As the crypto asset market has expanded dramatically in recent years, stablecoins have also experienced remarkable growth.

In response to this, the Digital Euro Association (DEA) issued a report analyzing the use cases of European-Union-denominated stablecoins, looking at trends like machine-to-machine (M2M) payments and other aspects of decentralized finance impacting the broader sector of the stablecoin market.

The report titled – “The future of machine money – Opportunities for stablecoins in Europe” – suggests that Europe could leverage stablecoins to facilitate the development of the Internet of Things (IoT), provided that regulations are established.

Europe’s DEA believes that automated micropayments enabled by stablecoins could be a means for Europe to uphold its digital competitiveness.

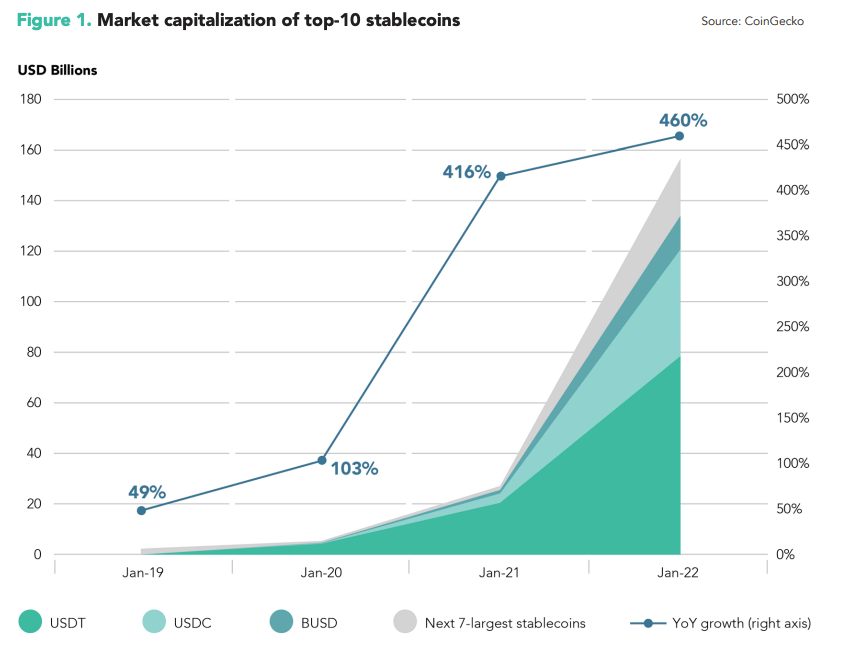

Market capitalization of top-10 stablecoins

As of March 2022, prior to the collapse of TerraUSD, the top ten stablecoins had a combined value of approximately USD 164 billion, representing a 460% increase from the previous year.

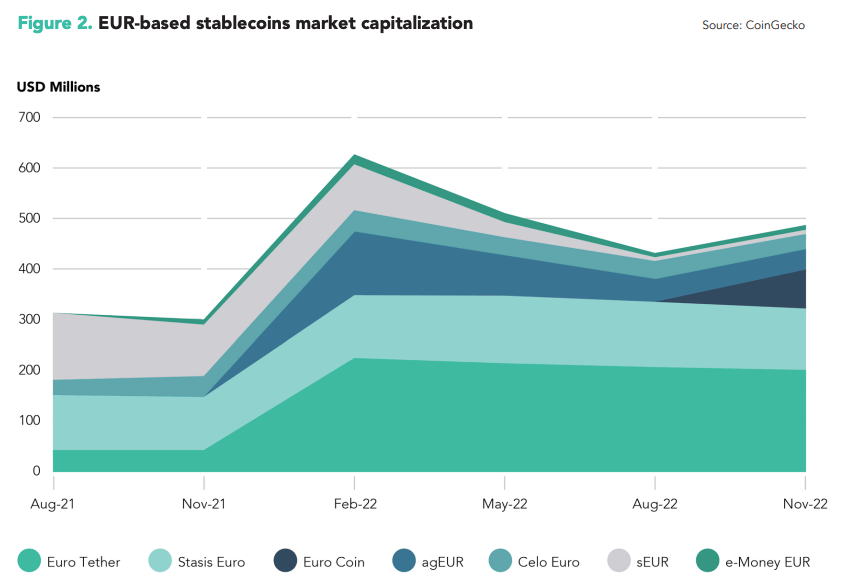

The two largest stablecoin issuers, Tether and Circle, have both introduced stablecoins backed by the Euro. Tether’s Euro Tether (EURT) is valued at $220 million, with more than 200 million tokens currently in circulation, while its USD-pegged stablecoin, USDT, has a market capitalization of $71 billion. Circle’s Euro Coin (EUROC) has a market capitalization of $33 million, whereas its USD-pegged stablecoin, USDC, has a market capitalization of $43 billion.

As of November 2022, EUR-based stablecoins accounted for less than USD 500 million in market capitalization, equivalent to roughly 0.2 percent of the total stablecoin market.

Europe’s potential stablecoin future

Apart from acting as an entry point to crypto trading, a safe haven from market volatility, and providing access to decentralized finance (DeFi) markets, stablecoins have also been utilized to enhance financial inclusion and facilitate cross-border payments for underserved communities, the report argues.

Trading, cross border remittances, inflation hedge, decentralized finance, and settlement of tokenized securities all serve as reasons for stablecoin adoption.

Differentiation between internet-of-things (IoT) IoT and machine-to-machine (M2M) payments is starting to emerge, however, led by more than 11.3 billion operational IoT devices worldwide in 2021, which experts believe will surge to 30 billion by 2030. This burgeoning trend is set to impact all sectors of the economy and is expected to unlock economic value ranging from USD 5.5 trillion to USD 12.6 trillion, an economic boon for global finance too.

Key findings

The report says that European policymakers and regulators should encourage the implementation of industry-wide or EU-level standards that incorporate established best practices and global standards.

- “EUR-based stablecoins for M2M payments could be issued on different types of blockchains or distributed ledgers (e.g., permissionless, permissioned, hybrid or even consortiums).”

- “With a digital euro not likely to be issued until late 2026 at the earliest, an alternative instrument is needed for growth in the M2M space to truly develop. EUR-based stablecoins could play an important role in this regard.”

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Chainlink

Chainlink  Avalanche

Avalanche  Wrapped Bitcoin

Wrapped Bitcoin  Stellar

Stellar  Wrapped stETH

Wrapped stETH  Sui

Sui  Hedera

Hedera  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Litecoin

Litecoin  WETH

WETH  Polkadot

Polkadot  Hyperliquid

Hyperliquid  LEO Token

LEO Token  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Uniswap

Uniswap  USDS

USDS  Wrapped eETH

Wrapped eETH  Ethena USDe

Ethena USDe  MANTRA

MANTRA  Pepe

Pepe  Official Trump

Official Trump  NEAR Protocol

NEAR Protocol  Ondo

Ondo  Aave

Aave  Aptos

Aptos  Internet Computer

Internet Computer  Monero

Monero  WhiteBIT Coin

WhiteBIT Coin  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Bittensor

Bittensor  Cronos

Cronos  POL (ex-MATIC)

POL (ex-MATIC)  Dai

Dai  OKB

OKB