Non-fungible token (NFT) sales rose slightly last week, increasing 1.23% to $232.49 million in recorded sales. The top two NFT collections, Otherdeed and Doodles, saw growth of 44% to 58% compared to the previous week. Ethereum continues to dominate the NFT industry, accounting for more than 81% of total sales last week with $188.51 million in NFT sales.

7-Day NFT Sales Increase; Otherdeed, Doodles See 44% to 58% Growth

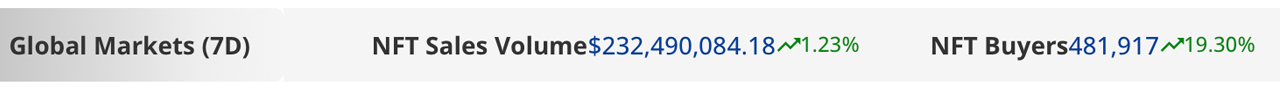

NFT sales remain steady this week and during February 2023, with $39.72 million in recorded sales so far this month. Over the past seven days, there were $232.49 million in NFT sales, a 1.23% increase compared to the previous week.

During that time, 481,917 buyers participated in NFT sales, 19.30% more than the previous week. Additionally, 1,390,784 NFT transactions were processed, a 3.21% increase over the prior week. Of the $232.49 million in sales, Ethereum had the most out of the 20 blockchain networks listed on cryptoslam.io.

Ethereum accounted for 81% of total NFT sales, or approximately $188.51 million in settlements. The second largest blockchain for NFT sales was Solana, which processed $27.40 million in the past week, a decrease of 2.65% from the previous week. Immutable X ranked third in NFT sales, with sales rising 37.85% to $4.5 million.

The remaining top NFT sales blockchains, in order, are Cardano, Polygon, Flow, BNB Chain, and Arbitrum. Fantom saw the largest increase in NFT sales this week, with a 73.81% rise, although only $17,064 in NFT sales were settled in the past seven days.

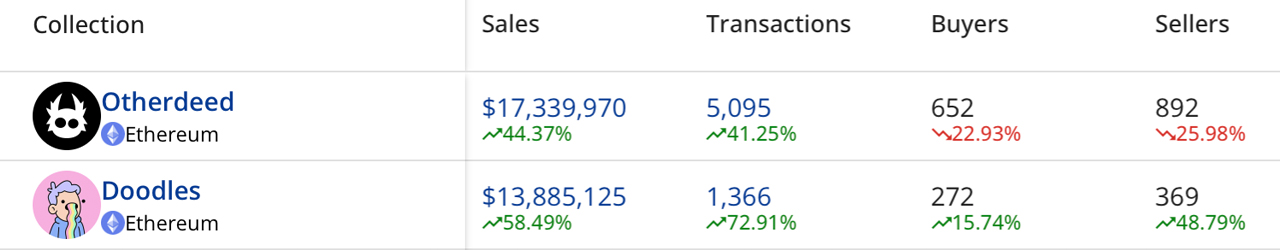

This past week, the top NFT collection was Otherdeed, with sales rising 44.37% to $17.33 million. Doodles saw a 58.49% increase, reaching $13.88 million in total sales. Otherdeed and Doodles were followed by Mutant Ape Yacht Club (MAYC), Bored Ape Yacht Club (BAYC), and Checks VV Edition.

The highest NFT floor value on February 5, 2023, was for Cryptopunks, at 63.99 ether at 8:00 a.m. Eastern Time. The second highest floor value belonged to the BAYC collection, with a slightly lower value of around 63.5 ether.

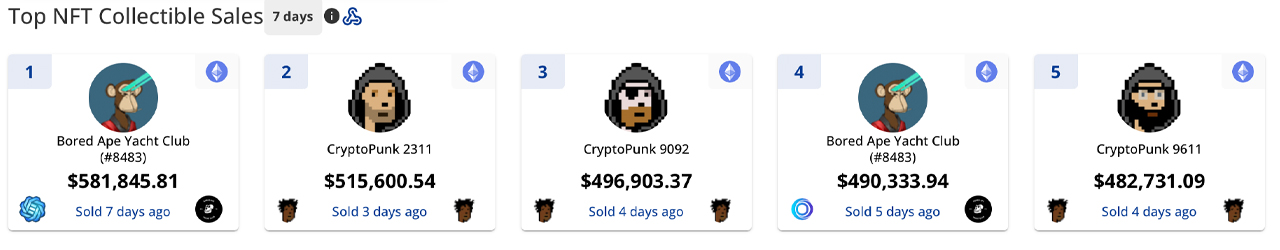

The most expensive NFT sales from the past week include: Bored Ape Yacht Club #8,483, which sold for $581,000 seven days ago but then sold again for $490,000 two days later; Cryptopunk #2,311, sold for $511,000 three days ago; Cryptopunk #9092, sold for $496,000 four days ago; BAYC #8,483, making the fourth largest sale after being sold twice; and Cryptopunk #9,611, sold for $482,000 four days ago.

The fifth most expensive sale was Cryptopunk #9,611, followed by Hausphases #379, which sold for $461,000 on Sunday, Feb. 5, 2023.

What do you think will be the next big NFT collection to make waves in the market? Share your thoughts in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, cryptoslam.io,

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Chainlink

Chainlink  Wrapped stETH

Wrapped stETH  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Bittensor

Bittensor  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)