Two bills related to crypto were introduced to the Massachusetts House of Representatives on Jan. 19. The first related to a new “special commission on blockchain” and the second on “protecting consumers in cryptocurrency exchanges.”

Given the recent publicity received through the FTX collapse, it is unsurprising that officials would look to add extra consumer protection. The creation of a ‘special commission’ on blockchain could also be a bullish indicator for the citizens of Massachusetts, providing the commission receives adequate information to analyze.

Special Commission

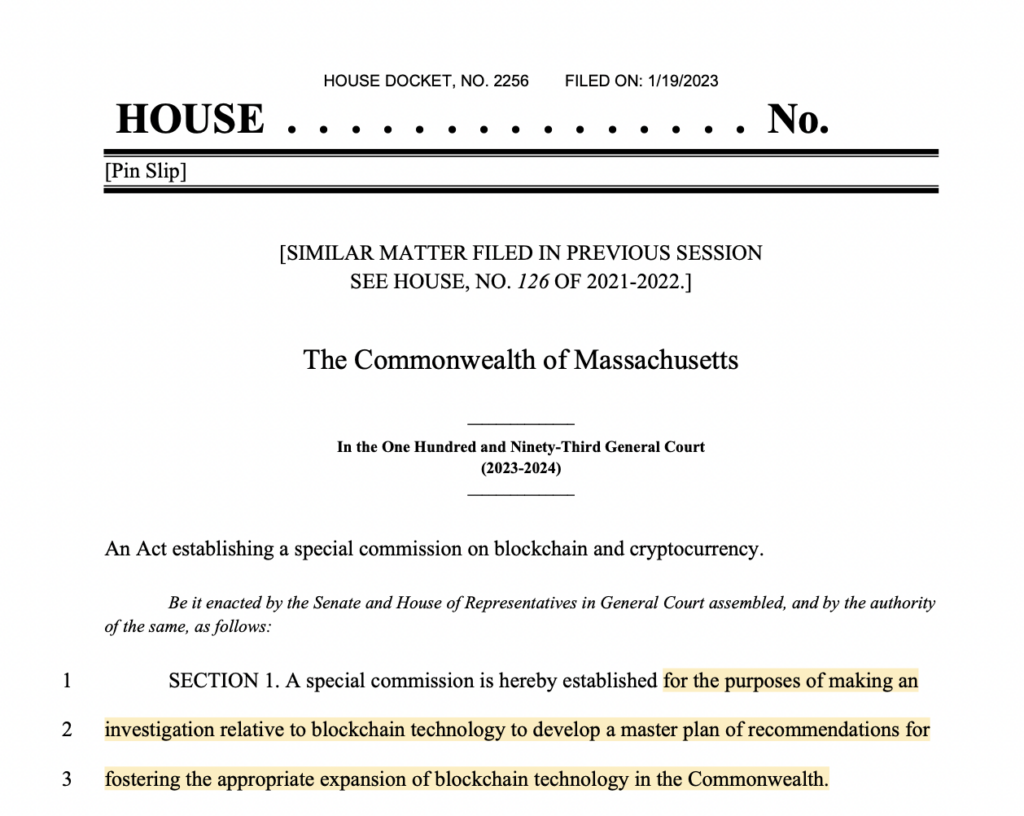

Massachusetts Representatives Josh S. Cutler and Kate Lipper-Garabedian submitted the bill entitled “An Act establishing a special commission on blockchain and cryptocurrency” on Jan. 19 to create a steering group within the Massachusetts House to look at blockchain technology.

“For the purposes of making an investigation relative to blockchain technology to develop a master plan of recommendations for fostering the appropriate expansion of blockchain technology in the Commonwealth.”

The commission is planned to contain 25 members, including the House Speaker, the minority leader, and the president of the Senate, suggesting, if passed, the commission is to be taken seriously.

The commission is designed to focus on several key areas

- The feasibility, validity, admissibility, and risks related to using blockchain technology for government usage within Massachusetts.

- Whether its definition of blockchain is sufficient concerning enforceable laws.

- The potential impact on the Massachusetts state revenues of digital assets and cryptocurrencies.

- Government and business advisory availability, with a focus on cannabis retail stores.

- How energy consumption may need to be regulated.

- Any additional consumer protections required for retail users of crypto.

- “Best practices for enabling blockchain technology to benefit the commonwealth.”

- Which state entities should be responsible for the enforcement of blockchain regulations.

- Any other blockchain-related topic suggested by the commission.

“The commission shall take input from a broad range of stakeholders with a diverse range of interests affected by state policies governing emerging technologies, privacy, business, finance, the courts, the legal community, and state and local government.”

According to the bill, the commission will report its findings within one year of the authorization as it looks to “foster a positive blockchain technology environment.”

Consumer protection

A further bill was filled with the title “An Act protecting consumers in cryptocurrency exchanges.” The bill was submitted by Representative Susan L. Moran to “protect” consumers engaging with crypto exchanges.

The bill is directed at businesses that offer crypto trading or conversion operating in the state of Massachusetts or with Massachusetts customers.

However, given the specific wording of the bill, the new rules should not apply to Decentralized Exchanges (DEXs) within Massachusetts. The bill describes a Massachusetts customer as “a person who uses a virtual currency exchange service whose information on record with or available to said exchange service indicates a Massachusetts home address.”

Therefore, any site able to operate within the U.S. without any KYC requirements would not be affected.

A vital aspect of the bill is the requirement for crypto exchanges operating in the state of Massachusetts to pay the state an annual “Registration fee” of 5% of gross revenues.

Further, businesses must retain any advertising materials used to promote crypto for no less than seven years. All marketing must also include the business’s legal name and confirmation of its registration to operate a cryptocurrency business.

To attempt to combat incidents such as the FTX collapse reoccurring, the bill also requires businesses to “disclose in clear, conspicuous writing all material risks to the person associated with the particular virtual currency business activities in which it engages.”

Virtual Currency Insurance Fund

The bill also introduced the concept of a Virtual Currency Insurance Fund to protect customers against fraud. The insurance pool will be funded through payments related to any violations of the newly proposed regulations. Each violation shall come with a fine of up to $5,000 per violation.

Customers will be able to receive grants from the fund if they have crypto assets held with an exchange “that is unable to meet any monetary obligations to any of its customers.”

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Stellar

Stellar  Sui

Sui  Toncoin

Toncoin  Hedera

Hedera  Shiba Inu

Shiba Inu  WETH

WETH  LEO Token

LEO Token  Litecoin

Litecoin  Polkadot

Polkadot  Bitget Token

Bitget Token  Bitcoin Cash

Bitcoin Cash  Hyperliquid

Hyperliquid  USDS

USDS  Uniswap

Uniswap  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  Pepe

Pepe  MANTRA

MANTRA  NEAR Protocol

NEAR Protocol  Aave

Aave  Monero

Monero  Ondo

Ondo  WhiteBIT Coin

WhiteBIT Coin  Aptos

Aptos  Internet Computer

Internet Computer  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Dai

Dai  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Bittensor

Bittensor  OKB

OKB