A new report by the Network Contagion Research Institute (NCRI) suggests that social media activity, especially from inauthentic accounts, may have significantly amplified the value of certain cryptocurrencies listed on the now-defunct FTX exchange.

According to the report, Twitter activity surrounding FTX-listed tokens like Gala (GALA) and ImmutableX (IMX) often featured many bot-like and inauthentic accounts, comprising around 20% of total online chatter about these assets.

Further analysis revealed that for half of the FTX-listed tokens studied, this inauthentic Twitter activity appeared to forecast subsequent price changes.

The report notes that “inauthentic networks successfully and deliberately deployed to influence changes in FTX [listed] coin prices.”

Bot activity followed FTX listings.

While the NCRI report does not directly accuse FTX of deploying bots, some of its findings point to suspicious activity around tokens after they were listed on the exchange.

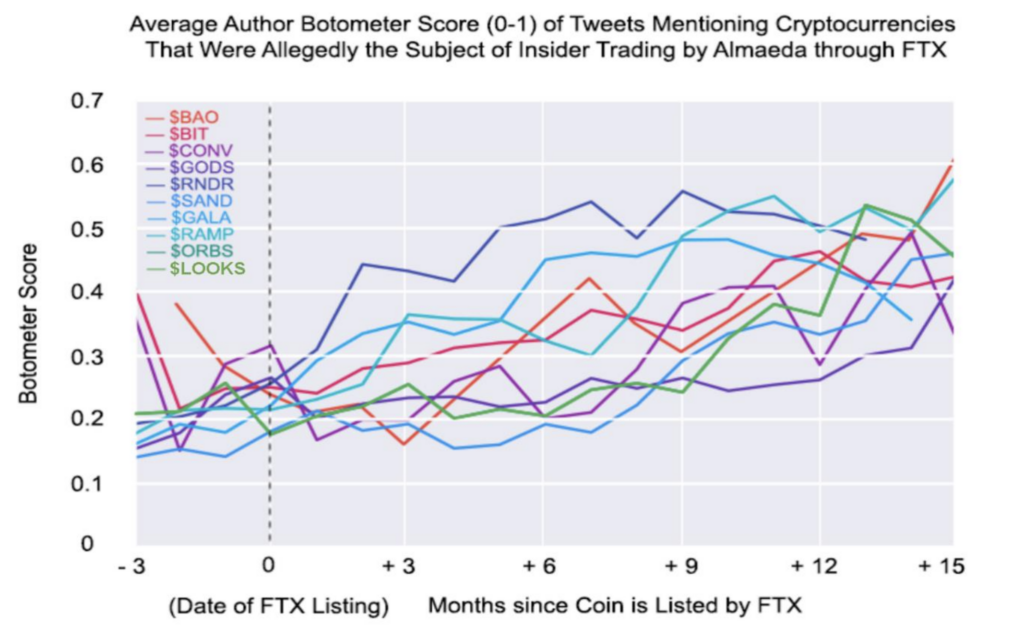

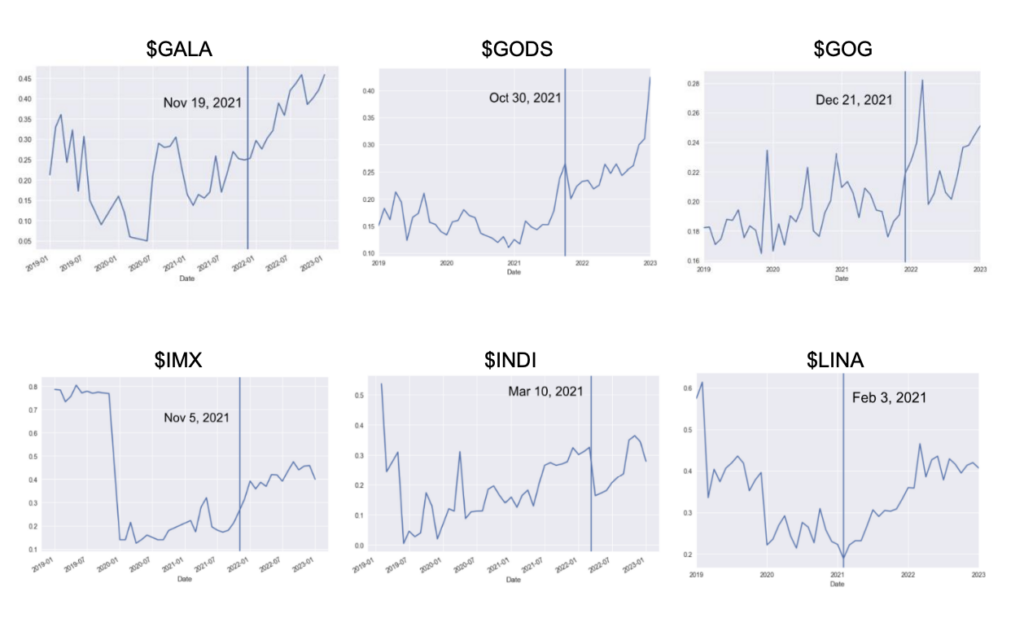

The researchers found that the promotion of a coin by FTX was often followed by a rise in average bot scores for accounts tweeting about that coin over time, with inauthentic activity reaching 50% of total volume after 15 months in some cases. The below charts show how bot activity increased following FTX listings, remarked by the vertical line.

Analyzing a sample of FTX-listed tokens, the researchers found a significant rise in bot-like activity after these assets received a promotion from FTX’s Twitter account. For tokens like GALA, IMX, GODS, LINA, SAND, DODO, and others, the proportion of tweets from inauthentic, bot-like accounts grew steadily over time following the FTX listing announcement.

The report states that across the FTX coin sample, inauthentic chatter forecasted price changes for half of the assets.

While not conclusively implicating FTX in the coordinated bot activity, the timing of the surge in inauthentic tweets about its listed tokens is potentially suspicious. As the report details, promotion by FTX appeared to act as a catalyst for attracting bot amplification around these tokens.

Whether directed by FTX/Alameda itself or not, the researchers argue the data indicates an orchestrated effort involving bots to manipulate market sentiment after the exchange listed potentially and advertised certain cryptocurrencies.

Ongoing bot activity

However, the report cautions that this phenomenon is ongoing, citing an analysis of meme coins like PEPE and PSYOP, which recently reached billion-dollar market capitalizations. NCRI also found significant bot activity around these tokens, with inauthentic chatter appearing to predict PEPE price changes in some tests.

While noting that further research is required, the report concludes that as cryptocurrencies become more mainstream, the prospect of market manipulation through coordinated social media activity poses substantial risks to investors and financial stability.

Greater transparency and oversight of cryptocurrency markets are needed, according to the researchers. However, recent limits on data access for external analysts may create barriers to identifying potentially fraudulent activities on social media that could impact prices.

“It’s also worth noting the alarming trend of social media companies, including Twitter and Meta, limiting data accessibility to researchers.

This action may obstruct external observers from identifying fraudulent and consequential activities, creating a barrier for transparency in financial markets.”

The report advises that regulators, platforms, and the public should be aware of the potential for manipulation and develop methods to counter such tactics.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Hedera

Hedera  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Litecoin

Litecoin  WETH

WETH  Polkadot

Polkadot  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  NEAR Protocol

NEAR Protocol  MANTRA

MANTRA  Official Trump

Official Trump  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Bittensor

Bittensor  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Dai

Dai  OKB

OKB