Data analytics provider IntoTheBlock just reported a 3,580% increase in Shiba Inu outflows from large crypto wallets. These massive token movements reflect surging whale activity within the ecosystem.

Specifically, outflows surged from 422 billion SHIB on February 7th to 2.31 trillion SHIB by February 9th. Another leap happened on February 11th, from 42 billion tokens to over 3.46 trillion.

Also read: Ethereum Breaks Crucial Resistance; Will ETH Hit $3,000?

Such outflows generally show tokens getting moved off exchanges and going into private storage. This suggests investors aggressively accumulate SHIB in anticipation of substantial volatility or uptrends.

Most SHIB Holders Remain Out of Profit

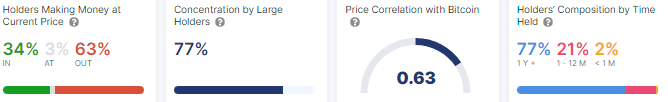

Critically, most everyday SHIB investors haven’t yet turned positive on their holdings. Per IntoTheBlock, 63% of token holders sit in the red, compared to just 34% enjoying profits.

This lopsided distribution means the majority awaits higher prices before likely selling. So newfound whale interest could propel an intense SHIB run while retail holders support uptrends by holding onto tokens.

Also read: Chainlink Weekly Price Prediction, LINK Sustains $20 Level

A resistance Break Would Confirm a New Bull Market

Zooming out, Shiba Inu has traded downhill since peaking near $0.000011 on December 17th. However, its latest bounce has it sandwiched between key resistance and higher-low support, setting the stage for big moves.

If SHIB breaks above its horizontal ceiling at $0.00001 decisively, analysts expect confirmation of a new bull phase targeting long-term gains. The needed weekly close above that barrier would spark tremendous buying momentum.

Credit: Source link

Huobi BTC

Huobi BTC  Morpheus Network

Morpheus Network  Thales

Thales  ASSAI

ASSAI  Clayton

Clayton  WEMIX Dollar

WEMIX Dollar  MOE

MOE  Defi.money

Defi.money  Shido

Shido  Sei fastUSD

Sei fastUSD  Koto

Koto  Keep3rV1

Keep3rV1  Observer

Observer  zkExchange

zkExchange  Mettalex

Mettalex  888

888  Arthera

Arthera  Primate

Primate  cUNI

cUNI  Moontax

Moontax  Penpie

Penpie  StakeWise

StakeWise  gAInzy

gAInzy  QORPO WORLD

QORPO WORLD  stake.link

stake.link  Cerebrum DAO

Cerebrum DAO  Financie Token

Financie Token  imgnAI

imgnAI  Bucket Token

Bucket Token  dogi

dogi  Music by Virtuals

Music by Virtuals  Polaris Share

Polaris Share  Jesus Coin

Jesus Coin  Rally

Rally  GameGPT

GameGPT  Fren Pet

Fren Pet  Soil

Soil  Muse DAO

Muse DAO  Deep Worm

Deep Worm  Carbon Browser

Carbon Browser  LEOX

LEOX  Beeper Coin

Beeper Coin  VNX Swiss Franc

VNX Swiss Franc  EarnBet

EarnBet  King Protocol

King Protocol