CryptoSlate’s analysis of on-chain Glassnode metrics indicated mixed results for a Bitcoin bottoming.

Previous research published on Sep. 27 looked at the Percent Supply in Profit (PSP,) Market Value to Realized Value (MVRV,) and Supply in Profit and Loss (SPL) metrics, all of which indicated a bottom was forming at the time.

In revisiting these same metrics, it was noted that the PSP and MVRV still point to a bottoming, but the SPL no longer does.

Percentage of Bitcoin addresses in profit

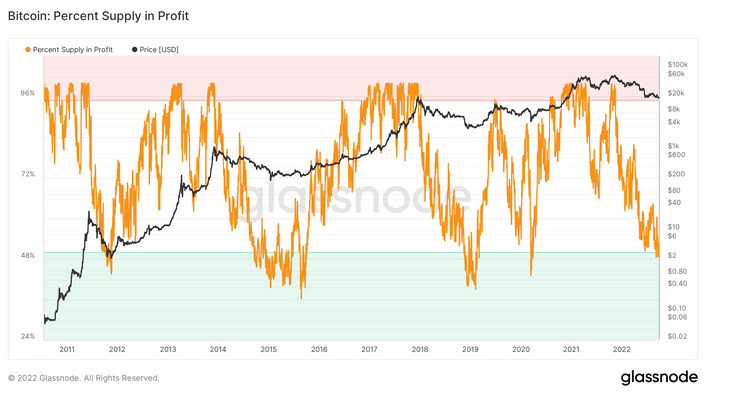

The Bitcoin: Percent Supply in Profit (PSP) metric refers to the proportion of unique BTC addresses with an average buy price lower than the current price.

During bear markets, the percentage of Bitcoin addresses in profit had always dropped below 50%. Moving back above this threshold generally coincided with bullish price movements.

The chart below, which dates back to 2010, shows a current reading below 50%, suggesting a bottoming is on the cards.

However, analysis shows the percentage of BTC supply in profit dipping much lower than 50% in the past, with profitable addresses sinking as low as 30% in 2015, this being the most extreme example on record.

2015 was an irregular period, recording multiple swings above and below the 50% threshold before a decisive PSP breakout towards the end of the year. This corresponded with BTC recapturing $1,000.

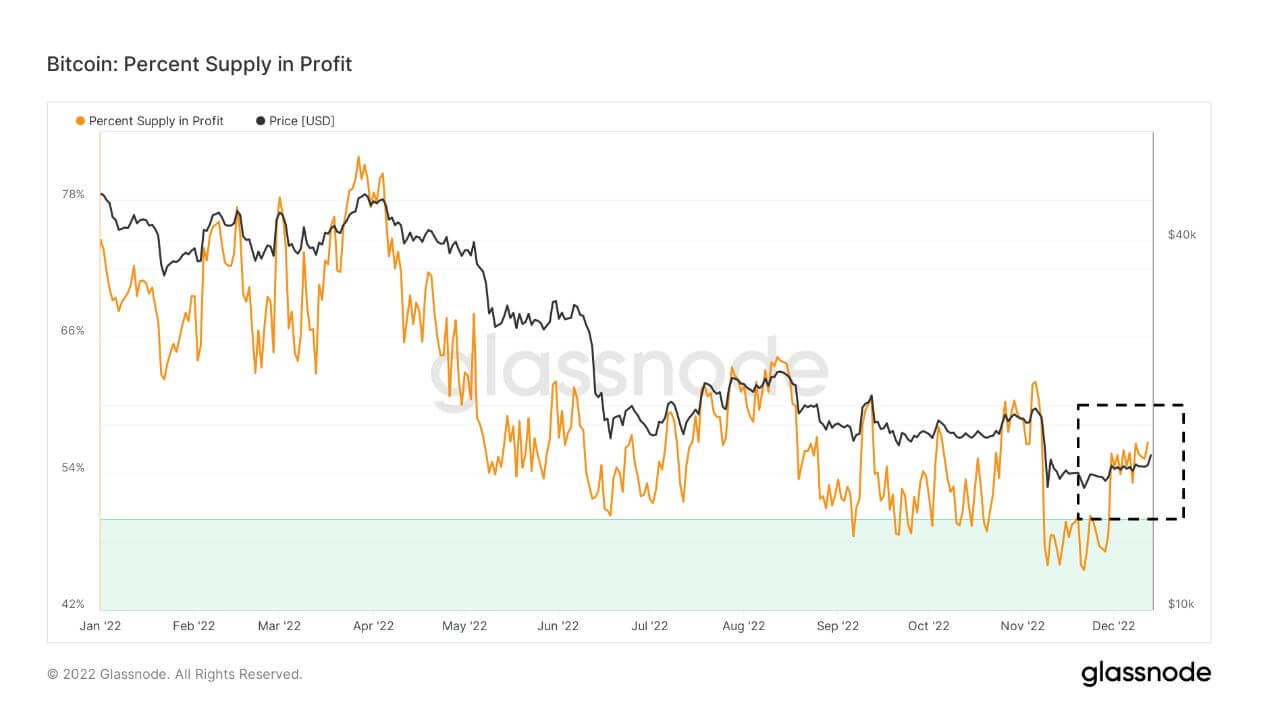

Zooming in on 2022’s movement shows PSP dipping below the 50% threshold yet crossing back above it in December.

