In a turn of events within the non-fungible token (NFT) market, Bitcoin (BTC) has achieved a significant milestone by surpassing Ethereum (ETH) in 24-hour NFT sales volume. This marks the first time that Bitcoin has outperformed Ethereum in this aspect.

BTC’s NFT Breakthrough

Bitcoin’s recent achievement of surpassing Ethereum in 24-hour NFT sales volume signals a changing trend and growing interest in the NFT market.

While Ethereum has long been recognized as the dominant blockchain for NFTs, Bitcoin’s entrance into the space demonstrates its increasing relevance and appeal to NFT enthusiasts and collectors.

The data highlights that Bitcoin accounted for $17,291,694 in NFT sales, with 575 buyers participating. On the other hand, Ethereum recorded $26,689,252 in total sales, with 11,225 buyers.

Despite Ethereum maintaining a higher total sales figure, the relatively lower wash percentage of Bitcoin suggests a potentially healthier and more organic market activity.

However, when it comes to volatility, data from Deribit, the leading crypto derivatives exchange, shows that the spread between ETH and BTC volatility, commonly referred to as the ETH DVOL vs. BTC DVOL spread, has narrowed significantly since October 23rd from -11.6 to just -0.6. This shift indicates a change in investor sentiment and increased attention towards Ethereum and altcoins.

In light of this development, Ethereum has outperformed Bitcoin over the past fourteen days. ETH has seen significant price movement, gaining over 2% in the last 24 hours, 6% in the last seven days, and 4% in the last fourteen days, bringing its current price to $1,899.

Meanwhile, Bitcoin has exhibited a slowdown in its upward momentum and is currently consolidating above $35,400. It has seen a 2% increase in the past 24 hours, 3% in the past seven days, and 1% in the fourteen-day timeframe.

However, it is important to note that BTC has gained more than 82% year-to-date, while ETH has only increased by 30% during the same period, according to CoinGecko data.

Nasdaq 100 Correlation With Bitcoin Plummets

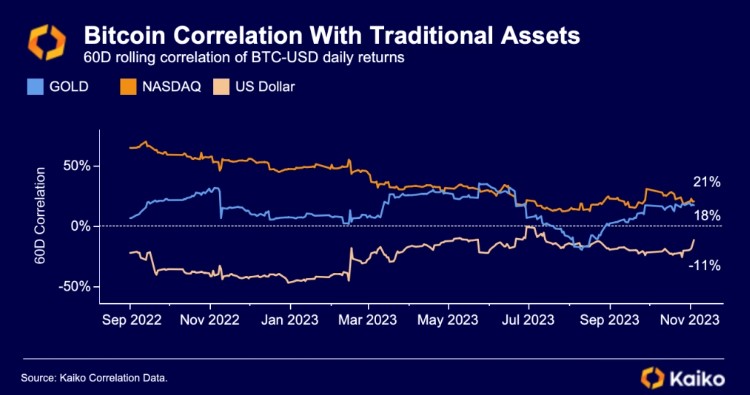

According to recent Kaiko data, BTC has witnessed a significant decline in its correlation with traditional assets throughout the year. One notable development is the diminishing correlation between Bitcoin and the Nasdaq 100 index.

Over the past year, Bitcoin’s 60-day correlation with the Nasdaq 100 has substantially declined, plunging from over 70% in September 2022 to approximately 19% as of last week.

Bitcoin’s negative correlation with the US dollar, which ranged from 40% to 50%, has also weakened. Currently, the correlation is around 11%, signifying a reduced tendency for Bitcoin’s value to move in the opposite direction of the US dollar.

While Bitcoin’s correlation with gold has seen some upward momentum since August, the average correlation throughout the year has remained relatively low at 12%.

This suggests that the relationship between Bitcoin and gold has been modest regarding price movements and indicates a potential divergence in investment characteristics between the two assets.

Featured image from Shutterstock, chart from TradingView.com

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Ondo

Ondo  Aave

Aave  Bittensor

Bittensor  Aptos

Aptos  Dai

Dai  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  OKB

OKB  Tokenize Xchange

Tokenize Xchange  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC