Trading volume on decentralized exchanges (DEXs) hit $32 billion within seven days in mid-November, recording another high since early June this year. This came after an explosive, tumultuous week in the crypto industry, which drove many investors — both seasoned and new alike — to take refuge in self-custodial, permissionless and decentralized trading platforms.

A variety of DEX models are available on the market at present; built on the principles of decentralization and financial freedom for all without restrictions, DEXs have been welcomed for the following reasons:

- Removal of intermediaries supervising trades, where traders execute their trades based on immutable smart contracts

- Greater security and privacy as only traders are privy to their data and such data cannot be shared/seen by others

- Traders own their funds and assets, with multiple alternatives for fund recovery in the event of platform service suspensions or disruptions.

- No access restrictions based on geographical locations or profiles, i.e., no KYC requirements

- Community-focused, where stakeholders share in the platform’s revenue for providing liquidity, staking, and more.

DEXs such as Uniswap dominated the surge in November 2022, and traders are spoilt for choice when choosing a DEX to rely on, given the multiple options on the market. For seasoned traders searching for a derivatives alternative to capture trading opportunities and use every trading signal to the fullest, one could turn to derivatives DEXs — where margin trading and leverage options exist for customizable orders on various popular contracts.

Here’s a comparison of three derivatives DEXs that have shown up on traders’ radars recently, two of which are familiar to most traders — dYdX and GMX. The last DEX we’ll be looking at is the newly-launched ApeX Pro, which has increasingly gained attention after its beta launch back in August with recorded 6,000% growth in trading volume.

Let’s dive into the detail

dYdX is a leading decentralized exchange that supports spot, margin and perpetual trading. GMX is a decentralized spot and perpetual exchange that supports low swap fees and zero price impact trades and works on a multi-asset AMM model. And finally, ApeX Pro is a non-custodial derivative DEX that delivers limitless perpetual contract access with an order book model.

Comparison Criteria

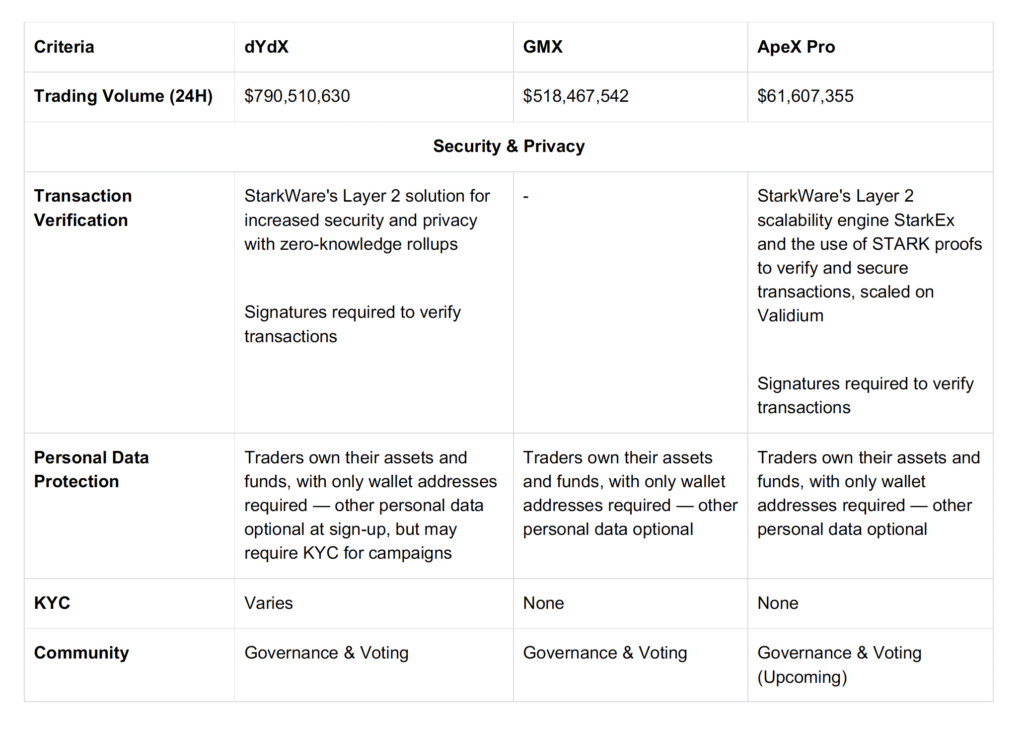

For this article, we’ll be looking broadly at these three measures: (1) security and privacy, (2) transaction and cost efficiency, and lastly, (3) token ecosystems and reward-generating offerings.

The above is a non-exhaustive list of notable highlights from the respective DEXs. dYdX and GMX are trader favorites for good reasons, so let’s see how the new ApeX Pro fares against the other two DEXs.

(1) Security & Privacy

All three DEXs are on relatively equal grounds regarding privacy-preserving measures, of which self-custody of funds is a common denominator across — the importance of a trading platform that is non-custodial is undeniable in light of recent events.

In particular, both dYdX and ApeX Pro have added safeguards with the integration of StarkWare’s Layer 2 scalability engine StarkEx, allowing the users of both DEXs to access forced requests to retrieve their funds even if the DEXs are not in service. Additionally, STARK proofs are used in both dYdX and ApeX Pro to facilitate the accurate verification of transactions, whereas GMX relies on the safety provisions of Arbitrum and Avalanche.

DEXs are known for their privacy-preserving measures, which is why GMX and ApeX Pro, in true decentralized fashion, are fully non-KYC. dYdX, on the other hand, has, on a previous occasion, implemented KYC to claim rewards for a selected campaign.

Another notable factor would be the provisions for governance and community discussions — on dYdX and GMX, pages to host votes and discussions are readily available. At present, however, ApeX Pro is still working towards creating their community-dedicated space for individuals to carry out activities such as voting and putting up suggestions.

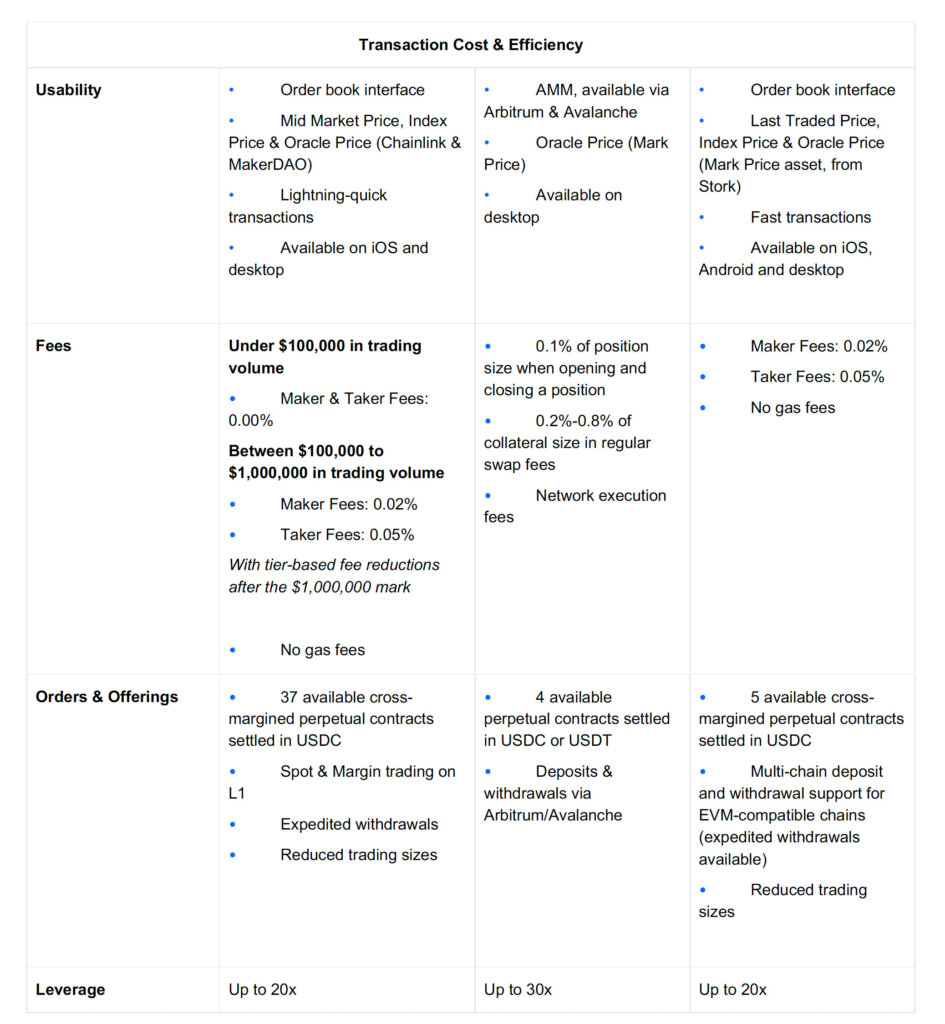

(2) Transaction Cost & Efficiency

ApeX Pro has decided to go with the orderbook interface that is found most commonly in CEXs, and like dYdX, this trading model works because it removes the barrier to entry for traditional and aspiring crypto traders to step into DeFi. It also utilizes three price types which help to prevent market manipulation. However, it would be up to a trader’s preference to see Mid-Market Price (dYdX) or Last Traded Price (ApeX Pro) for more accurate trades.

With StarkWare’s integration, it is no surprise that ApeX Pro amped up on transaction speeds to process approximately ten trades and 1,000 order placements every second at no gas fees, together with the low maker and taker fees. dYdX’s tiered fees are incredibly comprehensive and cater to different trader’s different trading sizes; without any gas fees, it is unsurprising that derivatives DEX traders have looked primarily at dYdX.

These tiered fees are also familiar to derivatives traders on CEXs. GMX, on the other hand, does charge network execution fees, which means that gas fees paid by the trader for their trade may vary according to market factors.

ApeX Pro doesn’t have tiered fees just yet but considering that it just launched in November, differential fees are likely to drop soon with an upcoming VIP program, where the staked amount of APEX will determine the discount applied to maker-taker fees.

For traders looking for choices in trading pairs, dYdX remains the DEX with the greatest number of perpetual contracts while also providing access to spot and margin trading at the same time on Layer 1 Ethereum. ApeX Pro and GMX do not offer as many perpetual contracts as dYdX. Still, with new trading pairs being introduced frequently, it’s only a matter of time before traders get access to multitudes of assets and pairs on the remaining DEXs.

What might be notable for all is ApeX Pro’s support for multi-chain deposits and withdrawals on EVM-compatible chains; this is certainly a plus point for traders who engage in dynamic trades across multiple platforms, chains and asset categories in crypto.

(3) Tokens & Rewards

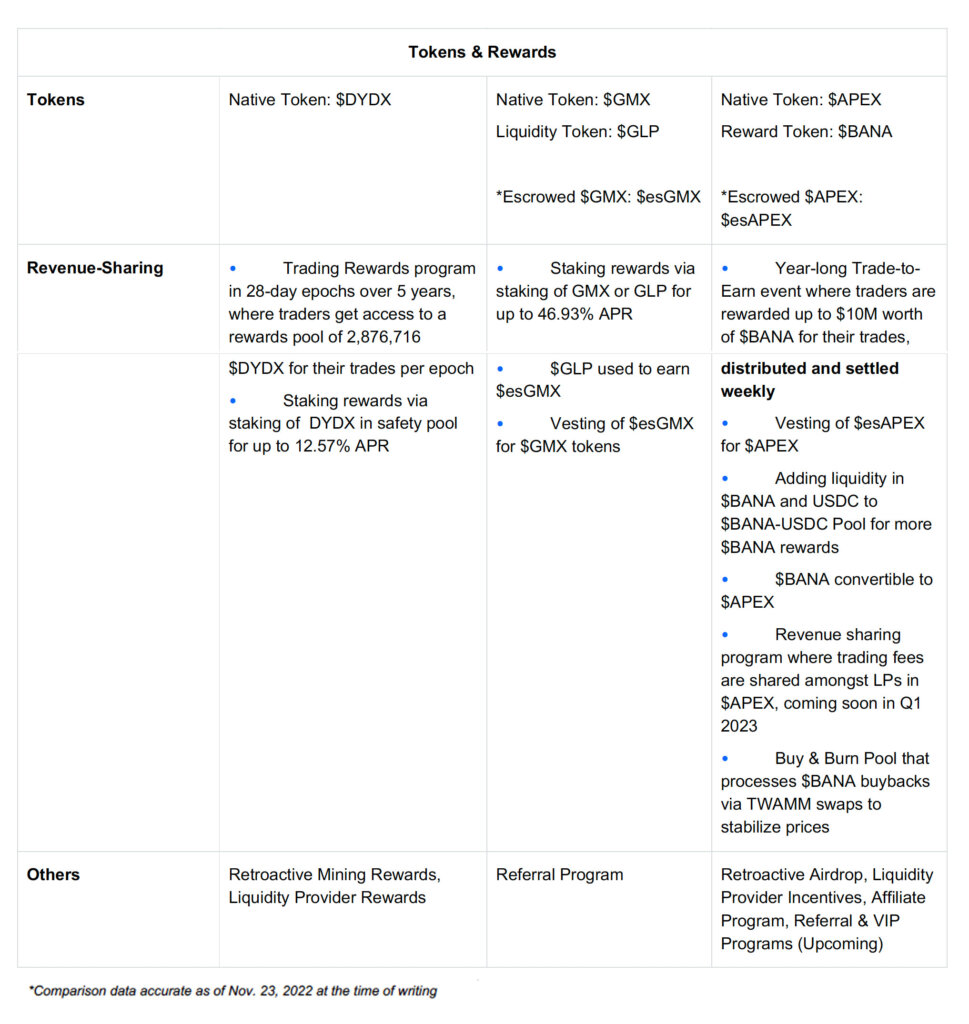

Of all factors, this is probably the one that most traders are interested in — how each DEX helps to multiple rewards and earnings while ensuring that these rewards remain valuable to the individual trader over time.

With dYdX and GMX, the success and popularity of trading events to earn rewards and staking incentives are apparent. It is paramount for DEXs to enable access to revenue-sharing programs for their community members and token holders, which commonly involve the distribution of trading fees accrued over a single period. Rewards and incentives are typically distributed in the platform’s native tokens.

dYdX’s offerings are straightforward, with a Trading Rewards program that distributes 2,876,716 $DYDX to traders based on their trading volume in 28-day epochs. On top of that, users can also stake $DYDX in a pool to receive additional staking rewards. This dual-earning track remains a success amongst traders. GMX, on the other hand, has taken community rewards forward by utilizing escrowed tokens in its staking program to stabilize further and sustain the value of the reward tokens that their traders receive.

ApeX Pro follows in GMX’s footsteps by enriching its token ecosystem with escrowed and liquidity tokens, which allows for more dynamism in maximizing token value and sustaining long-term token use cases for the community than using a single token for all DEX initiatives.

With a total supply of 1,000,000,000 $APEX, 25,000,000 $APEX has been minted to create $BANA. With ApeX Pro’s year-long Trade-to-Earn event and weekly reward distributions in $BANA, traders get to swap rewards for tangible incentives in USDC, and also redeem $APEX tokens after the event ends. Traders can also add liquidity to a $BANA-USDC Pool in exchange for LP Tokens, which they can then exchange for more $BANA.

Moreover, ApeX Pro maintains the stability of $BANA’s value with a Buy & Burn Pool, ensuring that its users’ holdings of either token are maximized at any time. $190,000 worth of $BANA will be distributed weekly for a year — a quick and easy settlement that every trader can certainly appreciate.

Conclusion

Innovations in DEX architecture in the nascent DeFi industry abound as DEXs find their footing in a world dominated by CEXs. It’s good news for traders because they can choose DEXs based on the provisions that suit them most or draw their preferred benefits across various platforms. With the growth, it has seen within its first week of mainnet launch and an ecosystem that combines the best of features on existing DEXs, ApeX Pro is one to watch out for in 2023.

Ending with a quote as usual.

“Blockchain-based projects should go back to their roots – decentralization. Decentralization is here to stay and it is the future.”

– Anndy Lian

Guest post by Anndy Lian from Mongolian Productivity Organization

Anndy Lian is a business strategist with over 15 years of experience in Asia. Anndy has worked in various industries for local, international, and publicly traded companies. His recent foray into the blockchain scene has seen him manage some of Asia’s most prominent blockchain firms. He believes that blockchain will transform traditional finance. He is currently Chairman of BigONE Exchange and Chief Digital Advisor at the Mongolian Productivity Organisation.

Learn more →

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Ethena USDe

Ethena USDe  Bitget Token

Bitget Token  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC