The Bitcoin Halving: Gold is on Borrowed Time

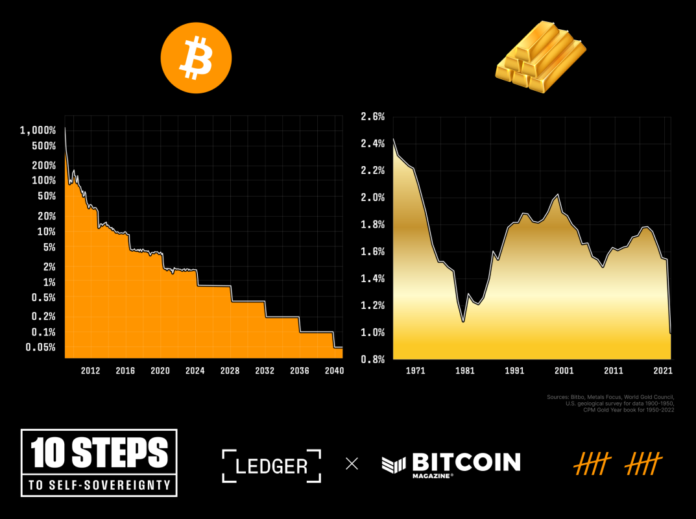

For the first time since its inception, Bitcoin’s annual inflation rate is poised to become less than that of gold, the quintessential store of value. At Bitcoin block height 840,000, the annual supply of Bitcoin will be cut in half, resulting in a decrease in its annual inflation rate from 1.7% to 0.85%. In comparison, the supply of gold is estimated to increase by 1-2% per year, depending on technological changes and economic conditions.

To date, Bitcoin has experienced three halving events:

November 28, 2012: Bitcoin’s block subsidy decreased from 50 BTC per block to 25 BTC per block.

July 9, 2016: The second Bitcoin halving decreased the block subsidy from 25 BTC per block to 12.5 BTC per block.

May 20, 2020: The third Bitcoin halving reduced the block subsidy from 12.5 BTC per block to 6.25 BTC per block.

The upcoming fourth Bitcoin halving is projected to occur on April 20, 2024 EDT, and with it, the newly supplied bitcoin per block will decrease from 6.25 to 3.125 BTC. This epoch — a period of 210,000 blocks or approximately 4 years – will see Bitcoin’s supply increase by 164,250 BTC (from 19,687,500 to 20,671,875), a mere 328,124 bitcoin from the maximum supply limit of 21 million.

~94% of the total #bitcoin supply has now been issued and the halving is in 11 days 👀

Digital scarcity at its finest 🚀 pic.twitter.com/fjbLs1tq7r

— Bitcoin Magazine (@BitcoinMagazine) April 8, 2024

Gold Throughout the Ages

One benchmark often used to underscore the store-of-value function is that the value of an ounce of gold matches the price of a “fine man’s suit” over time. This principle, known as the “gold-to-decent-suit ratio,” can be traced back to Ancient Rome, where the cost of a top-of-the-line toga was said to be equivalent to an ounce of gold. After 2,000 years, the amount of gold you would pay for a high-quality suit is still close to the price of an equivalent Ancient Roman toga.

While gold has held remarkably true to the expectation of procuring a fine man’s suit for its holders over the years, the lustrous yellow metal does come with its challenges.

For example, the cost of verification – or assaying – gold requires it to either be dissolved in a solution or melted down. This is certainly a challenge for someone who wants to purchase everyday household goods with their hard-fought store of value.

Additionally, the cost and onerous nature of transporting and storing gold itself arguably led to the demise of the gold standard. While certificates of deposit were historically redeemable for gold, the underlying commodity was often rehypothecated, resulting in the infamous ”Nixon Shock” in 1971, when the United States left the gold standard for good.

This is not to mention the risks that come from securing physical gold, its physical nature again proving a risk and liability in serving its function as currency. Executive Order 6102 comes to mind, when then-President Franklin Delano Roosevelt prohibited “the hoarding of gold coin”, highlighting the unique challenge of adequately and privately securing precious metals to store value.

Bitcoin’s Transition from Speculation to Safe Haven?

Initially regarded as a speculative asset due to its notable price fluctuations in the early days, bitcoin has increasingly been adopted as a store of value. Today, investors recognize its potential worth, and superior qualities as a monetary asset. Bitcoin represents the discovery of digital scarcity while offering a range of use cases far beyond those of precious metals.

As such Bitcoin has become a significant force in the economy in just 15 years – reaching a market cap of $1.4 trillion on March 13, 2024.

While this growth cannot be monocausally ascribed to the fact that Bitcoin satisfies the requirements of a store of value better than gold, it is certainly promising. This “magic internet money” continues to rapidly gain on gold’s estimated $15.9 trillion market capitalization.

Gold’s Monetary Qualities: Perfected Digitally

Scarcity: Bitcoin has a finite supply of 21 million coins, which makes it resistant to the arbitrary inflation that ails traditional currencies, and the market-driven supply of precious metals.

Durability: Bitcoin is a purely data-based, immutable form of money. Its digital ledger system uses proof of work and economic incentives to resist any attempts to alter it, ensuring it remains a reliable store of value over time barring unforeseen catastrophic tail risks. Given its informational nature, the ability to store Bitcoin despite the attempts of adversaries to prevent you from doing so is another positive monetary attribute.

Immutability: Once a transaction is confirmed and recorded on the Bitcoin blockchain, it is incredibly difficult, though not impossible, to alter or reverse. This immutability, derived from the geographical distribution of Bitcoin’s network of nodes and miners, is a critical feature. It ensures that the integrity of the ledger is maintained, and transactions cannot be tampered with or falsified. This is especially important in an increasingly digital world, where trust and security are paramount concerns.

Conclusion

Bitcoin’s rise as a monetary good – predictable, free of terminal inflation, and easily transferable – has contributed to it gaining acceptance as a store of value among holders. With the upcoming halving, its scarcity will surpass gold’s for the first time and will likely serve as a wake-up call for market participants seeking to avoid the drag of monetary debasement.

While there are no certainties in life, and especially none in investing, the near-certainty that Bitcoin provides in its ability to maintain the integrity of its 21 million supply cap through its decentralized nature continues to drive adoption one block at a time.

Gold had a good run. But, with the halving on the horizon, it’s Bitcoin’s time to shine.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)