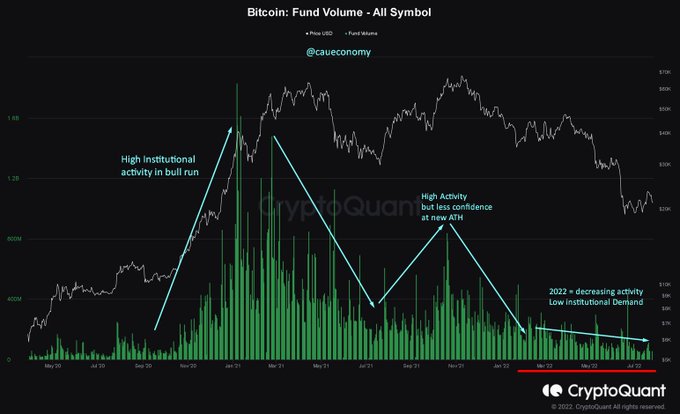

Institutional activity remains sluggish as bitcoin hovers around the lower $20K level, depicting a low-risk appetite.

On-chain analyst Caue Oliveira pointed out:

“Low institutional activity evidences de-risking movement by traditional whales. Looking at the daily trading volume in mutual funds traded in the traditional market with direct/indirect exposure to BTC, we can see the current low-risk appetite.”

Source:CryptoQuant/CaueOliveira

Institutional investment has played an instrumental role in enabling Bitcoin to hit all-time highs (ATHs). For instance, BTC breached the then-historic highs of $20K in December 2020 after failing to do so for three years as more institutional investors joined the network.

Furthermore, institutional investments enabled the leading cryptocurrency to record the latest ATH of $69,000 in November last year.

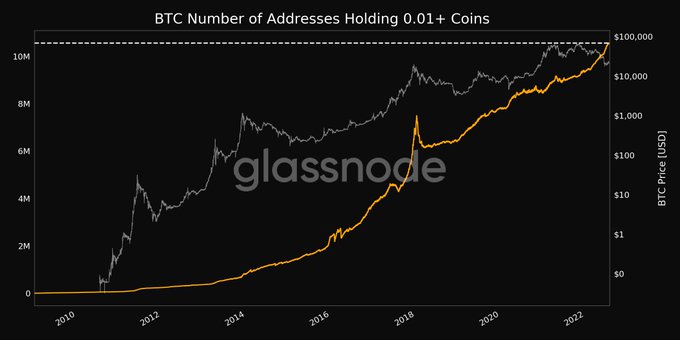

Nevertheless, retail investors continue jumping on the Bitcoin bandwagon based on the rise of non-zero BTC addresses. Market insight provider Glassnode stated:

“The number of BTC addresses holding 0.01+ Coins just reached an ATH of 10,560,930. Previous ATH of 10,560,117 was observed on 26 July 2022.”

Source:Glassnode

Despite the back and forth being experienced in the BTC market, long-term objectives continue to take shape.

Through its weekly report dubbed “Conviction Through Confluence,” Glassnode highlighted:

“Long-term supply dynamics continue to improve, as redistribution takes place, gradually moving coins towards the hodlers. Notable supply concentrations are observable at $20K, $30K, and $40K, which tend to align with both technical and on-chain price models, making these regions significant zones of interest.”

Bitcoin was hovering around $21,392 during intraday trading, according to CoinMarketCap. With the looming interest rate review by the Federal Reserve (Fed) slated for July 27, it remains to be seen how the top cryptocurrency plays out in the short term.

Image source: Shutterstock

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC