The smart contract token economy rose 5.6% against the U.S. dollar on Thursday, reaching $332 billion. Additionally, the value locked in decentralized finance (defi) increased to nearly $50 billion, a record high not seen since the collapse of FTX.

Smart Contract Economy and Defi TVL Bounces Back

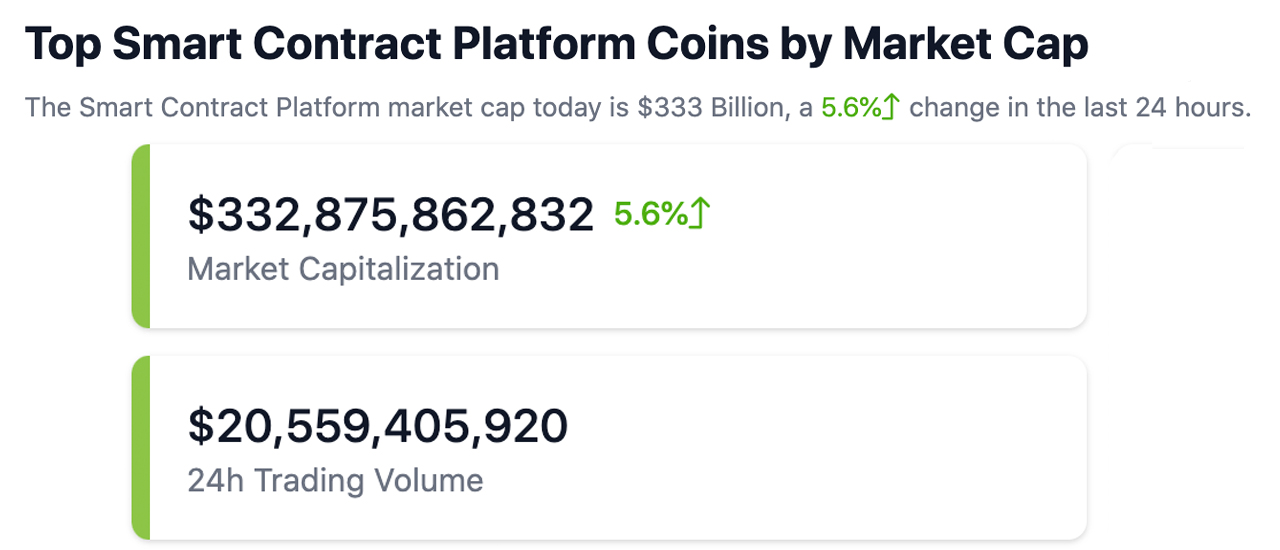

On Thursday, Feb. 2, 2023, the top smart contract platform coin economy increased to $332.86 billion, a rise of 5.6% in the last 24 hours. Currently, roughly $20.44 billion in global trading volume is paired with smart contract tokens. Of the top ten smart contract crypto assets by market capitalization, polygon (MATIC) led in 24-hour gains, rising 12% in the last day. Aptos (APT) followed with the second-largest increase, jumping 10.4% higher on Thursday.

Polkadot (DOT), chainlink (LINK), and solana (SOL) all experienced notable gains in the last day, jumping 6% to 7.1% higher. Smart contract coins outside the top ten that saw significant increases include near protocol (NEAR), which rose 11.4%, and fantom (FTM), which jumped 17.5% on Thursday. Parsiq (PRQ) was the largest gainer with a 27.7% increase, while counterparty (XCP) was the biggest smart contract token loser, shedding 9.9% on Thursday.

The value locked in decentralized finance (defi) has also risen and is near the $50 billion range, at approximately $49.48 billion. Lido Protocol leads the defi pack, as its total value locked (TVL) today represents 17.32% of the $49 billion on Thursday.

Lido’s TVL increased by 5.79%, and the second-largest defi protocol, Makerdao, jumped 2.97% in 24 hours. Rocket Pool experienced one of the biggest defi protocol increases in the last day with a 7.38% rise. According to defillama.com statistics, the top 20 defi protocol TVLs have all seen double-digit increases in the last 30 days.

Ethereum remains the top chain in decentralized finance today, as its defi protocols dominate the total value locked (TVL) by 59.4%. Ethereum is followed by Tron, Binance Smart Chain (BSC), Arbitrum, and Polygon, respectively, in terms of TVL size on Feb. 2, 2023.

Changes over the past month show that the top ten blockchains in terms of defi TVL have also seen double-digit increases in TVL. The largest increase in the last month was Optimism’s TVL, which increased by 47.41% over the 30-day span. The last time the TVL in defi was this high was in Nov. 2022, just before the crypto exchange FTX collapsed.

What do you think about the market performances of smart contract tokens on Feb. 2 and the rise in defi’s TVL? Share your thoughts in the comments sections below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC