The biggest news in the cryptoverse for Sept. 5 includes Binance ceasing support for USDC, Michale Saylor calling Bitcoin Lightning Network the most important technology and FatManTerra tricking his followers with a fake investment scheme.

CryptoSlate Top Stories

Binance will stop supporting USDC, certain other stablecoins by Sept. 29

Binance will reportedly cease support for the USDC stablecoin across its platform from Sept. 29. It expects that the move will enhance liquidity and capital efficiency for users.

Binance CEO “CZ” clarified that the move does not translate to delisting USDC as users can still deposit and withdraw USDC from its platform.

Not delist. You can still deposit and withdraw USDC. Just merging all liquidity into one pair. Best price, lowest slippage for users.

— CZ 🔶 Binance (@cz_binance) September 5, 2022

Saylor says Bitcoin’s Lightning Network most important technology in the world right now

Bitcoin Maximalist Michael Saylor said the Bitcoin Lightning Network is very important to the world of technology today as it will help scale BTC to billions of customers and will allow developers to build highly scalable dApps.

He also announced that MicroStrategy is developing an in-house Lightning network solution. Upon release, the infrastructure will help bring Bitcoin adoption to over 10 million customers.

FatManTerra educates community on crypto scams by creating fake investment scheme

In less than 2 hours, crypto influencer FatManTerra received over $100,000 from community members that fell for his fake investment scheme.

Inspired by Lady of Crypto, a while ago I pitched my own investment scheme to Twitter…

In two hours, I received over one hundred DMs. I raised 3.45 BTC from Twitter and 2 BTC from Discord – over $100k, with more requests flooding in by the minute.

But there’s a little twist.

— FatMan (@FatManTerra) September 5, 2022

He plotted the scheme to educate community members against falling for influencers who promise astonishing high-yield opportunities without a clear explanation as to how the yields will be generated.

Congress not looking to ban crypto as it has ‘too much money and power behind it’

U.S. Congressman Brad Sherman who has been a vocal critic of cryptocurrencies said that it is unlikely that Congress will place a ban on the crypto industry as it has grown too big with so much money and power behind it.

However, Sherman expressed pessimism that the crypto industry still poses a threat to the U.S. economy, dollar dominance, and national security.

Vitalik Buterin poll reveals community want 5-letter .eth domain name for $100

Vitalik asked the crypto community how much they would be willing to pay for a .eth domain over a 100-year period.

What is a fair price that someone should have to pay to register and unconditionally guarantee ownership of a 5-letter .eth domain for 100 years?

— vitalik.eth (@VitalikButerin) September 4, 2022

The community weighed in for a fee of less than $100 as it would ensure inclusivity for more people.

Vitalik said that there is a need to implement measures that will prevent scalpers from parking domains and make it unaffordable for smaller players.

Helium down 55% in last 30 days as challenges run rife

The Helium ecosystem is battling for survival as its market cap has declined 55% in the last 30 days. The native HNT token has fallen 92% from its all-time high, with market cap declining from over $1 billion to only about $490 million.

The decline largely stems from a lack of trust in the project. It is alleged that Helium’s product has little to no demand. Community members also backed out of plans by developers to migrate its infrastructure to the Solana blockchain.

Russia to reportedly consider crypto use for international payments

Increased sanctions against Russia have led the country’s central bank to consider legalizing crypto usage for international payments.

Russia’s Deputy Finance Minister Alexei Moiseev said the move is to help the central bank supervise entities offering crypto services locally, as against foreign platforms that are beyond the government’s control.

Almost half of Shiba Inu’s initial circulating token supply has been burned

Shiba Inu has a total supply of about 1 quadrillion, which explains why the project is consistently burning its token to reduce its oversupply.

According to shiba-burn-tracker.com, 329.8 million tokens have been burned since the start of September. The most significant daily burn so far happened on Aug 31, which saw 455,699 tokens burned within 24 hours.

Bitcoin mining hash rate spikes 60% despite plummeting revenue per terra hash

Available data suggests that Bitcoin’s mining hash rate and price are diverging. On Sept. 4, the mining hash rate spiked to over 60% within 24 hours. The effect was that bitcoin’s hash rate reached a new all-time high.

On the flip side, the BTC price has been trading downwards and struggling to break off the $19,400 and $20,000 price zone.

Research Highlight

Weekly MacroSlate: Rising US dollar – The impact of high inflation, high energy and rising rates on Bitcoin price

CrypoSlate is publishing a weekly report that examines prevailing macro factors and how they affect the crypto market. Be the first to read our debut report.

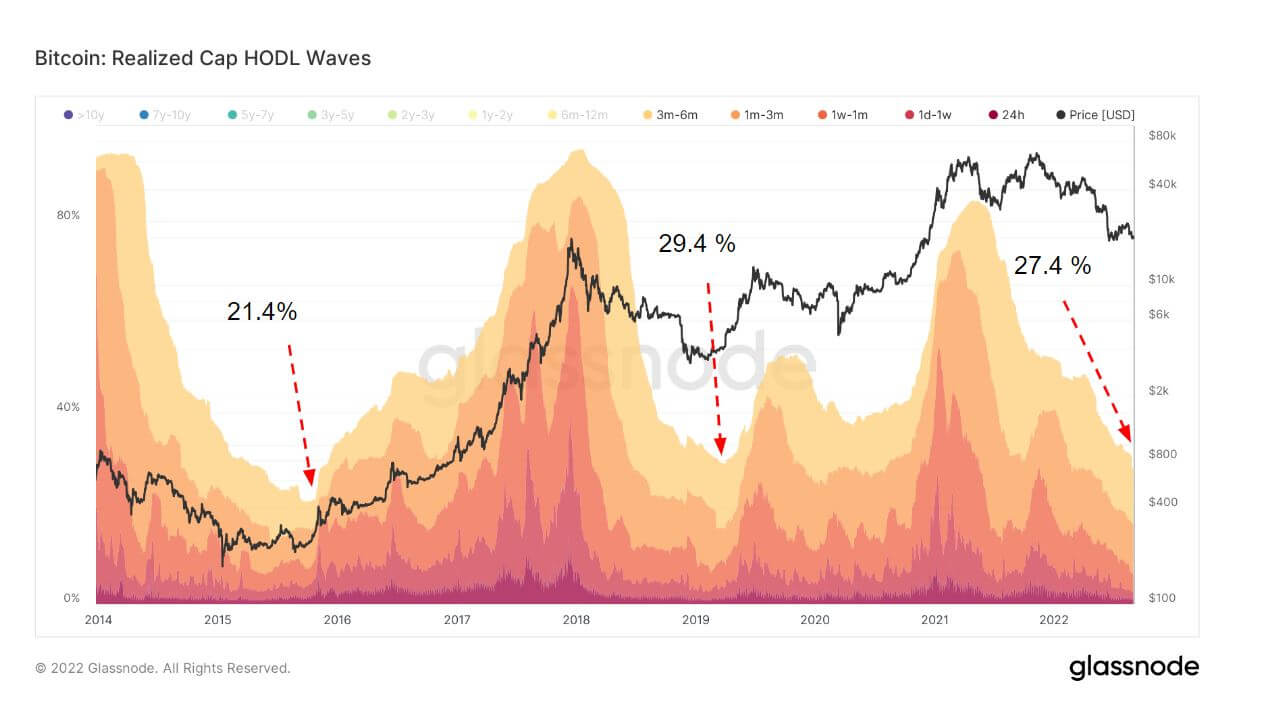

HODL waves show short-term holders at levels lower than the 2019 bear market bottom

CryptoSlate analyzed the HODL Waves chart to reveal that short-term Bitcoin holders are exiting the market. Historically, whenever the short-term holders fall below 29%, it is indicative that the market bottom is near.

Back in 2019, short-term holders made up 29% of all Bitcoin holders. The current market conditions have seen the short-term holders’ rate drop to 27.4% suggesting that the market bottom is near.

News from around the Cryptoverse

Crypto exchanges in the UK mandated to report sanctions

The UK’s Treasury Office of Financial Sanctions introduced a new law that mandates crypto exchanges in the region to report suspected sanction violations to authorities, according to The Guardian.

The move to introduce strict rules seeks to make it difficult for Russian entities to bypass sanctions imposed by the European government.

Australian Federal Police forms cryptocurrency unit to fight criminals

The Australian Federal Police has formed a cryptocurrency unit that will address the use of cryptocurrency for money laundering and financial crimes, according to the Financial Review.

The move comes after the police force seized over $600 million from criminals who laundered funds using cryptocurrency since 2020.

Crypto Market

Bitcoin was down -0.82% on the day, trading at $19,772, while Ethereum was trading at $1,601, reflecting an increase of +1.72%

Biggest Gainers (24h)

Biggest Losers (24h)

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC