Crypto traders were in for a tough Monday morning as they woke up to double-digit percentage losses across the market. Large-cap altcoins like Solana, XRP, and Cardano shedded millions of dollars from their respective market caps, while Bitcoin and Ethereum lost 6% and 7% at press time respectively.

As per data from CryptoSlate, Solana traded -12% from yesterday’s highs, Cardano at -7%, and XRP at -8%. Terra (LUNA) fell as much as -11%, Algorand (ALGO) at -13%, and Theta (THETA) at -11%.

Dump all crypto?

‘Liquidations’ occur when traders borrow excess capital from brokerages/exchanges (i.e., ‘margin’ or trading futures) to place bigger bets on the assets they trade.

They pay a fixed fee for doing so, while exchanges close out these positions at a predetermined price—when the trader’s collateral is equal to the loss on that position. Such a trade is then said to be liquidated.

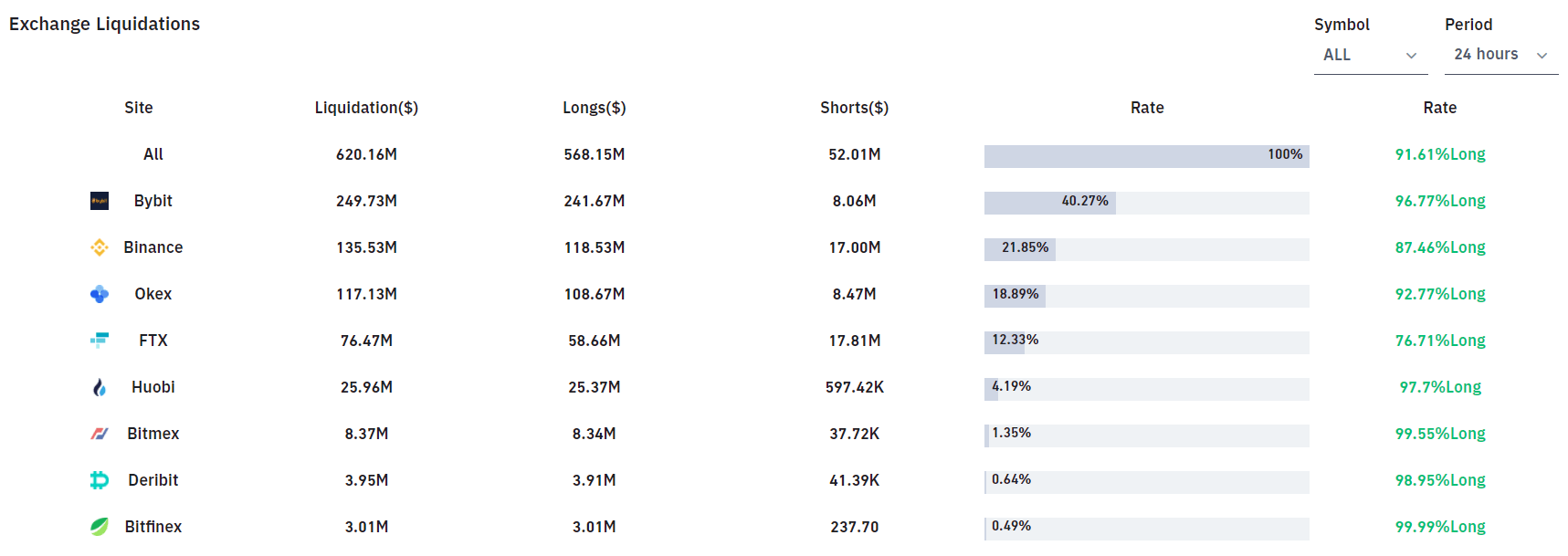

Data from analytics tool Bybt shows $620 million was liquidated in the past 24 hours alone. Of those, Bitcoin accounted for over $220 million in liquidations, followed by Ethereum at $126 million.

XRP saw $45 million worth of liquidations, while Solana, EOS, Cardano, and Avalanche followed with $26 million, $14 million, $13 million, and $10 million worth of liquidations respectively.

A staggering 91% of all liquidated traders were ‘long’ the market—meaning they had put on positions betting on higher asset prices. Just $52 million worth of shorts were, on the other hand, liquidated.

Futures powerhouse Bybit—known for its degen traders—oversaw $249 million with of liquidations, the most among all other crypto exchanges. Binance, OKEx, and FTX followed with $135 million, $117 million, and $76 million.

139,753 traders were liquidated in all, with the largest single liquidation order occurring on Bybit—Bitcoin trade valued at $7.17 million. At press time, Bitcoin seems to have stabilized at the $45,500 price level. But as is with all things crypto, it may not signal the end of the dip.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

Join now for $19/month Explore all benefits

Like what you see? Subscribe for updates.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  MANTRA

MANTRA  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC