The adoption of stablecoins, digital assets whose values are pegged most commonly to the U.S. dollar, is spreading by the day as more and more private users and institutions appreciate the benefits of these tokens.

As reported in a blog post by researchers Kyle Waters and Nate Maddrey at Coin Metrics, analyzing recent on-chain trends in stablecoin activity, the total market cap of all stablecoin taken together surpassed the $150 billion mark on Monday.

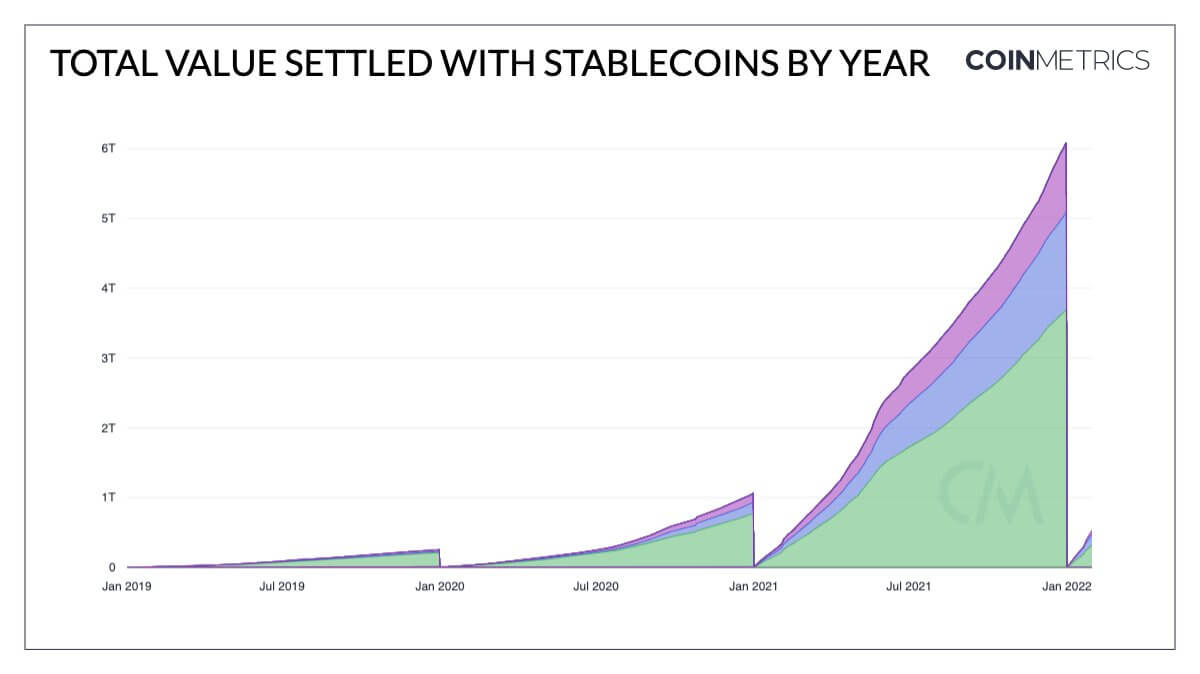

Just one month into 2022, over $500 billion has been settled with stablecoins. In 2021, total stablecoin transfer volume didn’t cross $500 billion until mid February, and in 2020, it took stablecoins until October before passing $500 billion in total value settlements. Going further back in time, the total value settled in stablecoins in 2022 is already double the entire year of 2019.

Stablecoins total supply has increased dramatically

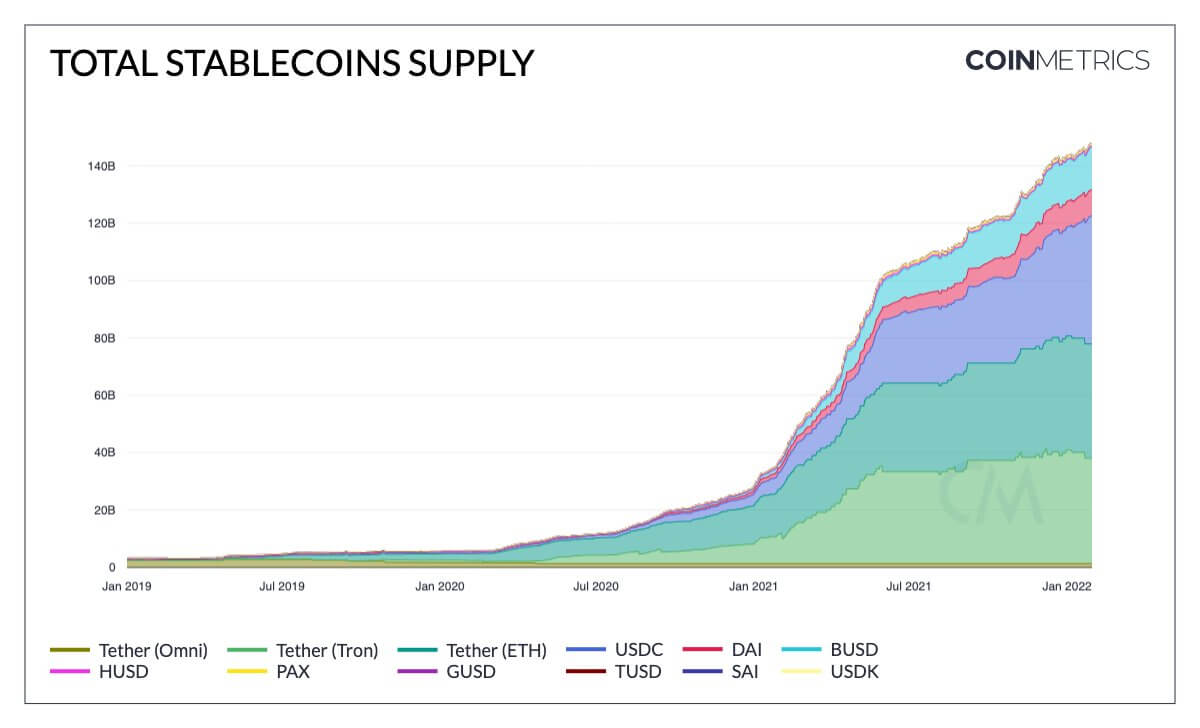

According to the report, the main reason why stablecoins are handling more economic throughput is because their total supply has increased dramatically. The total supply of stablecoins is now slightly above $150 billion, a new record and a sharp contrast from 2020.

The largest stablecoins by total supply are mostly issued and backed by third parties. These include Center’s USD Coin (USDC), BUSD issued by Binance, and Tether’s USDT which together account for over 90% of the total supply of stablecoins. Of these stablecoins, USDT is still the market leader with almost $78 billion in market cap; USDC comes second with a market cap of just over 51$ billion.

Coin Metrics’ report points out a few notable trends: USDC recently passed $44 billion in supply on the Ethereum blockchain, making it the largest stablecoin on Ethereum; USDT’s share is approximately 50% across the three networks the token is issued on; and the decentralized stablecoin DAI’s supply seems to be moving to side-chains and Layer-2 networks on Ethereum via co-called bridges that transfer token assets between different blockchains.

BUSD and HUSD dominate their respective exchange

Looking at the average stablecoin transfer in dollars per day, Binance’s BUSD and Huobi’s HUSD are in the lead as these are exchange-issued coins likely primarily used to facilitate trading on the respective exchange. This metric’s low end is Tether on Tron, which has distinct on-chain activity patterns from Tether on Ethereum. For Tether on Tron, the median transfer is about $250, while over 30% of transfers are less than $100.

Compared with USDT on Ethereum, the median transfer size on the premiere smart contracts platform is around $1,600, and less than 10% of transfers are under $100. Most transfers involving USDT on Ethereum are in the $1,000 to $10,000 range, and 1% of the transfers are over $1 million in value.

At the same time, data from analysts Santiment shows that Tether’s addresses valued at $1 million are on the cusp of returning to owning at least 80% of USDT’s supply for the first time in 3 weeks. Generally, stablecoin addresses with large holdings increasing their buying power is a good prospect for crypto’s long-term future.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Toncoin

Toncoin  Shiba Inu

Shiba Inu  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)