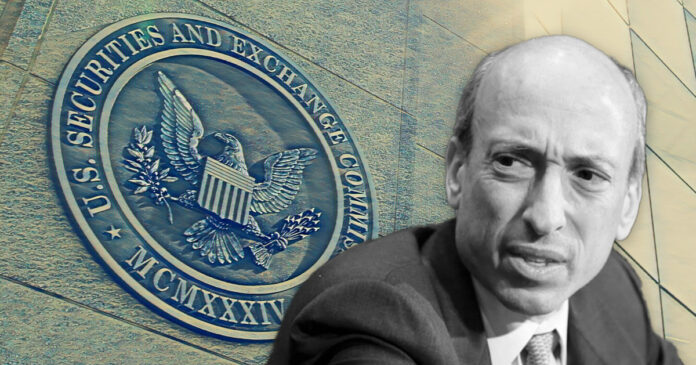

SEC chair Gary Gensler asked U.S. lawmakers for greater resources to increase his agency’s staff count during a hearing that took place on March 29.

Gensler appeared before the U.S. House Appropriations Subcommittee on Financial Service and General Government. There, he discussed the U.S. Securities and Exchange Commission’s (SEC) budget request for the 2024 fiscal year.

SEC needs staff to oversee crypto industry

Though Gensler discussed several matters, he specifically mentioned cryptocurrency as one justification for greater staffing. He stated that the SEC has seen a “Wild West of the crypto markets, rife with noncompliance” and said his agency must grow with the industry.

Gensler said the SEC’s Division of Enforcement must deal with innovations in the crypto sector and elsewhere that have led to misconduct. He said the SEC aims to combat this problem by increasing the division’s staffing and obtaining new “tools, expertise, and resources.”

Gensler also said he intends to expand the SEC’s Division of Examinations, which helps ensure that companies comply with regulations. Gensler said this growth will help confront risks around crypto, cybersecurity, and the “resiliency of critical market infrastructure.”

Overall, Gensler requested that the SEC receive resources to increase its staff to 5,139 employees from 4,685. This does not necessarily represent the actual number of SEC staff but rather the number of full-time equivalents (FTE) working for the agency.

SEC is regulating crypto aggressively

Gensler has recently become known for his aggressive regulatory stance. Though the SEC has taken action against fraudulent projects, the regulator has also targeted well-regarded cryptocurrency companies such as Coinbase and Kraken under Gensler’s leadership.

The SEC has also attempted to expand rules around asset custodianship and cryptocurrency staking. Certain statements from Gensler also suggest that most cryptocurrencies, apart from Bitcoin, can be considered securities.

Greater funding for the SEC will undoubtedly enable further regulatory action.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Ondo

Ondo  Aave

Aave  Bittensor

Bittensor  Aptos

Aptos  Dai

Dai  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC