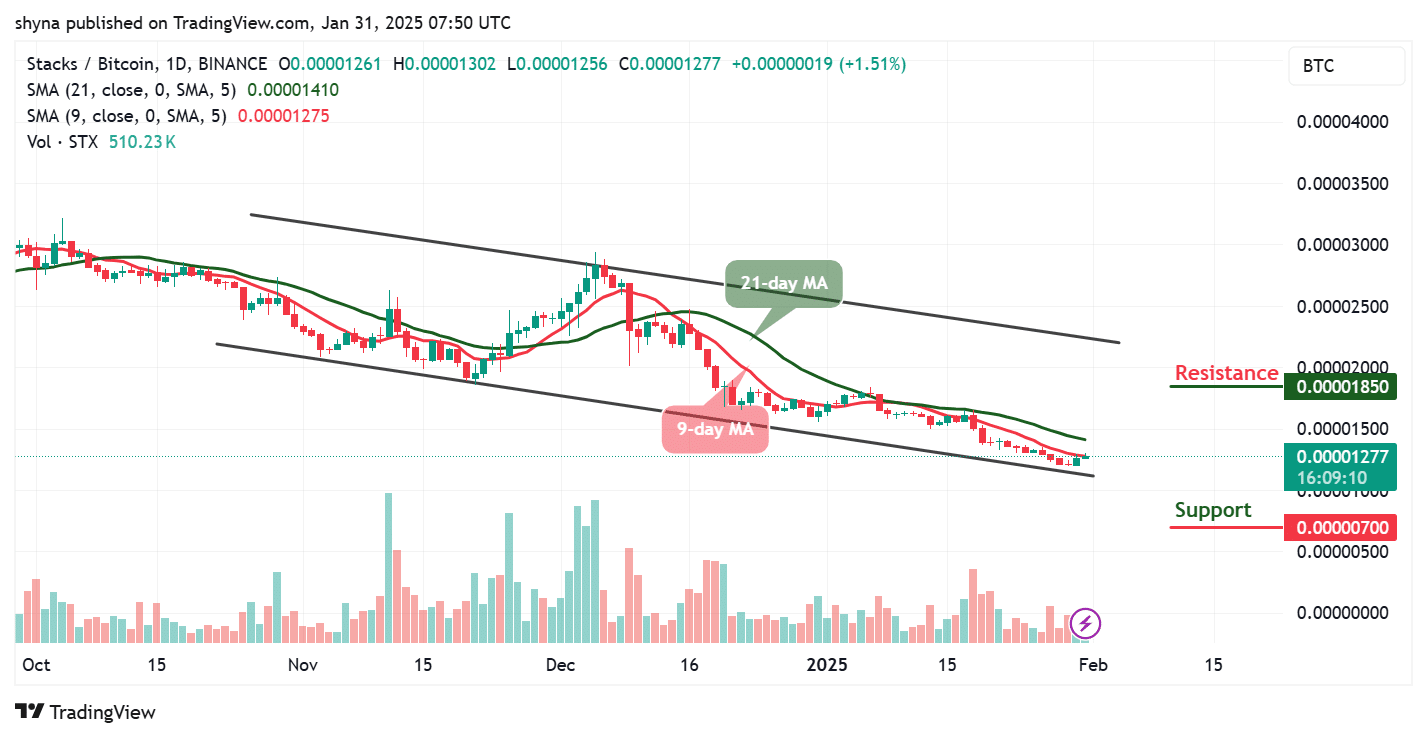

STX/BTC May Cross Below the Trendline

STX/BTC daily chart continues to trade within a descending channel, with the current price at 1277 SAT. The market remains bearish as the 9-day MA (1275 SAT) is below the 21-day MA (1410 SAT), confirming downward pressure. However, the price is near the channel’s lower boundary, suggesting a potential support test at 700 SAT. If this level holds, a short-term rebound toward the 9-day MA or even the 21-day MA could be expected. Failing to maintain this support, however, could accelerate the bearish momentum and push prices lower.

On the upside, for STX/BTC to reverse its current trend, the price must break above the 21-day MA and target the next resistance at 1850 SAT. However, a bullish breakout from the descending channel could signal a trend shift, but current volume levels remain weak, suggesting low buying interest. If bulls fail to sustain momentum, the downtrend may continue. Meanwhile, traders should monitor how the price reacts near the support zone and whether it can reclaim the 9-day MA as initial resistance.

Moreover, @inmortalcrypto shared on X (formerly Twitter) that $STX caught their attention as the first-ever SEC-qualified crypto project, emphasizing that with America leading the crypto space, U.S.-based coins like Stacks are likely to outperform.

One of the main reasons $STX catch my attention is because it was the first-ever SEC-qualified crypto project.

America will be at the forefront of crypto, and coins like Stacks, literally an American coin, will most likely outperform.$STX pic.twitter.com/G0UAT8Q3P8

— Inmortal (@inmortalcrypto) January 21, 2025

Stacks Alternatives

Recent market developments indicate that the price of STX is currently squeezed within a falling wedge, which could soon resolve in a breakout. If the price breaks above the upper resistance of this wedge, the technical target would be around $3.50, which aligns with the previous breakout targets. In other words, Wall Street Pepe has gained significant traction in the crypto market, raising over $65 million in its presale with a hard cap of $73 million. Compared to USD, $WEPE’s momentum suggests strong early demand, but post-launch price action will depend on investor behavior.

This Will Not Last – Wall Street Pepe Likely To Sell Out Early

With daily inflows of over $1 million, demand is soaring, and early investors are positioning themselves for potential exponential gains. The project has already attracted major interest from holders of previous successful tokens, showing strong community backing and confidence. As the crypto market heats up, $WEPE stands out with its unique branding, growing ecosystem, and bullish sentiment. Don’t miss out — secure your position now before the presale sells out and $WEPE takes off on major exchanges.

Visit Wall Street Pepe

Related News

Newest Meme Coin ICO – Wall Street Pepe

- Audited By Coinsult

- Early Access Presale Round

- Private Trading Alpha For $WEPE Army

- Staking Pool – High Dynamic APY

Join Our Telegram channel to stay up to date on breaking news coverage

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped stETH

Wrapped stETH  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  Polkadot

Polkadot  WETH

WETH  Litecoin

Litecoin  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  NEAR Protocol

NEAR Protocol  MANTRA

MANTRA  Aave

Aave  Official Trump

Official Trump  Ondo

Ondo  Internet Computer

Internet Computer  Aptos

Aptos  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  Cronos

Cronos  Dai

Dai  POL (ex-MATIC)

POL (ex-MATIC)  OKB

OKB