In Todays Headline TV CryptoDaily News:

TrueUSD’s Bitcoin trading volume nears Tether’s on Binance

The TrueUSD stablecoin’s market share in bitcoin trading volume on Binance is catching up to Tether’s USDT following the exchange’s zero fee trading discount, but data shows traders are still reluctant to use TUSD.

Ripple drops XRP from liquidity hub

Ripple, the cross-border payment remittance firm no longer supports XRP as an asset in its liquidity hub product. While the payment giant offered an explanation for the same, XRP community members speculate that the move was influenced by the firm’s expectation of the SEC’s win in the lawsuit.

Bitcoin and Ether rise

BTC and ETH have risen about 9% and 12%, respectively, over the past ten days. While BTC has driven the market this year so far, the Shapella upgrade has boosted ETH trading, according to analysts.

BTC/USD saw a minor rise of 0.2% in the last session.

Bitcoin got a slight bump of 0.2% against the Dollar in the last session. The Stochastic indicator is giving a positive signal. Support is at 299701 and resistance at 307301.

The Stochastic indicator is giving a positive signal.

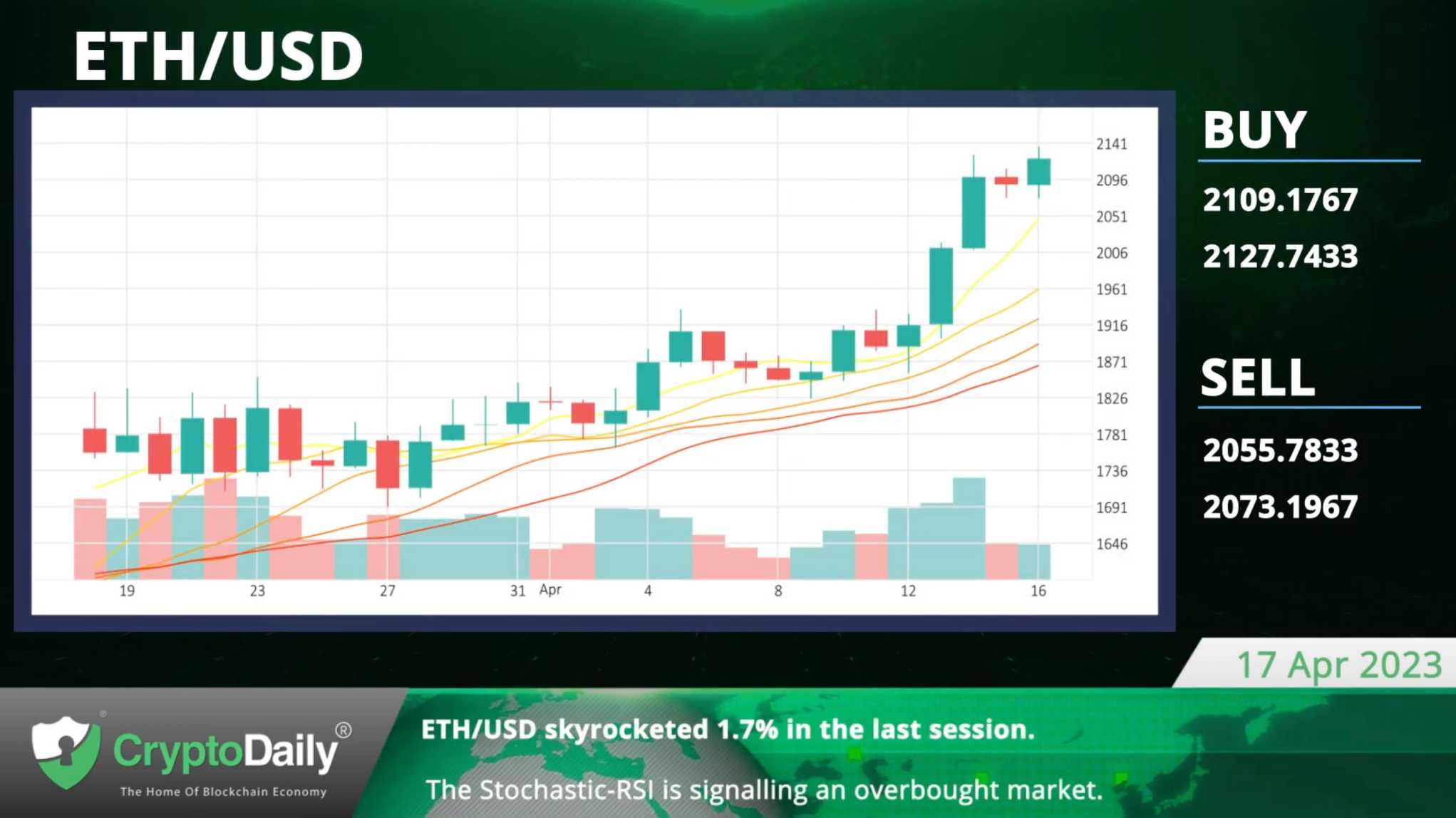

ETH/USD skyrocketed 1.7% in the last session.

The Ethereum-Dollar pair skyrocketed 1.7% in the last session. The Stochastic-RSI indicates an overbought market. Support is at 2055.7833 and resistance at 2127.7433.

The Stochastic-RSI is signaling an overbought market.

XRP/USD rose 0.6% in the last session.

The Ripple-Dollar pair rose 0.6% in the last session. The ROC’s negative signal contradicts our overall technical analysis. Support is at 0.5115 and resistance at 0.5301.

The ROC is currently in negative territory.

