The crypto venture firm Pantera Capital says Ethereum’s losing steam as Solana has become a “major contender for the future of blockchain development.”

Pantera Capital, a crypto venture capital firm managing billions in assets, reportedly eyeing a purchase of millions worth of SOL from the bankrupt FTX exchange, appears to be increasingly highlighting Solana’s potential over Ethereum to investors.

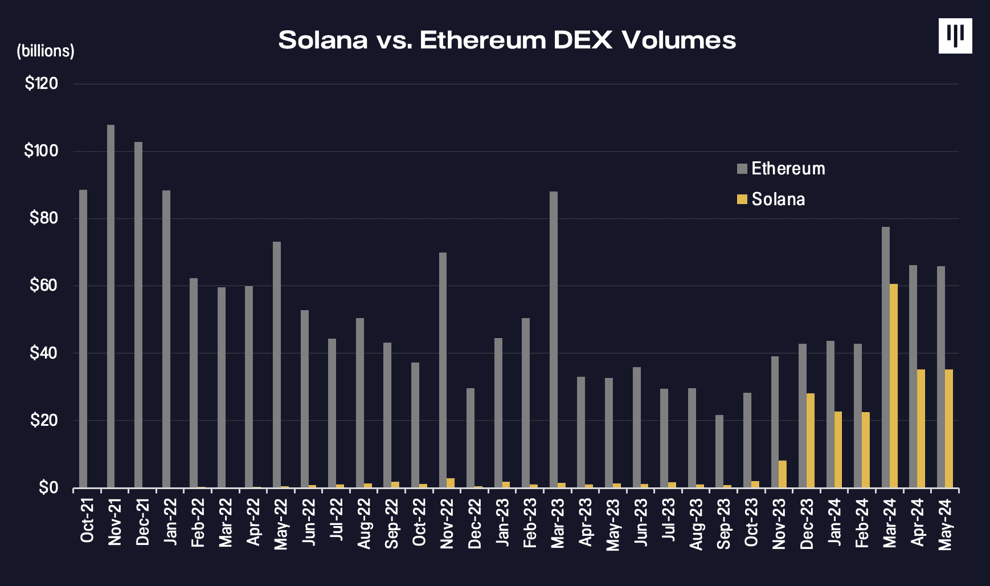

In a Jun. 18 newsletter, the Menlo Park-headquartered venture capital firm said Ethereum’s dominance “appears to be yielding to the multi-polar model,” pointing to Solana as a new prominent product that gained “significant share over the past year.”

“The shift is reminiscent of Microsoft’s dominance of the early desktop computer market, until Apple broke through with its vertically integrated approach. Solana is now a major contender for the future of blockchain development.”

Pantera Capital

Drawing parallels to Apple‘s breakthrough in the early days of personal computing, Pantera likened Solana’s integrated approach to Apple’s vertically integrated strategy with macOS, saying the network’s monolithic architecture has a product roadmap “focused on optimizing every component of its own blockchain.”

The venture capital firm says Solana’s “architectural advantages” enable a range of use cases and user experiences that “may be more challenging to implement on modular blockchains like Ethereum and Cosmos,” citing Solana’s “fast, low-cost transactions.”

“Solana’s architectural advantages are enabling it to capture an outsized share of the new demand coming into the blockchain space, accelerating its ascent as a rival to Ethereum.”

Pantera Capital

The firm’s endorsement of Solana follows reports saying that Pantera Capital was among the bidders for SOL tokens auctioned by FTX during its bankruptcy proceedings earlier this year, buying a significant stake in the tokens. Reports indicate that Pantera Capital was interested in buying auctioned SOL tokens amounting to as much as $250 million, although the precise amount acquired hasn’t been disclosed.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB