When crypto market sentiment sours, investors and other hopefuls will often flock to NFTs. Despite stellar growth in 2021, it appears as if non-fungible tokens have lost a lot of momentum. New findings in the report by Bybit and Nansen indicate things are heading in the wrong direction.

NFT Momentum Continues To Dwindle

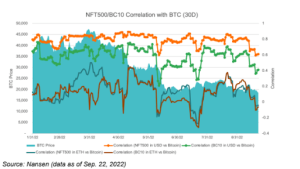

It is not uncommon to see certain correlations between crypto markets and NFT prices. When crypto assets like BTC and ETH do well, NFT price floors go down. Conversely, when NFT floor prices rise, BTC and ETH tend to become somewhat bearish. The September 2022 report by Bybit and Nansen illustrates this correlation rather well.

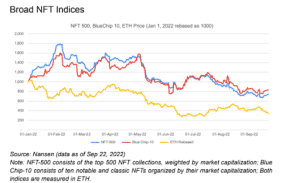

Moreover, the broad NFT indices are down by 26.2% and 16.7%, respectively. ETH’s price, on the other hand, decreased by 66% YTD. While these NFT indices are down overall, they hold their own compared to Ether. The percentages confirm both indices outperformed Ether YTD, although their USD values have decreased by 74.9% and 71.7%. From that viewpoint, NFTs underperformed against Ethereum.

It is often worth comparing NFT indices performance against BTC. Surprisingly, that correlation has decreased strongly. Bitcoin has continued to lose value, yet the two broad indices gained on Ether. Additionally, various top collections saw their price floors increase in September, including BAYC, MAYC, DigiDaigaku, and CryptoNinjaPartners.

Genre-wise, game-related NFTs continue their underperforming streak compared to social/metaverse/art assets. New projects offer a reprieve but often run out of steam relatively quickly. So, for now, the market focuses on social-oriented NFTs, rather than art, giving a better YTD performance. However, that momentum may change once again if a new Art Blocks series launches.

Solana NFTs Gain Ground

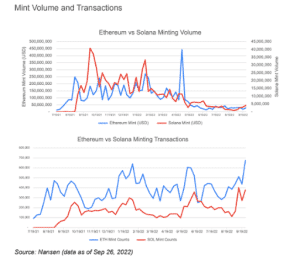

Behind the scenes, Solana and Ethereum continue to battle over NFT industry supremacy. Solana’s growing momentum has stalled a bit, although it remains visible. Several volume spikes have been recorded in September 2022, whereas Ethereum’s volume kept decreasing. The report illustrates the importance of zero-royalty projects (courtesy of Sudoswap), although Magic Eden opposes that concept. Instead, their MetaShield lets project owners introduce optional royalty fees and watermark select images.

Despite Solana building momentum, Ethereum leads the industry in minting transactions. However, the minting volume is almost split down the middle. New projects on Solana continue to drive more trading volume – at least in the short term – compared to Ethereum. That trend started in August and continued in September, primarily thanks to y00ts and DeGods.

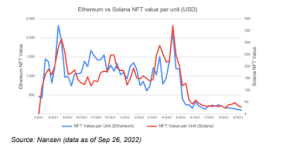

Overall, Solana now has more NFT users than Ethereum, even if the value per unit – in USD – is virtually the same on both networks. That USD value has declined significantly since early 2022. The chart for both chains looks almost identical on that front. Averages are now close to $30, making NFTs more affordable.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Sui

Sui  Hedera

Hedera  Toncoin

Toncoin  Shiba Inu

Shiba Inu  WETH

WETH  Litecoin

Litecoin  Polkadot

Polkadot  LEO Token

LEO Token  Hyperliquid

Hyperliquid  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  NEAR Protocol

NEAR Protocol  Official Trump

Official Trump  MANTRA

MANTRA  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Bittensor

Bittensor  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Dai

Dai  OKB

OKB