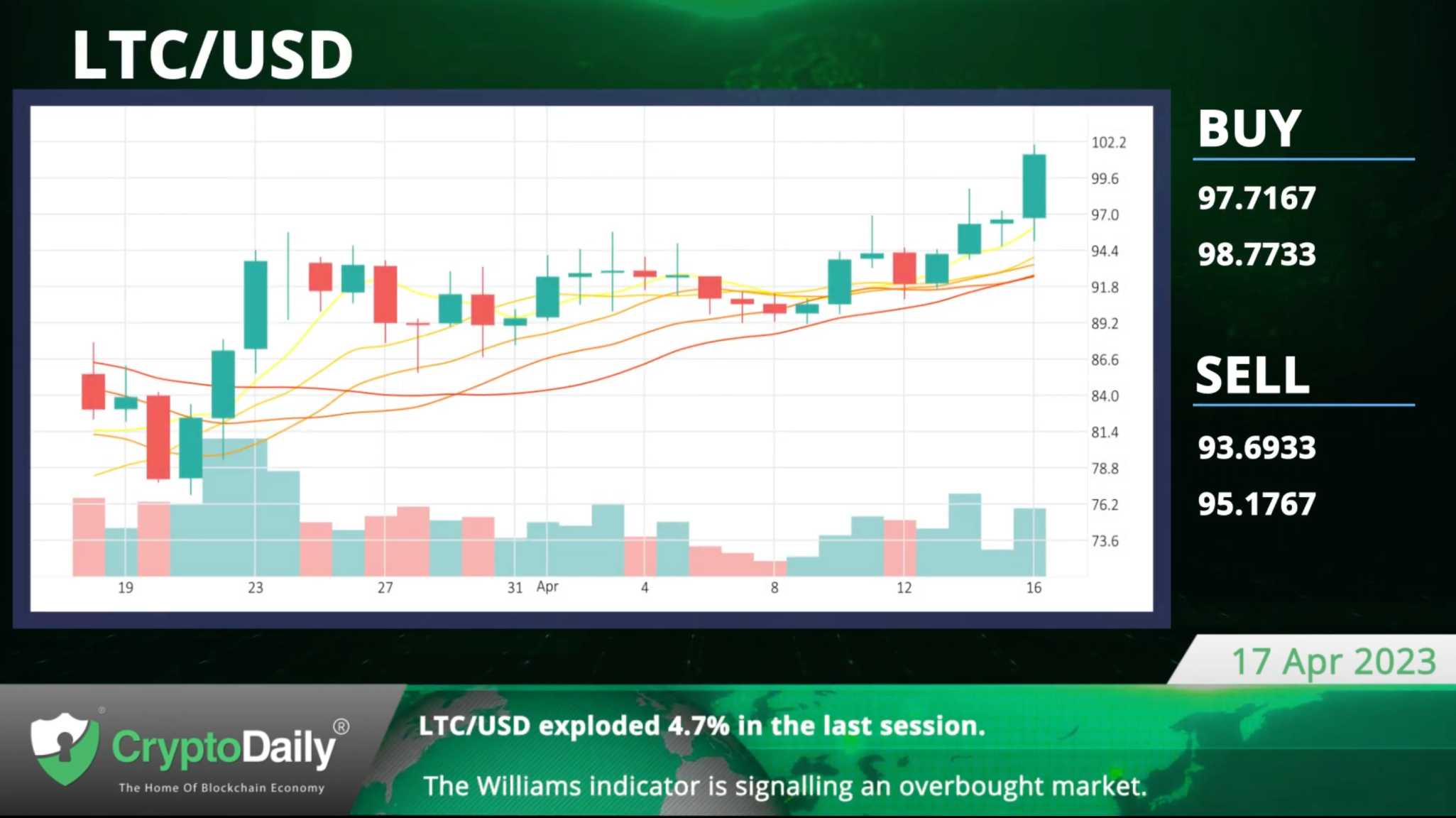

LTC/USD exploded 4.7% in the last session.

The Litecoin-Dollar pair exploded 4.7% in the last session. According to the Williams indicator, we are in an overbought market. Support is at 93.6933 and resistance at 98.7733.

The Williams indicator is signalling an overbought market.

Daily Economic Calendar:

US NAHB Housing Market Index

The NAHB Housing Market Index presents home sales and expected buildings in the future, indicating housing market trends.The US NAHB Housing Market Index will be released at 14:00 GMT, the US 3-Month Bill Auction at 15:30 GMT, and the US 6-Month Bill Auction at 15:30 GMT.

US 3-Month Bill Auction

Treasury bills are short-term securities maturing in one year or less. The yield on the bills represents the return an investor will receive by holding the bond until maturity.

US 6-Month Bill Auction

The auction sets the average yield on the bills auctioned by US Department of Treasury. Treasury bills are short-term securities maturing in one year or less. The yield on the bills represents the return an investor will receive.

US Total Net TIC Flows

The Total Net Treasury International Capital (TIC) Flows shows in and out flows of financial resources. The US Total Net TIC Flows will be released at 20:00 GMT, Italy’s Consumer Price Index at 09:00 GMT, and Germany’s German Buba Monthly Report at 10:00 GMT.

IT Consumer Price Index

The Consumer Price Index is a measure of price movements made by comparing the retail prices of a representative shopping basket of goods and services.

DE Buba Monthly Report

The German Buba Monthly Report, released by the Deutsche Bundesbank, contains relevant articles, speeches, and statistical tables. It also provides a detailed analysis of current and future economic conditions.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Shiba Inu

Shiba Inu  Toncoin

Toncoin  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  Mantle

Mantle  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC