In the past month, there have been more daily active addresses on the NEAR Protocol than in Ethereum and its layer-2 protocols, including Arbitrum and OP Mainnet, Artemis data from September 25 reveals.

Artemis, an institutional data platform for digital assets, shows that the number of daily active addresses on NEAR Protocol has been consistently above the 400,000 level in September.

Daily Active Addresses On NEAR Protocol Surging

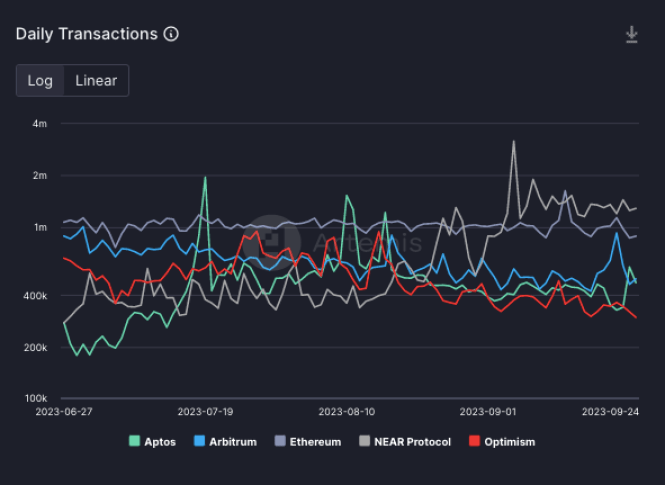

Looking closer at the data confirms that the number of daily active addresses on Ethereum, the pioneer smart contract platform that hosts most decentralized finance (DeFi) and non-fungible token (NFT) activity, has been dropping.

To illustrate, the number of daily active on Ethereum rose above 1 million in mid-September but has since more than halved to below 400,000. The same trend can be seen in Arbitrum, which dropped from around 200,000 in late June to 150,000 when writing on September 25.

During this time, NEAR Protocol’s daily active addresses have rapidly spiked from around 40,000 in late June to above 400,000, outperforming Ethereum in this metric. With rising daily active addresses, there has been a spike in daily transactions over the past month. According to trackers, the NEAR Protocol processes more transactions than Ethereum.

Public ledgers like NEAR Protocol and Ethereum depend on a community of users who actively transact—moving value or running protocols—or validators- to secure the network. However, the number of daily active addresses can provide valuable insights into the level of adoption, user engagement, and the network’s overall health.

Besides user engagement, rising daily active addresses might also point to changing market sentiment, which could significantly impact prices.

Bears In Control As DEX Trading Volume Remains Relatively Stable

When writing, NEAR, the native token of the NEAR Protocol, is trading at around 2023 lows. Changing hands at $1.107, the coin is down 61% from 2023 highs and remains under pressure.

The candlestick arrangement in the daily chart points to consolidation and stability above the primary resistance level at $1. Bears have the upper hand if prices remain below $1.23, a critical resistance level marking the August 17 highs.

As evidence shows, the network activity and price action diverge. Although the transaction count also rose, the number of unique addresses interacting with NEAR Protocol decentralized exchanges has mostly been stable. Looking at the numbers, DEX volume on the platform is significantly lower than those registered in Ethereum and its popular layer-2 platforms.

Feature image from Canva, chart from TradingView

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Toncoin

Toncoin  Shiba Inu

Shiba Inu  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Bittensor

Bittensor  Ondo

Ondo  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Ethereum Classic

Ethereum Classic  Mantle

Mantle  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Sonic (prev. FTM)

Sonic (prev. FTM)