Litecoin, a peer-to-peer cryptocurrency, remained in a consolidation phase as open interest in the futures market remained muted and as whale activity rose.

LTC whale activity increases

Litecoin (LTC), created by former Google engineer Charlie Lee, was trading at $64, where it has been stuck at in the past two weeks. This price is about 27% above its lowest point in August and down by 44% from its highest point this year.

The price action correlates with Bitcoin (BTC), which jumped to a record high of $73,800 in March, dropped to $49,000 in August and was trading at $54,000.

According to Santiment, Litecoin has seen a significant increase in whale-buying activity in the past few weeks, a sign that some of them are buying the dip. Santiment has also observed a big increase in the number of social media mentions.

However, more Santiment data shows that daily active addresses have retreated sharply in the past few months.

Litecoin had over 327,000 active addresses on Friday, Sep.6, down from 801,000 in June.

The other big issue is that Litecoin’s futures open interest has been muted in the past few months. Interest in the futures market stood at over $243 million on Sat. Sep 7, down from the year-to-date high of over $708 million.

Futures open interest is an important metric in the financial market because it shows the outstanding contracts that are yet to be filled. In most cases, a higher open interest is a sign that a coin has more demand among investors.

Meanwhile, Litecoin’s funding rate has retreated from 0.078% earlier this week to 0.0016%. A positive funding rate means holders pay a fee to short position holders. With the funding rate nearing the negative zone, there is a risk that it may continue falling.

Litecoin below this key resistance level

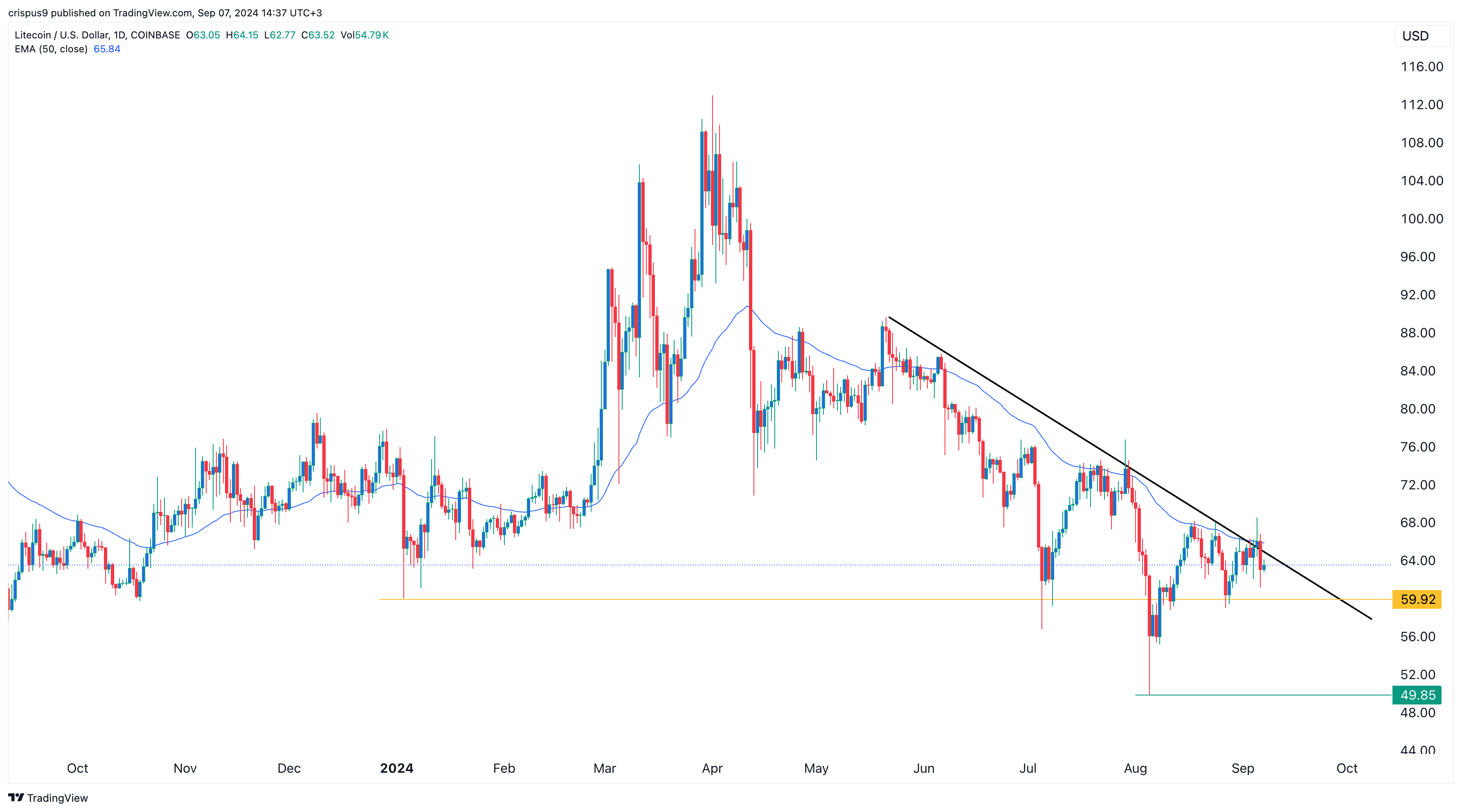

Technically, there are signs that Litecoin is below the descending trendline that connects the highest swings since May 20. It has also remained below the 50-day moving average, pointing to further downside.

If this happens, Litecoin — one of the biggest proof-to-work coins — may drop to the next key support level at $60, its lowest swing on Jan. 3.

A break below that support level will point to a drop to the next key support at $50, its lowest point in August. However, a volume-supported move above the descending trendline will point to more gains.

Credit: Source link

Bitcoin

Bitcoin  Ethereum

Ethereum  XRP

XRP  Tether

Tether  Solana

Solana  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  Lido Staked Ether

Lido Staked Ether  TRON

TRON  Wrapped Bitcoin

Wrapped Bitcoin  Wrapped stETH

Wrapped stETH  Chainlink

Chainlink  Avalanche

Avalanche  Sui

Sui  Stellar

Stellar  Litecoin

Litecoin  Toncoin

Toncoin  Shiba Inu

Shiba Inu  Hedera

Hedera  LEO Token

LEO Token  USDS

USDS  Hyperliquid

Hyperliquid  Polkadot

Polkadot  WETH

WETH  MANTRA

MANTRA  Bitcoin Cash

Bitcoin Cash  Bitget Token

Bitget Token  Ethena USDe

Ethena USDe  Wrapped eETH

Wrapped eETH  Uniswap

Uniswap  Monero

Monero  NEAR Protocol

NEAR Protocol  Pepe

Pepe  WhiteBIT Coin

WhiteBIT Coin  Aave

Aave  Ondo

Ondo  Bittensor

Bittensor  Aptos

Aptos  Internet Computer

Internet Computer  Dai

Dai  Official Trump

Official Trump  Mantle

Mantle  Ethereum Classic

Ethereum Classic  Tokenize Xchange

Tokenize Xchange  OKB

OKB  Gate

Gate  sUSDS

sUSDS  Coinbase Wrapped BTC

Coinbase Wrapped BTC