Quick Take

- The outlook from markets has completely changed in the past few weeks due to banking failures in the US and EU.

- The market is now pricing in no more rate hikes but substantial cuts, ending 2023 around 3.75-4%.

- Four cuts are priced into the rest of the year, while the market suggests a greater than 90% chance the Fed is done raising rates.

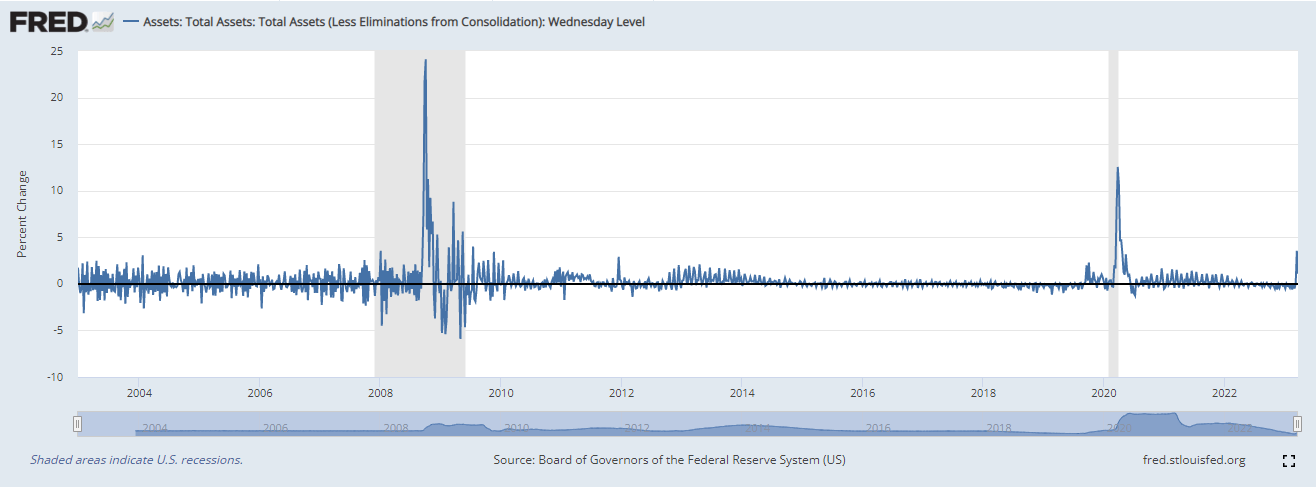

- The fed balance sheet has grown for the past two consecutive weeks; roughly $100 billion was added to the balance sheet this week.

- While two-thirds of quantitative tightening have been undone in a matter of weeks.

- This is the third biggest percent change to the fed balance sheet, only being beaten by covid and 2008.

The post Rate cuts are now the expectation as fed balance sheet grows appeared first on CryptoSlate.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  LEO Token

LEO Token  Hedera

Hedera  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  Sonic (prev. FTM)

Sonic (prev. FTM)  sUSDS

sUSDS