A decisive break above the previous local top of around 60% could signal a price reversal. However, the alternative scenario may be a repeat of 2015, with choppiness around the threshold, a drop to lower PSP levels, and sell pressure being the dominant factor.

Market Value to Realized Value

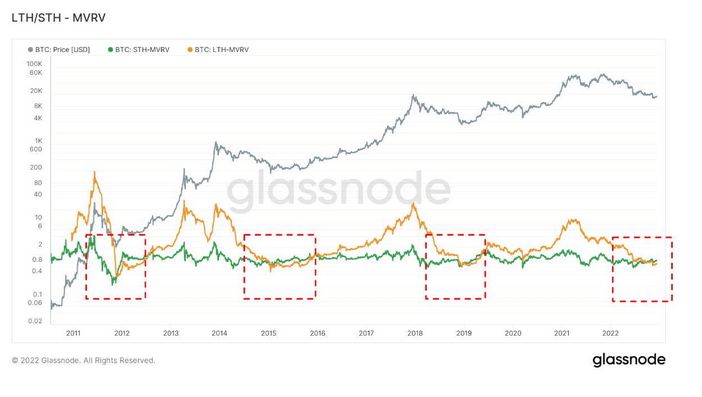

Market Value to Realized Value (MVRV) refers to the ratio between the market cap (or market value) and realized cap (or the value stored). By collating this information, MVRV indicates when the Bitcoin price is trading above or below “fair value.”

MVRV is further split by long-term and short-term holders, with Long-Term Holder MVRV (LTH-MVRV) referring to unspent transaction outputs with a lifespan of at least 155 days and Short-Term Holder MVRV (STH-MVRV) equating to unspent transaction lifespans of 154 days and below.

Previous cycle bottoms were characterized by a convergence of the STH-MVRV and LTH-MVRV lines, with the former crossing above the latter to signal a bullish reversal in price.

The STH-MVRV moving above the LTH-MVRV was noted on Sep. 27’s research report. An updated chart shows this pattern holding at present, suggesting a bottoming is still in the offing.

Supply in Profit and Loss

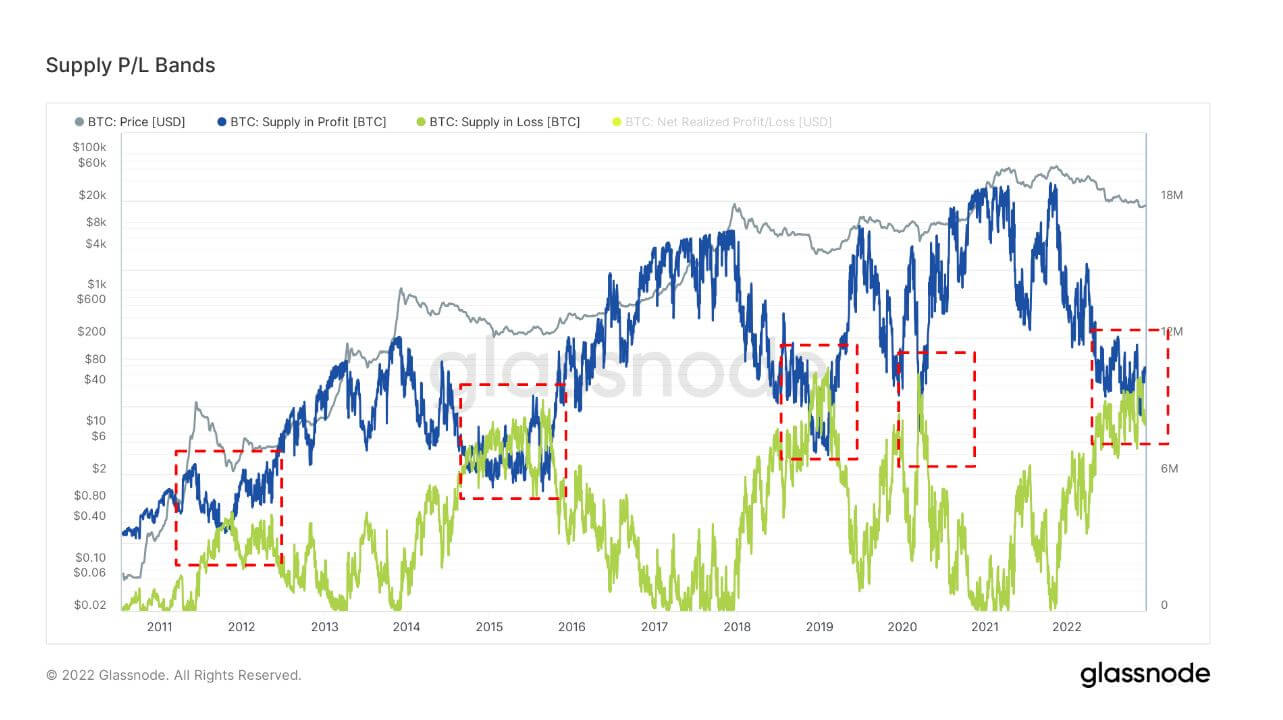

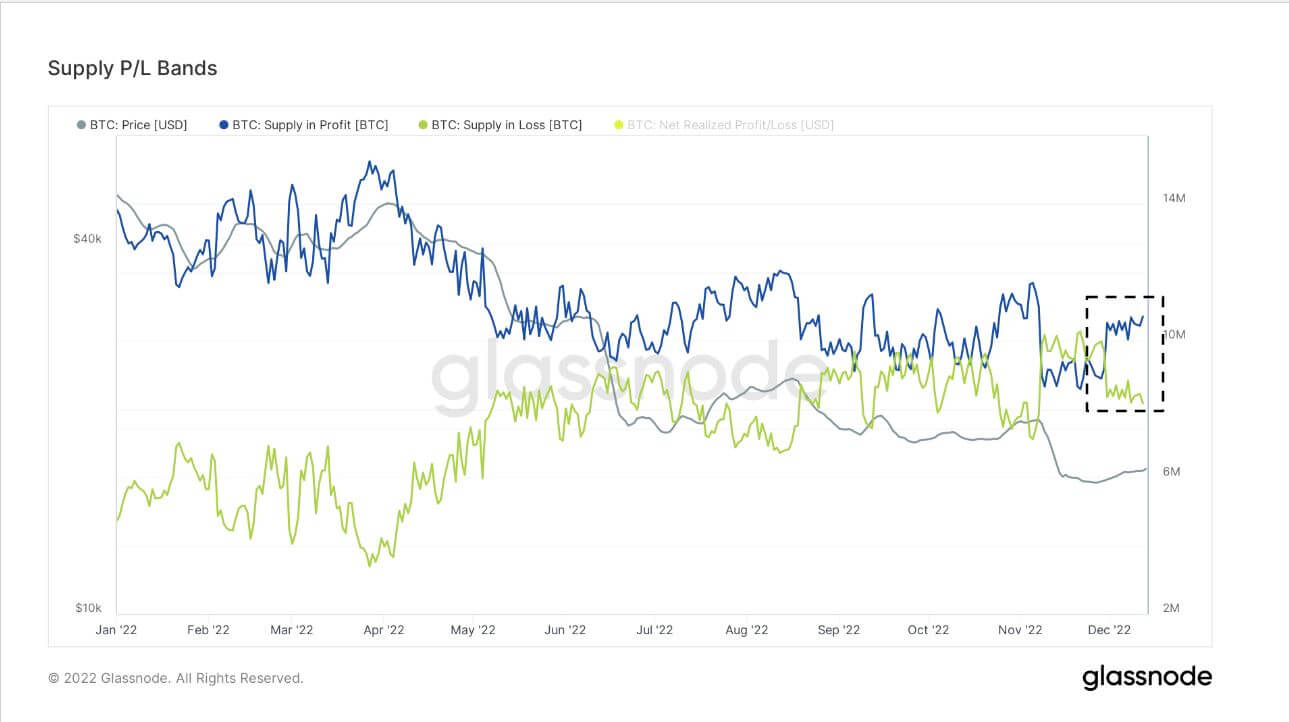

By analyzing the number of BTC tokens whose price was lower or higher than the current price when last moved, the Supply in Profit and Loss (SPL) metric shows the circulating supply in profit and loss.

Market cycle bottoms coincide with the Supply in Profit (SP) and Supply in Loss (SL) lines converging. Price reversals occur when the SL line crosses above the SP line. Currently, a convergence of SP and SL has happened.

Analyzing this on a zoomed-in timeframe for 2022 shows convergence occurring around September, indicating a bottoming playing out. However, since December, the SP and SL lines have diverged significantly, thus invalidating a bottoming.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)