Early signs of a bull market

CryptoSlate’s previous report dove deep into the signals that point to a Bitcoin bottom. Our analysis showed that despite the widespread macro uncertainty, most on-chain indicators suggest that a bottom was formed.

However, identifying a bottom is only the first step in predicting future market movements. A strong bottom only shows the potential for a market upswing — other on-chain indicators are required to further confirm the end of the bear market.

In this report, we dive deep into the on-chain metrics that show another bull market is currently in the making.

The Bitcoin network is expanding

The number of users interacting with a network is one of the best indicators of its performance. Early bull markets of the past decade all began with an uptick in daily users, a higher transaction throughput, and an increased demand for block space.

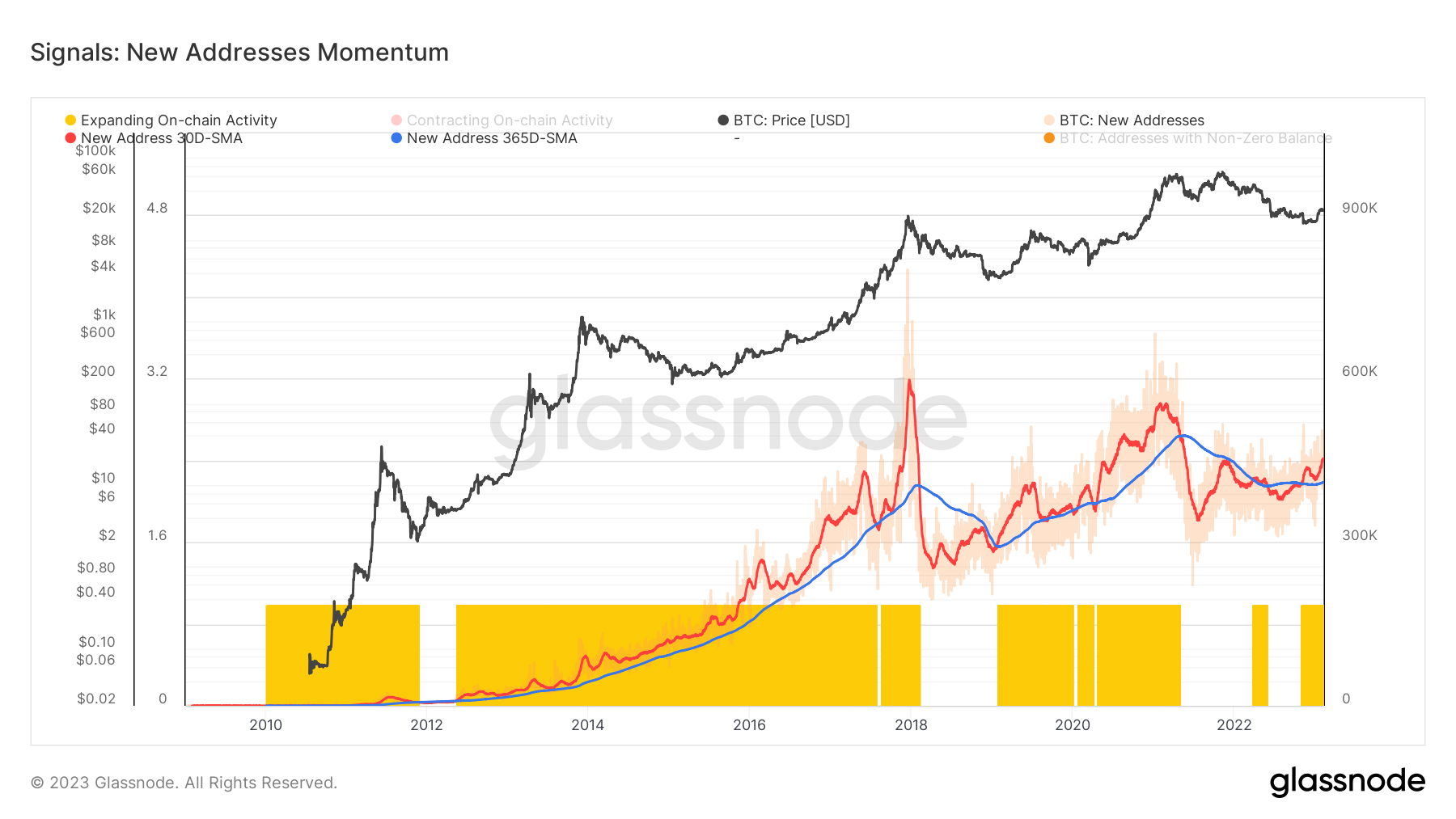

This can be seen when looking at the momentum of new addresses on the Bitcoin network. When the new address momentum’s 30-day simple moving average (SMA) crosses the 365-day SMA, the network enters into a period of expansion. Put simply, the rate at which new addresses were created over the past 30 days is higher than the rate they were created over the past year.

Data analyzed by CryptoSlate shows the Bitcoin network is seeing its fundamentals improve. The 30-day SMA has crossed the 365-day SMA, indicated in the graph below. Sustained periods of this trend have correlated with bull markets and led to a gradual increase in Bitcoin’s price.

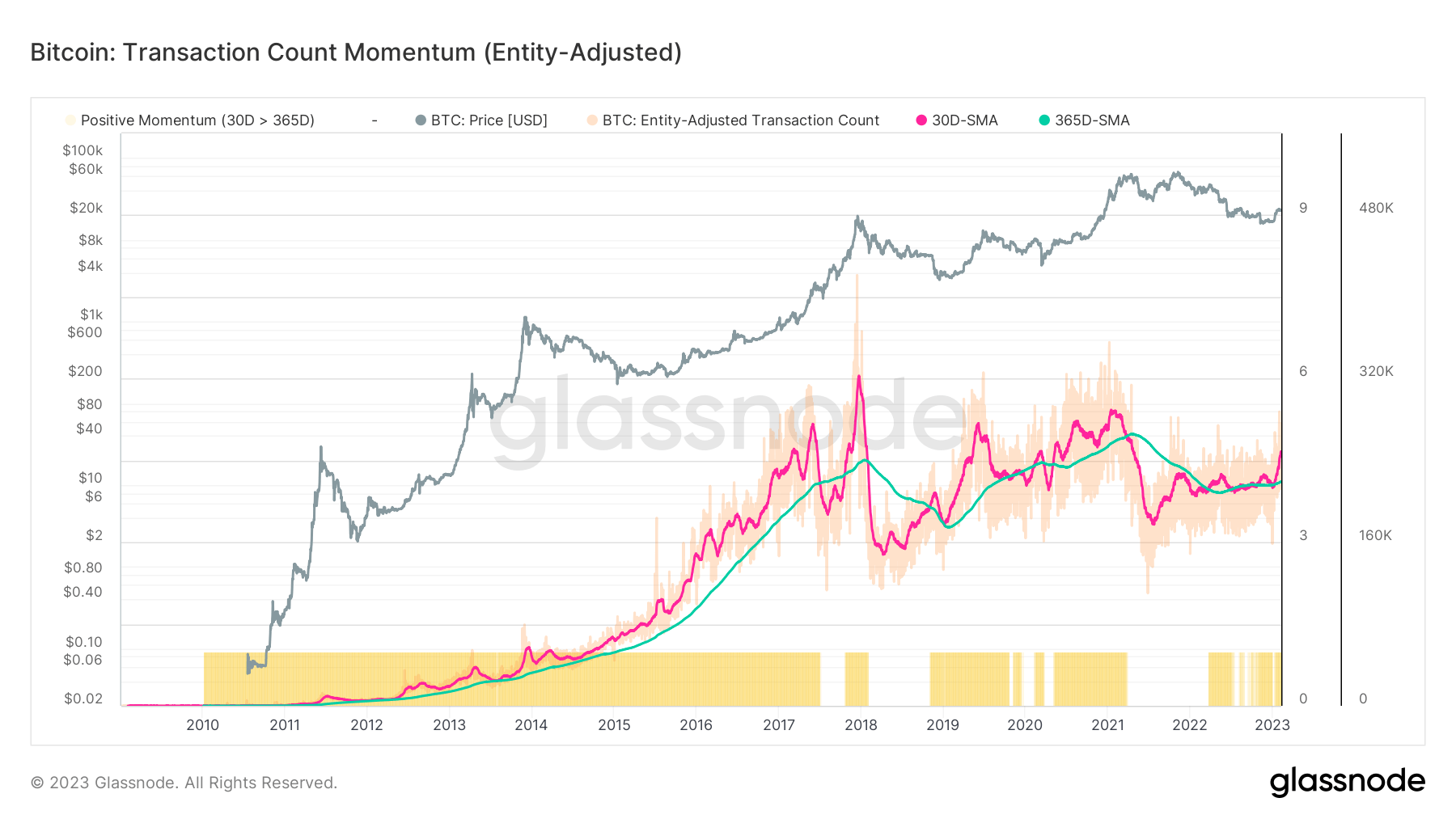

The same trend is also seen in the transaction count momentum, where the 30-day SMA spiked significantly since the beginning of the year, crossing the 365-day SMA.

The market is in profit for the first time since the collapse of LUNA

Both leading indicators of market profits have been flashing green since the beginning of the year.

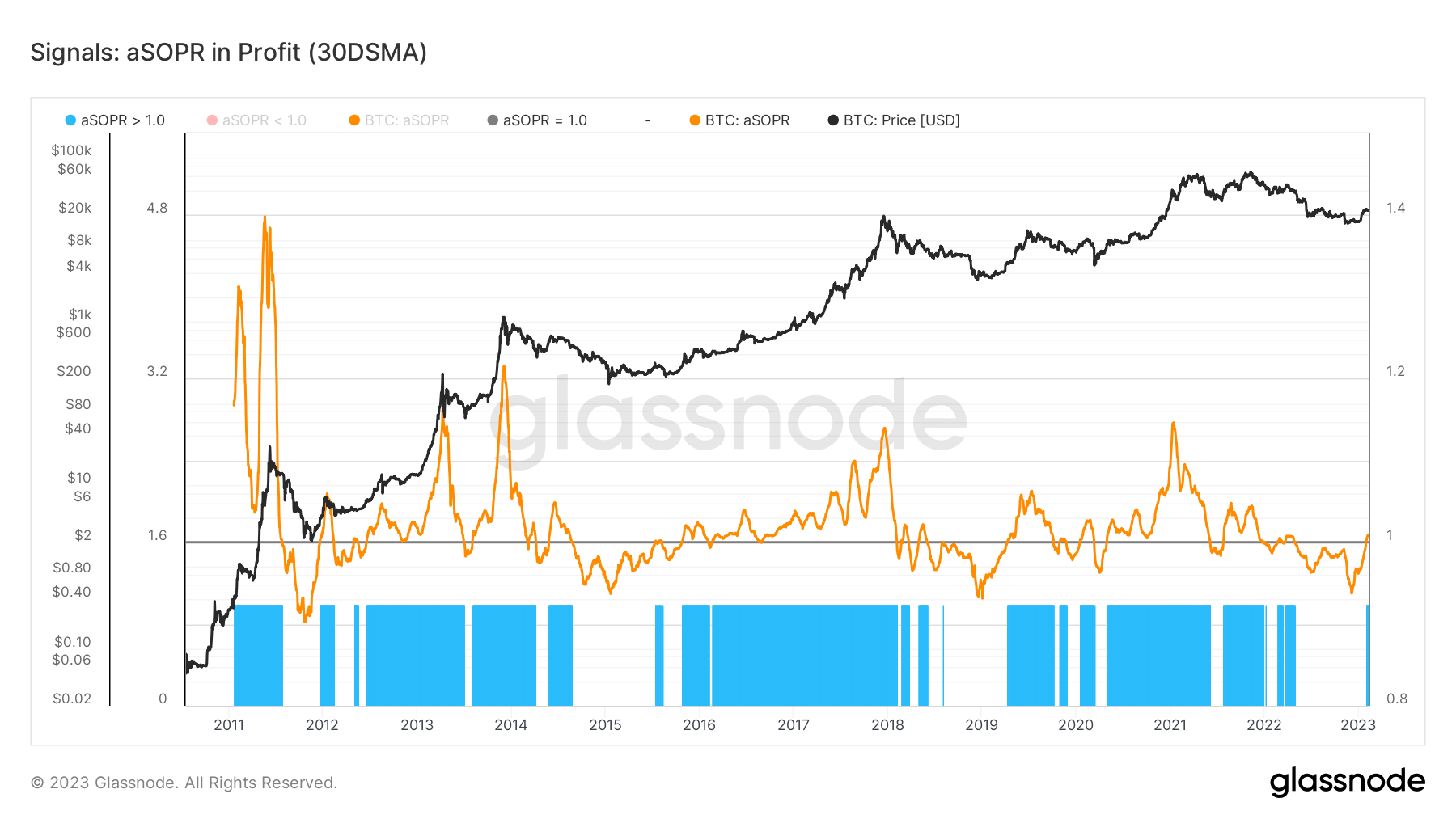

The Spent Output Profit Ratio (SOPR) is a metric indicating whether the coins on the Bitcoin network are moving between wallets at an aggregate profit or loss. The metric is a ratio between the value of Bitcoin UTXOs at creation and the value of Bitcoin UTXOs when they were spent.

And while SOPR assumes that all coins moving from one wallet to another were sold, it’s still a solid gauge for the profit that could potentially be on the network.

A SOPR score of 1 or above indicates the market has realized profits. Historically, SOPR breaking and holding has indicated a healthy increase in demand for Bitcoin.

The last time SOPR remained above one was in April 2022, just before the collapse of Terra (LUNA). However, the April peak was a short-lived break in the overall downward trend in SOPR that began in November 2021. As indicated in the graph below, a similar downward spiral was seen every time Bitcoin broke its all-time high.

Nonetheless, the current SOPR score indicates market recovery. While there might be several more dips below 1 before the market enters a true bull run, the current peak is a positive sign.

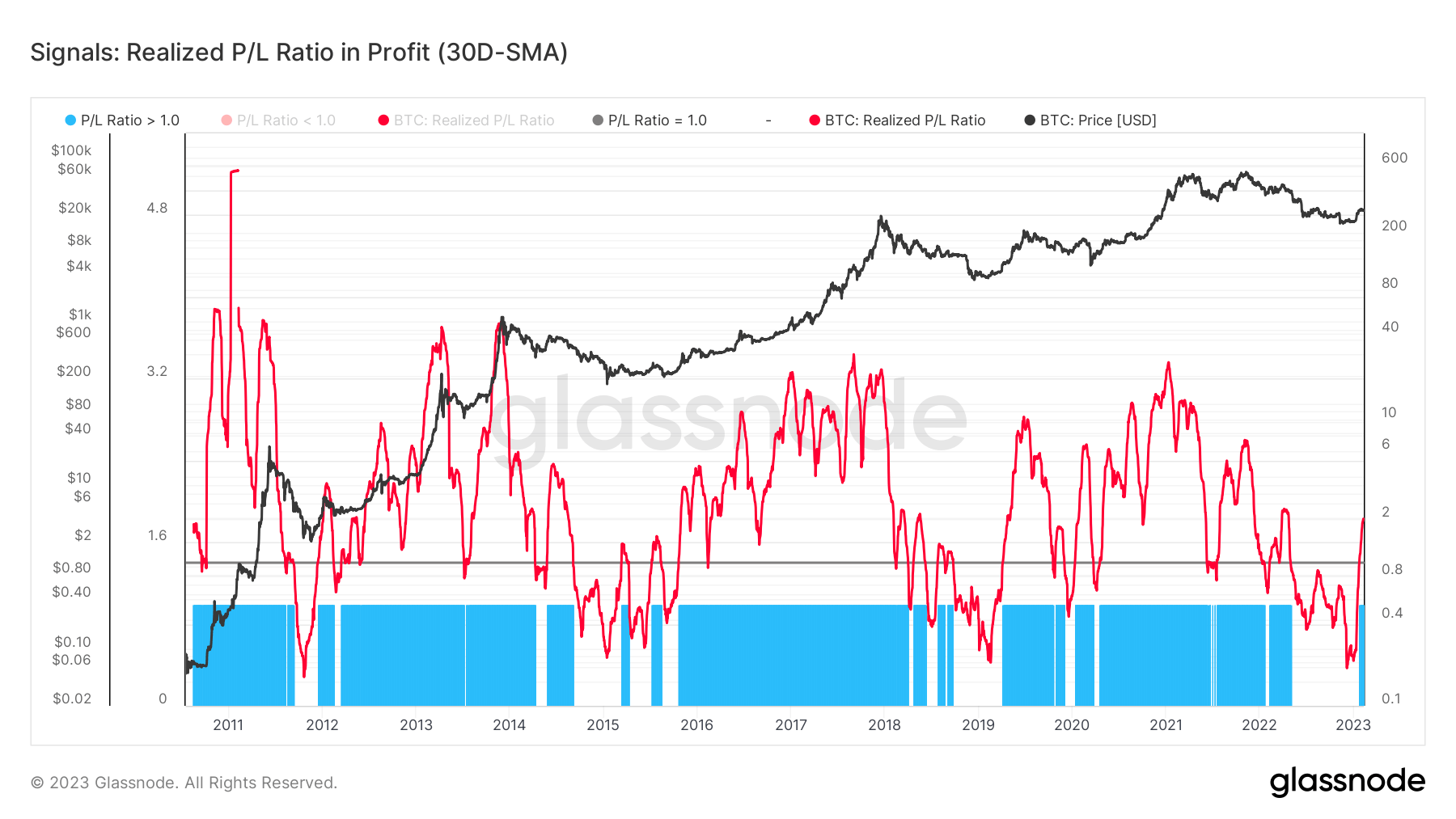

The trend SOPR suggests is further supported by the Realized Profit/Loss ratio. The metric represents the ratio between all coins moved at a profit and at a loss and is another solid indicator of market health.

Like SOPR, a P/L ratio higher than one shows a greater proportion of USD denominated profits than losses on the network. Data analyzed by CryptoSlate showed a P/L ratio of 2, showing that sellers with unrealized losses have been exhausted and there’s a healthy inflow of demand for Bitcoin.

It’s important to note that a P/L ratio is highly volatile and could be tested several times in an early bull market. The sharp uptick seen in 2023 could serve as resistance and support in the coming months.

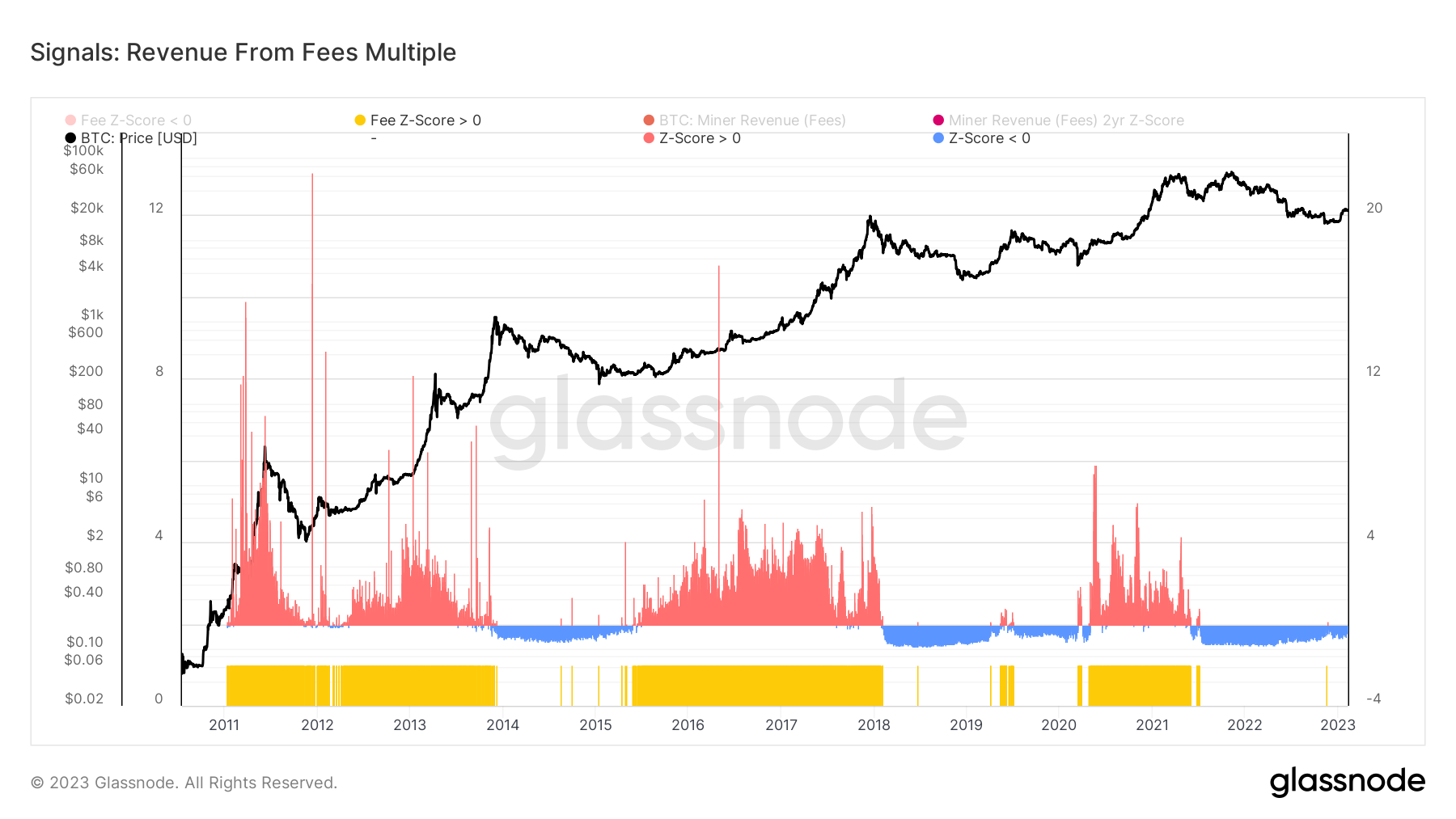

Miner revenue from fees is increasing

The expansion of the Bitcoin network is followed by an increase in the demand for Bitcoin block space. The network’s high number of transactions in the past three months has led to a notable increase in fee revenue for Bitcoin miners.

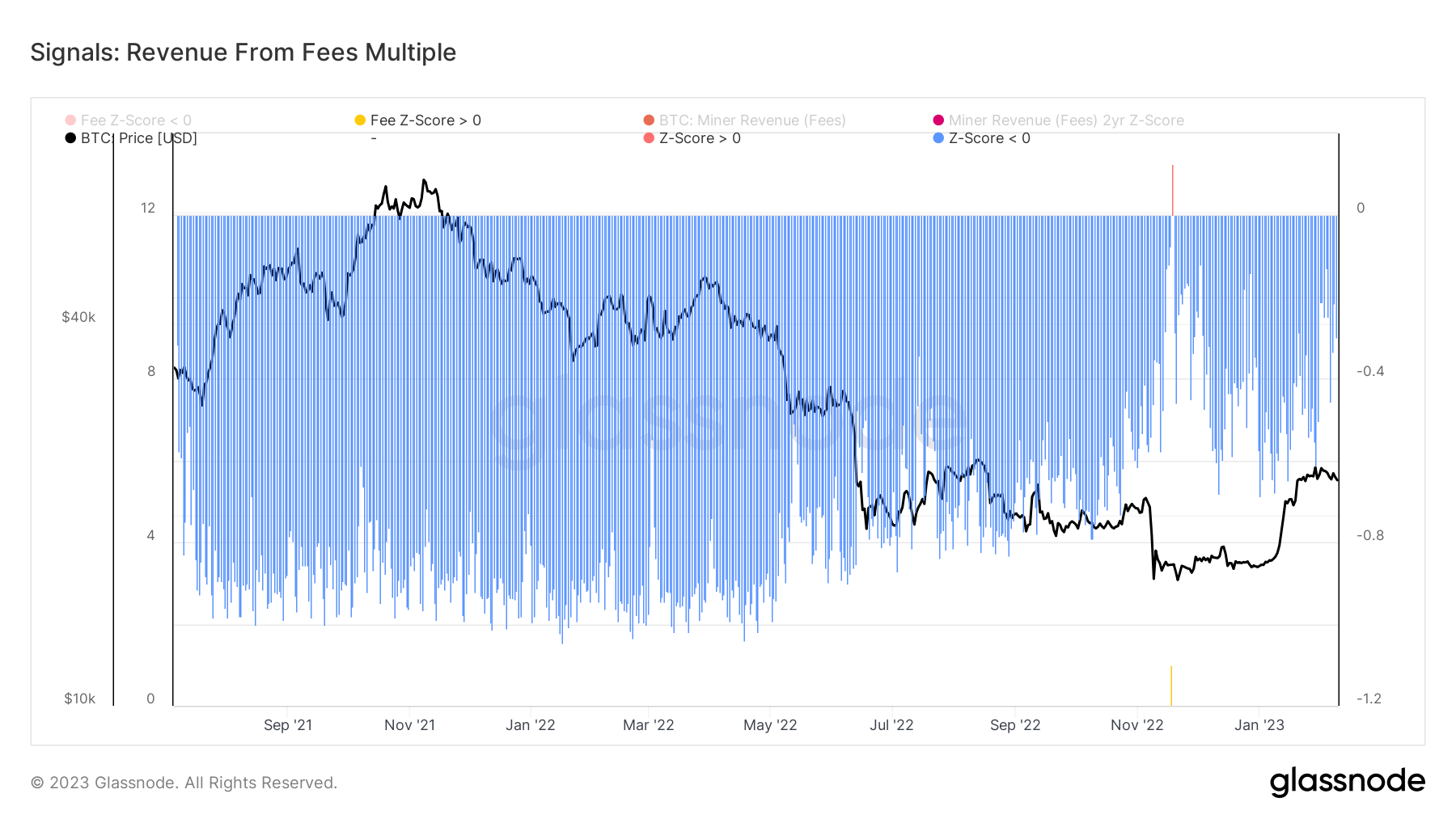

This is seen in the fee revenue Z-score, which shows the number of standard deviations above or below mean fee revenues. During bull markets, the Z-score is higher than 0, showing an increased demand for block space, leading to higher fees. Higher fees paid by users lead to an increase in fee revenues for miners. Bear markets see a decrease in block space demand, leading to a drop in fee revenues. The graph below marks positive Z-scores in red and negative Z-scores in blue.

The spike in Z-score seen in November 2022 shows that the FTX collapse caused an unprecedented demand for block space. And while some of this demand could be attributed to aggressive accumulation, most came from panic selling.

Diving deeper into the Z-score confirms previous findings that the bull market stopped in mid-2021. The second half of 2021 saw a massive decrease in demand for block space, evident in a continually low Z-score.

However, 2023 brought about a new appetite for block space. There has been a slow but steady increase in the Z-score, which peaked in late January with the launch of Bitcoin Ordinals. There has been an evident increase in the Z-score in February, which could continue throughout the quarter as the number of transactions grows.

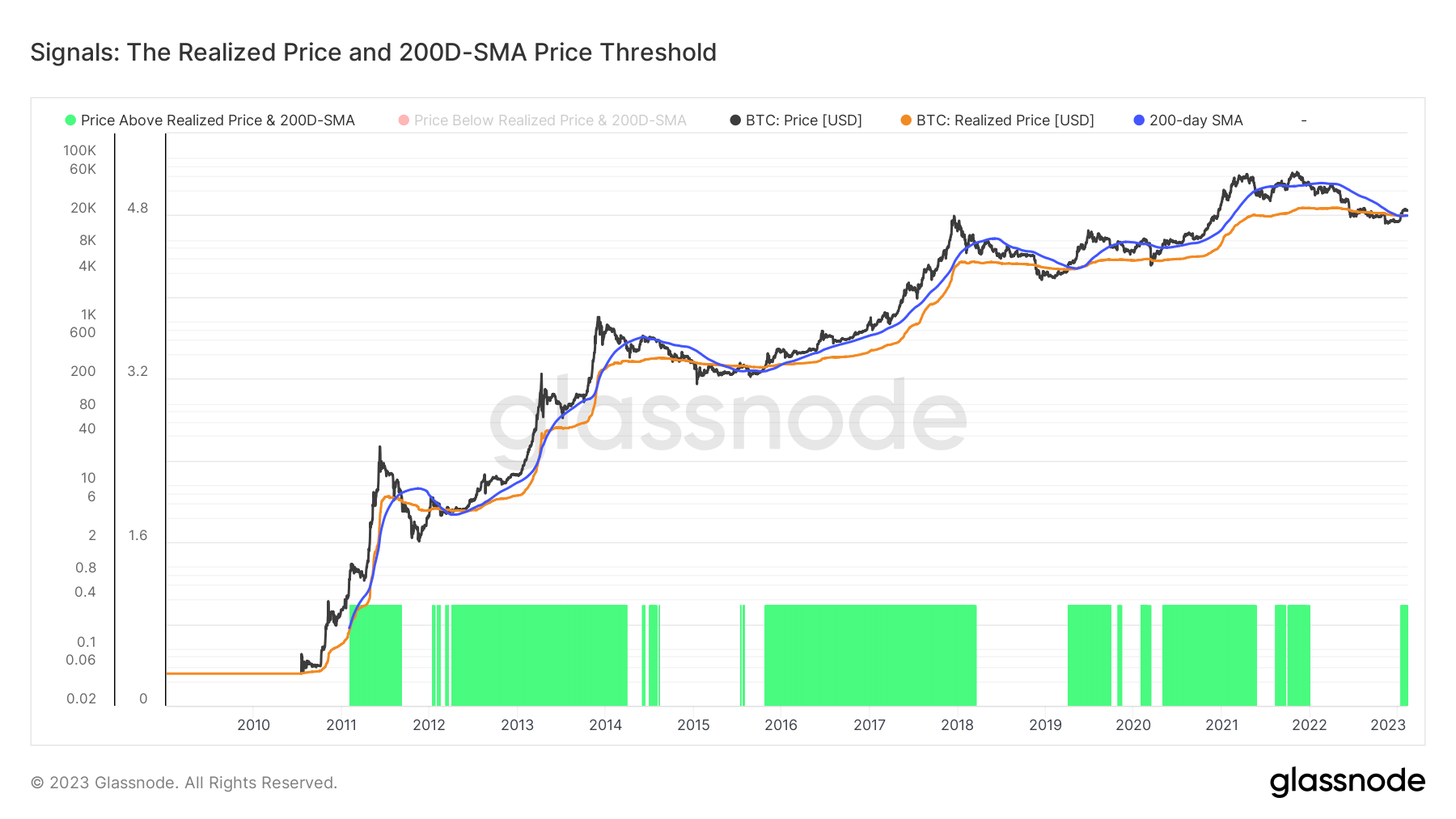

Technical pricing models have flipped

As covered in previous CryptoSlate market reports, Bitcoin has spent the past three months breaking through multiple resistance levels, the most notable being the short-term holder cost basis and realized price.

Since the beginning of the year, Bitcoin’s price has broken above its realized price and the 200-day SMA. The 200-day SMA is a significant indicator of Bitcoin’s price movements, as breaking above it indicates the beginning of a bullish trend.

Realized price is also a solid gauge of the value held in the market. Trading above realized price allows us to identify aggregate profitability and recognize unrealized profit.

The last time this occurred was in December 2021, but the trend was short-lived. Before that, a break above the realized price and the 200-day SMA happened around April 2020 and triggered a bull run that lasted until late 2021.

With Bitcoin currently trading above both indicators, the market could be gearing up for a bullish reversal. The onset of unrealized profits, missing in this winter’s bear run, could bring a new wave of demand to the market, pushing Bitcoin’s price up.

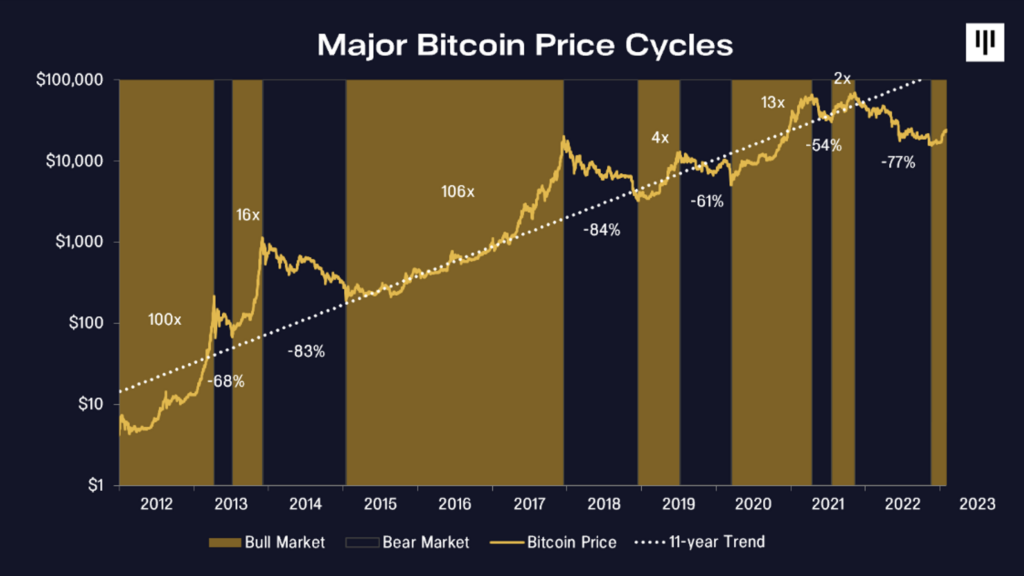

Conclusion

The increase in the number of addresses and transactions is a clear indicator of growing network activity.

This increase in network activity has increased demand for block space, driving the cost of transactions up and boosting miner revenue from fees.

In turn, a healthier, more active network attracts even more new users, creating additional demand and resulting in notable buying pressure.

When combined with other technical pricing models, like SOPR and the P/L ratio, these trends suggest Bitcoin is coming out of a late-stage bear market and could be gearing up for a bull run.

Pantera Capital, one of the largest VCs in the crypto space, also seems to have identified this trend, noting in its latest report that a seventh bull market cycle has begun.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB